撰文:ZK

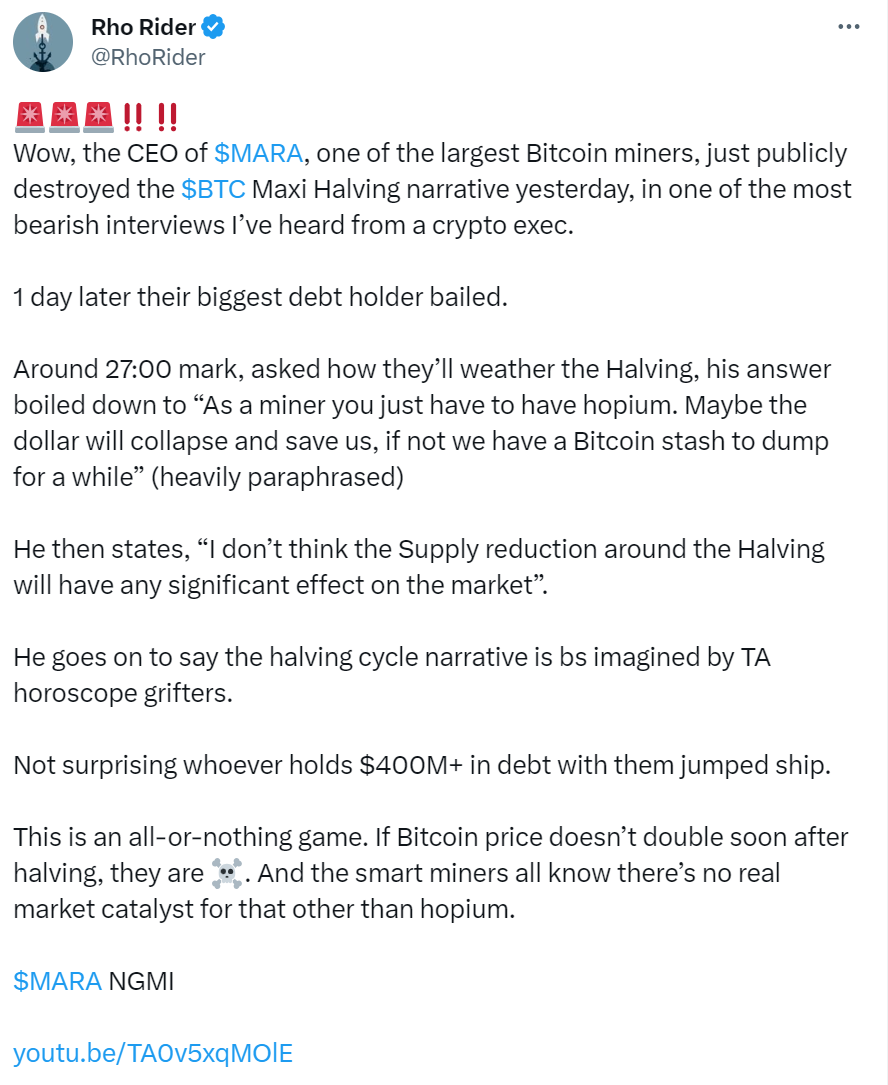

最大的比特币挖矿公司之一 Marathon Digital Holdings,其CEO Fred Thiel 日前在采访中公开表示:自己不认为存在比特币减半牛市,称其为“幻想”。

Marathon Digital Holdings 是最大、最节能、技术最先进的比特币挖矿公司之一,也是北美上市公司中最大的比特币持有者之一,成立于2010年2月。

比特币减半与矿工去留

9月6日,Marathon Digital Holdings CEO Fred Thiel 参加了Brave New Coin的在线访谈节目,被问到作为矿工要如何度过减半时Fred Thiel说到:“我们没有无法控制比特币价格、无法控制全球挖矿算力,我们只能关注于自身的挖矿效率、收入支出情况。我们持有约39000枚比特币,100万美元现金,如果减半后价格没有大的改善,我们会持续的抛售所获得的比特币,直到2026年。如果价格像前两次减半一样上涨,那么对我们矿工来说是很有利的。但我认为这不会发生,比特币的交易价格和流动性周期的关系更紧密,而不是减半。也许美元会崩溃并拯救我们,否则我们就会将比特币储备抛售一段时间。”

