Stablecoins are a central topic in the cryptocurrency ecosystem, but currently, stablecoins supported by cryptocurrencies have limitations in terms of capital efficiency, liquidation risk, use cases, and liquidity. This article will explore the statistical data, functions, and market conditions of stablecoins, with a focus on stablecoins supported by cryptocurrencies and their issues.

Author: Caesar / Source: https://mirror.xyz/0xa1eB063E50bd82f3b511BaC3084AbD67Cf79AfD

Translated by: Huohuo / Plain Language Blockchain

Due to the significant consistency between stablecoins and market demand, it remains a central topic of discussion within the ecosystem. Therefore, developers and enthusiasts are actively exploring ways to create stablecoins that can have a lasting impact on the ecosystem. However, progress in these efforts has been relatively limited so far.

I believe that the inherent limitations of stablecoins supported by cryptocurrencies have not been sufficiently discussed. As we will discuss in this article, current projects have failed to attract users because stablecoins supported by cryptocurrencies are limited in terms of capital efficiency, liquidation risk, limited use cases, and liquidity compared to fiat-backed stablecoins.

Throughout the article, I will examine some statistical data on the current landscape of stablecoins and share some thoughts on this. Then, I will discuss the concept of stablecoin functions to help us understand the reasons for the market conditions of stablecoins. Finally, I will focus specifically on stablecoins supported by cryptocurrencies and address their issues.

1. Current Stablecoin Market Statistics

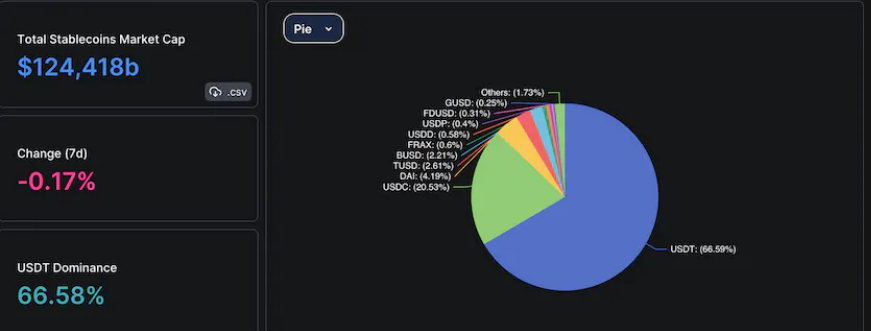

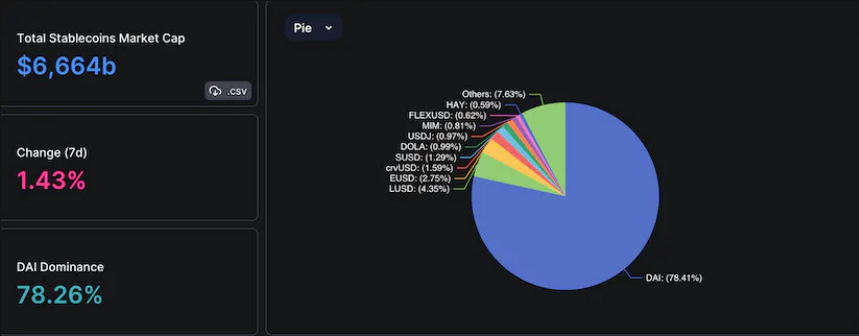

September 5, 2023, data from DeFiLlama

September 5, 2023, data from DeFiLlama

Looking at the data from DeFiLlama:

The total market value of stablecoins is approximately $125 billion, with nearly 87% held by $USDT and $USDC.

Fiat-backed stablecoins occupy about 92% of the entire market, with a value of nearly $116 billion.

Stablecoins supported by cryptocurrencies hold only about $7 billion, with $DAI holding about $5 billion.

The total market value of algorithmic stablecoins is about $20 billion, with $FRAX and $USDD occupying 75% of the market share.

