本文讲述了即将到来的疯狂牛市,重点关注生态系统的发展,提供技术创新、货币代币印刷机会和迷人故事。

原文标题:《Reexamining the Degen's Playbook for the Bull Market》

撰文:IGNAS

编译:Kate,火星财经

当你期待时会发生什么?

市场如何对待你的空投?

到目前为止,这对我来说还不错。目前前三名的空投:JITO, STRK 和 ETHFI。幸运的是,乐趣还没有结束。

在这篇博文中,我将介绍我们现在的情况,并重新审视我的 Degen 牛市的剧本,以及新的和以前分享的空投协议仍然值得推广。

我认为牛市的第二阶段已经开始:

在第一阶段,我们:

- 清理了上次牛市的烂摊子 ( 赢得了多起诉讼并消除了杠杆 )。

- BTC ETF 通过

- SOL 生态蓬勃发展

- 得到了几次重大的空投。

在第二阶段,我们将看到:

- 进一步战胜监管机构

- 降息投机

- ETH ETF 投机还是批准?

- 比特币 ETF 正流入增加

- 通过 Runes 协议,L2 和 BTC 原生 dApp 对 BTC 进行更多创新

- 使用 Restaking/LRT/Ethena 风格协议的新型杠杆积累

- 更大的空投:Eigenlayer、LayerZero、L2 空投、LRT 协议等。

我不是唯一一个认为第二阶段已经到来的人。对于 Yano 来说,第二阶段是认识到我们处于牛市中,但很多朋友仍然没有意识到这一点。

https://twitter.com/JasonYanowitz/status/1762878513731002570

「这是暴风雨前的平静。」

比特币价格目前处于积累区,当新的催化剂出现时,比特币价格将会上涨。

它只需要一个火花——任何催化剂都可以——来保持动力。减半的叙述可能就足够了。也许是降息,一个著名的机构参与者进入这个领域,或者可能是一些意想不到的事情。

市场想要抽水,我们会找到继续上涨的理由。

至少,这是我 ( 和大多数 degens) 所期望的。

当你期待时会发生什么

我记得观看了一场讨论比特币 ETF 对加密货币潜在影响的演讲。对不起,我现在找不到。在接近尾声时,有一个比较显示了 ETF 之前和之后的比特币用户。

「之前」的图片显示,比特币爱好者正在深入研究比特币的技术方面,比如这里的 Rodamor( 序数理论的创造者 )。

相比之下,「之后」的照片显示的是带着孩子退休的比特币持有者。

演讲者的主要论点是,由于持续的法币流入,比特币的价值将继续上涨,从而为比特币持有者带来财富。

「之后」的画面让我想起了「what to expect when you're expecting」的电影(我没有看过)。

这部电影的名字之所以贴切,还有另一个原因:我们都预计市场将继续上涨,空投将继续到来,并在 2025 年初达到顶峰。

对吧?

但这段旅程不会一帆风顺。

牛市比你想象的更加迟钝和不可预测。谁能想到 SBF 会偷用户的钱来赌币?

所以,我们都希望市场能继续印出百万富翁,空投物资也会不断到来,但我准备好了迎接意想不到的事情。

不过,每次牛市都会重复类似的模式。

最重要的是,每次牛市,我们都能找到创新的方式来印钱,通过发行由性感的新热门故事支持的代币。这些叙述通常是由于该领域的新技术进步,例如再质押或 RWA,而成为可能。

在牛市中,机会无处不在,但你需要找到关于加密货币市场份额的 Schelling 点。以下是我从过去两次牛市中得到的教训:

Navigating the Crazy Bull Market to Come

由于故事的叙述来来去去,我的目标是专注于蓬勃发展的生态系统,这些生态系统提供了 1) 技术创新,2) 货币代币印刷机会,3) 迷人的故事。

我在上一篇文章中详细介绍了如何识别蓬勃发展的生态系统:

Three Pillars of Booming Crypto Ecosystems

随着每次牛市的过去,创建代币变得越来越简单。

以前,狗狗币需要 PoW 硬件才能铸造代币,但现在即使是不知情的影响者也可以在短短 5 分钟内制造代币。

随着我们继续这一趋势,我预计我们将达到一个点,即过度涌入的代币将超过可用的注意力和货币流动,以维持其价格。这是派对结束的时候。

幸运的是,整个市场不在这里!

