Author: JW, Techub News

The only topic in the entire cryptocurrency market last week was undoubtedly Yi Li Hua (founder of Liquid Capital). He became the "ultimate prey" that short sellers across the market were focused on. His Ethereum position not only represented a personal stake but was also seen as a "pillar of confidence" or a "trigger for collapse" in this round of Ethereum market activity.

However, ultimately, instead of waiting for a rise, he chose to concede defeat due to several consecutive days of significant declines. As of now, his unrealized losses in Ethereum are close to $700 million. On the afternoon of February 8, the most watched investor in the network, Yi Li Hua, finally admitted on social media that his investment strategy had failed and explained why he had maintained a bullish stance against the trend, citing significant psychological effects from previous experiences of selling early due to FOMO.

Source: @Jackyi_ld

In the past week, Yi Li Hua has completely liquidated all his Ethereum holdings. Starting from a peak of nearly 650,000 Ethereum and several close calls with the "liquidation line," the cryptocurrency market experienced a phase of stabilization around last Friday's U.S. stock market close. Subsequently, Yi Li Hua began to sell off his spot holdings continuously, a pace that could even be described as "urgent."

Source: @ai_9684xtpa

This event quickly drew significant market attention, not only because of the nearly $700 million loss but also because Yi Li Hua was regarded as "one of the most steadfast bulls" in this round of Ethereum market activity. His position was not a secret bet but rather a long-exposed public position on the blockchain. To some extent, it constituted part of the market's mid-to-long-term confidence in Ethereum.

When such a position ultimately chose to exit, a larger question arose: was this merely a failure of personal judgment, or is some structural risk gradually becoming apparent?

From Heavy Position to Complete Liquidation, Yi Li Hua's Ethereum Was Not Sold Suddenly

Before we begin, let's briefly review the background of the individual involved. The first time I heard the name Yi Li Hua was during his public conflict with "Bitcoin Godfather" Li Xiaolai in 2018. At that time, Li Xiaolai was famous for holding "eight-figure Bitcoin," and Yi Li Hua was thrust into the public eye as a result.

In 2017, Yi Li Hua joined the coin capital founded by Li Xiaolai as a partner. However, this partnership lasted less than three months before it fell apart. Subsequently, Li Xiaolai publicly accused him of several charges, including privately transferring LP funds to his personal account (claiming Li Xiaolai was aware), profiting from operating "small secret circles" at high prices as a partner, and making negative comments about coin capital after leaving while attempting to sow discord among LPs. A veteran in the crypto circle bluntly stated that such behavior constituted "illegal misappropriation of company funds, and the amount is substantial."

After this "public spat," Yi Li Hua did not fade from the market but quickly co-founded "Liao De Capital" with Lou Jiyue, with Lou serving as the legal representative, officially starting an independent operation. From that time on, Yi Li Hua gradually formed a distinct label: aggressive, strong opinions, and willing to express judgments with heavy positions. Whether in public statements or actual positions, he preferred to use real money to "validate" his understanding rather than remain at the level of verbal judgments.

It is precisely against this character and past experience that we need to clarify a common misconception when understanding this Ethereum liquidation event: Yi Li Hua did not "suddenly decide to sell Ethereum."

Since the end of 2025, his Ethereum position has been continuously tracked by the market, and his accumulation path is quite clear: buying Ethereum through spot purchases, then using Ethereum as collateral to borrow stablecoins from lending protocols like Aave, and continuing to buy Ethereum. This "collateral-borrow-rebuy" structure was not uncommon in the early stages of a bull market, essentially amplifying bets on trends through leverage.

From the end of 2025 to early 2026, Yi Li Hua's Ethereum holdings once approached 650,000, with an average cost just above $3,100. This was not short-term trading but a clearly structured position betting on mid-to-long-term market trends. According to on-chain analysis, the cumulative borrowing scale of this position once approached a leveraged long of $950 million, and the related risk thresholds had been triggered at multiple points.

