Currently, it appears that the earliest results of whether it will be approved can be obtained as early as next Wednesday (January 3).

Author: Yilan, LD Capital

The ignition of the bull market

On October 13, the U.S. Securities and Exchange Commission (SEC) announced that it would not appeal a court ruling regarding Grayscale's refusal to convert GBTC to a spot ETF, which occurred in August this year. The ruling deemed SEC's rejection of Grayscale Investments' application to convert GBTC into a spot Bitcoin exchange-traded fund (ETF) as erroneous.

It was this key event that triggered the current market trend (as can be seen from the CME BTC OI chart, a significant surge began on October 15). Alongside the Fed's positive pause, the bullish trend in the BTC market continued. With the arrival of applications from Hashdex, Franklin, and Global X, the "window period" on November 17 was once again extended, providing the market with a reason to adjust. From a timeline perspective, the most crucial point is to observe the final decision date of Ark & 21shares' application on January 10, which has generated the strongest market sentiment. Currently, it appears that the earliest results of whether it will be approved can be obtained as early as next Wednesday (January 3).

Can a spot ETF be approved in the current state?

In terms of market expectations, Bloomberg ETF analyst James Seyffart believes that the likelihood of a Bitcoin spot ETF being approved before January 10 next year is as high as 90%. As someone closest to the SEC, his views have been widely circulated in the market.

Griffin Ardern, head of the BloFin Options Desk & Research Department, released a study on potential Authorized Participants (AP) purchasing seed funds for a potential spot BTC ETF approval in January.

Griffin's research concludes that an institution has continuously purchased $1.649 billion worth of BTC and a small amount of ETH through the same account from October 16 to the present, through compliant exchanges such as Coinbase and Kraken. Institutions capable of making $1.6 billion in cash purchases are few and far between in the entire crypto market. Combined with the channel for transferring to Tron instead of Ethereum and the trajectory of coin transfers, it is highly probable that this account is owned by a traditional institution headquartered in North America.

In theory, there is no limit to the scale of seed funds, as long as they can prove sufficient liquidity can be provided on the day of trading. Traditional seed fund purchases usually occur 2-4 weeks before the ETF is issued to reduce the position risk of APs (Authorized Participants) such as market makers or ETF issuers. However, due to the impact of the December holidays and settlements, purchases may have started earlier. Based on the above evidence, it is reasonable to speculate that the approval of a BTC spot ETF in January has some validity, but it cannot be used as a basis for certainty.

In terms of the ETF approval process, the longest period is 240 days, and the SEC must make a final decision. As the earliest applicant, Ark & 21shares must present the deadline for the approval results of this round to the SEC, which is January 10, 2024. If ARK is approved, it is highly probable that several subsequent applicants will also be approved.

If rejected, ARK will need to resubmit materials, theoretically restarting another 240-day application process. However, in reality, if any of the subsequent applicants are approved in March-April 2024 or later, ARK may also be approved earlier.

In terms of the SEC's attitude, the SEC's previous rejection of Grayscale's proposal to convert GBTC to a Spot ETF was mainly due to two reasons:

First, concerns about the trading of cryptocurrencies on unregulated platforms, making it difficult to monitor, and pointing out that market manipulation is a long-standing issue in the spot market. Although the SEC has approved cryptocurrency futures ETFs, these ETFs are all traded on platforms regulated by U.S. financial regulators. Second, many investors in BTC spot ETFs use pension and retirement funds for investment, and they cannot afford high-volatility and high-risk ETF products, which may lead to investor losses.

However, the SEC did not appeal against Grayscale again, and in the process of applying for ETFs by major asset management companies, the SEC's more active communication reflected a higher probability of approval. The SEC's website recently disclosed two memoranda, one of which showed that on November 20, the SEC held discussions with Grayscale on the proposed rule changes for the listing and trading of Grayscale Bitcoin Trust ETF. On the same day, the SEC also held a meeting with the world's largest asset management company, BlackRock, on the proposed rule changes for the listing and trading of iShares Bitcoin Trust ETF. The memorandum was followed by a two-page PPT produced by BlackRock, showing two ways of ETF redemption: the In-Kind Redemption Model or the In-Cash Redemption Model. The In-Kind Redemption Model means that the final redemption is the BTC shares held by the ETF, while the In-Cash Redemption Model uses equivalent cash to replace the BTC shares, and BlackRock seems to be more inclined towards the former (it has already agreed to the conditions of In-Cash at present). As of the 20th of this month, the SEC has held 25 meetings with the applicants for ETFs. This also indicates that the two new conditions have been discussed in multiple meetings, including 1) the need for ETFs to use cash to create and remove all in-kind redemptions; 2) the SEC hopes that the applicants can confirm the information of APs (Authorized Participants, i.e., underwriters) in the next S-1 filing update. If these two conditions are met before the expected approval date of January 10, it seems that all processes are ready. These are positive signals that the SEC's attitude may have changed.