但市场上有杠杆风险增加的迹象,例如 Ethena 的 sUSDe 以及 LRT ETH 衍生品资产被主要 DeFi 协议接受为抵押品。

但我认为市场是健康的。我们可以增加杠杆。

实际上,我认为市场上缺乏新的高质量代币。

很少有人有兴趣购买之前周期的代币。它们并不令人兴奋,而且大多数都被高估了。此外,在早期周期中取得成功的团队缺乏进一步推销代币的动力。例如,Compound 的 $COMP…

该团队已经停止在社交媒体上互动,他们提出的复合链计划连同一条被删除的推文一起消失了。

因此,我预计市场将继续对新代币的估值高于前一个周期的代币。

越新越好。

JITO 和 ETHFI 的 FDV 高于 LIDO。Ethena 的 ENA 比 MKR 贵 2.5 倍。

这对空投来说是个好消息:更高的估值会导致更慷慨的空投。

因此,考虑到这一切,我在 2023 年 12 月分享了我的 DeFi Degen 的牛市剧本:第一部分,其中包括 10 个生态系统中的 60 多个协议。

距离最初的帖子已经过去了四个月。我预计这 10 个生态系统的表现将超过市场。

因此,是时候更新那些仍然值得耕种的生态系统 / 协议了。此外,我将包括在我之前的文章中没有提到的新协议。

重温 Degen 的牛市剧本

请注意,这不是 Part 2 Playbook。市场正在进入第二阶段,但与 4 个月前没有太大的不同。一些事情发生了变化:

- BTC 规则,ETH 烂透了:幸运的是,以太坊有再质押,否则我会考虑卖掉我的大部分 ETH

- Meme 币热变得更奇怪了

- 协议团队拥有永无止境的积分方案,可能会通过延迟代币生成 ( 和倾销 ) 事件,无意中延长这个看涨周期

https://twitter.com/DefiIgnas/status/1775910200962088994

所以,我的 degen 策略还是一样的:存入资产,点击按钮,然后领取空投。

注意:我不喜欢 Meme 币交易。自从我在 2020 年停止用法币购买加密货币以来,我已经上涨了 100 倍。现在,我正在追逐一个 10 倍的目标,专注于通过多次空投蓬勃发展的生态系统是一种更安全的方式。如果你正在寻找 100 倍的机会,我在之前的文章中分享了一些增加机会的策略。

How to Find 100x Gems: 5 Strategies

首先,我将分享新的空投策略,然后我将回顾仍然值得关注的生态系统 ( 与新的空投协议 )。

新的空投

• Elixir:订单簿流动性网络筹集了 800 万美元,估值为 8 亿美元,来自 Crypto Hayes, Sui, Amber 等。Elixir 允许向订单交易所提供流动性并获得奖励,包括 Vertex、Bluefin 等。

积分 (potion),可以通过存入 ETH 和铸造 elxETH 来获得神秘宝箱。你的 ETH 将被锁定,直到 8 月主网启动。

• Phaver: Lens 的最佳前端。随着 Farcaster 的使用和空投的爆炸式增长,这股潮流正在向 Lens 袭来。Phaver 的挖矿严重不足。你可以通过发布、连接 NFT 等多种动作获得 Phaver 积分。Phaver 从 Polygon、Nomad Capital 等融资 700 万美元。

• Zircuit:另一个 L2,带有各种流行语:「支持 AI 的模块化 zk rollup」,以及令人讨厌的 Blast 式仅限邀请的营销活动。很糟糕,但是..

