作者:CapitalismLab

Ethena 的 Blog 几乎明示即将结束积分活动,而目前 Pendle 上 USDe 隐含 APY 到达了恐怖的 170%! 就是说市场认可其 170% 的 APY 这高到没朋友的收益。

这下不得不快马加编一篇 《Ethena 挖积分最强攻略》 帮大家了解如何以正确的姿势搭上这最后一班车。

首先简单介绍下 Ethena,就是你给 U 给项目方去交易所买入 stETH 等 LSD ,然后做空 ETH 实现对冲同时吃到 ETH Staking 收益和做空资金费率收益,牛市资金费率很高所以 Ethena 收益也很高。

Ethena 包装出了两个代币产品:

- sUSDe - 享受原生利息的代币,利息反应在 sUSDe/USDe 汇率会随时间不断增长上,需要 7d unstake 成 USDe

- USDe - 无利息,与 DeFi 组合构建流动性等,底层对应的资产收益给 sUSDe 提高了 sUSDe 的收益,积分也主要是给这块。注意一般用户只能使用 DEX 兑换 USDe 与 USDC/USDT,所以进出有少量损耗

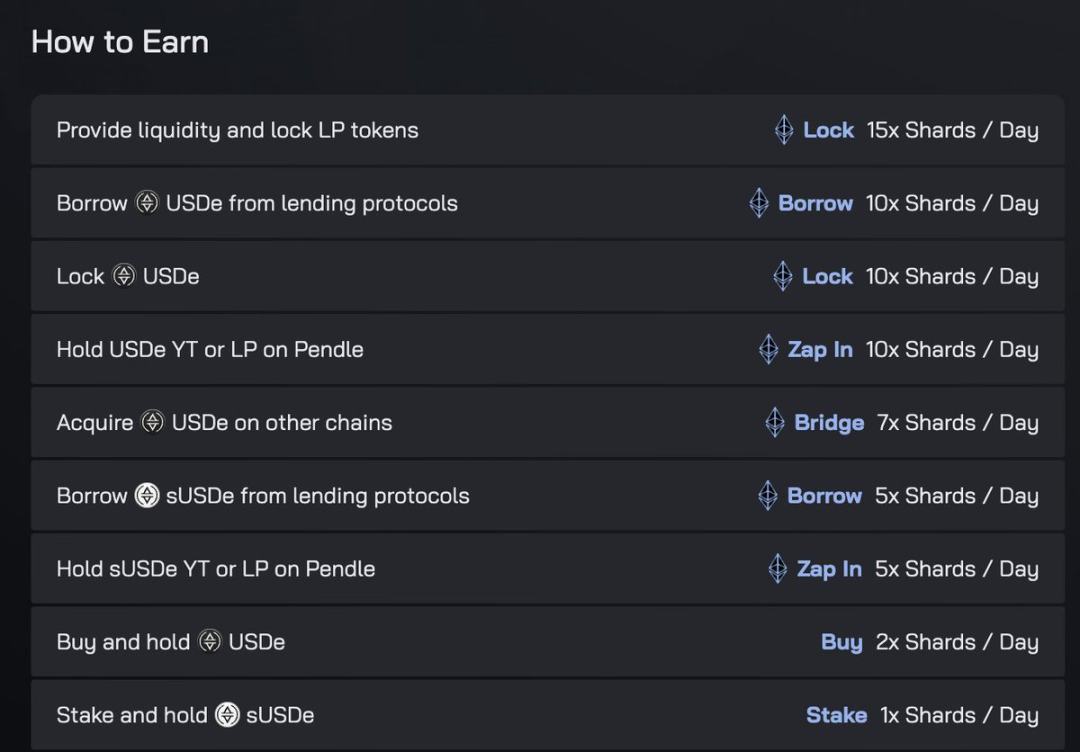

Ethena Labs 积分挖矿种类多样,积分的倍数也不一样,本文接下来直接推荐不同收益与流动性需求下的最佳方案。

欢迎使用我们的邀请链接:http://app.ethena.fi/join/wogwi

1. Zircuit+USDe - 无解锁周期中收益最高的方案且有额度。

将 USDe 存入 @ZircuitL2

可以获取 7 倍积分以及 Zircuit 积分,可以即时解锁,Zircuit 是 知名 VC 投资的 L2。

https://stake.zircuit.com/?ref=3yn4f8

2. 锁定 USDe - 额度最多,收益与流动性适中。

直接锁定 USDe 有 10 倍积分,解锁 7 天,剩余额度较大。

3. 锁定 Curve USDe LP - 收益高,流动性最差额度少。

锁定 http://app.ethena.fi/liquidity 页面中所展示的 LP 可以获取 15 倍积分收益,但是需要 21 天解锁并且解锁期无收益。考虑目前积分活动即将结束,机会成本比较高,如果你觉得之后的矿远不能和这个比,可以考虑,但是目前额度几乎已满,建议观察等有额度后出手。

4. 持有 sUSDe - U 本位收益高,积分收益很少。

积分仅 1 倍,可以获取高达 67% 的原生收益,即 U 本位收益,但是解锁需要 7 天,流动性一般,也可以通过 DEX 折价卖出。

5. Pendle/Gearbox USDe 理论收益高但是完全没额度。

Pendle 上可以利用 YT 实现 200 倍 积分,但是额度已满。

Gearbox 上对 USDe 进行循环借贷,可以加杠杆获取最高达 90 倍的积分,但额度非常稀缺,且需要考虑借贷成本。

这两个方案都有不小的亏钱概率,只推荐了解机制的专业人士参与。

其他方案相对上述方案,流动性更高的收益没有更高,收益高的流动性不如上述方案,所以一般针对各自的流动性需求适配上述方案即可。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。