Original Author: bootly, Bitpush News

The Ethereum Foundation (EF) once again finds itself at a crossroads amid personnel upheaval.

Tomasz Stańczak, the Co-Executive Director of the Ethereum Foundation, announced that he will step down at the end of this month. This comes just 11 months after he and Hsiao-Wei Wang took over from the long-serving Aya Miyaguchi to form a new leadership core.

He will be succeeded by Bastian Aue. This individual has very little public information available, having registered a Twitter account only eight months ago, with virtually no speaking record. He will continue to co-manage this organization, which controls the core resources and direction of the Ethereum ecosystem, alongside Hsiao-Wei Wang.

This seemingly sudden personnel change is, in fact, an inevitable outcome of the intertwining internal conflicts, external pressures, and strategic transformations within the Ethereum Foundation.

Appointed in Crisis: A Turbulent Year

To understand Stańczak's departure, one must first return to the context of his tenure.

By early 2025, the Ethereum community was in a state of anxiety. At that time, the overall cryptocurrency market was rising after the U.S. elections, Bitcoin was hitting new highs, and competitors like Solana were gaining momentum. Meanwhile, Ethereum's price performance was relatively weak, and the Ethereum Foundation itself became a target of criticism.

The criticism was aimed directly at then-executive director Aya Miyaguchi. The developer community complained of a severe disconnect between the foundation and frontline builders, identified conflicts of interest in strategic direction, and criticized the insufficient promotion of Ethereum. Some questioned the foundation's overly "laid-back" approach, suggesting that by presenting itself as a "coordinator" rather than a "leader," it was allowing Ethereum to lose its first-mover advantage.

As Ethereum’s "central bank," the foundation was being asked not to govern with inaction, but to take decisive action.

Amid this public relations storm, Miyaguchi retreated behind the scenes and entered the board, while Stańczak and Wang were called to the forefront.

Stańczak was not a parachute candidate. He is the founder of Nethermind, a company that serves as one of the core execution clients in the Ethereum ecosystem, playing a key role in infrastructure development. He understands technology, has entrepreneurial experience, and possesses a firsthand understanding of community pain points.

In his own words, the directive he received upon taking office was clear: "The community is shouting — you are too chaotic, you need to be a bit more centralized and a bit faster to respond to this critical period."

What was accomplished in this year?

The combination of Stańczak and Wang indeed brought visible changes.

First was organizational efficiency. The foundation cut 19 employees, streamlined its structure, and attempted to shake off the label of bureaucracy. The strategic focus returned from Layer 2 to Layer 1 itself, clearly stating a priority to expand the Ethereum mainnet rather than allowing L2 to operate independently. The pace of upgrades became noticeably faster, with EIP advancements being more decisive than before.

Second was a shift in posture. The foundation began publishing a series of videos on social media, actively explaining Ethereum’s technological direction and development path to the public. This "outreach" communication style contrasts starkly with the relatively closed and mysterious image of the past.

In terms of strategic layout, Stańczak promoted the exploration of several new directions: privacy protection, responses to quantum computing threats, and the integration of artificial intelligence with Ethereum. In particular, regarding AI, he clearly stated that he saw "agent systems" and "AI-assisted discovery" as trends reshaping the world.

On the financial side, the foundation started discussing more transparent budget management and funding allocation strategies, attempting to respond to external criticisms regarding the efficiency of its fiscal resources.

Vitalik Buterin’s assessment of Stańczak was, "He has significantly enhanced the efficiency of multiple departments within the foundation, making the organization more agile in responding to the external world."

Implied Messages in the Resignation Statement

Why resign after less than a year?

Stańczak’s resignation statement was quite candid and somewhat thought-provoking. He provided several key points:

First, he believes that the Ethereum Foundation and the entire ecosystem are "in a healthy state." It is time to pass the baton.

Second, he wants to go back to being a "hands-on product builder," focusing on the integration of AI and Ethereum. He mentioned that his current mindset is similar to when he founded Nethermind in 2017.

Third, and perhaps the most intriguing statement was: "The leadership of the foundation is becoming increasingly confident in making decisions and controlling more matters. Over time, my ability to execute independently within the foundation has diminished. If I were to stay on, by 2026 I would be mostly just 'waiting to pass the baton'."

This statement reveals two layers of meaning: one is that the new leadership team has developed its own drive, no longer requiring his intervention in everything; the other is that his actual power may be shrinking: for someone used to jumping into action with a strong entrepreneurial spirit, this feeling clearly does not fit him anymore.

He also mentioned, "I know that many ideas regarding agent-based AI may not be mature or even useful at this moment, but it is this game-like experimentation that defines the innovative spirit of early Ethereum."