Fred Thiel举例说到:“区块奖励从9个变成4个不会对交易市场有多么大的影响。但可以预见的是,如果价格没有上涨,那么很多矿工会因为收支不平衡而退出挖矿,从而导致算力下跌,在那个时候,挖矿的效率是最为重要的因素。未来10年,比特币将要经历两轮减半,挖矿收益会下降到不足2BTC每区块,我期望比特币能够在这期间获得更多的人采用,从而提升比特币的交易手续费收入。”

Fred Thiel的说法很大程度上能够代表矿工的观点:如果没有利益,矿工就会被迫抛售、离开比特币。

这也暗示了另一个将要面临的情况,如果出现了效益更高的机会,矿工也会离开比特币网络而去往收益更高的地方,比如以太坊。

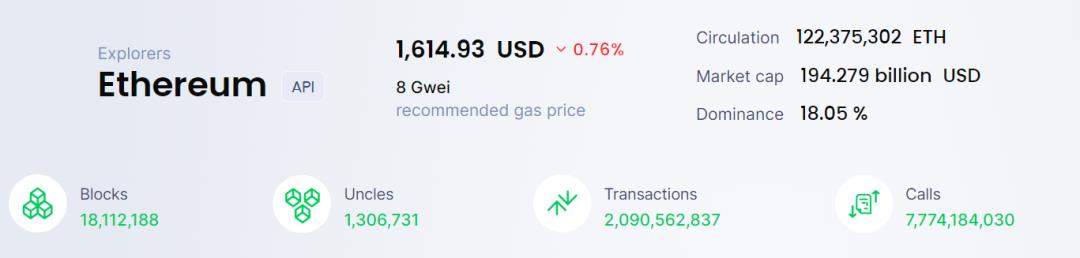

比特币比以太坊早出现近8年时间,但链上交易数不足以太坊的一半。

我们在谈论的是多大级别的收益呢?

运行一个以太坊验证器需要质押32个ETH,在各种质押应用如Lido等的帮助下,验证器运行者的成本可以降低到1个ETH,加上运行软件的硬件成本,币本位收益率可以达到5%至20%。另一方面,验证者成本下降,对于网络的去中心化程度也有提升作用。

