作者:Frank,PANews

2月28日,Telegram创始人Pavel Durov在其Telegram个人频道中表示,下个月起,Telegram频道拥有者将能够从其工作中获得财务奖励。他表示,目前,Telegram广播频道每月产生1万亿次观看量,但只有10%的观看量通过Telegram Ads实现了变现,这是一个以隐私为设计理念的推广工具。3月份,Telegram广告平台将正式向近百个新国家的所有广告商开放。这些国家的频道拥有者将开始获得Telegram从其频道显示广告中赚取的50%收入。为确保广告支付和提现快速安全,将专门使用TON区块链,并通过Toncoin出售广告并与频道拥有者分享收入。

该消息一经曝出,TON代币应声上涨,最高短时涨幅达到38%,价格最高至2.95美元。但在4小时后,TON价格再次经历大幅回落,最大跌幅25%,价格最低降至2.2美元,几乎回到上涨前的的水平。Telegram这次的变化,具体将为TON链带来什么利好?还是又一次短期市场刺激?

或增20亿广告流水 暂无分红利好

或许正是长久以来的不温不火,使得Telegram创始人Pavel Durov多次通过联姻的方式来为TON输血。那么,就本次推出的合作事项来说,对TON的实际影响到底有多大?

在这次的关键信息中,Pavel Durov提到Telegram广播频道每月产生1万亿次观看量,但只有10%的观看量通过Telegram Ads实现了变现。在其3月份开始推出的新的广告计划后,频道拥有者将获得50% 广告收入,这部分收入将通过Toncoin进行交易。

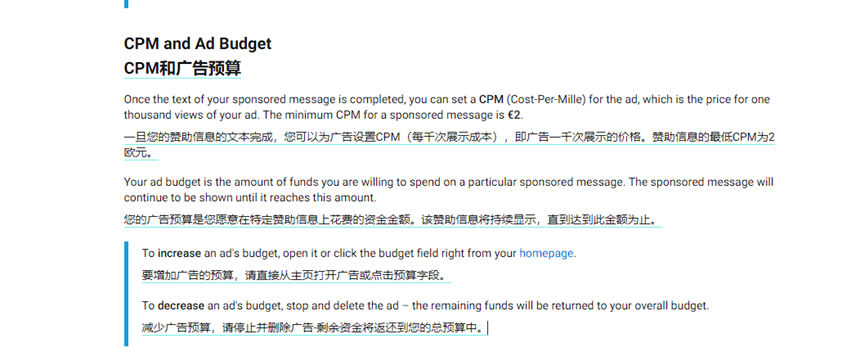

PANews在Telegram官方的广告商说明中看到,目前Telegram的CPM(每千次展示成本)最低为2欧元。根据Pavel Durov提到的月观看量1万亿次和10%的广告观看量计算。在广告部分的播放量约为10亿次左右,根据CPM最低值计算,Telegram每月最低的广告收入约为2亿欧元,频道拥有者的总收入最低约为1亿欧元每月。

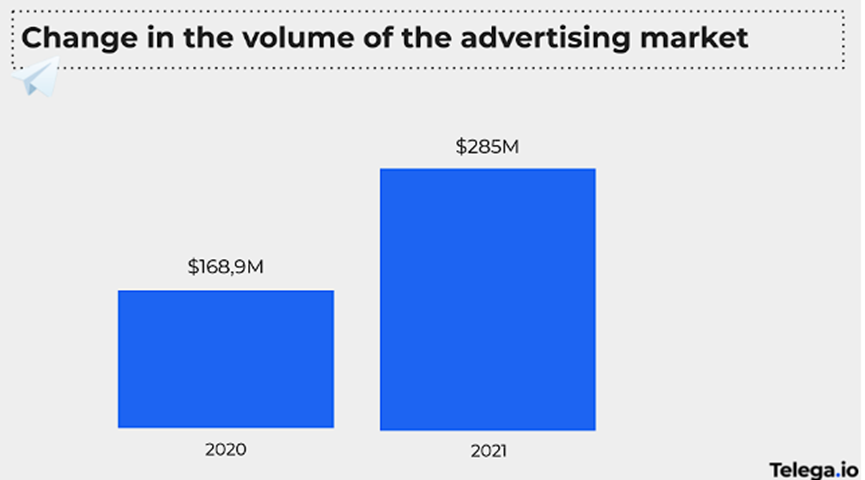

另一个报告也基本验证了这个数据,根据Telegram俄语板块的最大广告交易市场Telega.io的一份报告显示,2021年,俄罗斯的Telegram用户群体超过5000万,该年度俄语市场的广告收入达到了2.85亿美元。而根据目前Telegram全球8亿用户的说法计算,目前Telegram全球的广告收入约为45.6亿美元。按此数据计算,可通过Toncoin链上交易的数据约为22.8亿美元/年。

但值得注意的是,这笔收入并非给TON代币的持有者分享,而是以TON的方式进行链上交易。因此,这个消息与前段时间Uniswap提出的持币者分红有着很大区别。不过,从目前TON的链上数据来看,即便只是在链上走这样规模的交易量,也将为整个链上的活跃度提升一个台阶。

