Written by: Xiao Za Legal Team

On February 6, 2026, the central bank and eight ministries jointly issued the "Notice on Further Preventing and Handling Risks Related to Virtual Currencies" (referred to as the "2.6 Notice"). In our opinion, the 2.6 Notice is actually an advanced version of the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading Speculation" issued by ten ministries in 2021 (referred to as the "9.24 Notice"):

The regulatory norms regarding virtual currencies remain largely unchanged from the 9.24 Notice, with no substantial changes except for some patches that need attention;

The regulatory norms regarding NFTs and other digital assets, digital artworks are still blank;

A relatively clear but strict regulatory norm for RWA has been established.

Next, the Xiao Za team will elaborate on the interpretation.

I. Detailed Explanation of RWA Regulatory Norms

In summary, the current regulatory approach in China towards RWA can be described as: allowed under strict conditions.

It must be noted that the 2.6 Notice is the first time that China has clearly defined RWA in a normative document: "Tokenization of real-world assets refers to the use of cryptographic technology and distributed ledger or similar technology to convert ownership, income rights, and other rights of assets into tokens (certificates) or other rights and bond certificates with token (certificate) characteristics, and to carry out issuance and trading activities."

In terms of regulatory principles, Article (13) of the 2.6 Notice clearly states: "Without the approval of relevant departments in accordance with laws and regulations, domestic entities and their controlled overseas entities shall not issue virtual currencies overseas." This statement not only restricts RWA but also broadly restricts ICO activities. However, whether NFTs fall within the prohibited scope is worth further discussion. From a textual interpretation perspective, the Xiao Za team tends to believe that this article does not regulate the issuance of NFTs.

