Author | David Hoffman

Translation | Plain Language Blockchain

During the period from 2015 to 2017, Bitcoin experienced an internal conflict known as the "block size war". This was a key conflict in Bitcoin's history, with both sides arguing for their preferred Bitcoin network expansion strategy to ensure it could meet the growing demand over time.

The two factions in this debate were known as the big block supporters and the small block supporters.

The big block supporters advocated for increasing the original size of Bitcoin blocks from 1MB to 8MB. This would increase the throughput of Bitcoin transactions by 8 times while reducing transaction costs.

The small block supporters advocated for maintaining the block size, believing that increasing the block size would jeopardize Bitcoin's decentralization, as it would make it more difficult for the average user to run and verify the Bitcoin blockchain. The small block supporters ultimately proposed an alternative path called Segregated Witness (SegWit), which would optimize the number of transactions that can fit in a block instead of directly increasing the block size. Segregated Witness would also open the door for off-chain scaling solutions beyond the core Bitcoin protocol, known as Layer 2 scaling.

To better support these viewpoints, the small block supporters hoped to expand in two ways:

- Increase block density to accommodate more transactions in the same space

- Open the door for functional off-chain scaling solutions through layer-based scaling strategies

Therefore, this is the focus of the debate: Should we increase block size, or should we maintain block limits and force expansion to higher layers?

01. Modern Big Block and Small Block Factions

The debate over block size echoes in the halls of crypto history and continues to exist to this day.

We no longer refer to these factions as big block or small block, as people now prefer to identify with more modern factions, usually defined by specific Layer 1 characteristics. Nevertheless, the differing philosophical viewpoints expressed by these two camps exist within the culture and belief systems of each Layer 1 faction, whether they realize it or not.

In modern times, the debate between small block and big block factions continues to be reflected in the debate between Ethereum and Solana.

The Solana camp argues that Ethereum's costs are too high, its speed is too slow, and it cannot onboard global users. Unless transactions become instant and free, consumers will not use crypto assets, so we need to design as much capacity into Layer 1 as possible.

The Ethereum camp believes this is a fundamental compromise of decentralization and neutrality, leading to a fixed set of winners and losers and ultimately creating the traditional societal financial stratification we are trying to escape. Instead, we should focus on increasing the density and value of Layer 1 blocks and force expansion to Layer 2.

This debate is not a new phenomenon. The landscape of crypto assets changes, adapts, and evolves, but the debate between small block and big block philosophies persists.

1) Precision Blocks vs. Raw Blocks

Ethereum's 0 to 1 innovation was adding a virtual machine (EVM) within the blockchain. All chains before Ethereum lacked this key element and attempted to add functionality as separate opcodes rather than a fully expressive virtual machine.

Early Bitcoiners philosophically disagreed with this choice, as it added complexity and attack surface to the system and increased the difficulty of block validation.

