原文标题:铭文之后,BTC 生态下一个爆发是 Bitcoin Layer-2 吗

原文作者:Bitwu.eth

铭文火了已经有一段时间,Meme 和矿工狂欢之后,市场开始在 #BTC 生态上寻找新的机会,似乎所很多人认为后期爆发点是 Bitcoin Layer2

那我们今天就来看看 Bitcoin Layer2s

本文超过 3000 个字,信息量大,观点新颖,阅读需要一定时间,建议收藏后再仔细阅读:

本文分为 3 个部分:

1、10 年前的 Bitcoin Layer2

2、Bitcoin Layer2 发展

3、市场上几个新的 Bitcoin Layer2 分析

·ZTC Global(@ZTCGlobal)

·B² Network(@BsquaredNetwork)

·BL2(@BL2_official)

4、相关总结

一、Bitcoin Layer2 前世

其实 Bitcoin Layer2 的争议并不是现在就有的,从 2015 年一直到现在都在讨论,曾经 BTC 社区曾经发生过激烈的争吵

BTC 区块链容量大小上限为 1M,这 1MB 的区块极大限制了每个区块中所能容纳的交易数。这些争吵逐渐形成了 2 派:扩容派和 core(保守派)

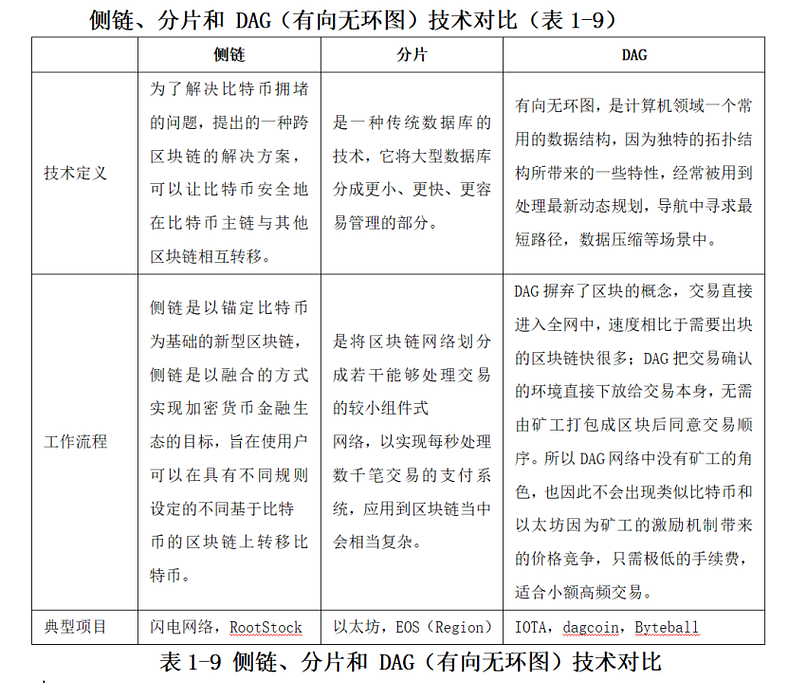

Core 认为:应该在主链之外开发一条侧链,技术解决方案是搭建一条二层网络协议(如:闪电网络),这就导致后来出现了各种联盟链、私有链、跨链等

目前的现状是 BTC 继续以小区块运行,既然是小区块,那矿工总交易笔数就有天花板,而每笔交易收入也有天花板,比如用户一笔交易可接受范围是几百块 Gas,再高用户就选择离链交易、在 Bitcoin Layer2 等替代方案上交易,这就会导致矿工在 Gas 上的收入变少。

扩容派认为:1M 的区块容量太小,Gas 费收入有天花板,Gas 费太高时,用户都去闪电网络等 Bitcoin Layer2 上去交易,导致矿工收入减少。

这可不行,必须扩容,将区块扩容到 8MB、32MB 甚至更高容量,让用户都在主网上交易,这样矿工就能躺着赚钱。

于是乎 BTC 最大的分叉就出来了,第一个分叉出 BCH,这就导致 2017 年在 ICO 后的第一波火爆,BTC 的各种分叉币漫天飞舞,很多人一夜之间暴富,更多人一夜之间手里的分叉币归零。遥想那年,我也投了不好比特币给各种分叉币,最后一地鸡毛!