它由 Pantera 和 Dragonfly 支持,并且它集成了主要的 LRT 协议,因此你可以同时进行 LRT + Zircuit 空投。存入你的 LRT ETH以获得 2 倍积分。你可以随时取款。

• Mode network:另一个 Blast/Zircuit/Manta 副本 L2,但它是一个 Optimistic rollup。再一次,我买了它,因为它支持 EtherFi weETH 和 Renzo ezETH,所以是挖矿的两倍。

Token 将于本月发行,但凭借 1.75 亿美元的 TVL,它并没有过度。

• Ethena:不需要介绍,但如果你坐在稳定币上,可能没有比这更好的空投了。

我将分享新的空投协议,以及之前分享的 DeFi Degen 的空投剧本,这些空投在这个看涨的市场中仍然值得加入。

1. Eigenlayer+ 流动性质押代币 + 主动验证服务

Eigenlayer 主网最早将于 4 月推出,可能会伴随着代币。此外,我预计 LRT 协议也将在同一时间推出它们的代币。

EigenLayer 的 TVL 增长是惊人的。自从去年 12 月我的 Degen 剧本以来,TVL 从 2.62 亿美元增长到 120 亿美元——4480%!它仅次于 Lido,超过了 AAVE。

流动性再质押,仅 13 个协议就累积了 84 亿美元,这意味着大多数 EIGEN 空投猎人更喜欢通过 LRT 协议进行挖矿。

更重要的是,每个人都忘记了 EigenLayer 的 AVS 空投。还有 14 个以上正在筹备中。就在本周,一家新的 AVS「Gasp」跨链互换公司宣布获得 500 万美元种子期融资,估值为 8000 万美元。风险投资公司为 AVS 提供资金是一个好兆头。

如果你想学习 AVS 协议,请查看我之前的帖子。

Navigating Restaking: Your Guide to Eigenlayer's Actively Validated Services

我预计 LRT 协议的数量会继续增长,但市场已经稳固了。TVL 超过 1 亿美元的只有 7 个。

所以,如果你坐在原生 ETH 上,LRT 是最好的地方。

该怎么办?

• EtherFi:即使在代币发布后,ETHFI 的 TVL 也有所增加,第二季将于 6 月 30 日结束。需要考虑的策略:

( 简单 ) 将 eETH 存入 EtherFi「流动性」策略以获得 20% 的 APY, 2 倍 EtherFi 和 1 倍 Eigenlayer 积分

( 高级 ) 在 Fluid 上,高达 10 倍的杠杆 Eigen 和 20 倍的 EtherFi 积分。

• Renzo:发展最快的 LRT,TVL 高达 23 亿美元。币安实验室宣布投资,Thor Hartvigsen 计算指出,Renzo 是「目前停放 ETH 的最佳地点」。代币发布日期尚未公开。

选择适合你在多个 L2 和协议上的任何 DeFi 策略。

• Swell:确认在 4 月中下旬推出代币,rswETH 提款即将到来,Swell 将推出自己的 L2,具有原生质押收益率。如果你想要快速进出,Swell 可能是一个不错的选择。

铸造 rswETH 和获得更多的珍珠

考虑等待 Swell L2 预存款很快开放

• Puffer:第三大 LRT,但 TVL 在下降。这是因为 Puffer 目前不支持原生 ETH 质押 ( 不像 Renzo 和 EtherFi)。因此,新的 stETH 储户无法在 Puffer 上获得 Eigen 积分。不过,它是由币安实验室支持的,所以一些曝光是有效的。

加入 Crunchy Carrot Quest 并在此处存款到 Curve/Convex 池获得 2 倍积分。

• Kelp:做了一些可能会惹恼 Eigenlayer 团队的事情:推出流动 EIGEN 点作为 KEP 代币。在此处查看 KEP 价格。

Kelp 推出了「通往十亿之路」TVL 奖励,每个 ETH 可获得高达 100 个额外的 EIGEN ( 每个 ETH 约 17 美元,每个 KEP 0.17 美元 )

