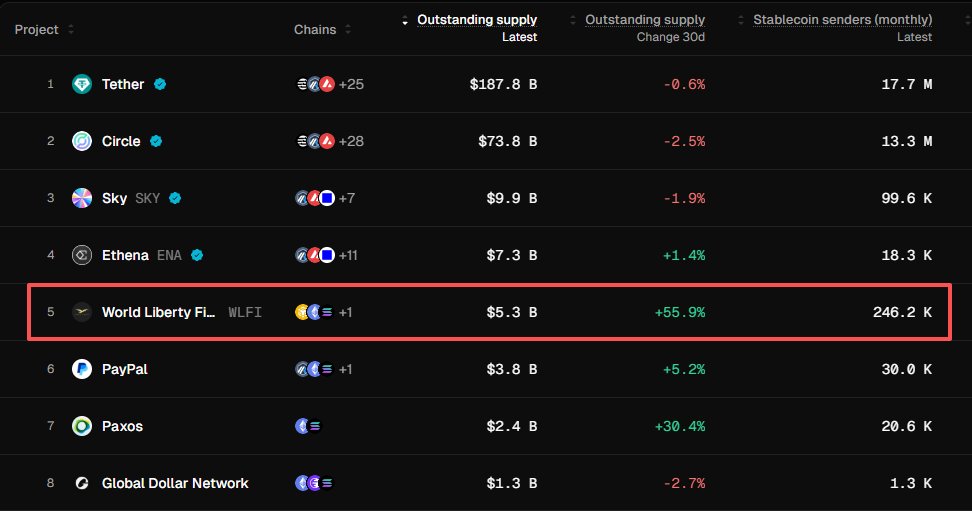

⚡️With deep integration on Binance, the $USD1 has seen a growth rate of 55% in one month, and its current market capitalization has surpassed the $5 billion mark, firmly entering the top tier of stablecoins!

Now it's time to relax; aside from dual currency gains, it's basically just lying back and enjoying the returns from USD1.

There are two investment options—

1⃣ Main channel: Binance platform + WLFI subsidies.

1) Placing in contract/leverage accounts, with a tested position of 50,000 USD1, you can earn nearly 1,500 $WLFI, worth 150 USD, with an annualized return rate of around 16%.

This primarily relies on WLFI subsidies and can still yield for over a week.

After the subsidy ends on February 20, the protocol's endogenous earnings (lending interest + fee sharing) can roughly support an annualized return of 2-3%.

2) Placing in wealth management, with a 4.2% flexible return.

2⃣ On-chain protocol earnings (World Liberty Markets)

Based on the Dolomite protocol's earnings structure, combined with WLFI subsidies, the comprehensive APY can reach 9.6%.

Family, is it possible that we can look forward to another USD1 wealth management activity? 👀

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。