The last transaction of 534 Ethereum, worth $1.11 million, marked the end of a nearly $690 million loss trade.

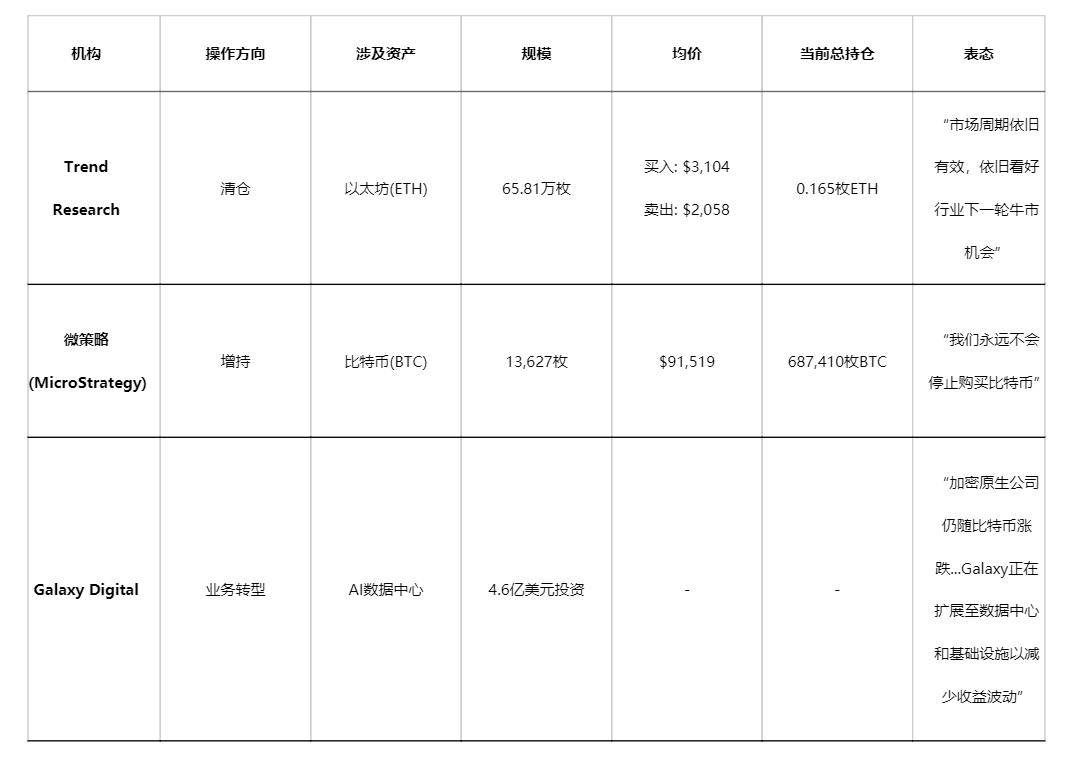

Trend Research, a crypto investment firm under Yi Lihua, liquidated all 658,168 Ethereum in the past week. Based on an average entry price of approximately $3,104 and a liquidation price of $2,058, the loss reached $688 million.

Meanwhile, MicroStrategy, the largest corporate holder of Bitcoin, announced plans to increase its holdings by 13,627 Bitcoin in early 2026, bringing its total holdings to 687,410 Bitcoin.

The cryptocurrency market is witnessing significant strategic divergence among institutional investors.

1. Liquidation Action

● According to blockchain monitoring platform Arkham, Trend Research completed its total liquidation of Ethereum in February 2026. The last transaction of approximately 534 ETH was transferred to Binance, valued at about $1.11 million, leaving only 0.165 ETH in the on-chain address.

● This liquidation action began 8 days ago, with Trend Research transferring a total of approximately 31,073 ETH to Binance, valued at about $65.07 million. Trend Research purchased approximately 658,100 ETH at an average price of about $3,104 and ultimately liquidated at an average price of about $2,058. This operation resulted in a massive loss of approximately $688 million.

● Notably, Trend Research had previously made a profit of about $315 million in the last bull market; this loss not only wiped out all profits but also recorded a net loss of $373 million.