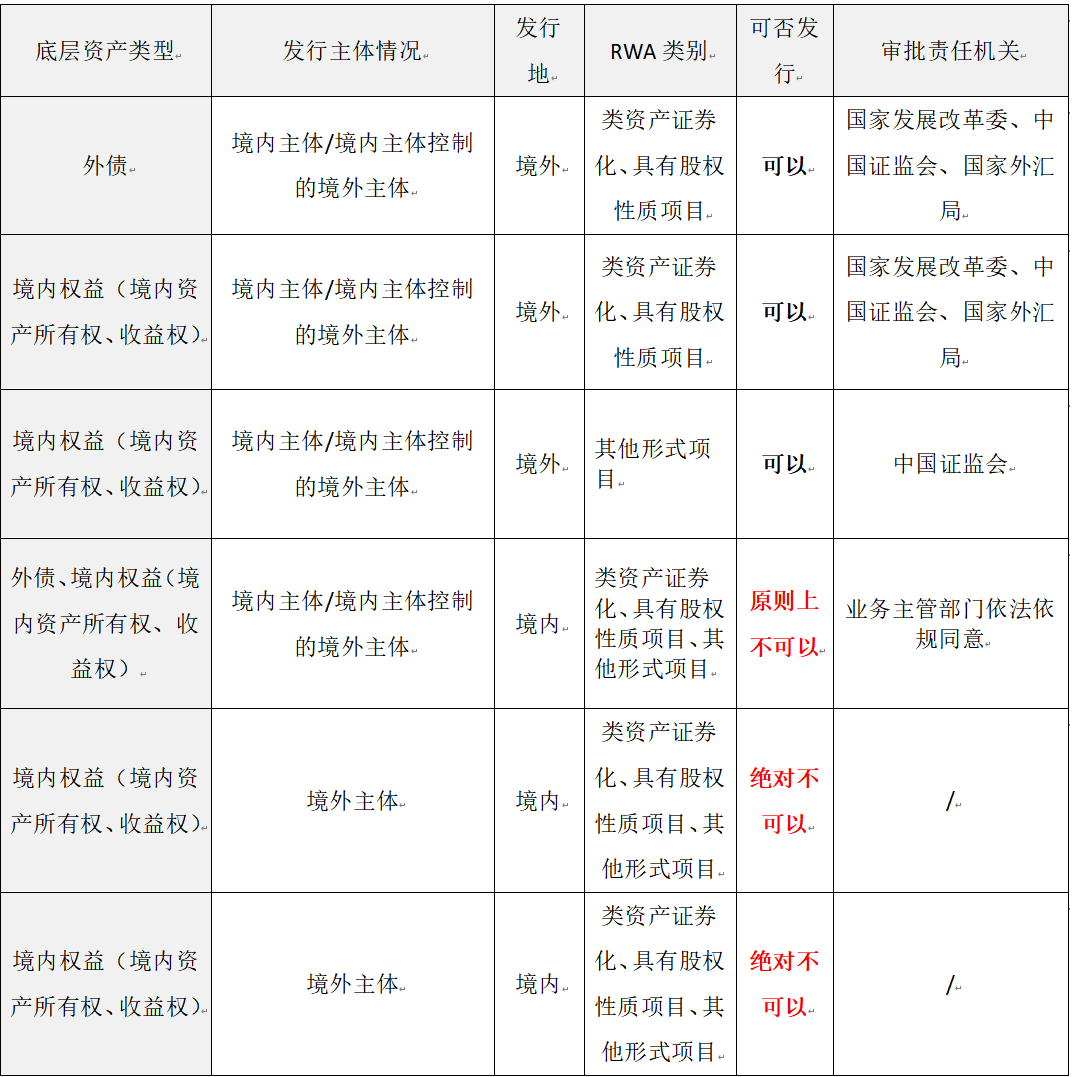

In terms of specific regulatory norms, China has clarified the "RWA issuance approval system." The Xiao Za team summarizes it as follows:

When the RWA concept was at its peak in 2025, the Xiao Za team had already repeatedly and clearly warned that regardless of the method (e.g., using NFT issuance as a disguised RWA), scale (e.g., small-scale internal directed issuance of RWA), or underlying assets (e.g., issuing RWA with agricultural products), the behavior of issuing RWA in China is difficult to separate from the ICO behavior prohibited by the September 4, 2017 announcement, has poor compliance, and may touch legal red lines. Article (2) of the 2.6 Notice affirms this: "Engaging in tokenization activities of real-world assets within the territory, as well as providing related intermediary, information technology services, etc., suspected of illegal issuance of token certificates, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities conducted with the approval of the business competent authority based on specific financial infrastructure."

Some partners are optimistic about the exception conditions for domestic issuance in this article: "Except for relevant business activities conducted with the approval of the business competent authority based on specific financial infrastructure." In our opinion, the Xiao Za team believes that in the short term (within a few years), Chinese regulatory authorities will not allow domestic entities to issue RWA projects. It is expected that only after accumulating certain regulatory experience through a considerable scale of overseas project experiments will Chinese regulatory authorities possibly convert this clause into a feasible path.

As for the commonly concerned issue of what constitutes "overseas entities controlled by domestic entities," specific issuance conditions, and the responsibilities of intermediary institutions, the Xiao Za team will provide detailed explanations in subsequent special articles on RWA compliant issuance.

II. What Important "Patches" Did the 2.6 Notice Add to Virtual Currency Regulation?

Regarding the nature of virtual currencies, the prohibition of related businesses in mainland China, and judicial policies (invalid for violating public order and good customs, risks borne by oneself), the 2.6 Notice is no different from the 9.24 Notice, and the Xiao Za team will not elaborate further. Today, we will focus on analyzing the important new "patches" of the 2.6 Notice.

(1) No issuance of RMB stablecoins without permission

Article (1) of the 2.6 Notice, paragraph three, states: "Stablecoins pegged to fiat currencies perform part of the functions of fiat currencies in circulation. Without the approval of relevant departments in accordance with laws and regulations, no unit or individual, domestic or foreign, shall issue stablecoins pegged to the RMB overseas."

The reason for this patch is directly related to the "Stablecoin Regulations" formulated and issued in 2025 in Hong Kong, which caused the concept of stablecoins to "explode" and go viral. Some illegal individuals began to issue air coins in mainland China and Hong Kong under the guise of stablecoins, even "RMB stablecoins," seriously disrupting financial order.