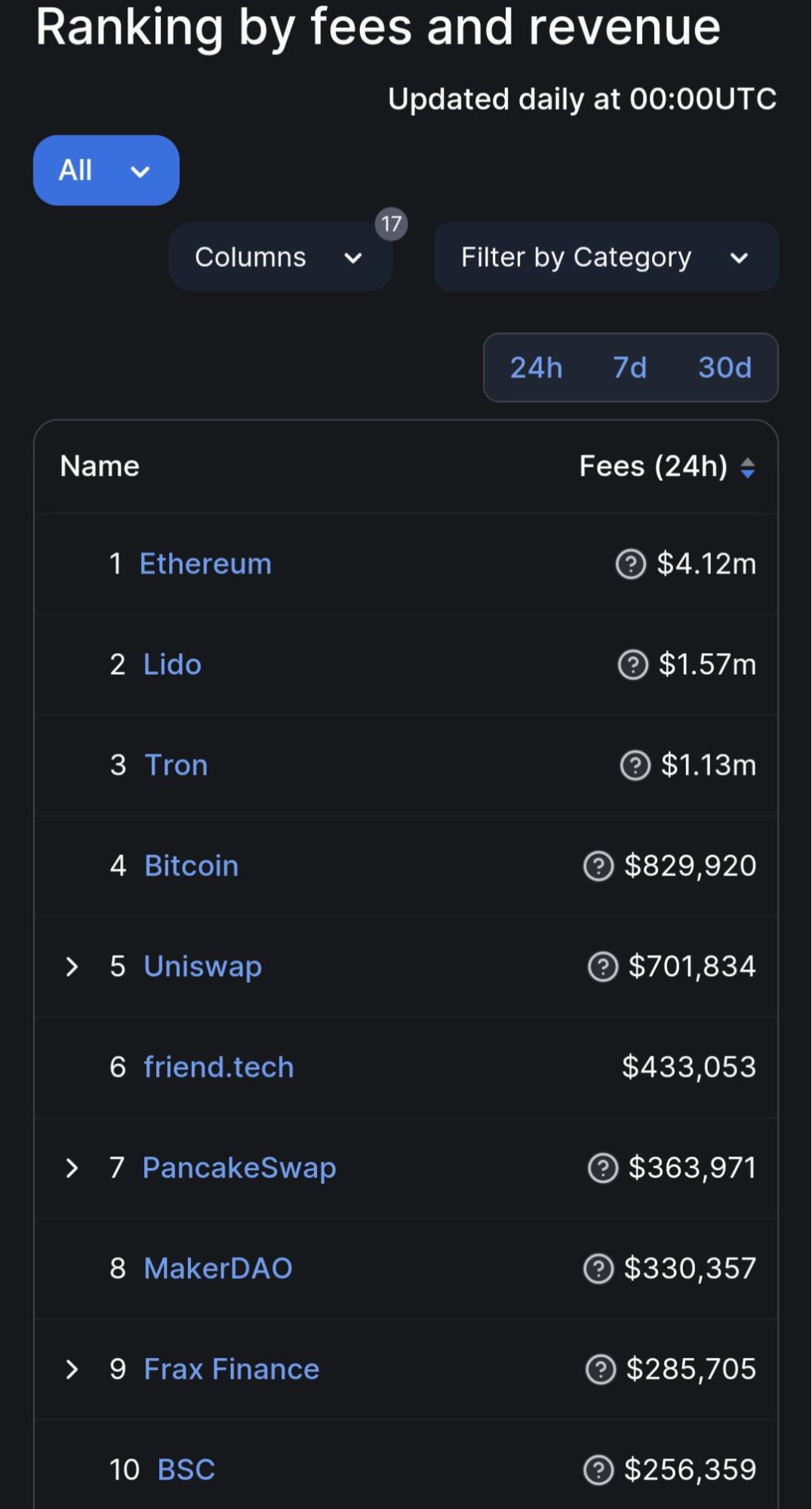

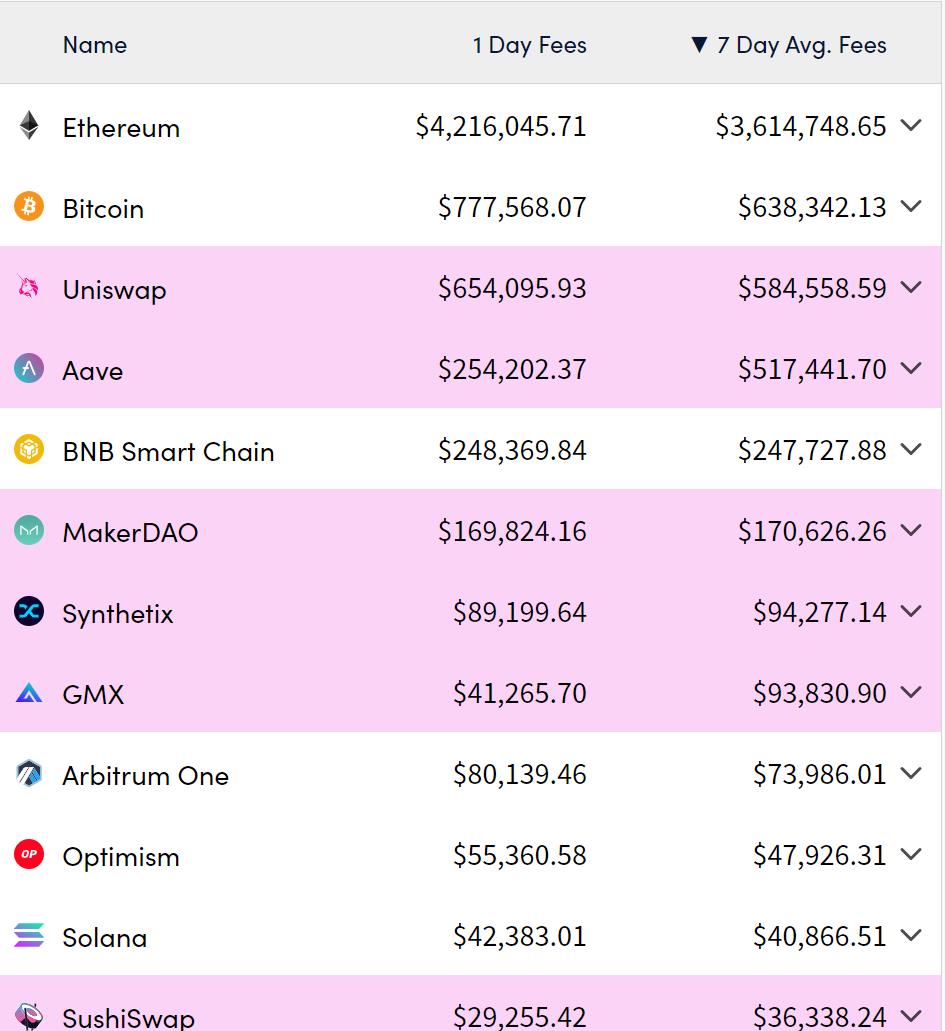

美国交易所Coinbase利用以太坊Layer2 Optimisitc的OP Stack技术,搭建Base链,其链上社交应用 Friend tech产生的交易手续费,就大于整个比特币网络的交易手续费。

更多的对比可以在 https://cryptofees.info/ 当中看到,以太坊生态的收益远远高于比特币。

基于比特币的交易太少了,还被CEX、闪电网络分走了很大部分。以太坊生态蓬勃发展的对面,比特币矿工们即将面临收益减半。一面是低投入高收益,一面是高投入伴随着收益不断下降,你很难阻止矿工在看到这样的数据对比之后不产生动摇。

加密世界的用户在期待比特币减半,矿工却只能指望美元崩溃来拯救他们。这是讽刺的,去中心化的加密货币没有选择让自己变更好,而是在等待敌人自己衰弱。

比特币是最好的Layer 1

比特币不是没有出路。在这场访谈中,Fred Thiel还表达了这样的观点:“我认为比特币是最好的Layer 1,在它之上能够建立起各种非常有趣的应用。”

这也是另外一个矿工们的普遍想法:基于比特币的交易增多,而矿工自身要做的事情依旧是挖矿、验证交易。

比特币是最好的Layer 1,这里应该存在着一个前提,即它必须是最安全的网络,才能成为最终的结算人。而比特币网络的安全性,与网络算力成正比,与它能够给矿工带来的收益成正比。实现比特币扩容是这个问题唯一的解法。

网络扩容——矿工收益提升——更多的矿工加入——网络安全提高——使用者增多——矿工收益提升

与必须确保网络安全一样,扩容路线不能是大区块等类似Web 2不断增加服务器的横向扩容方式,他们会导致运行比特币软件的成本显著提高,进而影响比特币的安全性。

有Layer 1,就会有Layer 2。纵向、分层的扩容方式是解决区块链不可能三角的有效方式:Layer 1保证安全性与去中心化程度,Layer 2提供高度的可拓展性和强性能,提供维持网络安全的经济动力。