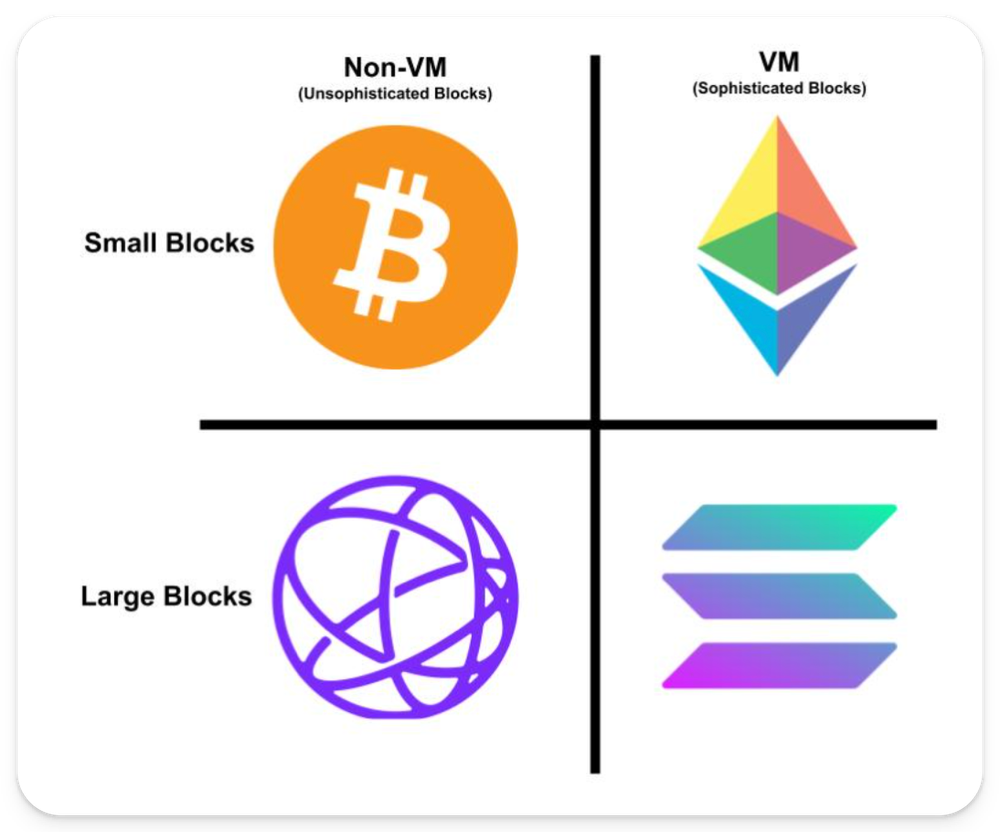

Although both Bitcoin and Ethereum are "small block" philosophical chains, the addition of the virtual machine still caused a significant divergence between these two communities. Fast forward to today, and you can see clear parallels between some of the largest factions in modern blockchain philosophy.

"Block size" contains two variables: the size of the block and the number of blocks within a unit of time. In essence, "block size" is "throughput" or "data per second".

While this viewpoint may remain in 2024, I believe these four Layer 1 blockchains occupy four different types of valid logical conclusions within Layer 1 architecture:

- Bitcoin's Layer 1 design is super restrictive, taking every possible measure to limit the capacity of Layer 1.

- Ethereum has been sufficiently restricted at the Layer 1 level, but by increasing Layer 1 capacity, it has created space for unlimited block supply at Layer 2.

- Celestia restricts the capacity of its Layer 1 but maximizes its capacity, pushing more functionality to Layer 2 while providing them with maximum building space (hence the slogan "build anything").

- Solana is super unrestricted, maximizing the capacity and functionality of Layer 1 while limiting the ability to build higher layers.

2) Functional Escape Velocity

My thesis for crypto asset investment is that a blockchain design that incorporates both small block and big block philosophies will ultimately win the crypto game.

Both small block and big block philosophies are correct. They both have valid points. Arguing over who is right and who is wrong is meaningless; the key is to build a system that maximizes the strengths of both.

Bitcoin, as an architecture, cannot accommodate both small block and big block philosophies simultaneously. Bitcoin small block proponents claim that scaling will occur at Layer 2 and guide big block supporters to the Lightning Network, telling them they can still use Bitcoin within the Bitcoin system. However, due to the functional limitations of Bitcoin Layer 1, the Lightning Network cannot develop sufficiently, and big block supporters have no other choice.

In 2019, Ethereum founder Vitalik Buterin published an article titled "Base Layer and Functional Escape Velocity" to clarify these situations and advocated for minimal increases in Layer 1 functionality to enable functional Layer 2.

"Although Layer 1 cannot be too powerful, as greater power means greater complexity and thus greater fragility, Layer 1 must also be powerful enough for Layer 2 protocols to actually be built on top of it."

"Keeping Layer 1 simple and compensating at Layer 2" is not the universal answer to blockchain scalability and functionality issues, as it fails to consider that Layer 1 blockchains themselves must have sufficient scalability and functionality to make this "building on top" behavior actually possible.

My conclusion:

We need to expand the scope of Layer 1 blocks rather than just pursuing small blockism to ensure that Layer 2 can achieve "functional escape velocity". We need more complex block designs.

However, we should not expand the scope of Layer 1 blocks beyond the extent necessary to achieve "Layer 2 functional escape velocity", as this would unnecessarily compromise the decentralization and neutrality of Layer 1. Any additional Layer 1 functionality can be pushed to Layer 2. We should adhere to the small block philosophy.

This represents a compromise between the two sides. Small block supporters must accept that their blocks become slightly more complex and difficult to verify, while big block supporters must accept the layered scaling approach.

Once this compromise is reached, synergistic effects will occur.