In terms of the multi-party game, the approval of a Spot BTC ETF is a game of interests between the majority Democratic SEC, CFTC, asset management giants such as Blackrock, and important industry lobbying forces such as Coinbase. It is widely believed that Coinbase being chosen as the custodian by most asset management companies is beneficial for its revenue growth, but the actual custodial fees (generally ranging from 0.05% to 0.25%) and the additional international perpetual trading income and the increased spot trading income are not significant. However, Coinbase is still one of the largest beneficiaries in the industry after the approval of a spot BTC ETF, and has become a major lobbying force in the U.S. crypto industry after the collapse of FTX.

BlackRock has already launched a stock fund related to cryptocurrencies, namely the iShares Blockchain and Tech ETF (IBLC). However, despite the fund being launched for over a year, its assets are only less than $10 million. BlackRock also has sufficient motivation to push for the approval of a spot BTC ETF.

And BlackRock, Fidelity, and Invesco, among other traditional asset management giants, play a unique role in government regulation. As the world's largest asset management company, BlackRock currently manages approximately $9 trillion in assets. BlackRock has always maintained close ties with the U.S. government and the Federal Reserve. U.S. investors are eagerly anticipating the legal ability to hold cryptocurrencies such as Bitcoin to hedge against fiat currency inflation risks. Institutions such as BlackRock have fully recognized this and are using their political influence to pressure the SEC.

In the political game of the 2024 election, cryptocurrencies and artificial intelligence have become hot-button issues in the 2024 election cycle.

The Democratic Party, Biden, the White House, and the current regulatory agencies appointed by the president (SEC, FDIC, Fed) seem to largely oppose cryptocurrencies. However, many young Democratic members of Congress support cryptocurrencies, as do many of their constituents. Therefore, a turning point is also possible.

Republican presidential candidates are more likely to support crypto innovation. Republican leader Ron DeSantis has already stated that he will ban CBDC and support innovation related to Bitcoin and cryptocurrency technology. As governor, DeSantis has made Florida one of the most crypto-friendly areas in the United States.

While Trump has made negative comments about Bitcoin in the past, he also launched an NFT project last year. And his main supporting states, such as Florida and Texas, largely support the crypto industry.

The biggest uncertainty comes from Gary Gensler, the Democratic SEC leader. Gensler believes that, apart from Bitcoin, most token trading on Coinbase is illegal. Under Gensler's leadership, the SEC has taken a tough stance on crypto. Coinbase is facing SEC litigation over its core business practices. Binance is facing a similar lawsuit and is defending itself in court. In the worst case scenario, regulatory crackdowns could reduce Coinbase's revenue by more than a third, according to Mark Palmer, an analyst at Berenberg Capital Markets. "There is almost no hope of changing the stance of most SEC commissioners in the short term."

Coinbase and other companies are not hoping for a court ruling, but rather for Congress to separate crypto from securities regulations. Executives from Coinbase and other companies have been pushing for legislation to limit the SEC's regulatory power over tokens and to establish rules for "stablecoins" (such as USDC, a digital dollar token held by Coinbase).

Crypto companies are also trying to defend themselves—lobbying against bills that require them to comply with anti-money laundering requirements. Executives argue that this is expensive or impossible to comply with in a decentralized world based on blockchain assets and transactions. However, with each ransomware attack or terrorist attack funded in part by token-based fundraising, their task becomes even more challenging. Organizations associated with Hamas have requested crypto donations before and after attacks on Israel.

Some bills are making progress towards their goals. For example, the House Financial Services Committee has passed a bill supported by Coinbase on crypto market structure and stablecoins, paving the way for a full House vote. However, there is no indication that Senate Democrats will introduce this bill, or whether President Joe Biden will sign a crypto bill.

With this year's spending bill likely to be a top priority for Congress, and with Congress entering election mode in 2024, controversial crypto bills may be difficult to make progress for a while.

"FTX's collapse was a setback, but some in Congress recognize that crypto is inevitable," said Christine Smith, CEO of the Blockchain Association. The industry may have to settle for Bitcoin exchange-traded funds for now, while its lobbying efforts continue to push for legislation to bring it to the finish line next year.

According to a recent study by Grayscale, 52% of Americans (including 59% of Democrats and 51% of Republicans) agree that cryptocurrencies are the future of finance; 44% of respondents said they hope to invest in crypto assets in the future.

