Today is the fifth day of the Lunar New Year, Saturday, the market is fluctuating within a narrow range, so there is no desire to watch the market. The current price of Bitcoin is around 68200, with two consecutive small bullish candles on the daily chart. The KDJ three lines are converging to form a golden cross upwards, RSI is also turning upwards, and MACD bullish volume is continuing to increase. However, the price has not been able to surge upwards too much, the Bollinger Bands are narrowing, the upper band and the middle band are opening downwards, but the lower band is opening upwards, which raises concerns for short positions about the market pushing up to liquidate short leverage. For long positions, be careful as the market may just be manipulating to induce longs for a slow rise; recently it has been a slow rise followed by a sharp drop, so if there is profit in long positions, remember to gradually reduce your holdings, and for those with trapped long positions, timely exit if need be! On the weekly chart, the KDJ is flat, the downward trend is slowing, RSI is turning down, and MACD bearish energy is continuing to increase; overall, the trend is still bearish.

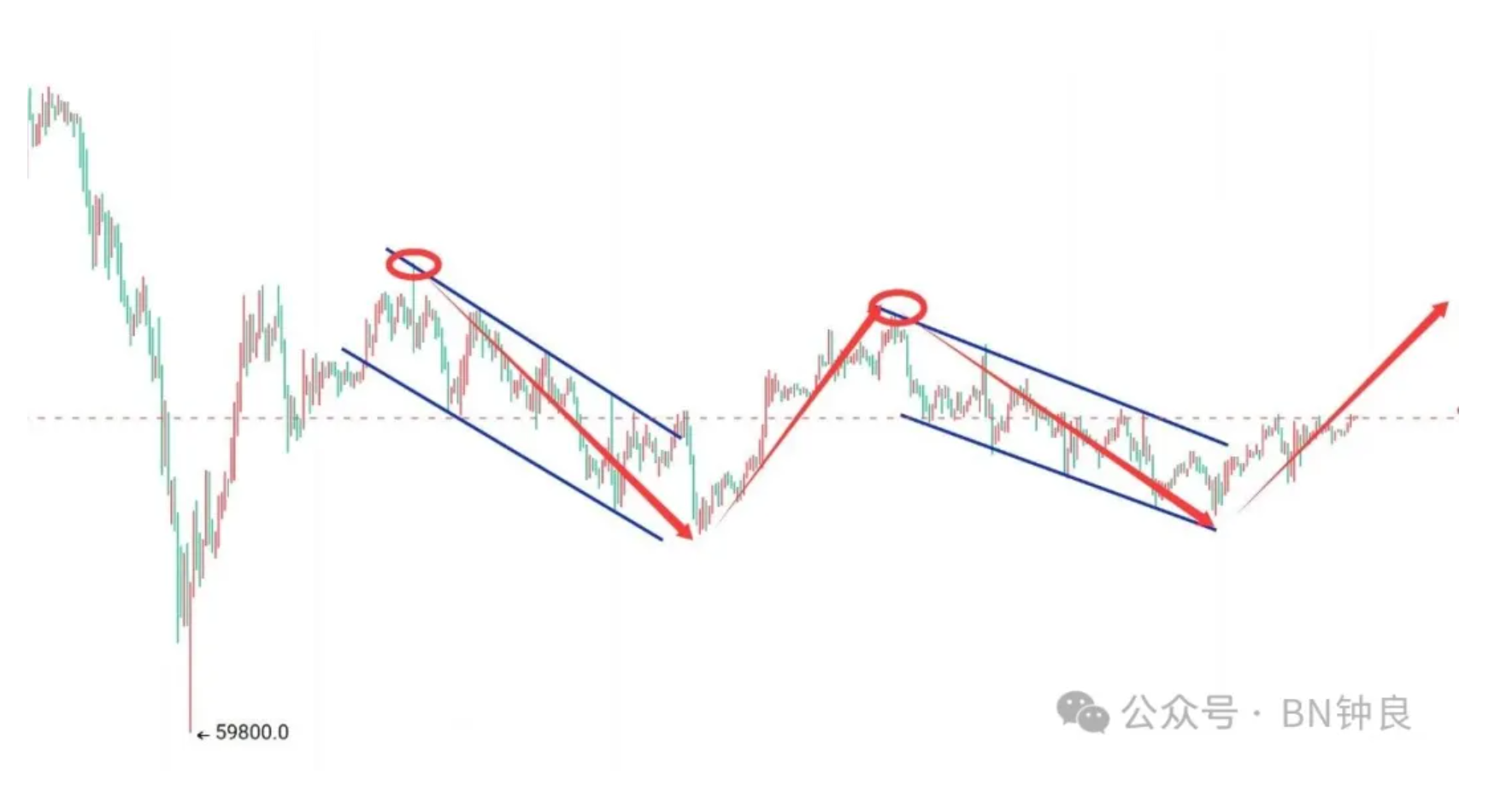

The market stopped dropping at 59800 and rebounded, reaching a high of 72300 before creating a small downward channel, with the lowest pullback stopping at 65081, followed by a rebound. After reaching a rebound high point around 70938, it faced pressure and formed another small downward channel, with the lowest pullback stopping at around 65595. Currently, the market is correcting and rebounding. As shown in the chart, the market has the potential to form an irregular W pattern, with the two bottom points at 65081 and 65595, and the two top points at 70938 and 72300. The high short positions for next week need to focus on the area below 70000; there is no need to chase short positions on a short-term basis because the second downward channel has not broken the previous low, making it easier to rebound and test the pressure upwards!

Ethereum is the same, there is also no need to participate in short-term short positions below 2000. Next week's high short will consider participating around 2100 for testing, which makes it easier to set stop-loss. After the market consolidates and fluctuates, it can easily cause movements. As the saying goes, a rebound is normal; without a rebound, there would be no opportunities for high shorts. The rebound is only to provide a better and higher position to short, that's all!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。