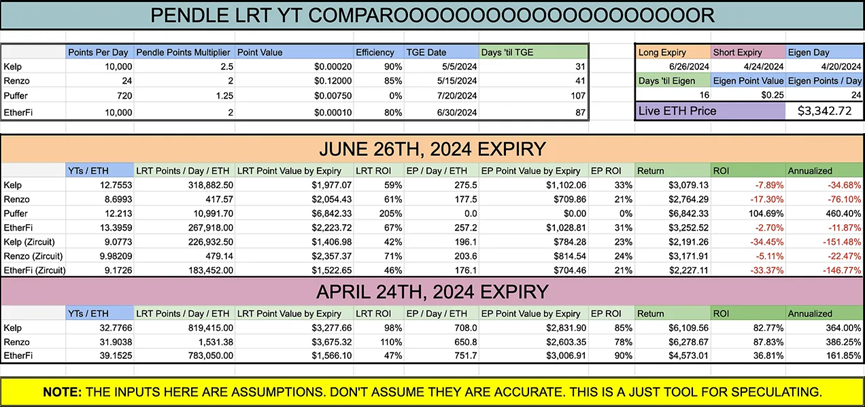

重要提示:Eigenlayer 和 LRT 代币很快就会发布,所以要利用你的积分,可以考虑使用 Pendle YT 代币。YT 的值在到期时降至 0,但由于 Pendle,我的 EtherFI 空投是有史以来最大的。

你可以在这里查看 Thor Hartvigsen 的 Pendle LRT 计算,在这里查看 Stephen DeFi Dojo 的实时计算。

https://docs.google.com/spreadsheets/d/1ijVL4sNJw1405ifvK3dps_1iuDGcXpndKszRuWQoF9I/edit#gid=0

2. Stacks

仍然是我最喜欢的戏剧之一,因为:

1.比特币 L2 叙事

2. Nakamoto 的升级将在 4 月推出 5 秒交易 ( 最终在 Stacks 上交易将变得有趣 )

3.生态系统仍然很小,很少有挖矿者,所以很容易提前定位自己。以美元计算,TVL 在 4 个月内从 3500 万美元增长到 1.76 亿美元,但这是由于 STX 价格上涨。在 STX 中,TVL 翻了一番。

很好。还早。

如果你非常懒惰,但想要奖励,那么 Stacks 有两个最好的机会:

• Stacking DAO: STX 的 stSTX 流动性质押。积分直播用我的推荐,如果可以的话🙇♂️

奖励:将 stSTX/STX LP 存入 2 倍空投到 Bitlow: Stacks DEX 。Stacking DAO 将在 Bitlow 空投之上提供额外积分。

• Lisa:另一种流动性 Stacking 刚刚启动。在这里申请等候名单。Alex 实验室的质押和挖矿。

其他需要考虑的农场:

•Arkadiko:抵押 STX 以铸造 USDA 稳定币。将推出比特币原生贷款。交换并持有一些 USDA。

•Hermetica:使用衍生品策略在 BTC 上赚取资金。使用堆栈 sBTC。目前在测试网,但我会等待主网尝试。

•Zest:比特币借贷。目前在内部测试,但可以请求访问这里。

•Velar:AMM。刚刚完成了 Gate 和 Bybit 的 ICO。空投的积分系统启动了。

3. Starknet

我知道你们很多人都很失望,因为没有得到空投,所以永远离开了这个生态系统。

但我仍然喜欢 Starknet,因为它独特的 Cairo 开发语言 ( 防止容易分叉和更少的协议→容易关注哪里可以挖矿 ),STARK 和 SNARK 的扩展技术以及 STRK 代币实用程序的质押和 gas。

