ZK、RWA、Intent......越来越多的项目开始往这些热点方向靠拢,有的项目是深思熟虑后的发展选择,但也有很多项目只是在追一时的热点。在不怎么被提及的赛道,其实也有很多问题需要被解决,比如预言机。9 月 12 日,Google Cloud Oracle 与 LayerZero 达成合作,并面向所有 LayerZero 应用程序提供服务,预言机再次受到市场关注。

在近日结束的 TOKEN 2049 上,Douro Labs (Pyth Network) CEO Mike Cahill 以 "The Pyth Effect: How the Oracle is Reshaping DeFi" 为主题,分享了 Pyth 对预言机赛道的思考,目前存在的问题等。在分享结束后,我们对 Mike 进行了专访,聊一聊 Pyth 为什么要选择预言机赛道,目前的预言机有哪些问题,以及与竞争对手未来的关系。

Pyth Network 是专为 DeFi 打造的预言机,在高吞吐量的 DeFi 世界中占有领导性地位,目前在支持的协议数量上稳居预言机行业第二位(仅次于 ChainLink),以下是我们的专访全文。

启动 Pyth:坚定选择预言机赛道,找回 DeFi 缺失的关键部分

TechFlow 深潮:很高兴你能接受我们的采访,刚才我也听了你的演讲,非常有吸引力和洞见。首先能不能请你向我们的读者介绍一下 Pyth Network 和你的角色,以及你在这家公司主要负责什么?

Mike Cahill:当然,我是 Mike,是 DouroLabs 的 CEO,Douro Labs 正在为 Pyth 构建一系列的工具并支持相关的开发工作。Pyth 是最大的一手预言机网络,它的使命是把所有的金融数据都传输到链上,就像全世界所有的音乐都通过 Spotify 进行流动一样。我们认为未来世界上所有的金融数据,都将通过 Pyth 进行传输。

Pyth 属于预言机赛道。区块链应用程序无法获取到来自现实世界的数据,他们只能访问区块链的状态。而将外部数据带入到区块链的工作则由预言机来完成。Pyth 是一个无需许可的预言机,拥有极快的运行速度。我们的目标是成为速度最快、最值得信赖的预言机,喂价数据涵盖金融领域、加密货币、股票、外汇、金属和利率等所有类型的数据。

TechFlow 深潮:谢谢你的回答。另一个问题是我们都知道预言机是属于 Infra 的一种。我很好奇你为什么要选择预言机这个赛道,有什么特别的原因吗?

Mike Cahill:这要追溯到最原点。我当时在一家交易公司工作,我们做了很多项目投资,并试图理解 DeFi 的愿景。一直让我感到兴奋的愿景是:建立一个去中心化的交易平台。就像美国的 RobinHood 或全球的 Interactive Brokers,但去中心化的交易平台将允许所有人都能有接触到可投资资产的能力。

当我继续在这个领域做深入研究时,我们意识到其中一个瓶颈是预言机问题。正如我前面所描述的,你需要有值得信赖的数据。但当我们仔细研究当时的解决方案时,我们意识到他们非常缓慢。这是因为以下几个原因:预言机主要从网上抓取数据,但互联网上的数据通常已经延迟了。正如我之前提到的,我在一家交易公司工作,在交易公司你就会知道"延迟"是非常致命的。如果你的数据很慢,你可能会赔钱。我们意识到这是 DeFi 或基础设施中缺失的关键部分。

从那时起,我们开始着手 Pyth Network 的工作。我们认为,没有 Pyth,DeFi 就没有能力做更进一步的突破。我们认为它可以使应用在很短的时间内与中心化的版本竞争。今天特定类型的衍生品交易应用已经做到了这一点,未来还将有更多的全球资产管理解决方案能实现这一点。

TechFlow 深潮:就像你说的,喂价数据在 DeFi 中非常重要,我们需要一个非常流畅和快速的喂价数据。Pyth 在这些方面也有很多的创新,能请你列出一些 Pyth 的关键特性以及对预言机这个赛道的影响吗?