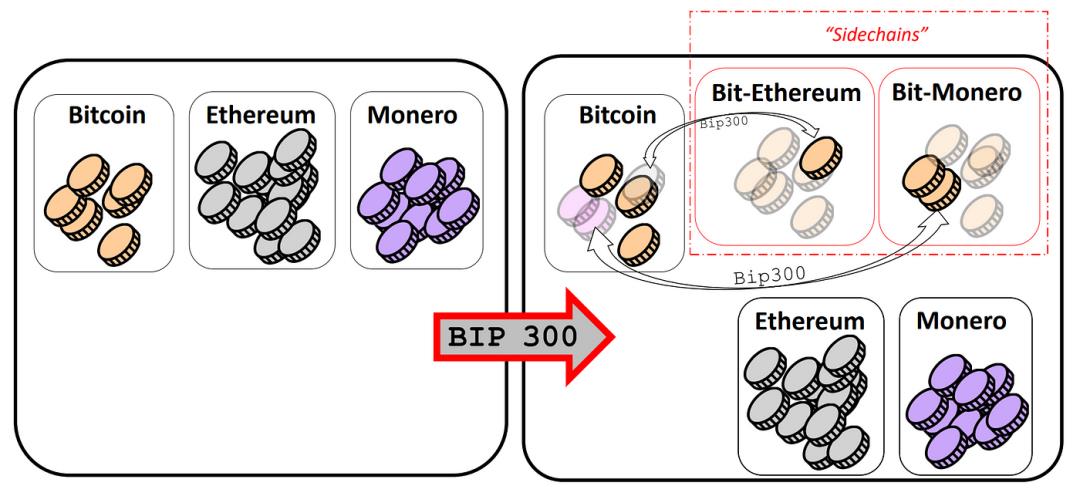

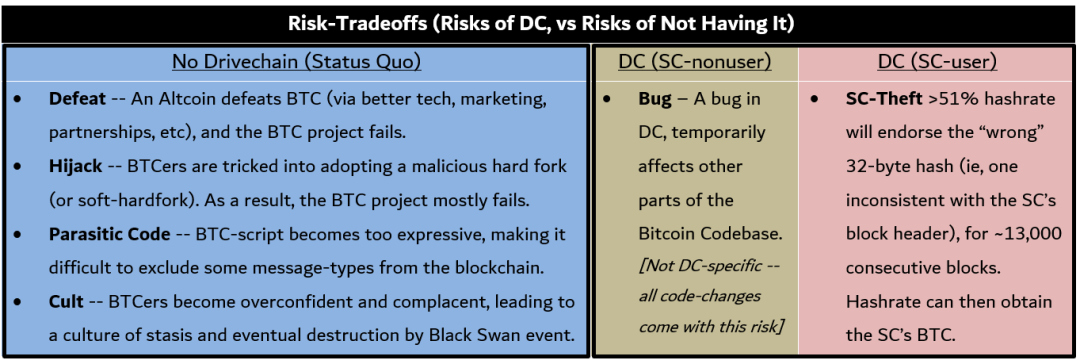

基于BIP-300/301,DriveChain能够将比特币作为最佳Layer 1的价值挖掘出来。中本聪在2010年也设计了这样的功能,合并挖矿设计是对侧链存在的认可。

比特币是最好的Layer 1,与通过分层、侧链的方式进行扩容,是共荣共损的一个生态系统。

DriveChain释放比特币的价值

DriveChain用一种安全、简单的方式,实现比特币的分层扩容,满足各方的需求。

DriveChain为开发者提供了利用比特币强大价值和效应的机会,用极低的成本去实现目标,并且有着完全自主的设计空间。

对比特币持有者,DriveChain可以带来更多的使用价值和增值机会,让比特币作为货币、资产的属性充分发挥。

比特币矿工会在繁荣的比特币侧链生态里,获得可观而持续的收入,比特币网络也能持续健康的运转。

我们必须认识到,比特币的网络效应是双刃剑。比特币取得成功以后,Maxium者以宗教般的虔诚、狂热著称,这种狂热造就了强大的网络效应,也蒙蔽了其中一些人的眼睛:持有者在强大网络效应长期以来的影响下,似乎有了一种蔑视一切、认为比特币无可挑剔的优越感。

相比于每天查看着比特币使用数据情况的矿工,他们的感知是落后的,对于比特币即将面临的问题,他们认为一切都不需改变,都会在网络效应的影响下大而化小、小而化无,缺乏进行改变的紧迫感和动力,他们还因此害怕改变,害怕出现差错影响网络声誉。

而当创新遇上网络效应,其作用、价值将得到迅速的扩张,这像是被压制的欲望获得了释放的空间,能量喷薄而出,比特币网络这样的价值应当被正确的使用。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。