另外,第二次 STRK 空投即将到来,而 Starknet 的 TVL(3.14 亿美元 ) 与 STRK 的 FDV(190 亿美元 ) 相比仍然很低,所以我可以闻到一个空投即将到来。

然而,我对 zkLend 的空投感到失望:我只获得了几百美元的贷款 / 借款 5 位数的资产。几乎没有人知道空投已经启动,点击这里查看。

我希望这三种协议能给用户带来更多的回报:

•Nostra:第一。TVL 的 dApp (Starknet 总计 3.14 亿美元,其中 2 亿美元 )。

•Ekubo:第一,DEX。除了运行积分系统外,大多数主要资产的 LP 奖励是 50%,所以你可以获得空投积分 + 收益。

注:Ekubo LP 提款费用高得离谱(最高 1%),因此选择宽范围的 LPying 资产。

•Avnu:Starknet 的 Jupiter。为了得到更多的积分,我经常进行小额交易。

4. Solana

Solana 的大多数主要 dApp 都在投放代币 ( 尤其是 KMNO、PRCL、TNSR 和 DRFT?),但挖矿并没有结束。现在有一种新趋势,即在第二季中立即推出代币和积分活动,以防止 TVL 流失。这很有效,因为第一批只有一半的代币是空投的。

以下是我目前关注的:

•Kamino:第一季结束了,第二季正在进行中。预计 4 月上市!

我最喜欢的是 5 倍 SOL 乘以 degen 金库 ( 但清算风险较低 )。

•Sanctum:新的 LST,或者 LST 聚合器。JTO 的空投很好,Sanctum 可能更好。获 Dragonfly、Sequoia、Solana Labs 等融资 610 万美元。对于 1 亿美元的 TVL 来说,这还为时过早。我把钱存入 INF( 一篮子利率为 9.3% 的 LST)。

•Marginfi:开玩笑地发布代币,但我厌倦了他们没完没了的积分活动。此外,他们还推出了原生稳定币 YBX。老实说,Aave 和 Curve 推出了稳定币来吸引 TVL,但未能获得牵引力,所以我对他们的稳定币也不抱太大期望。不过,还是需要耕种一点。

•Backpack:有交易所和钱包。需要 KYC 进行交换,以防止女巫,并可能提供更高的空投。获得由 Placeholder VC & Wormhole 领投的 1700 万美元融资。

•Tensor:我仍然持有并质押 Tensorian NFT,但价格已经下跌。令人惊讶的是,尽管 MagicEden 正在蚕食 Tensor 的市场份额,Solana NFT 的销量仍在增长。

尽管如此,Tensor 团队仍在推出新功能 ( 价格锁定 ),代币的发布可能会引发 FOMO 的复苏。

•Grass:我用旧手机被动地赚取积分。如果你的资金有限,Grass 是一个划算的选择。

它符合 Solana x AI 的叙述。他们会推出自己的 L2。你需要安装谷歌扩展程序才能挖矿积分。刚刚从 Polychain Capital、Bitscale 等公司融资 350 万美元。

•Parcl:多头 / 空头房地产市场。我只是坐在 USDC 流动性中挖矿积分。

•Flash.trade:加密货币、大宗商品和外汇交易的永续合约。他们有 NFT,它会根据你的交易历史而变化,你会收到部分协议费用,而且他们很可能会空投。

•Drift:融资融券交易、借贷。

5. SUI

为什么 SUI?

我加入 SUI 比较晚,头寸也不大。但这次体验比我想象的要好得多。TVL 继续增长,使 SEI、INJ 或 Aptos 相形见绌。但主要的 dApp 仍然没有代币。

我喜欢它是用 Move 开发语言构建的,因为它可以防止简单的复制粘贴以太坊分叉。

考虑 SUI 上的这些操作

SUI 有三个 LST 可用 ( 可能是最简单的玩法 )