Mike Cahill:最主要的是三大创新。

首先,Pyth 是一手的预言机网络,目前网络中有超过 90 家的数据发布者。他们每一家都是一个金融机构,要么是一个交易公司,要么是一个交易所,他们拥有自己的数据,然后他们被激励直接发布这些数据。这让 Pyth 可以前所未有地访问不同类型的数据,不仅仅是免费提供的数据或者你可以打包购买的数据,还可以访问更多。比如我们想要获取美国一些资产数据,这通常是非常昂贵的,但 Pyth 的数据发布者可以提供这些数据。这是第一个创新。

第二个创新是 Pythnet,他是一个基于 Solana 虚拟机的区块链,它具有与 Solana 相同的透明性。所以你可以看到所有链上被创建的价格数据,也可以看到这 90 个不同数据发布者的具体情况。这是一件非常重要的事情,因为今天我们有 350 个 Symbol(即交易对),这个数字每个月都在上升。一月份,大约有 200 个,它会继续增长,每 400 毫秒更新一次的 symbol 都可以通过 Wormhole 传递给 30 多个区块链。这是一个巨大的创新。我们称之为完整的预言机。所有的东西都发布在 Pythnet 上,然后这些 Symbol 中的任何一个都可以被这 30 个区块链中的任何一个拉取到,比如 Optimism、Solana、Sui 或者 Aptos。这是一个突破性的创新。