What do these data indicate about the market conditions? This data provides some insights into the market conditions:

1) $USDT and $USDC are projects that align with market demand and have a significant market share.

2) Despite the increasing number of projects in the category of stablecoins supported by cryptocurrencies, the dominant market share of $USDT and $USDC proves that there is currently no demand for alternatives.

3) Although the rise in the savings rate of DAI helped it gain market share for a period, last year, DAI failed to maintain its market value in terms of the US dollar, and its dominant position among stablecoins supported by cryptocurrencies is unchallenged.

4) As DAI's shift towards real-world assets (RWA), including US Treasury bonds, highlights the lack of scalable stablecoins resistant to censorship and free from counterparty risk.

5) The adoption of other stablecoins supported by cryptocurrencies (excluding DAI) is limited, indicating that their success and potential may have been overestimated.

6) Unless there are significant events that disrupt the credibility of $USDT and $USDC, or breakthrough projects emerge, the stablecoin landscape is unlikely to undergo significant changes.

2. Why Do Users Prefer $USDT and $USDC?

Cryptocurrencies were initially a movement defined by beliefs in freedom, decentralization, and skepticism of centralized participants. However, the current landscape of the stablecoin market is not as such. Clearly, as adoption within the ecosystem increases and more people enter the field, the purity of the ecosystem will decrease, as most newcomers are not here for decentralization or resistance to censorship.

The most concentrated and possibly the most opaque projects are the market leaders. The main reasons for this situation can be explained by a new concept I propose, called stablecoin functions:

Stablecoin functions are a new concept used to understand some key themes in the stablecoin space:

1) Market dynamics between users and stablecoin projects

2) Reasons for the adoption of some stablecoins and the non-adoption of others

3) The vision that stablecoin project developers should have

I believe stablecoins should be seen as digital versions of off-chain assets they are pegged to. Therefore, in our example, USD-backed stablecoins need to represent the functions of the USD. These functions can be integrated into stablecoins:

1) Medium of exchange: Stablecoins should be viewed by users as a tool for exchanging cryptocurrencies or transacting with others, and need to be available on major protocols such as CEX and mature DeFi projects like Uniswap, Balancer, and Curve. Basic pairings are required.

2) Store of value/pegged stability: Stablecoins should have a history of maintaining their peg, and from the user's perspective, even a 1% deviation can be seen as a failure.

3) Capital efficiency: If stablecoins require over-collateralization or pose liquidation risks, they are not capital efficient, which will limit user adoption, as most users understandably expect their holdings to be free from such risks or limitations.

4) Fiat on/off ramps: If stablecoins do not provide on/off ramp solutions, using them becomes increasingly difficult, as the lengthy process of converting crypto assets to cash makes this process costly and cumbersome.

5) Resistance to censorship: Stablecoins should serve as a secure harbor for privacy and self-custody, without relying on centralized entities like banks, thus protecting their users from arbitrary actions by centralized participants.

It can be understood that $USDT and $USDC possess most of these functions, including medium of exchange, store of value, capital efficiency, and fiat on/off ramp solutions, but both of these stablecoins are centralized and therefore lack censorship resistance. Although $USDT and $USDC have not fully succeeded within the stablecoin functions framework, they are the most successful within this framework, and therefore, they have product-market fit. Additionally, the first-mover advantage and brand recognition of these projects have led to their high adoption by users.

It is evident that for stablecoin projects to threaten the dominance of $USDT and $USDC, they need to meet these five main requirements and then have brand recognition within the community.

However, we need to consider whether it is possible for existing stablecoin projects supported by cryptocurrencies to challenge $USDT and $USDC in the current model/technological development. Let's delve into some existing stablecoin projects that could be seen as challengers to $USDT and $USDC.

3. Review of Stablecoins Supported by Cryptocurrencies

In this section, I will focus on some stablecoins that I believe are worth analyzing, as they cover all aspects of stablecoins supported by cryptocurrencies that need to be understood.