02. Typical Cases

1) Ethereum Layer 1 - The Foundation of Trust

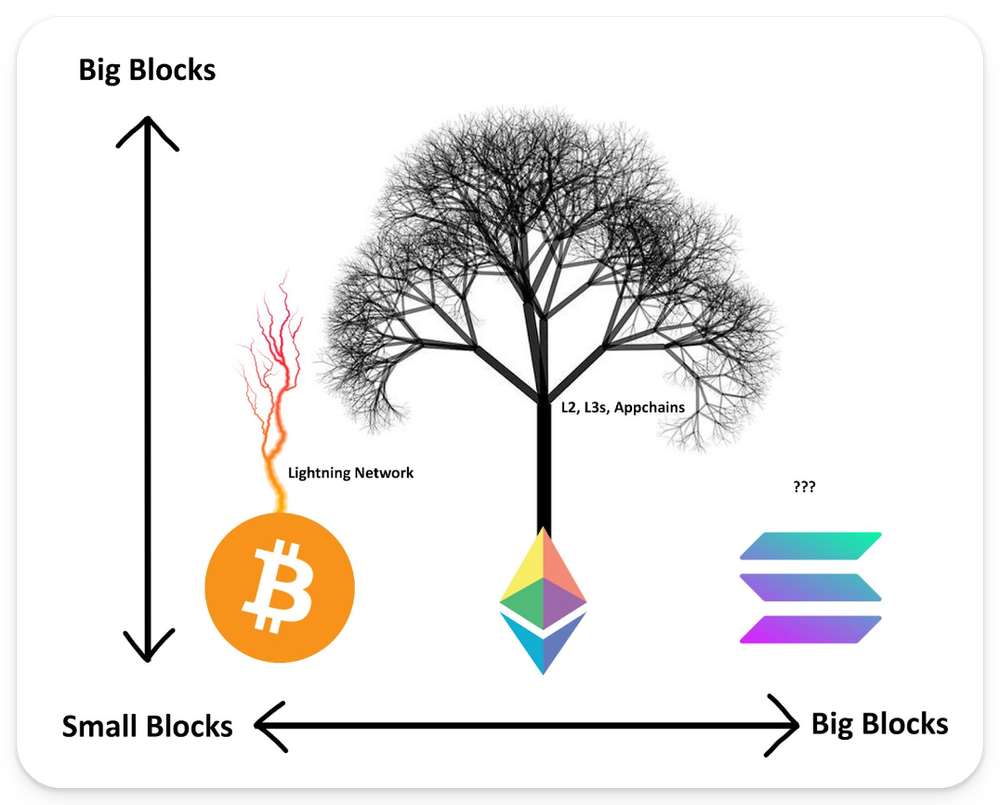

Ethereum is a foundation of trust. Ethereum's Layer 1 maintains its small block philosophy by leveraging cryptographic advancements to achieve functional escape velocity at higher levels. By accepting fraud proofs and validity proofs from higher levels, Ethereum can effectively compress almost unlimited transactions into verifiable bundles, which are then verified by a decentralized network of consumer hardware.

This design architecture upholds the crypto industry's fundamental commitment to society. Ordinary validators can check the power of experts and elites, ensuring equal system access for everyone, without privileged parties or sacred status.

The crypto industry has made a philosophical commitment, and Ethereum has translated this philosophy into reality through cryptographic research and traditional engineering.

Imagine the bottom as small blocks and the top as big blocks, with decentralized, trusted, and verifiable consumer blocks on Layer1 and highly scalable, instant, and low-fee transactions on Layer2!

Unlike treating small blocks and big blocks as a continuum of horizontal balance, Ethereum vertically flips this continuum and builds a big block structure on top of a secure, decentralized small block foundation.

Ethereum is the anchor point of small blocks in the big block world.

Ethereum allows for a network of 1000 big blocks to flourish and generate synergies from a consistent and composable ecosystem, contrasting with the fragmentation of many Layer1s.