This position was once considered the third-largest potential institutional Ethereum holding at the time, second only to institutions like BitMine and SharpLink, indicating its influence and psychological support in the market.

The problem arose after prices continued to weaken.

When Ethereum broke through several key levels, this structure began to come under pressure: the value of collateral assets declined, but the debt side would not contract simultaneously, pushing the collateral ratio higher. On-chain data shows that starting from early February, Yi Li Hua began to transfer Ethereum to exchanges. The initial transfer scale was not extreme, but it quickly evolved into a continuous, concentrated, and almost irreversible sell-off.

In just 8 days, transaction records show that he continuously transferred about 658,000 Ethereum to exchanges and completed large-scale sales, effectively liquidating his position by February 8, with the last few hundred also transferred to exchange accounts.

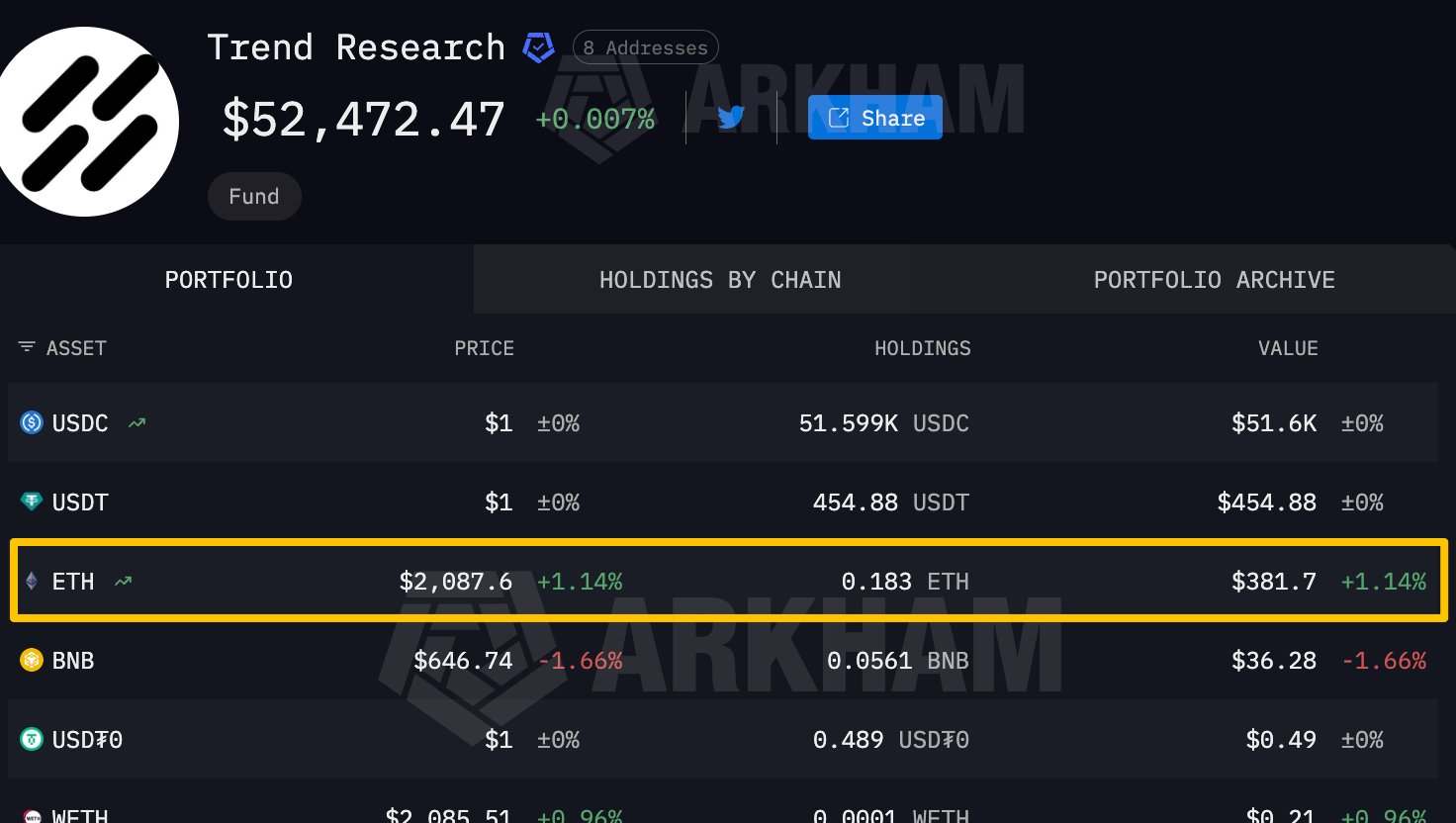

Source: Arkham

From the behavioral path, this appears more like a forced retreat completed under liquidity and risk control pressure rather than a proactive, calm reversal of opinion.

Yi Li Hua and "1011 Insider Brother" Used the Same Binance Deposit Address

Many discussions tend to simplify this event to "judgment error" or "leverage gone wrong," but if we only stay at this level, we overlook a key question: why did Yi Li Hua choose to hold on to this position?

From public statements and historical operations, he is not an emotional trader. His judgment on Ethereum is not a spur-of-the-moment decision but based on a long-term narrative of systematic bullishness. In his logic, this round of decline did not completely negate Ethereum's fundamentals: ETF expectations remain, the scale of stablecoins and RWA continues to expand, and while ecological activity has declined, it has not collapsed.

At the same time, he also mentioned afterward that personal experience played an important role in this decision. In earlier market cycles, Yi Li Hua had missed subsequent rises due to selling early, leaving a significant psychological "aftereffect." This time, he clearly did not want to regret "selling too early" again.

The problem is that when the position size is large and leveraged, the market will not slow down because of your beliefs. Price declines do not just translate to unrealized losses but will directly convert into collateral ratio pressure. Once approaching the liquidation line, the choice is no longer entirely in the trader's hands.

Just as the market generally viewed this as "the big player conceding defeat," some subtle changes began to emerge.