For the SEC, the most important reason for opposition and contradiction with cryptocurrencies still lies in the inherent manipulability of BTC, which cannot be fundamentally resolved. However, we will soon find out whether the SEC will succumb to the pressure from various forces and approve a BTC spot ETF.

Sensitivity analysis of Spot BTC ETF & BTC price impact

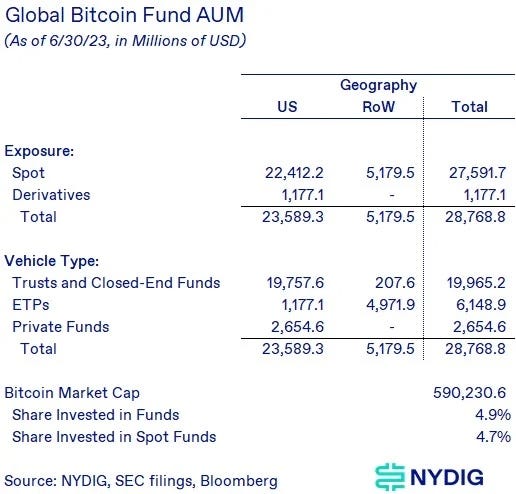

Although the U.S. has not yet launched a direct ETF related to spot Bitcoin, investors have already participated in the Bitcoin market through existing product structures. The total assets under management (AUM) of these products have exceeded $30 billion, with approximately 95% invested in products related to spot Bitcoin.

Before the appearance of a spot BTC ETF in the U.S., investment methods and product structures for BTC included trusts (such as Grayscale Bitcoin Trust GBTC), BTC futures ETFs, spot ETFs already launched outside the U.S. (such as in Europe and Canada), and other private funds with BTC allocations. The AUM of GBTC alone has reached $23.4 billion, the largest BTC futures ETF BITO AUM is $1.37 billion, and the AUM of the largest spot BTC ETF BTCC in Canada is $320 million. The allocation of BTC in other private funds is not transparent, and the actual total amount may be much larger than $30 billion.

Spot ETF vs. existing alternatives

Spot ETF vs. existing alternatives

Compared to investment product structures, ETFs and closed-end funds (CEFs) have lower tracking errors (returns of BITO, BTF, and XBTF lag behind spot Bitcoin prices by 7%-10% annually), better liquidity than private funds, and potential lower management fee costs (compared to GBTC), such as Ark setting its fee rate at 0.9% in its application documents.

Potential inflows:

Existing demand

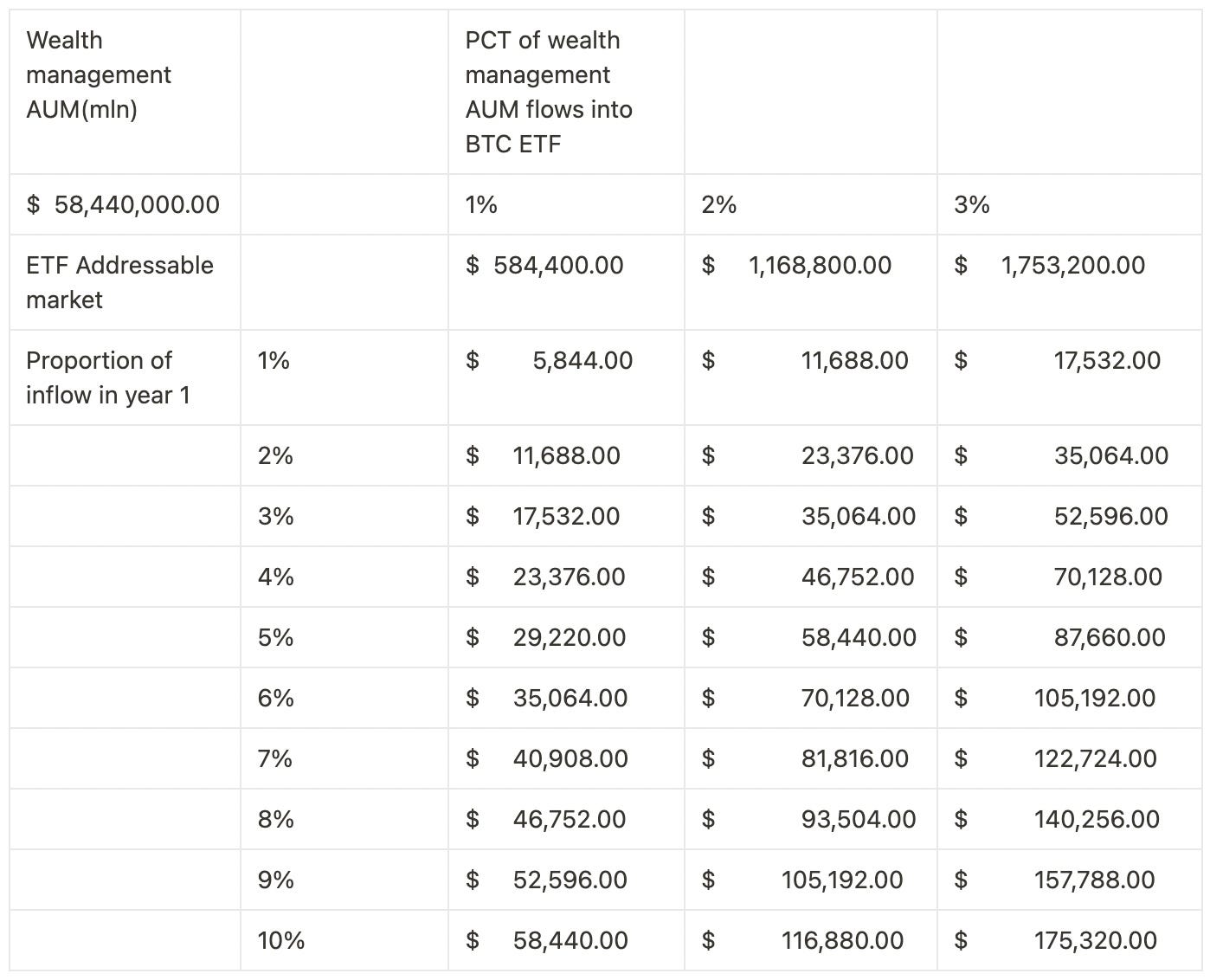

It can be foreseen that a large amount of AUM in GBTC will flow out before the fee structure is improved, but this will be compensated by new ETF demand. Assuming that 1% of the $58.44 trillion in wealth management AUM flows into BTC, with 5% flowing in the first year, this would bring in $29 billion in existing wealth management fund inflows. Assuming that 10% of the funds enter on the first day, this would bring in $2.9 billion in buying pressure (10% of $29 billion), combined with the pressure level of BTC's rise. With a market cap of $557 billion on October 13 (BTC price=$26,500), considering the inflow of funds from the spot ETF and not considering other factors, the target price for BTC, starting from October 13, is $53,000 (the main factor considered is the pressure level of the rise, and the impact of the inflow factor on price changes is difficult to predict due to the dynamic changes in market trading volume). However, due to the complexity of market sentiment, it is very likely that there will be a situation of a rise followed by a drop.

By analogy, with a $209 billion AUM for gold ETFs, the total market value of BTC is 1/10 of gold, so assuming that the AUM of a BTC spot ETF can reach 10% of the Gold ETF's $209 million AUM, i.e., $20.9 billion, then assuming that 1/10*20.9 billion flows in the first year (Gold ETF retains about 1/10 of total AUM in the first year after approval, AUM gradually accumulates, with the second year's AUM being 1.2 times that of the first year, experiencing the largest inflow in the 6-7th year, followed by a decrease in AUM. The remaining buying pressure will be realized over several years), this would bring in a net inflow of $2.1 billion in the first year.

Therefore, if we compare it to SPDR Gold (an ETF issued by State Street Global Advisors, the largest and most popular one), we can see that SPDR's AUM is $57 billion. Assuming that the BTC spot ETF AUM can reach 10%-100% of SPDR's $57 billion AUM, that would be $5.7 billion to $57 billion (assuming that 1/10*5.4 billion = $540 million to $5.4 billion flows in the first year, with the first year after the approval of the gold ETF retaining about 1/10 of the total AUM, AUM gradually accumulating, with the second year's AUM being 1.2 times that of the first year, experiencing the largest inflow in the 6-7th year, followed by a decrease in AUM. The remaining buying pressure will be realized over several years). Using the SPDR Gold to deduce the first year's $5.4-54 billion inflow for BTC is a very conservative estimate.

By using a very conservative method similar to gold and estimating the inflow of funds into BTC in the first year after the approval of the BTC spot ETF, using 1% of the $58.44 trillion in wealth management AUM flowing into BTC, it is estimated that the first year's inflow of funds will be around $5.4 billion to $29 billion.