2) Cosmos: The Lost Tribe

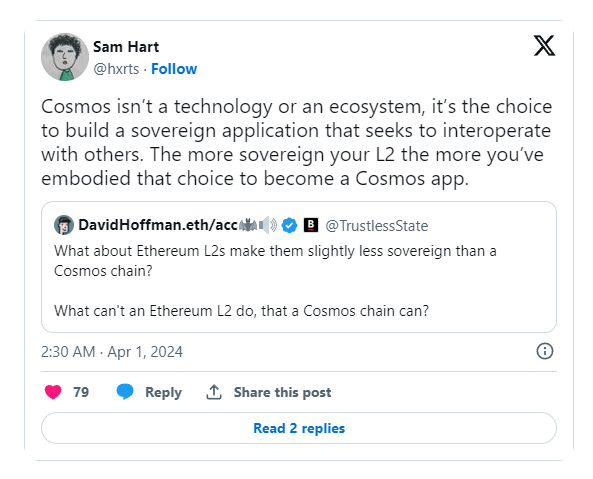

Okay, but where does Cosmos fit into this argument? Cosmos does not strictly align with any network design. After all, there is no "Cosmos" network; Cosmos is just an idea.

This idea is an interconnected sovereign chain network. Each chain maximizes its sovereignty and, through shared technical standards, can unite to some extent and abstract away some of their complexity.

Cosmos is not just a technology or ecosystem; it represents a choice: the choice to build an application that is independent and interoperable with other applications. The more independent your Layer2 is, the more it reflects the choice to become a Cosmos application.

The problem with Cosmos is that it is too insistent on sovereignty, to the point where Cosmos chains cannot coordinate and build themselves well, nor can they share each other's successes. Overemphasizing sovereignty leads to too much chaos in Cosmos' development. The excessive pursuit of sovereignty inadvertently optimizes for anarchy. Due to the lack of a central coordinating structure, the idea of Cosmos has remained niche.

03. Synergies

Similar to Vitalik's concept of "functional escape velocity," I believe there is also a phenomenon of "sovereignty escape velocity." For the Cosmos idea to truly take root and thrive, it needs to make small compromises in network sovereignty to maximize its potential.

The Cosmos idea and the Ethereum Layer2 vision are essentially the same thing. This is a horizontal landscape composed of independent, sovereign chains that have the right to choose their own destiny.

The core difference is that Ethereum Layer2 sacrifices some of its sovereignty by anchoring its state to its Layer1 bridging contracts. This small change turns previous internal operations into external operations, settling through a centralized Layer1.

By extending the security and settlement guarantees of Layer1 through cryptographic proofs, the infinite Layer2 that developed from the Ethereum base becomes essentially the same global settlement network. This is where an extraordinary synergy between small block and big block philosophies emerges.