扩容社区中间并不那么团结,内部争吵不断,2019 年 11 月 16 日,BCH 硬分叉成 BCH SV 和 BCH ABC。

总结一下就是:

比特现金旨在通过链上(onchain)的方式对网络进行扩容,其社区成员认为,比特币现金将延续中本聪所提出的「点对点电子现金」的愿景。

而由中本聪发起的比特币项目则在 Core 开发团队的带领下,走上了支付通道(如闪电网络)等链下(offchain)的扩容道路,即通过隔离见证(Segwit,2017 年)和闪电网络(Lightning Network)来实现链下扩容

二、Bitcoin Layer2 发展

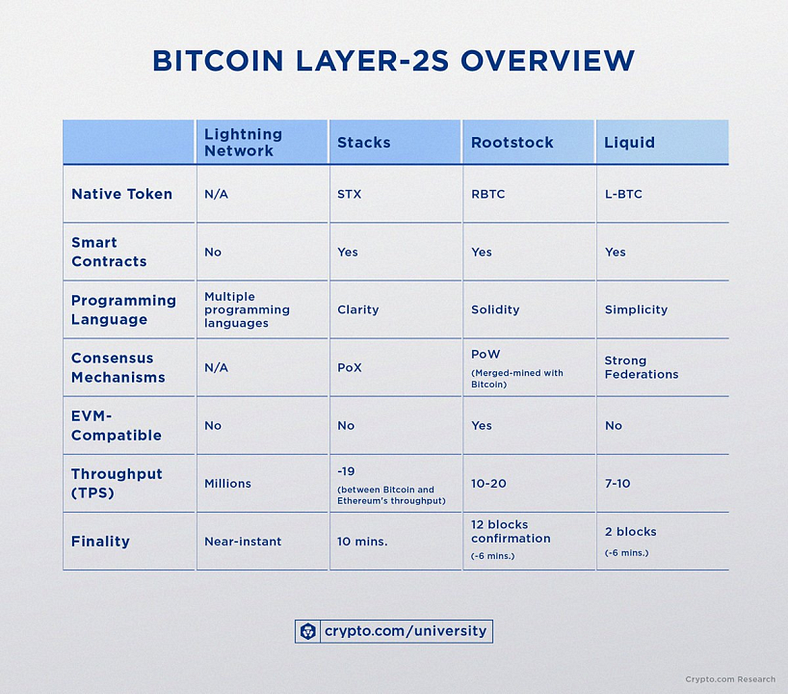

早期 Bitcoin Layer2 有很多,比如闪电网络(Lightning Network)、Rootstock、Stacks、Liquid Network ……

今天我们不去探索古典 Bitcoin Layer2 的技术,因为很多比较强的技术概念市场表现一直平平无奇(比如 EOS)

关于二层协议,在我 2018 年准备出版的一本书中有一张插图,这张插图可以看出,在 2018 年前后 BTC、ETH 的二层概念是闪电网络和雷电网络……

2019 年后 Ethereum 生态繁荣发展(去掉 ICO 之后),导致后面几年出现很多 Ethereum Layer2 以及 NFT 带来的巨大财富效应,BTC 社区中的一部分人似乎意识到,在 Ethereum 的历史,也可以在 Bitcoin 上再重演一遍。