•在 Headal 上为 haSUI 质押一些 SUI。

注:可以在 Cetus 协议上交换 SUI 到 haSUI 以获得更好的速率。

•在这里为一个 SUI LST 质押一些 SUI。

注:为挖矿提供高达 100% 年利率的流动性。

•借出 haSUI 或 / 和 afSUI 并在Navi 协议(有代币但 APY 高达 30%)和Scallop(第 2 阶段空投积分上线)上借入稳定币或 SUI

•借出 $SUIto 借入Bucket- Maker of Sui 上的稳定币 $BUCK。

6. 比特币的生态系统

比特币序数是加密领域第二个看涨的东西。就在再质押后面。

我很早就购买了比特币 NFT,它们不仅升值了,而且在多次空投中获得了回报,最著名的是 RSIC 和 Runestone。事实上,我得到的空投太多了,我都不知道它们是做什么的。

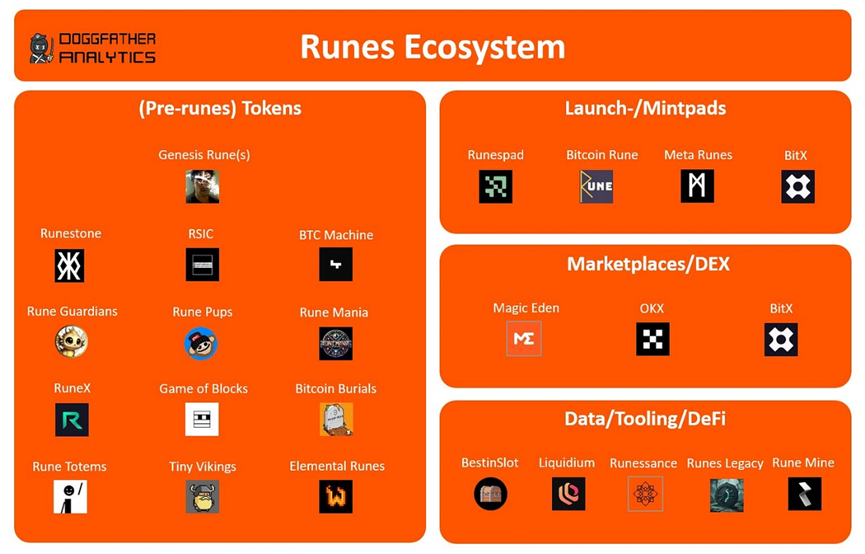

现在,Runes 协议正在比特币减半区块启动,这将为比特币带来更多的交易机会。

协议越来越多,所以我建议在乐趣开始之前检查这个线程并学习。

https://twitter.com/DoggfatherCrew/status/1775546878836294102

另外,这里还有peddy的很棒的教育线程。

https://twitter.com/peddy2612/status/1775948393904308314

如果你是序数的新手,我已经写了一个初学者的解释和一些协议供你尝试:

Ordinals & BTC DeFi: Start Here.

7. SEI

我退出了 SEI 的大部分生态系统。到目前为止,缺乏增长和很少的 dApp。SEI 将通过 SEI V2 推出 EVM,但我预计它会被低工作量的以太坊分叉所淹没。

不过,我看好的一个领域是 SEI 的 Silo 流动性质押。只需质押一些 SEI 并等待空投。

在Silo上质押。

8. Injective

我最近完全退出了 Injective 生态系统。

生态系统中充斥着低质量的 dApp( 甚至它们的前端都充斥着错字 ),缺乏一个充满激情的社区,更糟糕的是,INJ 质押者和 dApp 用户收到的微薄空投只值几百美元。几个月来,我一直在挖矿,存入了近六位数的金额。

Injective 内部似乎缺乏创新。我的怀疑是,在最终的代币解锁后,投资者将打算套现。或许一个退出泵即将出现。

总的来说,我对市场的预期是:在积累完成后,加密货币会上涨,空投会不断到来。

然后市场会发生一些结构上的变化 ( 总是这样 ),Degen 的剧本也会改变。所以,当它发生时,请订阅第 2 部分。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。