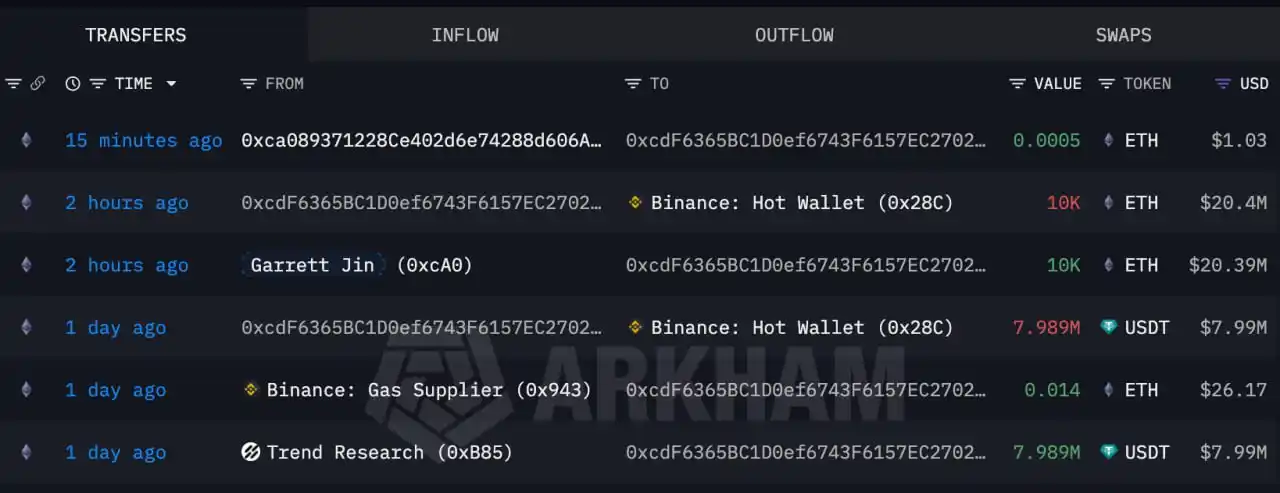

On February 7, according to Lookonchain monitoring, the address starting with 0xcA0, marked as "1011 Insider Brother" (agent Garrett Jin), used the same Binance deposit address as Yi Li Hua's Trend Research.

Source: Arkham

On-chain data shows that the Trend Research address transferred 7,989,000 USDT to the address starting with 0xcdF one day prior, which was then transferred to a Binance hot wallet address starting with 0x28C; meanwhile, "1011 Insider Brother" transferred 10,000 Ethereum to the same 0xcdF address just two hours earlier, which subsequently flowed to the same Binance hot wallet starting with 0x28C.

The interaction of the same deposit address has sparked widespread discussion in the market and community. Some believe that in OTC or cross-address funding channels, such "shared" addresses, while statistically unlikely, cannot be ruled out as part of a transaction arrangement for intermediary clearing services or fund transfers. Multiple community discussions pointed out that there is still a lack of direct evidence proving a direct operational relationship between the two, meaning that the overlap of on-chain addresses may involve more complex funding flow paths and should not be overly simplified.

As of now, the market has not reached a clear conclusion regarding the potential connections implied by this detail.

How Should Investors in the Current Cryptocurrency Market Respond to Similar Market Volatility?

The liquidation by Trend Research has impacted the market not only in terms of price.

The deeper impact comes from changes in psychological expectations. Prior to this, there existed a widely held but unspoken consensus in the Ethereum market: when prices drop significantly, there will always be large funds to pick up the slack. The heavy position taken by Trend Research inadvertently reinforced this expectation.

When this portion of the position was forced to exit, the market clearly realized for the first time: large holders also have clear risk boundaries. "Long-term bullish" does not mean one can infinitely withstand drawdowns.

From on-chain data, after the concentrated selling pressure was released, Ethereum's price actually showed signs of stabilization. This was not because the selling pressure was painless, but because some passive risks had been cleared. The market began to shift from the imagination of "someone is there to catch the fall" to a more realistic supply-demand game.

For this reason, some differing voices in the market believe that while this liquidation has impacted short-term sentiment, it may not be entirely negative for the mid-term structure. At the very least, the leverage risk has been genuinely exposed rather than continuing to be hidden under "faith."

This is not a lesson for one person but a microcosm of the entire cycle.

If we only regard this event as a story of a big player crashing, it would be incorrect.

The liquidation by Trend Research is more like a microcosm of the current market's deleveraging process. It reflects several realities that repeatedly occur in the cryptocurrency market: trend judgments may be correct, but the timing may not be on your side; leverage can amplify returns but will also amplify misjudgments about the cycle's rhythm; and when the position is large enough, exiting itself becomes a problem.

For ordinary investors, the biggest lesson from this event is not whether to continue being bullish on Ethereum, but how to view risk exposure. Belief cannot replace risk control, and transparent large positions do not equate to safety.

In a bull market, many issues can be masked by rising prices; but in a bear market, structural risks will ultimately be magnified one by one.

Conclusion

The liquidation by Trend Research is not the end of the cryptocurrency market, but it is a sufficiently clear signal.

The market will not change its long-term direction because of the exit of a big player, but every large-scale passive retreat will allow participants to see the true existence of risks more clearly. The narrative around Ethereum continues, and the cycle of the cryptocurrency market is far from over, but the illusion that "there's always someone there to catch the fall" has been thoroughly shattered.

In the cryptocurrency market, while judging direction is certainly important, the ability to stay at the table during volatility is the rarer skill.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。