1) Synergy 1: Chain Security

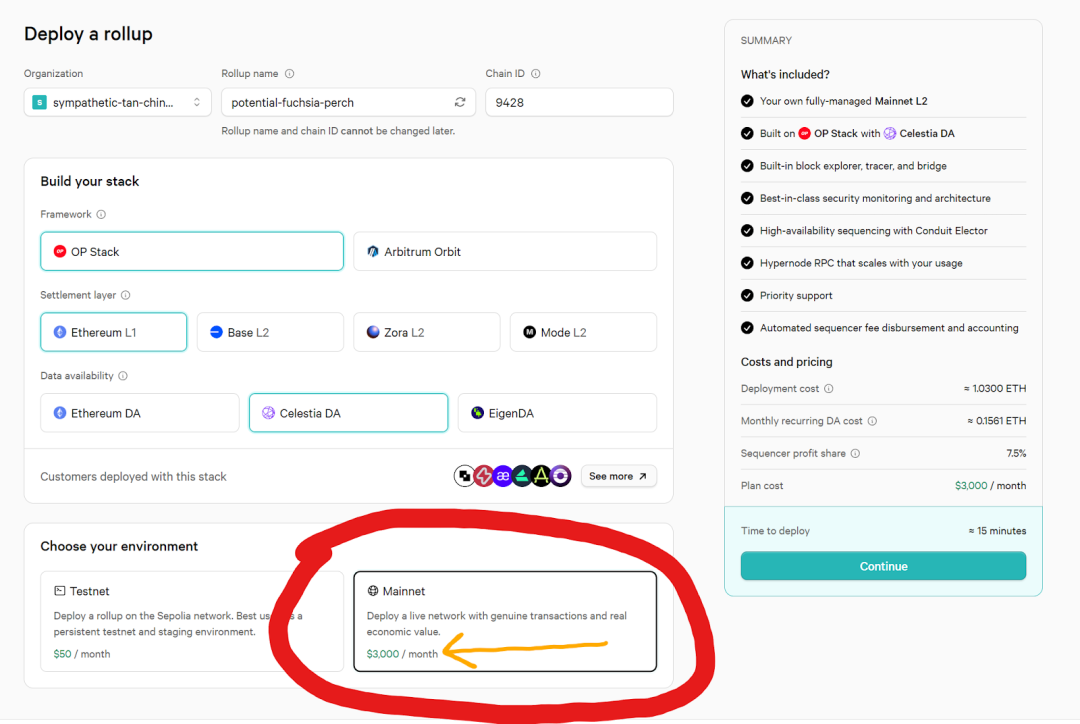

Layer2 chains do not have to pay for their own economic security, eliminating most of the network inflation of the base asset and retaining the 3-7% annual inflation rate within the value of their respective tokens.

Taking Optimism as an example: based on its $14 billion FDV (Fully Diluted Valuation), assuming a 5% annual security budget, this effectively means $700 million per year unpaid to third-party external security providers. In reality, the Optimism Mainnet has paid $57 million in gas fees to Ethereum Layer1 over the past year, measured before EIP-4844, which reduced Layer2 fees by over 95%!

The cost of economic security is reduced to zero, leaving DA as the only meaningful ongoing operational cost for Layer2 networks. With DA costs also close to zero, the net cost of Layer2 is also close to zero.

By creating sustainability for Layer2 chains, Ethereum can unleash all chains demanded by the market, creating more total chain sovereignty than the Cosmos model can produce.

Conduit.xyz can build a chain for you monthly at a price of $3,000

2) Synergy 2: Composability

The cost for Layer2 clients to obtain cryptographic proofs has also been marginalized, as settling cryptographic proofs to Layer1 provides trusted connections between all Layer2s. By retaining Layer1's settlement guarantees, users can navigate Layer2 without having to 'probe' each encountered chain. Naturally, users also won't engage in this activity, and service providers offering chain abstraction services (bridges, intent fillers, shared sequencers, etc.) can provide more robust services if they have uncompromising security guarantees for their underlying business.

Additionally, with the launch of many Layer2 chains, each Layer2 will attract its own edge users into the larger Ethereum ecosystem, creating a cluster effect. As all Layer2s add their users to the "heap," the total number of Ethereum users grows, making it easier for edge Layer2 chains to find enough users as the network expands.

Translated: Ethereum has been criticized for its fragmentation, but it is actually a network composed of combined chains. "Many L1s" is the real fragmentation.

Translated: Ethereum has been criticized for its fragmentation, but it is actually a network composed of combined chains. "Many L1s" is the real fragmentation.

Ethereum is criticized for being "fragmented," which is ironic because it is the opposite of reality. Ethereum is the only network that connects other sovereign chains through cryptographic proofs. In contrast, the multitude of Layer1 spaces is completely and thoroughly fragmented, while Ethereum's Layer2 space is only affected by delayed fragmentation.

3) Synergy 3: Unit of Account

All these benefits converge on ETH as the consensus point for assets. The growing distributed settlement network of Ethereum makes ETH a currency.

ETH becomes the unit of account for all its Layer2 networks, as each Layer2 network generates economies of scale by centralizing security to Ethereum Layer1.

In simple terms, the growing distributed settlement network of Ethereum makes ETH a currency.

04. Conclusion

The Ethereum project seeks a unified architecture that covers the widest possible use cases. It is a network that can handle everything.

Small yet powerful Layer1s come together to form the foundation needed to open up the widest design space in Layer2. Early Bitcoin supporters often said, "If it's useful, it will eventually be built on Bitcoin." I fully believe in this concept, but I think Ethereum is a more optimized network because it has been optimizing for this goal.

The preservation of values in the cryptocurrency industry happens at Layer1.

Decentralization, censorship resistance, permissionlessness, and trust neutrality. If these can be maintained on L1, they can be functionally expanded in an infinite number of L2s, which are cryptographically bound to L1.

In the battle for the crypto throne, Ethereum's core investment thesis is that any other Layer1 can either be better built as a Layer2 or have its functionality integrated into L1.

Do you want instant consensus? It's faster as a Layer2.

Do you want a completely private blockchain? It's more effective as a Layer2.

DA as a blockchain? Why not just establish it on Layer1.

Ultimately, everything will become a branch on the Ethereum tree.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。