Monday was not very peaceful. Both Japan and China have some influence on the U.S. economy. Just after Takashi Hayashi's victory, China began to reduce its exposure to U.S. Treasury bonds. Although the risk markets were somewhat turbulent, the impact felt minimal. U.S. stocks shifted from a lower opening to an upward trend, bringing $BTC back above $70,000. Currently, market sentiment remains relatively healthy.

The reason for this decline is still unclear, and we need to observe more data. However, U.S. stocks continue to show good resilience. While cryptocurrencies can move in sync with U.S. stocks, especially tech stocks, the synchronization is at different frequencies. Due to liquidity issues, the previous sharp declines and surges have transformed into sharper declines and weaker surges.

The S&P 500 is nearing new highs, while Bitcoin has dropped 40%. To break free from this situation, there needs to be either stronger stimulus for the cryptocurrency industry or a recovery in liquidity. Of course, if the market expects a return of liquidity, it would also be good for cryptocurrencies, such as a significant rate cut.

Looking at Bitcoin's data, today's trading volume is not very high, and investor sentiment remains relatively suppressed. Although there was some fluctuation during the day, it did not generate panic. The psychological resilience of cryptocurrency investors is still strong. Currently, the trading volume is mainly driven by short-term investors, while earlier investors have not made significant moves.

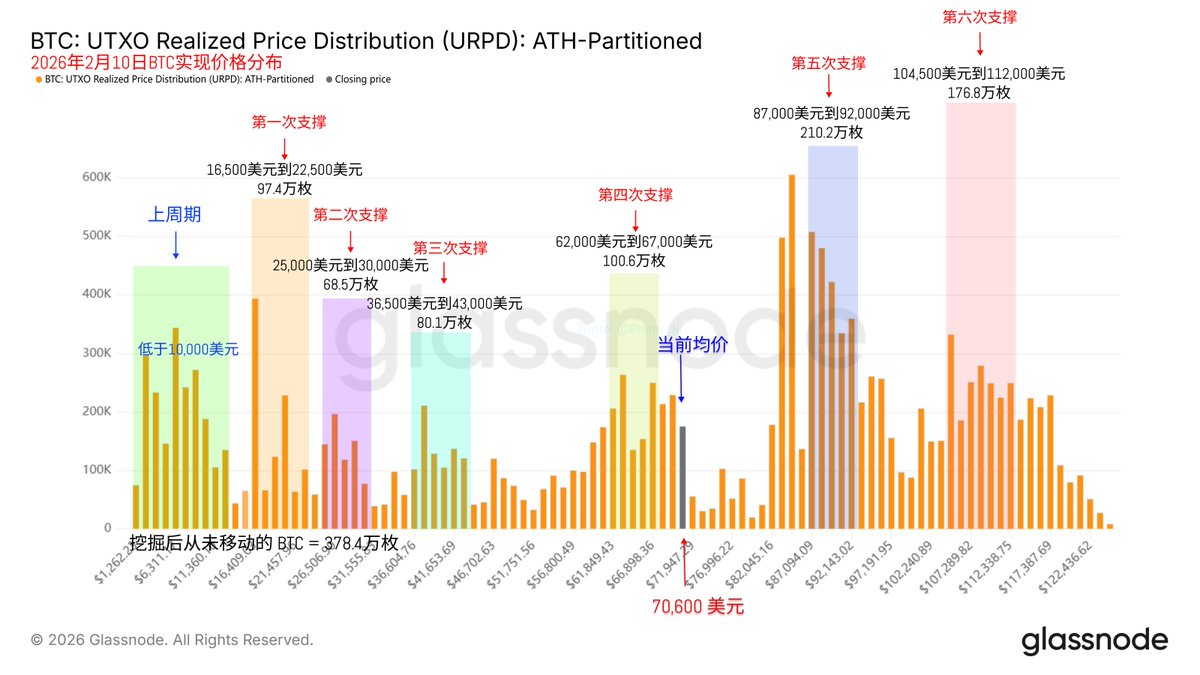

The chip structure is also very stable, which is the biggest difference in this round. If early loss-making chips were to participate in trading like before, the $60,000 price point would likely not hold. However, it currently feels quite healthy.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。