Before delving into each stablecoin, I want to emphasize that I believe the limitations of the collateralized debt position (CDP) model are the main issues faced by every stablecoin supported by cryptocurrencies. The CDP requires users to lock up crypto assets in over-collateralized loans with liquidation risks, thus limiting its scale.

The relationship of borrowing and lending between users and protocols is problematic, as it does not fit the stablecoin functions in several aspects:

1) Medium of exchange: Since users create borrowing positions through minting, they do not use these stablecoins for transactions other than for leveraged yield farming and leveraged trading. Therefore, stablecoins supported by cryptocurrencies are not seen as a medium of exchange.

2) Capital Efficiency: Since CDPs require over-collateralization and pose liquidation risks, from the user's perspective, it is not capital efficient, as there are more capital-efficient ways than minting stablecoins supported by cryptocurrencies.

Therefore, we can say that stablecoins supported by cryptocurrencies are not suitable for product-market fit. However, we need to analyze these stablecoins separately so that we can better understand their limitations and drawbacks, while also highlighting opportunities.

DAI

DAI is an over-collateralized CDP stablecoin issued by MakerDAO. It is one of the largest stablecoins supported by cryptocurrencies, attracting billions of dollars in funds and gaining good adoption in the DeFi ecosystem. However, with the introduction of new stablecoins supported by cryptocurrencies and the recent decoupling of DAI from USDC, some market share of the stablecoin has been taken by competitors. However, with the introduction of enhanced DAI savings rates, the protocol has gained some attention again, although discussions about sustainability are ongoing.

While it is one of the most profitable businesses in the ecosystem, as the protocol leverages its holdings of treasury bonds, its future is also questionable, as the protocol has faced some criticism, such as "DAI is the poor man's USDC" or reliance on centralized actors.

It is evident that the MakerDAO team has decided to abandon the decentralized spirit and focus on the monetization of the protocol, which is not necessarily a bad thing for business, but it will certainly raise some questions, such as why should I use DAI, and why can't I use USDC?

In my opinion, DAI will face several challenges:

1) Lack of innovation: DAI is minted by over-collateralized CDP positions, so it does not have any significant technological advantage compared to competitors. The introduction of enhanced DAI savings rates is also a good sign, indicating that the project is struggling to attract users.

2) Dependence on centralized actors: DAI is not a primarily decentralized stablecoin, as it is primarily backed by USDC and RWA assets, and income is generated through treasury bonds, meaning that asset custody is handled by centralized actors.

3) Lack of significant value proposition: The main value proposition of stablecoins supported by cryptocurrencies is decentralization and censorship resistance. As a trade-off, these protocols implement the CDP model and require over-collateralization with liquidation risks. However, while DAI retains these drawbacks, it does not provide any value proposition in terms of decentralization. Therefore, it combines the worst parts of fiat-backed and cryptocurrency-backed stablecoins.

On the other hand, DAI also has the following opportunities:

1) High adoption: DAI is one of the most well-known and widely adopted stablecoins in the ecosystem. This can be evidenced by approximately 500,000 DAI holders. Additionally, DAI exists in most mature DeFi protocols, with strong liquidity. Considering that bootstrapping liquidity is one of the most challenging parts for every stablecoin project, DAI is in a very good position.

2) Medium of exchange: DAI is considered a medium of exchange by many, as evidenced by the fact that many people use it for trading and buying/selling crypto assets, and it has multiple currency pairs with deep liquidity in various protocols.

3) Store of value: With the distribution of treasury bond income to DAI stakers through enhanced DAI savings rates, DAI can become a secure and reliable source of income and value storage, increasing its adoption.

FRAX

FRAX was initially an algorithmic stablecoin, backed by algorithmic mechanisms and under-collateralized cryptocurrency reserves. However, the decline of UST led to a loss of trust in algorithmic stablecoins, prompting the FRAX team to change this model. Therefore, they decided to use USDC as the reserve, achieving a 100% collateralization ratio. However, with FRAX becoming the "poor man's USDC," this model has faced criticism.

