The Blast ecosystem protocol has encountered another issue. On the evening of April 11th, some users discovered a large amount of ezETH liquidation on the lending protocol Pac Finance, involving a total amount of 24 million US dollars. The official response stated that the issuance liquidation threshold of Pac Finance was unexpectedly changed by the operation of a smart contract engineer without prior notification to the team.

Currently, there are many voices within the community calling for a boycott of the project. The official brief explanation of the incident stated that the investigation is still ongoing. Prior to this, Orbit Lending and Munchables, projects in the Blast ecosystem, also encountered issues with the liquidation threshold and attack events, which further drew attention from users. The community is urging Blast to strengthen the supervision of the protocol or introduce more mature protocols.

Large-scale ezETH liquidation prompts strong community reaction

Pac Finance is a cryptocurrency lending application running on the Blast network, allowing cryptocurrency holders to deposit funds and earn interest through lending capital. To ensure repayment, the application only allows borrowers to withdraw a loan equivalent to the percentage value of their collateral. This percentage is called the "loan-to-value ratio" (LTV). The development team can change the LTV, but this usually can only be done after an official announcement.

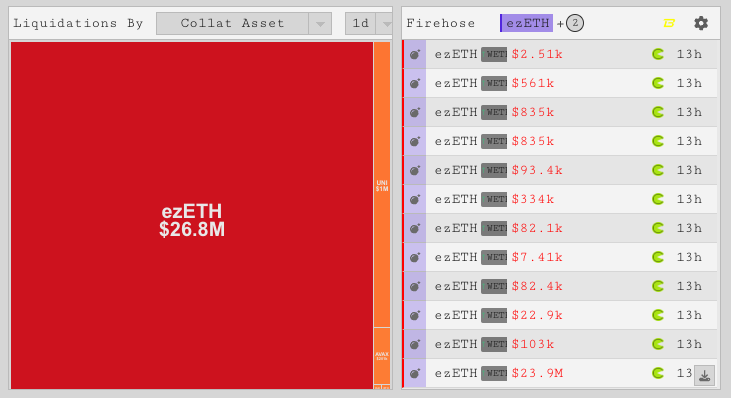

According to blockchain data from the Blast network, the developer wallet of Pac Finance called a function on the PoolConfigurator-Proxy contract of Pac Finance at 1:06 AM UTC on April 11th, setting the LTV of Renzo Restaked Ether (ezETH) to 60%. This change occurred without any warning, and the development team did not release any official announcement. However, with the adjustment of parameters, it resulted in the liquidation of 24 million US dollars from users.

On April 12th, Pac Finance replied to a tweet on X platform, stating that they were aware that the parameter modification led to the liquidation issue and were actively contacting affected users to work out a plan to mitigate the problem. The official explanation also mentioned that a smart contract engineer was commissioned to make the necessary changes to adjust the LTV. However, the issuance liquidation threshold of Pac Finance was unexpectedly changed without prior notification to the team, leading to the current problem. In the future, Pac Finance will establish governance contracts/time locks and forums for all future upgrades to ensure advance planning discussions.

The official explanation has sparked strong reactions within the community, with users on Twitter and Discord communities condemning the team, but not receiving further responses.

User @ChiHoiX strongly advised everyone to temporarily withdraw from Pac Finance and explained the potential dangers of modifying the liquidation line. "1. At that time, there were 10,000 ezeth in pac for loop lending. 2. In Juice Finance, the ezeth vault had 42,000 eth borrowed for leveraged mining. 3. Changing the 10% liquidation line instantly generated a $20 million liquidation sell-off. 4. The liquidator easily made hundreds of thousands of dollars in profit. 5. Fortunately, the ezeth/eth pool had $200 million in deposits. As long as the deposits are slightly reduced, all ezeth deposits in pac will be liquidated due to price manipulation. 6. By then, the price will be pushed down a bit more, exceeding the main market-making area of ezeth/eth v3, and the ezeth price will directly approach zero. 7. The 42,000 eth leveraged pool in Juice's ezeth vault will also be liquidated in a chain reaction. 8. The liquidator and the scientists who had previously ambushed to buy the bottom will be able to easily make tens of millions of dollars in profit." He also added, "Pac has a total deposit of $350 million. If other pools are secretly modified, the entire lending and leverage products in the blast ecosystem will be liquidated due to insufficient liquidity."

"Why can an engineer easily change such an important parameter in a production environment without notifying or auditing the management team?!" This question directly points out the lack of internal control within the Pac team.

Juice's official response immediately stated, "Juice vault is not affected. Even if you sell 50 million ezETH in the pool, it will convert ezETH to wETH, but this will not cause our v3 to be liquidated."

Another practitioner pointed out the shortcomings of the Pac protocol. @0x_Abdul tweeted, questioning, "How can a DeFi protocol obtain deposits of over $200 million without a time lock?" Time locks commonly used in DeFi protocols can lock certain functions of smart contracts for a period of time, greatly reducing the chances of rug pulls and hacker attacks, and increasing security.

As of 1:00 PM on April 12th, according to DefiLlama data, Pac Finance currently has a TVL of approximately $212 million, ranking 5th in TVL among Blast protocols, with a daily decrease of 12.80%.

Brother project ParaSpace once staged internal strife drama

The lack of internal management in Pac seems to be a "chronic problem" for its development team. A cryptocurrency user stated, "I believe the biggest problem with Pac Finance is actually the ParallelFi team, which was previously ParaSpace, and later renamed to Parax, until now it has unified back to the Parallel brand. During the ParaSpace era, there were hacker attack issues, and although they were subsequently dealt with, there was internal strife within the team."

Public information shows that Pac Finance was founded in 2024 and was incubated by the Parallel Network (@ParallelFi) team. The team had previously raised a total of $30 million from first-tier institutions such as Sequoia Capital (USA), Polychain Capital, Blockchain Capital, and Coinbase Ventures. In March of this year, Pac Finance announced the completion of a new round of financing, with participation from Manifold, the development team of DeGods @XDeGods, and the specific amount has not been disclosed.

In May 2023, the NFT lending protocol ParaSpace seemed to have staged internal strife, with rumors of user funds being misappropriated and the founder seizing power. This incident quickly spread within the community, and many users, out of panic, withdrew their funds from ParaSpace despite the high gas fees. Although the matter was eventually resolved, a series of dramatic events undermined the trust of users in the project. Subsequently, ParaSpace announced a merger with Parallel Finance for a brand reshaping, creating ParaX.

Looking back at the Blast ecosystem, Pac has had a series of projects encountering issues. In early March of this year, the Blast lending protocol Orbit Lending was accused by users of having issues with the liquidation threshold. In the same month, in the early hours of March 27th, the Blast ecosystem project Munchables posted on X platform stating that it had been attacked, with the Munchables locking contract suspected of having issues, resulting in the theft of 17,400 ETH (worth approximately $62.3 million). Although the attacker later returned all 17,000 ETH to a multisig wallet 0x4D2F, this incident still had a negative impact on the Blast ecosystem.

Although Blast, as an open underlying protocol, does not have regulatory power over its ecosystem projects, the occurrence of these events undoubtedly affects the community's trust. The community also calls for the Blast ecosystem to introduce more mature projects, rather than projects developed by coin factories.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。