New Demand

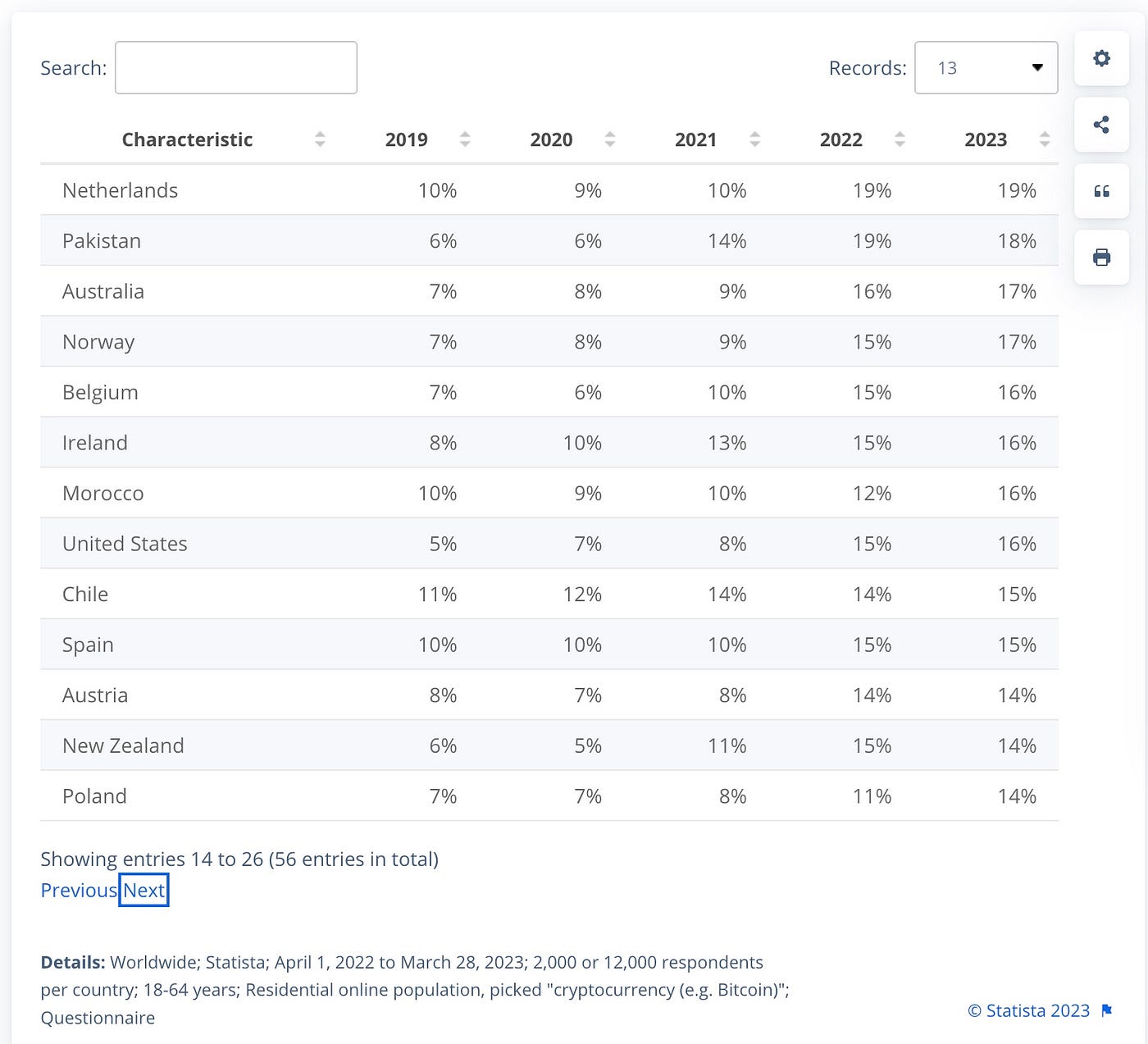

If we consider the additional adoption from the retail side, the percentage of BTC holdings in the U.S. was 5%, 7%, 8%, 15%, 16% in 2019-2023, ranking 21st among all countries. The approval of the BTC spot ETF is likely to continue to increase this percentage. Assuming this percentage increases to 20%, adding 13.2 million retail customers, calculated with an average household income of $120,000, assuming an average holding of $1,000 worth of BTC per person, this would generate an additional demand of $13 billion.

Conclusion

As more and more investors begin to appreciate the benefits of Bitcoin as a store of value or digital gold, combined with the increasing certainty of ETF launches, the upcoming halving, and the combined impact of the Fed's halt to rate hikes, it is highly likely that the price of BTC will be pushed to $53,000 in the first half of next year.

As for the Ethereum spot ETF, it will probably be approved much later than the BTC spot ETF, given the 240-day application process and the securities qualification dispute compared to BTC. Therefore, perhaps Ethereum will only welcome its ETF market when Gensler is replaced by a more crypto-friendly leader.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。