目前Telega.io显示,目前该市场有4,351个频道所有者属于已验证的广告位提供者,而活跃的广告商也仅为7万个左右。因此,从用户增长来看,可能产生的效果并不大。不过Telegram通过广告费沉淀在Toncoin上的资产反而成为社区关心的问题。

为了应对人们担心Telegram因专门销售TON广告而持有过多Toncoin,可能对去中心化生态系统造成不利影响的问题。Pavel Durov提出了一个解决方案,为限制Telegram持有的TON份额约为供应量的10%,他们计划以低于市场价格、但设有1至4年锁定和归属计划的方式,将即将超额的TON持有量出售给长期投资者。这样可以锁定自由流通的TON,稳定生态系统并降低波动性。此外,Telegram还设立了新的电子邮件地址,供大额投资者(100万美元以上)表达兴趣。

Telegram坎坷的加密路

说到TON,大多数人的印象可能会想起Telegram的官方加密计划TON公链。但目前的TON本质上并非Telegram直接控制的区块链公链。

早在2019年,Telegram 曾试图推出“Telegram Open Network”(TON)的区块链网络, TON 是一个多用途的区块链平台,旨在提供比比特币或以太坊更高的速度和可扩展性,以支持全球支付和去中心化应用。然而,这个项目在与美国证券交易委员会(SEC)的一系列法律斗争后被取消。

TON项目原计划由Telegram推进,在与SEC和解后,Telegram宣布不再参与TON项目。随后,社区和其他开发者团队决定继续这个项目,推出了基于TON的几个分支项目,如Free TON(后来更名为Everscale)和TONcoin。这些项目继承了TON的技术愿景,旨在创建一个高性能的区块链平台,但已经与Telegram公司没有直接联系。目前我们熟知的TON公链,名为:The Open Network,是Telegram官方加密计划流产后,成长的最为成熟的一个公链项目。虽然TON与Telegram没有直接关系,但Telegram官方和创始人Pavel Durov仍在近年来多次支持该项目,并强调Telegram与TON的业务联系。

2022年12月,Telegram 宣布用户可以通过支付 Toncoin 在Fragment 区块链上购买匿名号码。受到消息刺激,TON 从 1.84 美元上涨 30% 至 2.4 美元,价格一度高达 2.8 美元。尽管Fragment在随后的一个月内,交易量超过了5000美元,但TON的市场表现并未再持续坚挺,反而是随着加密熊市的步伐一路下跌至最低0.96美元。

坐拥8亿用户,渴望打造全球最大公链

在TON的官方介绍中这样写道:截至2022年,TON区块链仍然是为数不多的真正可扩展的区块链项目之一。因此,它仍然是最先进的区块链项目,能够每秒执行数百万甚至在未来必要时数千万个真正的图灵完备智能合约交易。

在其官方与其他公链的性能对比中,TON链似乎也在各个方面能够碾压以太坊和Solana。

2023年,TON基金会总裁Steve Yun在演讲中透露,其目标是在2028年前吸引Telegram 30% 的用户加入TON。预计TON在2028的活跃用户将达到5亿人。

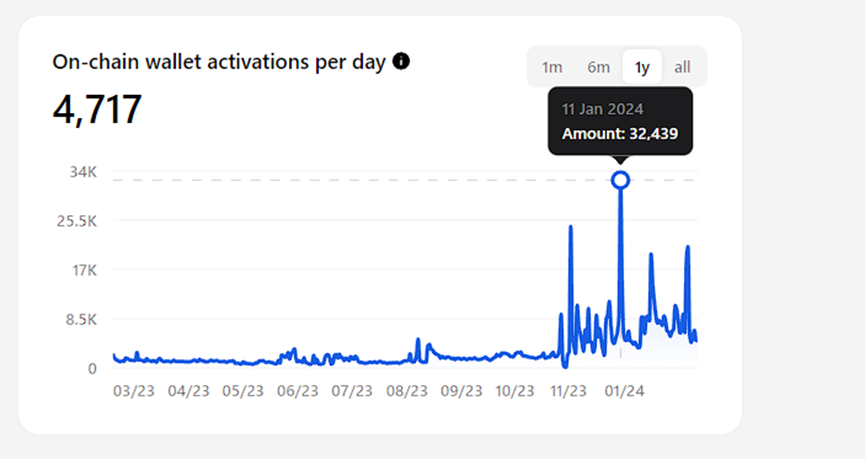

虽然目标很宏大,且背靠8亿用户的Telegram的强力支持,但TON目前的进展似乎仍并不理想。截至2024年3月1日,TON的链上激活的钱包约为156万个,历史最高日活跃用户为32439个。作为对比,以太坊的该数据约为1.1亿个。

总体而言,Telegram作为Web3.0基因十足的一款产品,深受行业的认可。尤其是随着越来越多的电报机器人和加密工具在Telegram上成长壮大。并且作为全球最大的社交平台之一,Telegram也有足够的潜力成为加密行业的场景之王,但就目前与TON这种隔靴搔痒式的联姻而言,市场的表现或许是最好的反馈。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。