作者:Daniel Kim, Tiger Research CEO & Founder

编译:Felix, PANews

根据近日韩国国会议员的选举结果,在全部300个席位中,韩国执政党选举惨败,而最大在野党共同民主党及其卫星政党共赢得175个席位。因此,有人预测,在未来4年(国会任期),韩国的主要法规将从保守立法转向进步立法。鉴于选举结果,下面根据民主党的竞选承诺,详解潜在的市场变化。

在竞选期间,共同民主党提出了各种承诺,以振兴数字资产市场。最重要的是,该党专注于通过比特币ETF上市和减轻个人投资者的税收负担等措施刺激虚拟资产市场。这意味着个人投资者可以在更加有利的环境下投资虚拟资产。

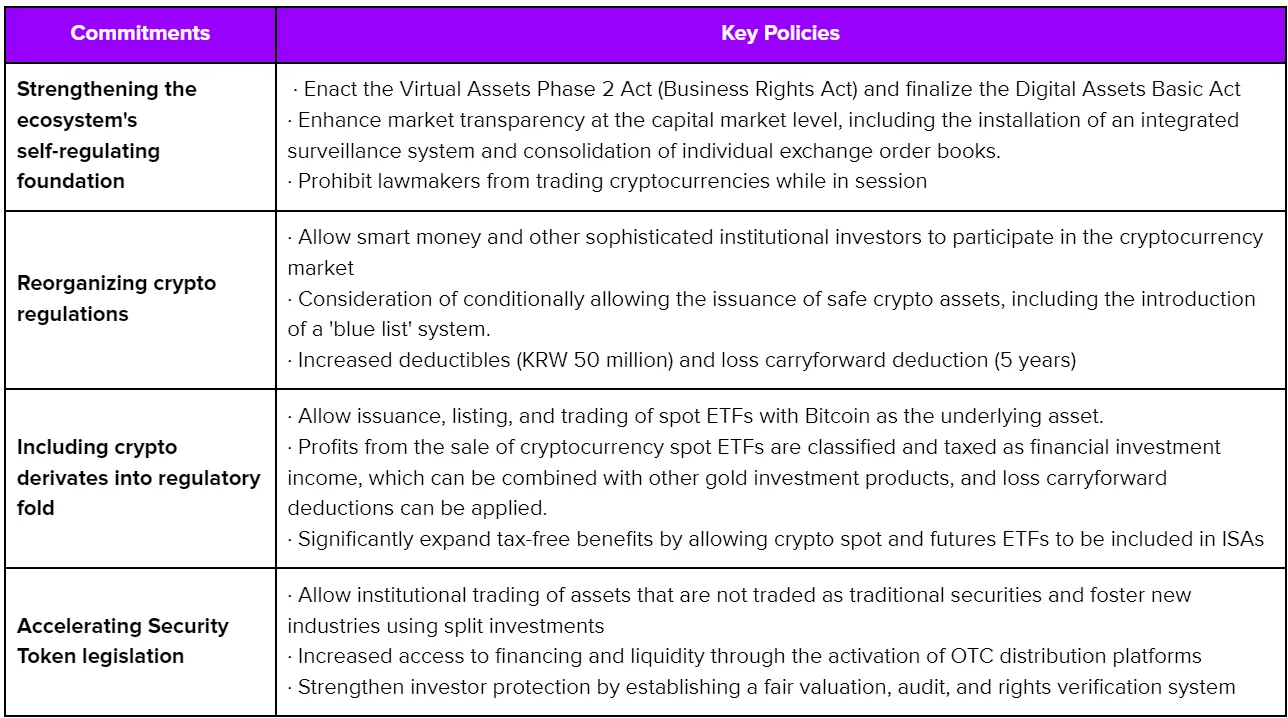

共同民主党在加密货币领域相关的承诺:

韩国共同民主党第22次大选誓言,来源:韩国共同民主党

共同民主党的主要承诺集中在:

- 促进比特币现货ETF的上市

- 减轻个人投资者加密投资的纳税负担

- 将加密市场制度化并加强投资者保护

共同民主党的政策方向侧重于促进加密市场的成长,同时加强投资者保护以改善市场的健康状况。如果承诺兑现,预计在制度框架内能为散户投资加密货币创造一个更安全、更便捷的环境。

比特币ETF上市和代币化证券制度化

共同民主党表示将允许现货比特币ETF的发行、上市和交易。这将为包括比特币在内的主流虚拟资产纳入现有金融体系提供机会,类似于美国ETF。此外,该党计划对代币化证券的发行、销售和披露制度进行立法,促进区块链在传统金融市场的采用。

尽管已此前经讨论过比特币现货ETF和证券型代币,但进展缓慢。证券型代币的指导方针发布已有一年,但该指南尚未通过国会。民主党能否加快这一步伐值得关注。

合理化虚拟资产征税和亏损扣除

民主党宣布将大幅提高虚拟资产投资的免税门槛,从目前的2000美元提高到4万美元。预计大幅减轻小规模投资者的纳税负担。与此同时,民主党计划针对虚拟资产投资产生的损失,引入亏损抵消和五年期的亏损结转扣除。这些税收优惠将激励个人投资者更积极地参与虚拟资产市场。

执政党敦促推迟征收加密货币税。虽然政府和议会已经将加密货币征税的实施日期推迟到2025年1月,但从大选结果来看,进一步延长的可能性不大。

共同民主党还坚持明年如期实施金融投资所得税。金融投资所得税是对股票收入超过 5,000 万韩元(约 36,500 美元)和海外股票收入超过 250 万韩元(约 1,800 美元)征收 20% 的税。由于加密市场的税负相对较低,存在资金流入加密市场的可能性。

限制大型交易所,加强投资者保护

共同民主党还提出了整合小型交易所的订单簿、实现交易服务商品化等限制大型交易所的方案。此前印度尼西亚的国有化交易所也实施了类似的行动。此举旨在防止交易所的交易过度集中,提高市场的公平性。这些政策预计将在市场上产生重大影响,特别是在韩国,Upbit长期以来一直占据韩国加密交易所市场约80%的份额。

来源:DAXA

此外,共同民主党计划引入“blue listing”制度来保护投资者。该制度只允许高质量的虚拟资产上市。这一举措与日本虚拟资产交易协会(JVCEA)采用的“白/绿名单系统”相似,提供了一个审查加密资产的框架。在新系统下,资产筛选将通过韩国交易所等独立第三方机构进行,提高了加密资产上市的透明度。

这一政策被视为韩国加密市场长期健康发展的必要措施。目前,有一个专注于韩元交易所的自律组织——数字资产交易协会(DAXA)。因此,这些机构与共同民主党的关系如何还有待观察。

结论

《虚拟资产用户保护法》和其他立法将如何在7月实施,值得关注。如果共同民主党的承诺顺利实施,韩国加密市场有望摆脱目前的模糊状态,拥有更加清晰、更有组织性的规则。

此外,预计将促进传统金融机构采用区块链,如代币证券和加密ETF,这些机构的采用速度相比其他国家较慢。如果提供各种投资和商业机会以及投资者友好型政策,营造出健全、安全的环境,将有助于韩国虚拟资产市场未来的振兴。

相关阅读:怯魅韩国加密圈:疯狂的泡菜溢价与币民骨子里的暴富梦

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。