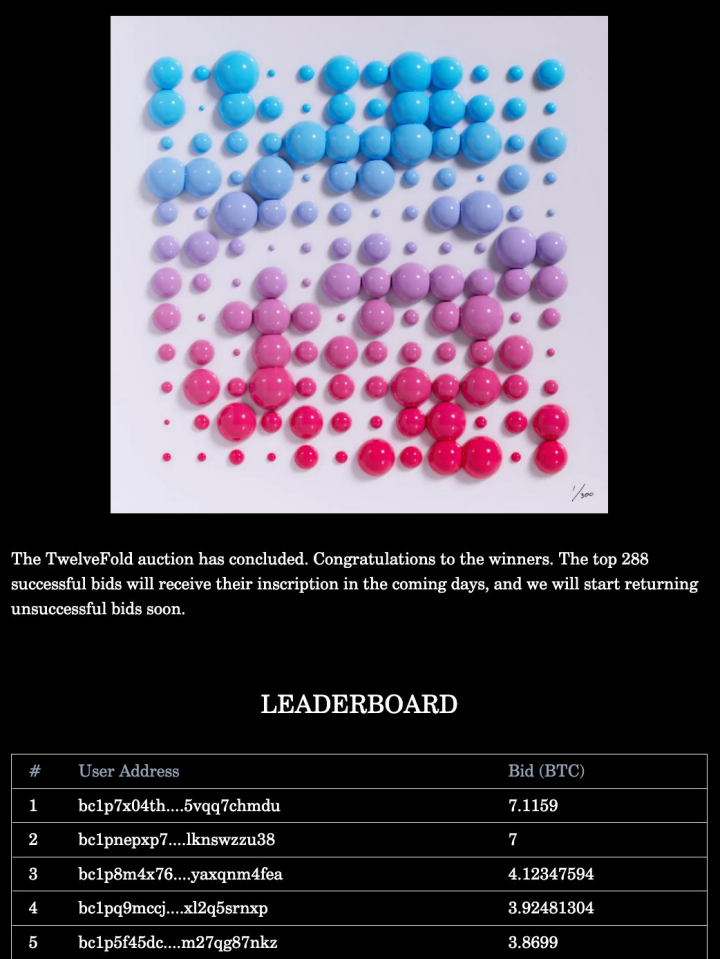

所以 2023 年 1 月份,比特币上的 NFT 协议 Ordinals 横空出世,3 月 8 日,Yuga Labs 在 Ordinals 上拍卖 BTC nft,288 枚 NFT 拍出总值 1650 万美元的价格。

这个由 Casey Rodarmor 在 2023 年 1 月发布的 Ordinals 协议,提出了一个想法:

我们能否按照一定的顺序排列这些「聪」,给他们分配一个节于 0 和 2,100,000,000,000,000 之间的序数,然后,把它们连接到其他信息: 图片、文字、视频甚至一串代码。从而每个聪都变得独一无二,不可替代。

这就相当于让比特币拥有了原生的、创造 NFT 的能力。

听起来是不是很神奇。其实这个协议在很大程度上依赖于 2017 年的 Segwit 和 2021 年 Taproot 的升级。

Taproot 升级为比特币网络带来了更高级别的隐私、安全和可扩展性。虽然通过技术手段将数据附加到比特币一直是可能的,但你可以基本上只能灌 4Mbs 的数据,再多就不行了。

Ordinal NFT 是基于 Ordinal 理论的,但现在的 Ordinal NFT 能够实现也有赖于 2017 年和 2021 年对比特币协议进行的隔离见证 (SegWit) 和 Taproot 的技术更新。

值得注意的是,这些更新并不是为了启用这些新型 NFT 的目的而被开发的。

但是,由于这两次更新都增加了一个区块存储数据量——这意味着现在有空间可以存储图像、视频,甚至游戏——无意中让 Ordinal NFT 的部署成为了可能。

三、市场上几个新的 Bitcoin Layer2 分析

随着铭文的火爆,Bitcoin Layer2 相关项目已经出来很多了,今天我们也不去评论已经出来的 Bitcoin Layer2 生态,我们就从这周的几个项目中挑选几个来分析。

本文不做任何投资建议,只是对新项目的看法。由于新项目风险很大,请大家自己做好研究,可能我发完后,项目就跑路了,所以请随时做好归零准备

由于新项目需要众多用户参与,在各项目落地之前,项目所说的技术创新都存在白皮书或者 PPT 上,那如果要吸引更多用户关注,项目之间做的最多的就是营销,所以我们从强营销、弱技术方面来写接下来的内容。