However, with the upcoming release of FRAX v3, this model will also change. Although not all details are public, there are rumors that the reliance on USDC will be abandoned, and the FRAX ecosystem and its stablecoin FRAX will be backed by US treasury bonds.

In my opinion, FRAX will face several challenges:

1) Dependence on centralized actors: One of the most common criticisms is that FRAX relies on USDC, so what is the reason for holding FRAX if it is backed by USDC? While they are changing the model, the reliance on centralized actors will continue, as they will collaborate with other centralized actors of the US Federal Reserve's main account.

2) Confusing and constantly changing vision of the leadership team: Whether the criticism is valid is debatable, but the FRAX leadership team seems to be focusing on too much development in a short period and changing the roadmap very frequently, raising questions about what the vision for FRAX is.

3) Lack of FRAX holders/users: Considering that FRAX has approximately 8,000 holders, according to Etherscan statistics, with a market value of about $800 million, the value proposition of FRAX is not as a medium of exchange, thus limiting its potential to challenge USDT and USDC. Frax is not widely used in the ecosystem, except for products built on top of Frax. This is due to Frax's position in the Curve Wars, where Curve pays incentives to the FRAX pool. The sustainability of Curve will also be a significant parameter for FRAX.

On the other hand, FRAX also has the following opportunities:

1) Capital efficiency: At this point, users can deposit 1 USDC and receive 1 FRAX, which is capital efficient. It can be assumed that this capital efficiency will continue with the migration to the new model, making it a competitive advantage for FRAX.

2) Building the FRAX ecosystem, enhancing use cases for FRAX: Most stablecoins face use case issues, meaning there is nowhere to utilize the underlying stablecoin. However, FRAX can be effectively used through the general FRAX ecosystem, including Fraxswap, Fraxlend, Fraxferry, and potentially in the future on Fraxchain.

LUSD

LUSD is one of the most forked stablecoin projects in the ecosystem, as it provides a unique solution for an uncensorable stablecoin. It is backed by ETH, and users can borrow against their held ETH, with a minimum collateralization ratio of only 110%.

Some features that make LUSD competitive:

1) Immutable smart contracts

2) Decentralized governance

3) No interest charged

4) Quality of collateral

Additionally, from the latest announcement of the Liquity Protocol, it is evident that with the launch of Liquity v2, they will develop a new model using a Delta-neutral approach to maintain the value of collateral. This will be a new stablecoin independent of existing projects.

In my personal opinion, LUSD will face several challenges:

1) Limited scalability: While LUSD is one of the most promising projects in the ecosystem, it is also one of the least scalable, as it requires over-collateralization, has liquidation risks, and only accepts ETH as collateral.

2) Lack of LUSD holders/users: Due to the limited scalability of LUSD, the stablecoin has only about 8,000 holders, with a market value of approximately $300 million, according to Etherscan.

3) Lack of use cases: Due to the limited scalability of LUSD, it is not possible to find enough liquidity in major protocols, hindering the adoption of LUSD.

4) Capital efficiency: Liquidity requires over-collateralization and poses liquidation risks. Therefore, from a capital efficiency perspective, this is not a good choice, limiting LUSD's ability to serve as a medium of exchange.

On the other hand, LUSD also has the following opportunities:

1) Censorship resistance: The most unique aspect of LUSD is its decentralized and censorship-resistant nature. I believe there is no competition in this field.

2) Strong brand: The long-term success of LUSD in decentralization and stability anchoring, along with the team's successful community trust, has made the LUSD brand a powerful one for the team to leverage.

