行情总是在不断的生死轮回中进行,对行情准确的把握,一定需要放大级别看,知道日线级别在干什么、4小时级别在怎么走,有了对大级别方向的把握,才能在小级别的波动中稳住内心,不受或少受情绪波动的困扰。这也是为什么解盘一定要从大级别开始,逐级看向小级别。

这一轮小牛市,依然有继续延伸的可能,但出现了大级别卖点的结构,就一定是以减仓为主。我们继续来看盘面。

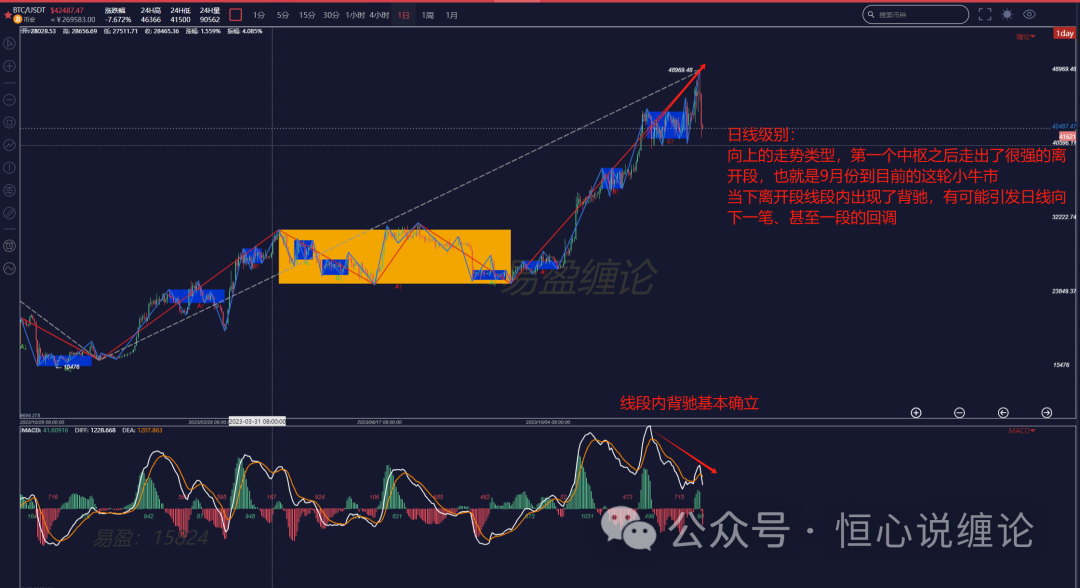

日线级别:

日线级别线段内的背驰(即所谓的背离)基本确立,市场进入向下回调的节奏。而市场的转折一般不会想暴风雨般强烈,即便是开启了(可能是)小熊市,也不会那么快跌下来。大级别的转折一般都会有至少几周的震荡行情,所以接下来,即便是操作大级别,最好也是以4小时线段为操作级别。

4小时级别:

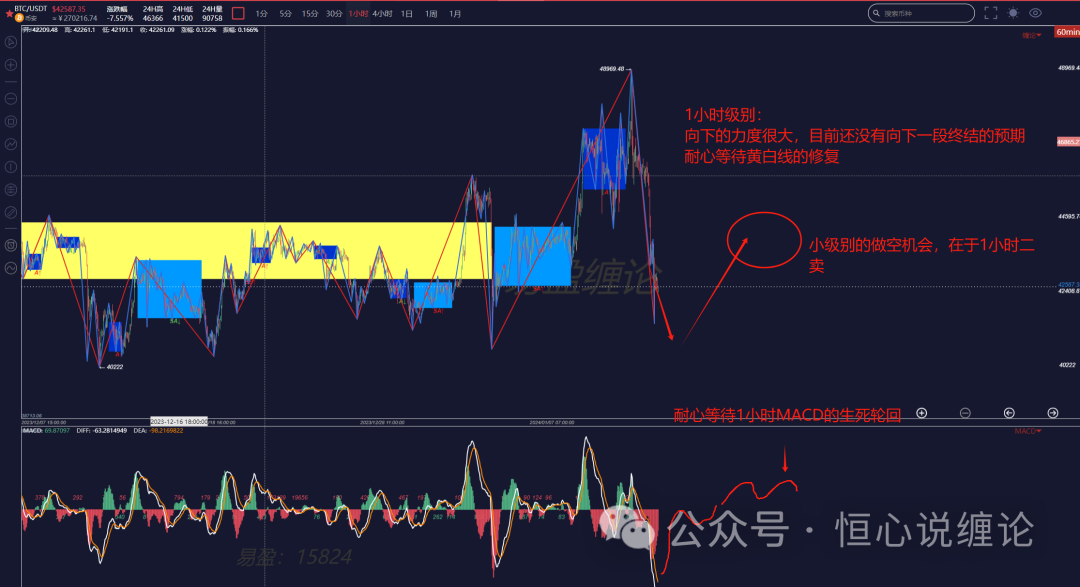

4小时级别当下可以很明显看到向下回调的力度,因此这个回调至少是4小时级别的。即便如此,当下依然不建议追空,大级别的空单,一定是在4小时二卖布局,当下即便做空,也是在小级别(如1小时级别二卖布局,在4小时向下段终结后就要离场)

1小时级别:

向下的力度很大,当下的位置不适合追空,一定是等待结构完整的形态出现后,再找进场位置。

简单的术语说明:

级别:缠论中特有的概念,代表在时间和空间周期两个维度的行情,级别越大,时间越长、波动空间越大,一般为4小时级别、1小时级别、30分钟级别等

走势类型:分为盘整和趋势两类,有上涨的走势和下跌的走势;各级别都有对应的走势类型

线段:次级别的走势类型构成,“某某级别的一段”特指线段

背驰:是指一段上涨或下跌的末尾,价格出现新高/新低,但力度上明显衰竭的走势。通常以MACD辅助判断。

文章内的观点仅供学习参考,不构成投资建议。

有想一起操作的朋友,在大牛市抓住大饼及优质山寨的机会,可以添加我的微信(vhenrythu)咨询、交流学习!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。