Overview: Felix, PANews

Last night, with more than 50 days left until the Bitcoin halving on April 21, Bitcoin broke through the $60,000 mark for the first time in over two years. The last time Bitcoin surpassed $60,000 was on November 12, 2021, when the market started to bearish, hitting a low of $19,297 in early April 2022, a drop of over 67%.

According to Coingecko data, the current price of Bitcoin is $61,314.65, up 8.1% in the past 24 hours, 19.1% in the past week, and 41% in the past month. Although Bitcoin has now stabilized above $60,000, the market trend last night was not smooth, with ups and downs.

Bitcoin Flash Dropped 7% After Touching $64,000, Liquidating Over $700 Million

Bitcoin surged rapidly last night, reaching as high as $64,000, seemingly poised to break a new high of $69,000. However, it quickly dropped 7% after hitting a high of $64,037, falling to $59,400. Other tokens were also affected, with ETH, SOL, XRP, ADA, DOGE, and AVAX all dropping 4%-9% within an hour, leading to a large number of leveraged traders being liquidated.

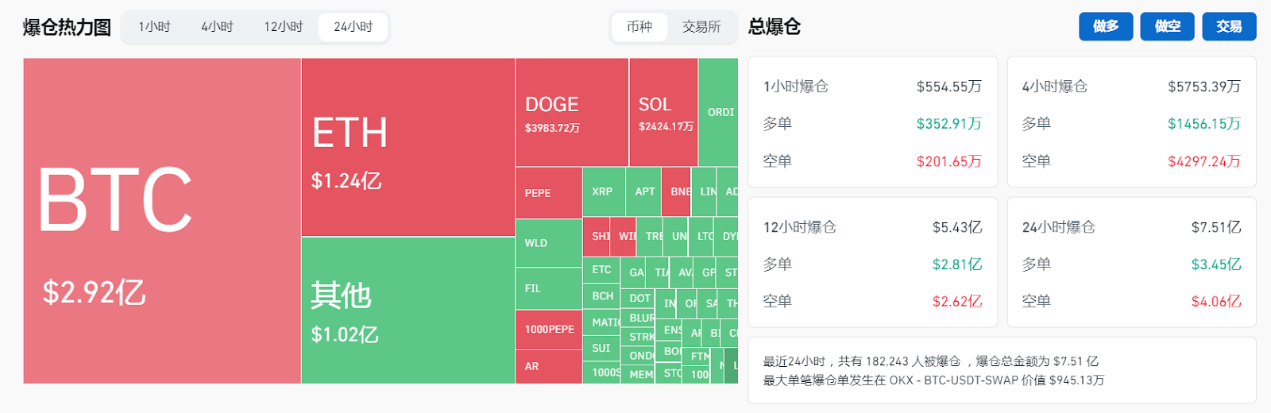

According to Coinglass data, approximately $751 million was liquidated in the past 24 hours, with long positions liquidating $345 million and short positions liquidating $406 million. Of this, about $292 million came from Bitcoin, followed by Ethereum at $124 million.