(1)BL2(@BL2_official)

这周在 Turtsat(小乌龟)平台发行 Launch,通过白名单赠送方式,取得很大的热度。

技术方面看:

BL2 建立在 VM 通用协议和 BTC 安全层之上,旨在通过创建 dApp 和智能合约平台来建立动态的 BTC Layer 2 生态系统。

项目将兼容 EVM,通过跨链桥应用引入以太坊生态资产,将 BTC 生态与 ETH 生态完全结合。

个人观点:

BL2 做的是基础协议,准备做一个兼容 EVM 的 BTC 智能合约平台,这在技术开发上需要一段时间。项目目前还没有开源,融资信息还没有,目前只是准备发行自己 Token,营销做的比较好,存在一定的市场风险。

(2)B² Network(@BsquaredNetwork)

B² Network 准备做一个基于比特币零知识证明兼容 EVM 的 Rollup,也就是一个区块链平台。

在营销方面:

B² Network 做的也很好,但没那么急功近利,发过一个「圣诞 NFT」试水,效果不错。当前没有采用 IDO 的方式吸纳用户,而是开发了一套任务系统,准备用空投的方式推出代币。项目还推出一个百万 Grant 计划,准备吸引更多 Dapp 入驻。

个人观点:

B² Network 在运营方面走的是 Ethereum Layer2 那一套,边用空投吸引用,边拉项目方入驻,然后融资(貌似已经有融资)。

(3)ZTC Global(@ZTCGlobal)

从技术上看:

ZTC Global 利用各种技术协议,比如 BRC-20/BRC-Y 和 BRC-420 等,开发一个没有低 Gas 费的 Bitcoin Layer2 平台。平台准备先做 2 款游戏和一款 SocialFi 来承载用户,边开发边吸引其他 Dapp 入驻,完成生态部署。

当前进度:ZTC 目前发行了一套铭文(近 80U 一张),目前已铸造将近 70%。官推显示:ZTC 将于 1 月 7 日 24:00 UTC-8 结束铸币,然后开发二级交易。铭文 MINT 完成后,挂单、铭刻不需要付出 gas 费。

铭文用途:

根据官方白皮书显示,铭文持有者,将会在游戏上线前,获得代币、NFT、WL 空投。

营销方面:

ZTC Global 不是那种很会营销的项目方,因此热度不是很高,加之 mint 期限过长。导致同行乘虚而入,在项目最薄弱的地方攻击,造成市场对该项目呈现两种不同的看法,也就是褒贬不一。

个人观点:

ZTC 还是很有格局,项目方已销毁 70% 代币,明天结束 mint,然后上市交易。但是后期项目具体怎么发展,主要看项目技术开发进度,如果你手里持有项目方铭文,等铭文开放交易后,可是视情况决定去留。

四、全文总结

Bitcoin Layer2 并不是一个全新的概念

在这 10 年中已经出现过很多二层技术,并且很多技术已经取得很大的成功。只不过那些协议在 Ordinals 协议出现之前,都是自上而下推进的项目。

19 年后,比特币社区看到 Ethereum 生态的巨大成功,社区认为在 Ethereum 上的叙事,可以拿到 BTC 上重演一遍,当时都是一些探索和尝试阶段。

Ordinals 协议的出现,让 Bitcoin Layer2 设想变成可能。因此引起了社区开发者、创业者、VC、机构的重点关注。

更多的热钱随之进入,带来更加繁荣的生态市场,这对于 BTC 的发展有很大的存进作用,随之会推高 BTC 市值,或者盘活 BTC 的 L2。

现在 Bitcoin Layer2 新项目有很多,我比较看好这个赛道,所以一直在研究这个方向,目前我只收纳这周热度较高的 3 个项目进行个人观点分析。

项目一定存在一定风险,所以分析并不代表投资建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。