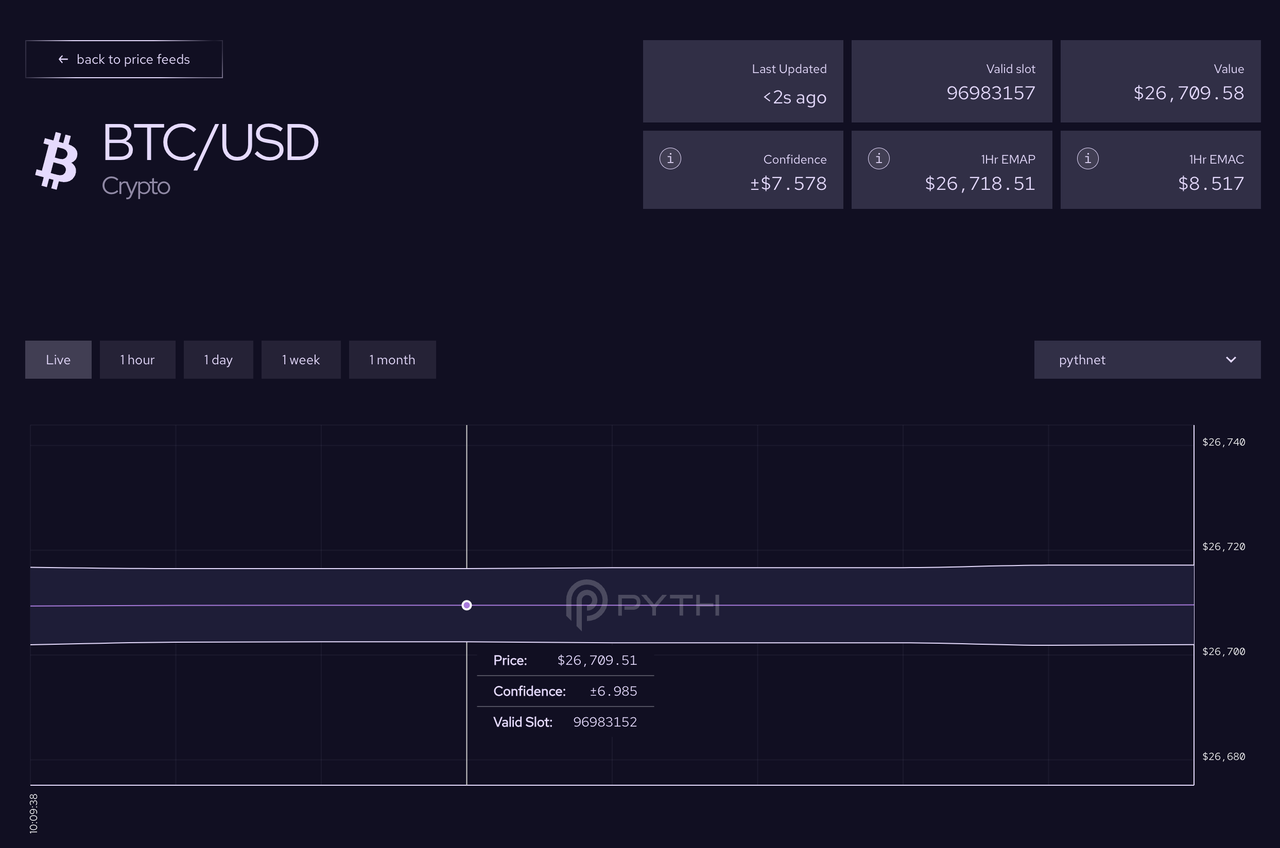

第三个是置信区间 Confidence Intervals,没有其他预言机团队做过这样的事情。这里的重点是,如果你为了准确地代表市场,你需要提供某个具体价格,如 X,但在任何给定时间内都有一个可接受的价格范围。比特币没有统一的价格。比特币在 Binance 上有自己的价格,比特币在 Coinbase、 Upbit 也都有一个价格,有时这些价格会出现分歧。因此,如果你想成为一个高速发展的预言机公司,但你的价格是有分歧的,你将很难建立信任。置信区间让我们的发展速度非常快,因为我们提供了更多的信息,比如,现在的价格是 X,但在一个可以接受的范围内,你可能会发现交易的价格是正 y 或负 y。

这就是三个核心创新,让 Pyth 在保持数据高速传输的同时保持可信。

TechFlow 深潮:谢谢,我还以为你可能会谈到 Push model and Pull model。你是如何看待这个模型的差异呢?我认为这也是非常重要的创新。

深潮注:目前预言机分为两大主要喂价模型:

Push model: 该模型中,预言机会持续向每个区块链推送价格更新,并为每次更新支付交易费用。这成为了限制预言机扩展性的基础性问题:越多数量、越多区块链、越频繁的喂价更新,意味着成倍增加的成本。

Pull model: 一个基于需求的价格更新模型(“拉取”模型),这个创新的设计可以实现用户(应用、清算方、套利方)仅在需要的时候进行链上价格数据拉取更新。

Mike Cahill:Push model 有各种各样的问题。但我们先来谈谈它的好处,它的好处是作为一个应用程序构建者,在你使用相关的数据时,你不必考虑预言机背后的运行机制,比如有外部很多的参与者正在以一个规定时间不断为你更新数据,这是很好的,但问题是,也必须要有人为此买单。

因此,商业模式最终变得非常模糊。所以 Push model 的典型运作方式是他们去向协议或协议周围的使用者收费。他们会说:我们希望你支付明年的数据费用,我们要从你那里收取一些 gas fee。如果你这样做了,我们就会继续发布和更新这些数据。但现在他们的利润最大化目标和所提供的价格数据质量之间存在矛盾,如果他们想要利润最大化,他们就会把数据发布的速度降至最低水平。如果 gas fee 上涨,他们维持这些价格更新的预算可能就会不足,所以这是不可持续的。

有了 Pull model,这个经济模式就会变得非常透明,使用者可以直接为他们所使用的价格数据付费。在 Pull model 中,你所做的事情是把价格拉到链上,但你看到了所有可用的价格,对吧?在 Pythnet 上,我们有 350 个 symbol,每 400 毫秒更新一次,增加交易对的数量没有额外的成本。如果我们想最大化整个预言机的利润潜力,只需要增加拉取的费用然后用户可以决定他们是否愿意为它付费以及这是不是一笔好交易。这是一个更公平的模式、更可持续的方式,因为你可以看到所有的价格更新,它的数量不会下降。所以我认为 Pull model 已经非常清楚地展示出了可持续的商业模式。

TechFlow 深潮:所以 DeFi 项目最好的选择是 Pull Model 对吗?