Bitcoin Spot ETF Trading Volume Hits Record High

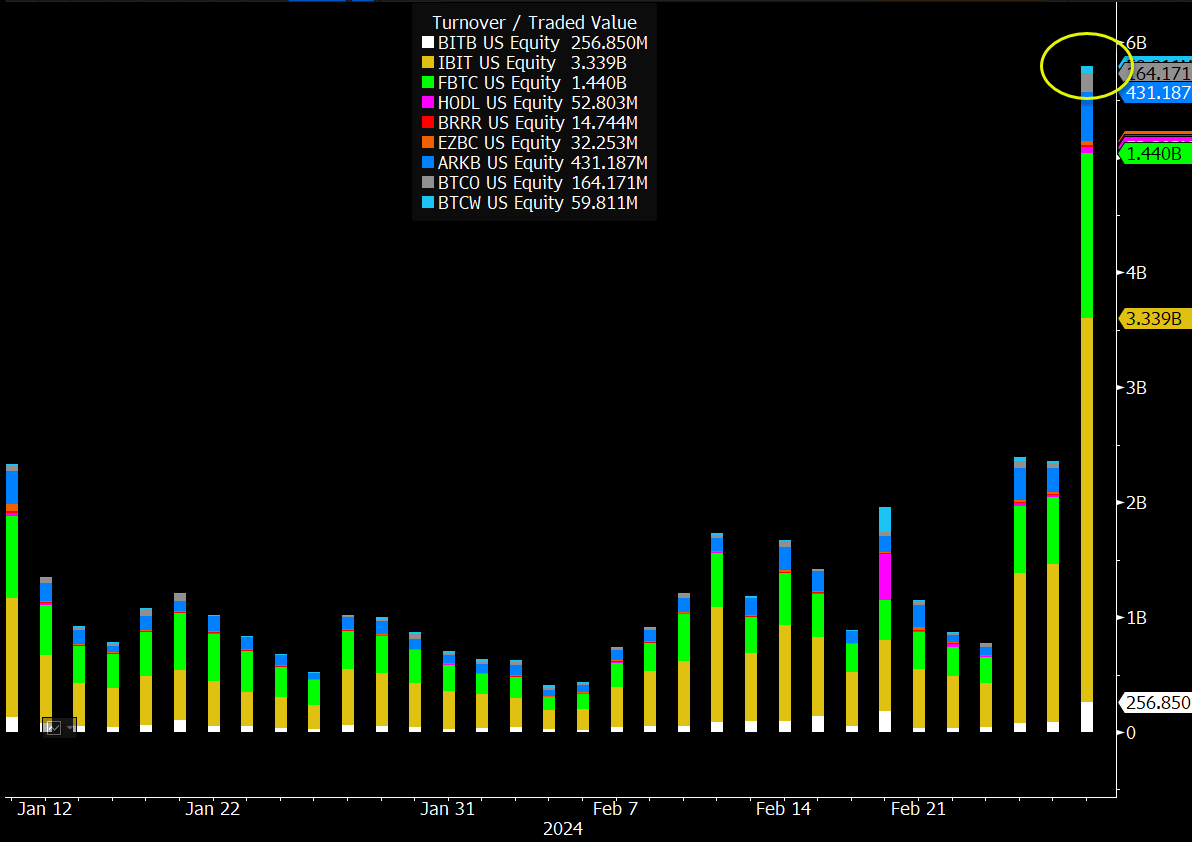

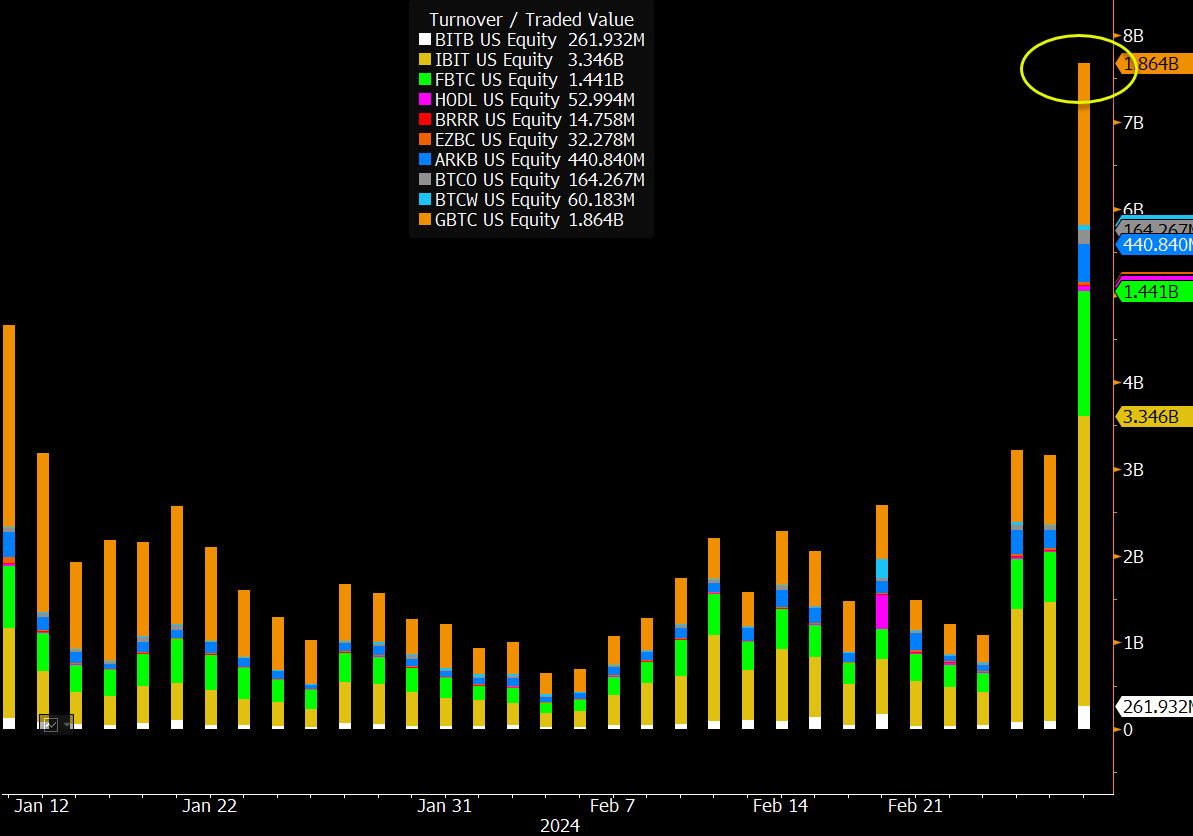

The frenzied price movement of Bitcoin has also brought record trading volume to U.S.-listed spot Bitcoin ETFs.

Data released by Bloomberg senior ETF analyst Eric Balchunas shows that on February 28, the daily trading volume of 9 spot Bitcoin ETFs, excluding GBTC, was approximately $6 billion, double the record set on Monday (February 26). Among them, the trading volume of the Bitwise BIT reached $3.3 billion, and that of the Fidelity FBTC reached $1.4 billion, both breaking previous records. At the same time, the number of trades also doubled, totaling over 500,000.

Grayscale's GBTC saw a net outflow of approximately $216.4 million, higher than the previous day's $125.6 million. Including GBTC, the total trading volume of the 10 ETFs amounted to approximately $8 billion.

Coinbase Encounters Technical Issues Again

Whenever the market fluctuates significantly, incidents of trading platform malfunctions seem to be "never absent." Yesterday, some Coinbase users reported that their balances were showing as $0 and they were unable to buy or sell assets.

Coinbase CEO Brian Armstrong stated that the malfunction was due to excessive traffic. "We simulated a 10x traffic surge and load tested it, and now the traffic has exceeded that number. Although the cost of maintaining overcapacity is very expensive, we will continue to focus on researching automatic scaling solutions and eliminating all bottlenecks."

This is not the first time Coinbase has encountered such issues. In August 2023, some customers reported the same problem, and Coinbase similarly stated that it was due to technical issues.

Currently, Coinbase has announced that all services have been restored. A very small number of customers may still see inaccurate balances in their accounts, and the team is working hard to resolve these display issues.