3) Liquity v2: The Liquity team is aware of the scalability issues in the protocol and aims to expand without disrupting the protocol. By developing a Delta-neutral model using capital protection methods to prevent losses from volatility, they can address the scalability issue to some extent.

eUSD

eUSD is a stablecoin backed by pledged ETH as collateral. Holding eUSD can yield stable income flow, with an annualized interest rate (APY) of approximately 8%. It is a CDP stablecoin that requires over-collateralization and poses liquidation risks.

In my opinion, eUSD will face several challenges:

1) Lack of capital efficiency: The over-collateralization model means that eUSD is limited in terms of capital efficiency, as users need to invest more capital than they receive and face liquidation risks.

2) Limited use cases: eUSD does not have many use cases, as there is not enough demand for stablecoins to create liquidity in multiple pools, limiting its scalability.

3) Limited growth potential: Emerging stablecoins need to have unique value propositions to have growth potential. While leveraging LSD products can be seen as a good way to scale, its limitations are limited due to intense market competition.

4) Not a medium of exchange: eUSD is a yield-bearing stablecoin, and the protocol does not prioritize its use as a medium of exchange. While this is also an important value proposition, it limits its growth potential.

5) Stability anchoring: eUSD holders are eligible to receive rewards in pledged ETH. Therefore, the demand for eUSD exceeds its supply, breaking the peg above $1.00. Unless the system changes, eUSD will struggle to find its peg.

On the other hand, eUSD also has the following opportunities:

1) Income-generating asset: Since eUSD can generate income for its holders, there will certainly be demand to use it as a value store. If users believe in stability anchoring, this could be a good way to earn ETH rewards.

2) Access to LSD products: LSDfi is a growing market that has certainly achieved product-market fit, and leveraging LSD to mint stablecoins is a profitable business for the protocol and users.

crvUSD

crvUSD is a CDP stablecoin project that requires over-collateralization and poses liquidation risks. Its unique feature is the LLAMMA liquidation mechanism, where LLAMA gradually sells parts of the collateral using different price ranges instead of immediately selling all collateral at a specified liquidation value. Thus, as the collateral price drops, parts of the collateral will be auctioned off in exchange for crvUSD.

So far, stablecoins have achieved gradual market value growth without any significant decoupling. However, while it has approximately $100 million in liquidity, it has only about 600 holders, which is concerning for the product's scalability.

In my personal opinion, crvUSD will face several challenges:

1) Lack of capital efficiency: Since crvUSD is an over-collateralized CDP position with liquidation risks, its scale can expand to a certain extent, but it does not differentiate in terms of capital efficiency compared to competitors.

2) Limited use cases: Due to low liquidity and lack of scalability, the use cases for crvUSD are limited. crvUSD has several collateral pools, but considering the trade-offs, it is not very attractive.

3) Lack of holders: As mentioned, with the insufficient demand for CDP stablecoins, crvUSD has approximately 600 holders. Therefore, despite offering a unique liquidation mechanism superior to other CDP stablecoins, crvUSD will still face the challenge of attracting new holders.

On the other hand, crvUSD also has opportunities:

1) Unique liquidation mechanism: The soft liquidation mechanism of crvUSD is a great innovation that will certainly be replicated by competitors, as it can prevent hard liquidation until a certain point, which can increase the scalability of CDP stablecoins.

2) Curve support: Curve is a well-established stablecoin exchange with deep liquidity in the ecosystem. crvUSD can leverage this in the future and effectively improve its scalability.

4. Conclusion

This is a lengthy article, and after closing the tab, you should remember one simple thing.

"The future of stablecoins supported by cryptocurrencies will be determined by a simple question: Can users purchase stablecoins instead of borrowing them?"

The current model does not provide an excellent solution for achieving stablecoin functionality in the field of cryptocurrency-backed stablecoins. Therefore, USDT and USDC can continue to dominate the field. However, they also have some limitations, especially in terms of decentralization, censorship resistance, and self-custody.

I am confident that there can be new models to address these issues and achieve stablecoin functionality. However, I am also certain that the current model has been disrupted and will not succeed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。