Mike Cahill:对,没错。我认为现在 Pull Model 的难点在于更多的集成工作,以及跟随市场的发展把数据接入到更多的网络。Synthetix 就是一个很好的例子,它已经从终端用户中抽象出来了。如果你在 Synthetix 上做交易,作为执行交易过程的一部分,会有一个信息叫 Pyth 价格,但用户根本不知道,因为它只是嵌入在代码的后端。Synthetix 的开发者过去需要做更多的工作但现在通过 Pyth 释放了更多增长的能力。

TechFlow 深潮:下一个问题是关于 Douro Labs 的。我们知道 Douro Labs 实际上是最近成立的一个新的组织,你能解释一下为什么要创建这个独立组织,以及它将如何影响 Pyth 的未来发展和生态建设吗?

Mike Cahill:这是 Pyth 成长的一个重要里程碑。在 Douro Labs 成立之前,有来自各种不同实体的贡献者在为 Pyth 工作,他们不一定都是全职的。Douro Labs 给了 Pyth 一个全职的开发团队,和一些真正有才华的人一起致力于 Pyth 开发工作和协议的商业拓展。Douro Labs 有 19 个人,其中有很多来自 Jump Tradings,核心成员还拥有高盛、法国巴黎银行、AWS 以及 Chorus One 等职业背景。这是一个非常有才华的团队,现在专注于开发 Pyth。也许在未来,我们的团队会把重点放在 Pyth 以外的事情上,但目前 Pyth 仍然是我们的核心焦点。

TechFlow 深潮:好的,谢谢你。正如 Pyth 在社交媒体上谈到的,你们将推动代币的治理部署。那么对于 Pyth Token 而言你们未来有什么计划可以和我们分享吗?

Mike Cahill:白皮书里有谈到,在某个时候将会有一个 Token 主导的治理机制。我们正在开发相应的工具。目前还没有宣布具体的时间范围。但是,代币主导的治理意味着网络的用户可以决定他们希望他们的网络如何运行。所以这方面很重要,比如收费标准、或者收费与否,比如新数据发布者或新的 symbol。如果你考虑一下目前与 Pyth 有关联的项目,其实已经有 200 多个。这通常需要许多不同的 symbol,这些 symbol 未来可以由 Pyth 代币持有者社区管理。对于我们来说,一个真正由社区拥有和运营的去中心化 Pyth 预言机网络将是一个令人惊讶的事情。

竞争关系:壮大整个生态系统,我们所有人都会成功

TechFlow 深潮:好的,让我们进入第二部分,关于竞争。第一个问题是市场上有很多的预言机,如果从所支持的协议数量来看,Pyth 目前是第二位。所以 Pyth 会如何看待与其他预言机之间的关系呢,以及从你的观点来看,Pyth 将在哪些方面脱颖而出?

Mike Cahill:我前面谈到的三个 Pyth 的创新部分我认为是非常独特的,这是我们引以为傲的部分。我认为我们正处于低延迟预言机洪流中,它可以从加密资产扩展到传统资产。在今天的 350 个 symbol 中,有 25% 是现实世界的资产。这是 Pyth 的一大区别,其他大多数预言机都只专注于加密资产。

我认为我们与其他预言机公司的关系是友好的。我们欣赏很多其他预言机所做而 Pyth 没有做的事情。Pyth 非常专注于以最快的时间获得链上最好的金融数据。Pyth 没有随机乘积产品,例如随机数生成器,不做体育比赛和天气预报相关的数据。所以其他的预言机需要做这些事情,我们很钦佩他们愿意这样做。

有一些预言机也已经发展出了不同的产品,比如桥:Chainlink 引入了他们的 CCIP 套件使用 Wormhole 作为桥接机制,但在未来它可能会使用不同的桥。我认为桥领域和预言机领域在垂直方向上是非常不同的。我们还处于起步阶段,我们必须支持我们的行业伙伴,因为如果这个生态系统最终发展壮大,我们所有人都会成功。

TechFlow 深潮:现在 Pyth 主要支持 DeFi 协议,未来你们还会涉足更多的领域吗?