"Winning Big" with Bitcoin Purchases

According to CNBC, after the stock price of MicroStrategy, the founder Michael Saylor's personal wealth increased by about $700 million following three consecutive days of increases in both the company's stock and Bitcoin prices. MicroStrategy's stock price rose by 10% yesterday, with a 40% increase over three days, following a 346% surge in 2023, and a 52% increase this year. Saylor is the largest investor in MicroStrategy, holding 12% of the company's shares. In 2020, he also disclosed that he personally held 17,732 Bitcoins. With the rise in Bitcoin prices, Saylor's MicroStrategy stock and Bitcoin holdings have climbed from $2.27 billion at the beginning of this week to $2.96 billion.

It is worth mentioning that during the latest earnings conference call on February 7, MicroStrategy's CFO Andrew Kang stated that the company is "the largest corporate holder of Bitcoin in the world, and we remain committed to our Bitcoin acquisition strategy."

MicroStrategy "walks the talk." On Monday (February 26), MicroStrategy announced that it had purchased 3,000 Bitcoins for approximately $155 million between February 15 and February 25. Currently, MicroStrategy and its subsidiaries hold approximately 193,000 Bitcoins, worth about $12 billion.

Meanwhile, El Salvador President Nayib Bukele posted on X platform that El Salvador's Bitcoin holdings have seen profits of over 40%, and there are no plans to sell Bitcoin. It is reported that the average holding cost for El Salvador is $44,292, with a total of 2,381 Bitcoins held in the national treasury.

Reference: Coinbase, The Block, CNBC, CoinDesk, Decrypt

Related Reading: Deep Thoughts: This Bull Market Differs from Previous Ones, How to Adjust Wealth Strategies Accordingly?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。