2. Institutional Divergence

As Trend Research liquidated its Ethereum, MicroStrategy adopted a completely opposite investment strategy.

● In early 2026, MicroStrategy purchased 13,627 Bitcoin for approximately $1.25 billion, with an average price of $91,519. This action brought its total Bitcoin holdings to 687,410, with an average cost of $75,355.

● MicroStrategy's Bitcoin strategy manager, Chaitanya Jain, stated on social media: “We will never stop buying Bitcoin.”

● In terms of funding, MicroStrategy raised a net of $1.13 billion by selling 6.8 million shares of MSTR stock and issued 1.2 million preferred shares to raise $119.1 million, totaling $1.25 billion for this Bitcoin purchase.

3. Market Turning Point

● Yi Lihua responded to this liquidation behavior on social media: “First, we acknowledge that the market cycle is still valid. Under the strong performance of the U.S. stock market and the new phase of DAT/ETF, the consensus in the crypto circle has not been broken.” He further explained: “Entering a bear market in the crypto circle is also the best time to position, just like we harvested in the last bear market.”

● Meanwhile, several signs indicate that the crypto market may be approaching a significant turning point. ARK Invest CEO Cathie Wood stated that the market “is nearing what many technical analysts consider a potential low point.”

● BitMEX co-founder Arthur Hayes pointed out that the lack of a rescue plan allows the market to “quickly clear out over-leveraged ‘tourist funds’ and then return to a rhythm of only rising.”

● On the prediction market Polymarket, traders have raised the probability of “Bitcoin rising to $75,000 in February” to 64%.

4. Industry Consolidation Wave

The liquidation actions of Trend Research and the continued accumulation by MicroStrategy reflect profound structural changes in the crypto industry in 2026. At the end of 2025, Galaxy Digital successfully secured $460 million in private investment to transform its Bitcoin mining facility in Texas into an AI data center.

● This investment comes from “one of the largest asset management companies in the world” and will help Galaxy expand its Helios campus, expected to provide 133 megawatts of IT capacity in early 2026. Core Weave has signed a 15-year contract with Galaxy to provide computing power for AI and high-performance computing workloads starting in 2026.

● This transformation reflects a general trend in the crypto industry. Galaxy Digital CEO Mike Novogratz noted at the end of 2025: “The revenues and expenses of crypto-native companies are still closely related to Bitcoin prices. When prices fall, transaction fees and staking income are compressed.”

He added that Galaxy is expanding into data centers and infrastructure to reduce revenue volatility.

5. Changes in Investment Logic

The outlook report from the eight leading crypto institutions in 2026 revealed a common theme: the end of the four-year cycle theory.

● 21Shares explicitly stated: “The four-year cycle of Bitcoin has broken.” Their analysis shows that the introduction of ETFs fundamentally changed the demand structure for Bitcoin, with market drivers shifting from supply-side impacts due to miner halvings to demand-side impacts from institutional allocations.

● Fidelity stated in its report that the market is entering a “new paradigm,” as sovereign nation reserves and traditional wealth management institutions enter the space, making the reliance on historical data cycle theory ineffective.

● In response to the new market environment, institutional investors are beginning to adopt different strategies. Galaxy Digital and 21Shares predict that the digital asset treasury sector will face a “major cleansing,” with small DAT companies forced to liquidate if they trade below net asset value for an extended period.

● 21Shares more sharply predicts that the vast majority of Ethereum Layer 2 solutions will not survive past 2026, becoming “zombie chains.” The reason is that liquidity and developer resources have a strong Matthew effect, ultimately concentrating on leading and high-performance chains.

The Ethereum network set a new daily transaction record of 2,896,853 on February 7, but this strong technical indicator sharply contrasts with the liquidation actions of institutional investors.

After Yi Lihua's liquidation, the price of Ethereum hovered around $2,081, while its purchase cost was $3,104.

On the other end of the market, MicroStrategy's Bitcoin reserves are valued at over $62 billion. The company stated in a filing with the U.S. Securities and Exchange Commission that it will continue to regularly purchase Bitcoin using proceeds from stock sales.

Wall Street's analytical models and blockchain transaction records are telling two entirely different stories about the same market.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。