Mike Cahill:现在下结论还为时过早。目前,有很多对于成功的定义。

对 Pyth 而言,因为 DeFi 使用的是金融数据,因此我们想要成为在这个垂直领域世界上最好的产品,然后再转向其他领域。我可以设想很多事情,比如使用其他类型的数据会有很多令人兴奋和有趣的创新,但目前还没有计划进入其他类型数据的计划。

TechFlow 深潮:好的,谢谢你。另一个问题是我们最近都知道了谷歌云与 Layer Zero 展开了合作,也是预言机领域,你能分享一些关于这次合作的想法和潜在影响吗?

Mike Cahill:因为这是刚刚宣布的,所以我也不知道具体细节。Layer Zero 是一个桥,谷歌云是云服务提供商。所以如果我要推测他们在做什么,我会说在 Pyth 模型中,Pyth 使用 Wormhole 作为它的桥。但 Pyth 的数据来源方式非常独特,我们有 90 个数据发布者。谷歌云给我的印象不像一个数据源,当然也没有竞争优势来激励受保护的金融市场数据被带到链上。因此,它给我的印象更深刻的是,它可能会专注非财务数据,并找到更适合的领域。比如开源数据,类似新加坡现在的温度是多少?我认为这种公共领域的东西通过 Layer Zero 被带到链上会非常适合。我很难相信谷歌云能够在没有特定商业模式的情况下为金融市场获取数据。

未来计划:世界上所有的金融数据都将通过 Pyth 传输

TechFlow 深潮:请教一个个人问题,能不能请你介绍一下你认为在未来 10 年里,哪一个 DeFi 协议会更加突出?

Mike Cahill:这也很难预测。但 Synthetix 已经证明了自己具有持久的力量。它们是最早的衍生品协议,也是链上衍生品协议中最大的之一。最近,他们正在部署 V3,他们的团队已经经历了这么多的周期,如此的有经验,所以他们很难失败。

TechFlow 深潮:另一个问题是,现在有很多预言机,从长远来看,整个市场格局肯定会发生一些变化,你认为 Pyth 会在未来的预言机竞争中占据多大的市场呢?

Mike Cahill:这个问题很难预测。但从金融数据的角度来看,我们认为世界上所有的金融数据都将通过 Pyth 传输,就像我提到的,世界上所有的音乐都将通过 Spotify 传输一样。这并不是不合理的。我们在垂直领域,在 DeFi 或金融数据方向上,我期待 100% 的数据都会通过我们进行传输。

TechFlow 深潮:Cool,最后一个问题是,也许很多用户会对你刚才提到的白皮书感兴趣,因为有很多关于 Pyth 代币和机制的实用性参考。有其他的预言机已经推出了他们的代币,对于 Pyth 而言,你能分享一下 Pyth 代币的独特做法和优势吗?或者未来有什么计划吗?

Mike Cahill:这个代币是一个治理代币。它将允许用户决定他们想要 Pyth 走向的方向。与其他治理代币类似,它也将用于费用支付,对发布者的奖励,并可能用于发布者的质押等,以提高网络的安全性。

目前还没有关于何时发行代币的公告。但正如我提到的,我们正在努力建立相关应用,以便我们可以有一个代币主导的治理模式。这是正在构建的一些工具,我们很高兴看到社区如何把 Pyth 带到更高的维度。

TechFlow 深潮:所以这个代币将是一个社区驱动的代币?

Mike Cahill:是的,这将是一个社区驱动的项目,成为社区治理代币,也是它的目标。

深潮注:了解更多关于Pyth的原理,欢迎阅读:Pyth V2 深度研究:喂价模式的关键转变,跨链和多场景支持后暴涨的产品力

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。