A deeper reason is that Chinese regulatory agencies must maintain the right to issue currency (also known as "economic sovereignty") and prevent virtual currencies from impacting China's economic security. The so-called right to issue currency (Seigniorage) can be intuitively explained as "an exclusive power owned and exercised by a specific entity (state or government) to mint, issue, and manage fiat currency," while a more academic and abstract explanation is: "the difference between the face value of currency and the production cost." The Xiao Za team will not elaborate further on this.

In practice, the right to issue currency has had different "roles" in different historical periods: in ancient times, the right to issue currency directly reflected the profits of kings (it is commonly believed that the origin of currency is linked to the establishment of state power and the demand for taxation); in modern times, the right to issue currency is a fiscal tool of the government; and in the modern financial discourse system, the right to issue currency has gradually transformed into a more complex power game between different countries or economic entities.

This explains why the first sentence of Article (1) of the 2.6 Notice clearly states: "Stablecoins pegged to fiat currencies perform part of the functions of fiat currencies in circulation…" Therefore, the Xiao Za team believes that, given the extensive promotion of the digital RMB in China, the 2.6 Notice essentially eliminates any possibility for any entity to legally issue RMB stablecoins. Partners should not harbor unrealistic fantasies about the exception of "with the approval of relevant departments in accordance with laws and regulations."

(2) New reporting obligations for internet enterprises

Article (7) of the 2.6 Notice states: "Strengthen the management of internet information content and access. Internet enterprises shall not provide network operating venues, commercial displays, marketing promotions, paid traffic diversion, and other services for virtual currencies and activities related to the tokenization of real-world assets. Any discovered clues of illegal activities should be promptly reported to relevant departments and provide technical support and assistance for related investigations and inquiries."

This provision adds another "Buff" to internet platform operators and service providers who are already heavily "chained." In fact, based on the practical experience of the Xiao Za team, there are currently quite a number of coin merchants, overseas project parties, and KOLs in the crypto space who are promoting crypto projects and services through internet platforms and social media groups. For example, certain forums and groups are among the largest "traffic distribution centers," and many victims of virtual currency theft and fraud learned about virtual currency-related "services" and "projects" on these platforms before being directed to overseas social media platforms, ultimately suffering financial losses.

It is foreseeable that after the issuance of the 2.6 Notice, major internet companies will urgently conduct another round of self-examination and correction activities. It is worth noting that to implement the requirements of the 2.6 Notice, internet platforms cannot simply delete relevant content as they did in previous rectifications; instead, they should assess and organize the relevant content and provide "clues" to relevant departments (cybersecurity, telecommunications authorities, public security departments, or financial regulatory departments) and provide technical support and assistance for subsequent investigations and inquiries (if any).

Of course, it currently seems that major internet platforms are temporarily unable to effectively implement this obligation, as there is currently no specific institution in China dedicated to handling risks related to virtual currencies.

According to the requirements of the 2.6 Notice, this specialized institution should be established under the leadership of local financial regulatory departments, working in coordination with "telecommunications authorities, public security, market supervision, and other departments, in conjunction with cybersecurity departments, people's courts, and people's procuratorates." Currently, local financial regulatory departments still need time to designate management plans and clarify internal responsibilities, and related work may be difficult to complete in the short term.

In Conclusion

In terms of content, the 2.6 Notice is not a completely independent normative document; it has a traditional aspect: re-examining the basic regulatory ideas of the 9.24 Notice, continuing to patch based on the original norms; but it also has a pioneering aspect: incorporating RWA, which had not entered the regulatory view in 2021 but exploded in popularity in 2025, into regulatory norms and issuing regulatory guidelines with a certain degree of operability.

This means that Chinese regulatory authorities are deepening their understanding of virtual assets and, based on understanding, experimentation, and observation, are gradually beginning to accept this new phenomenon. Although the progress of this process is extremely slow due to the continuous emergence of negative events, it can be confirmed that Chinese regulatory authorities have recognized the potential of virtual assets. For partners in the virtual asset industry, this is undoubtedly a significant positive development.

This concludes the Xiao Za team's sharing for today. Thank you to our readers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。