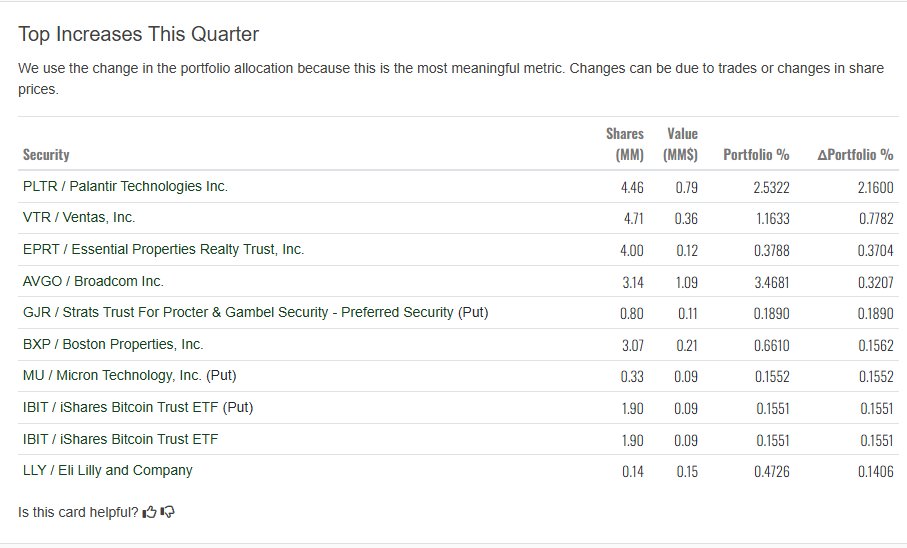

Today, I saw that Daiwa Securities, which manages assets exceeding $240 billion, established a new position of 1.9 million shares of $IBIT and 1.9 million shares of put options in the fourth quarter of 2025. This is Daiwa Securities' first purchase.

In simple terms, Daiwa Securities bought 1.9 million shares of IBIT because they were concerned that $BTC would fall, and then they hedged by buying the same amount of put options.

This is a common protective hedging strategy, holding a long position in an asset while mitigating the risk of price declines through put options. If the price of Bitcoin falls, the value of IBIT decreases, but the value of the put options will increase, thus partially or fully offsetting losses.

This time, it really feels like Daiwa Securities is tentatively establishing an exposure to Bitcoin.

@bitget VIP, lower rates, more benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。