Author: PSE Trading Trader @MacroFang

Federal Reserve's Outlook: Predicting a Soft Landing

According to the minutes released today, the Federal Reserve is expected to move towards a soft landing. Despite the minutes showing optimism and determination to bring inflation back to target levels, the Fed may remain cautious about making significant policy shifts due to slowing inflation data and increased downside risks to economic growth. This stance is unlikely to weaken financial conditions.

Currently, the Federal Reserve's policy tends to counter the risks of inflation and financial stability, and is not expected to change significantly.

Even as concerns about economic growth intensify, equal attention can be ensured for both aspects of the Fed's dual mandate. The softening of inflation data makes this balance easier, but stronger future inflation could pose challenges and potentially disrupt this balance, as lowering interest rates becomes more difficult for the Fed in the face of increased risks to economic growth.

US Stock Market: S&P 500 Expected to Hit New Highs in 2024

Strategists at Bank of America predict that the S&P 500 will reach new highs by 2024, as US companies have effectively responded to rising interest rates and macroeconomic turbulence. The rise is attributed to the Fed's previous actions rather than future cuts. Driven by strong economic growth and the end of profit declines, the S&P 500 has already risen by 18% this year. Strategist Savita Subramanian suggests that even as economic growth slows, profits can still increase. With most investors still bearish, other analysts see further upside potential and expect the upward trend to continue.

Fed Maintains Stance Amid Economic Concerns

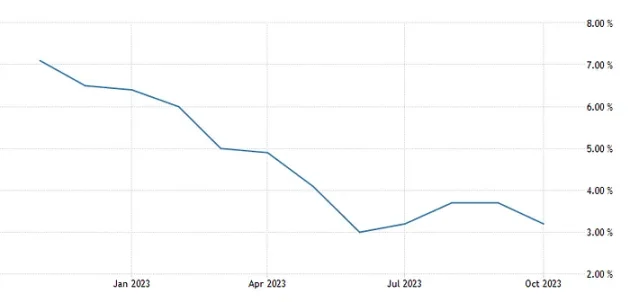

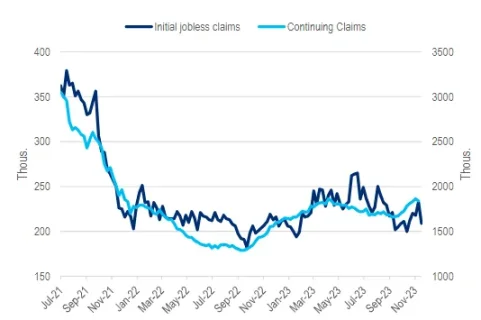

Despite rising risks to economic growth and inflation, the US Federal Reserve is currently maintaining its stance on interest rates. Recent data shows that initial jobless claims and the unemployment rate are on the rise, indicating the expected dampening effect of higher interest rates on economic activity. However, a recession is expected next year, with inflation expected to exceed its target. Despite these circumstances, the latest official stance does not indicate any intention to further raise or cut interest rates until a more significant slowdown in economic activity occurs. The gradual decoupling of inflation expectations is a concern for Fed officials.

Signs of Economic Slowdown and Accelerating Inflation Emerge

New signs indicate a potential slowdown in economic activity, contrasting with the current robust activity data (projected real GDP growth of 2.2% in the fourth quarter). Federal Reserve officials view the combination of strong activity and softer inflation as reasons for optimism about a soft landing for the economy. However, these conditions may occur simultaneously, rather than signaling a stable macroeconomic outcome. Significant increases in house prices have been observed, despite a slowdown in the past two months, possibly due to increased mortgage rates suppressing demand.

Initial claims for unemployment benefits fell more than expected, dropping from 233k on November 18 to 209k. Overall, the four-week moving average of initial claims for unemployment insurance remains low, with no clear signs of a significant increase in layoffs. The number of continued claims for unemployment insurance decreased for the first time in about two months, dropping from 1862k on November 11 to 1840k. Half of the seasonally adjusted decrease in continued claims is due to an abnormal drop in claims from Puerto Rico, which is expected to rebound in the coming weeks.

Federal Communication: No Further Rate Hikes

In the near future, data and communication from the Federal Reserve are expected to confirm that there will be no further rate hikes in this cycle. The softer growth in core PCE in October is consistent with this view. It is also expected that new home sales will decline due to higher mortgage rates, while the existing housing market may continue to exert pressure on prices due to supply-demand imbalances. The manufacturing purchasing managers' index is expected to rebound, partly due to the resolution of the November strike by auto workers. It is expected that Fed Chair Powell will not provide much new information, but may emphasize the Fed's cautious stance and readiness to raise policy rates when necessary.

FOMC Meeting Minutes: Rise in US Treasury Yields = Dovish Stance

The minutes of the Federal Open Market Committee (FOMC) meeting held by the Federal Reserve on November 1, 2023, revealed concerns about the rise in US Treasury yields and its potential impact on growth and financial stability. Policymakers pledged to maintain "sufficiently restrictive" financial conditions, but their strategy is cautious. This means that their goal is to avoid a rapid tightening of financial conditions, but they will not resist easing. Although inflation is expected to continue to exceed the target next year, it is not predicted that there will be further rate hikes in this cycle. Ahead of the meeting, Fed officials had indicated that a rise in the yield on the 10-year US Treasury, approaching 5%, would prompt a reconsideration of the 25-basis-point rate hike implemented later this year.

The minutes further indicate that the rise in Treasury yields is seen as a threat to financial stability, particularly for potential losses on banks' fixed-income asset portfolios. There is disagreement among Fed officials about the response to the rise in long-term yields. They acknowledge the recent slowdown in inflation but need more data to confirm whether inflation will return to the 2% target. While officials agree that the labor market is becoming more balanced, they are uncertain about whether labor supply will become a sustained trend. Some also point out that wage growth has exceeded the level consistent with 2% price inflation. Finally, the FOMC unanimously believes that policy rates should be adjusted cautiously, and the likelihood of raising policy rates is very low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。