This statement carries a slight implicit criticism of the current situation: as organizations become increasingly "mature" and decisions more "prudent", will that wild experimental spirit be lost?

Stańczak's resignation is superficially a personal choice but reflects the long-term dilemma faced by the Ethereum Foundation.

This organization has been in an awkward position since its inception. Theoretically, Ethereum is decentralized, and the foundation should not become a power center issuing commands. However, in reality, it controls a large amount of funds, core developer resources, and ecosystem coordination authority, objectively taking on a dual role of "central bank" and "development committee."

This identity paradox results in a long-standing dilemma for the foundation: if it does more, it is labeled as centralized; if it does less, it is criticized for inaction. During Miyaguchi’s tenure, there was a tendency toward a "coordinator" role, which resulted in accusations of weakness; Stańczak attempted to shift to an "executor" role, which indeed improved efficiency, but naturally concentrated internal power distribution.

Stańczak's resignation statement precisely exposes this tension: as organizations become more efficient and decisions more decisive, the individual play space of founding team members tends to be compressed. For an ecosystem that needs to balance "decentralized spirit" and "market competition efficiency", this internal friction is almost unavoidable.

What kind of person is Bastian Aue, who will succeed Stańczak?

Very little public information is available. His own description on Twitter suggests that he previously handled "difficult to quantify but crucial work" at the foundation: assisting management decisions, communicating with team leaders, budget considerations, strategic sorting, and priority settings. This low-key style contrasts sharply with Stańczak's vibrant entrepreneurial spirit.

Aue stated in his succession remarks: "The basis for my decision-making is a principled insistence on certain attributes of what we are building. The foundation's mission is to ensure that permissionless infrastructure—at its core, the spirit of crypto-punk—can be built."

This statement sounds more like the language style from the Miyaguchi era: emphasizing principles, spirit, and coordination rather than dominance.

Does this indicate that the foundation will rebalance its direction, shifting from "radical execution" back to "principled coordination"? That remains to be seen.

The Confusion of Ethereum

Stańczak's departure comes at a time when Ethereum is discussing a series of significant proposals. According to him, the foundation is set to release several key documents soon, including the specific plan for "Lean Ethereum," a future development roadmap, and DeFi coordination mechanisms.

The "Lean Ethereum" proposal has been whimsically dubbed by some community members as "the weight-loss era of Ethereum"—aimed at simplifying the protocol and lightening the burden to allow the mainnet to operate more efficiently.

These directional documents will profoundly impact the evolution path of Ethereum over the next few years. The timing of a change in core executive leadership undoubtedly adds uncertainty to the implementation of these proposals.

The broader context is that Ethereum is facing challenges on multiple fronts: competition from high-performance chains like Solana, the fragmentation issues of Layer 2, a new narrative window for the fusion of AI and blockchain, and the impact of overall market sentiment in the crypto space on ecosystem funding and attention.

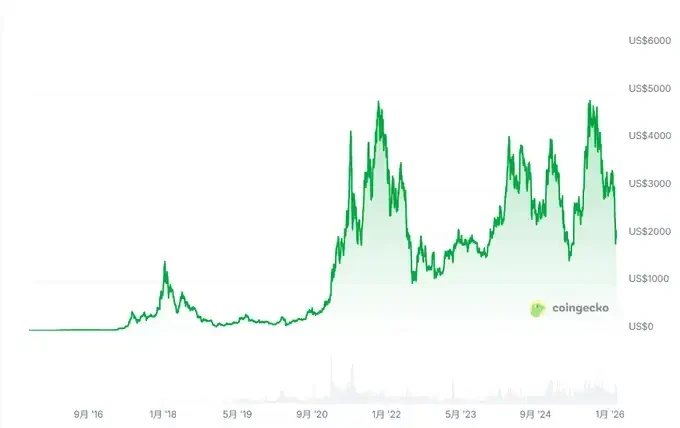

On the very day that Stańczak announced his resignation, ETH briefly dipped into the $1800 range. Should it continue to drop below this threshold, an awkward reality will emerge: the overall return for holders of ETH may fall below the cash interest rates of the U.S. dollar.

To put this in more painful terms: in January 2018, ETH first crossed $1400. That $1400 adjusted for U.S. CPI inflation compounding would equate to about $1806 by February 2026.

This means that if an investor bought ETH in 2018 and held it until now, without ever staking, then after eight years, not only would they have not made money, but they might even lag behind simply saving in a bank for interest on dollar cash.

For those who have believed in this journey as "E Guardians," the real question may not be "who won the ideological battle," but rather: how much longer can it last?

The only certainty is that this core organization, which controls one of the most important ecosystems in the crypto world, is still searching for its position in a rapidly changing industry, and this path is bound to be anything but smooth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。