Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)_

Cryptocurrency Market Sentiment Drops to Extreme Fear, Yet Prediction Markets Continue to Refresh Activity

If we only look at the market trends, there is nothing exciting in the current cryptocurrency market.

After last week's significant crash in the crypto market, Bitcoin's rebound has been limited, and altcoins continue to perform poorly, with a clear contraction in risk appetite. The change in market sentiment also confirms this: according to Alternative.me data, last month the cryptocurrency market's Fear and Greed Index remained in the 25 (Fear) range, while yesterday it briefly dropped to 7 (Extreme Fear). Even with a slight recovery today, the market is still in the "Extreme Fear" phase.

Cryptocurrency Market Fear and Greed Index

However, against this backdrop, one vertical track is showing a completely different trend—the prediction market is continuing to heat up.

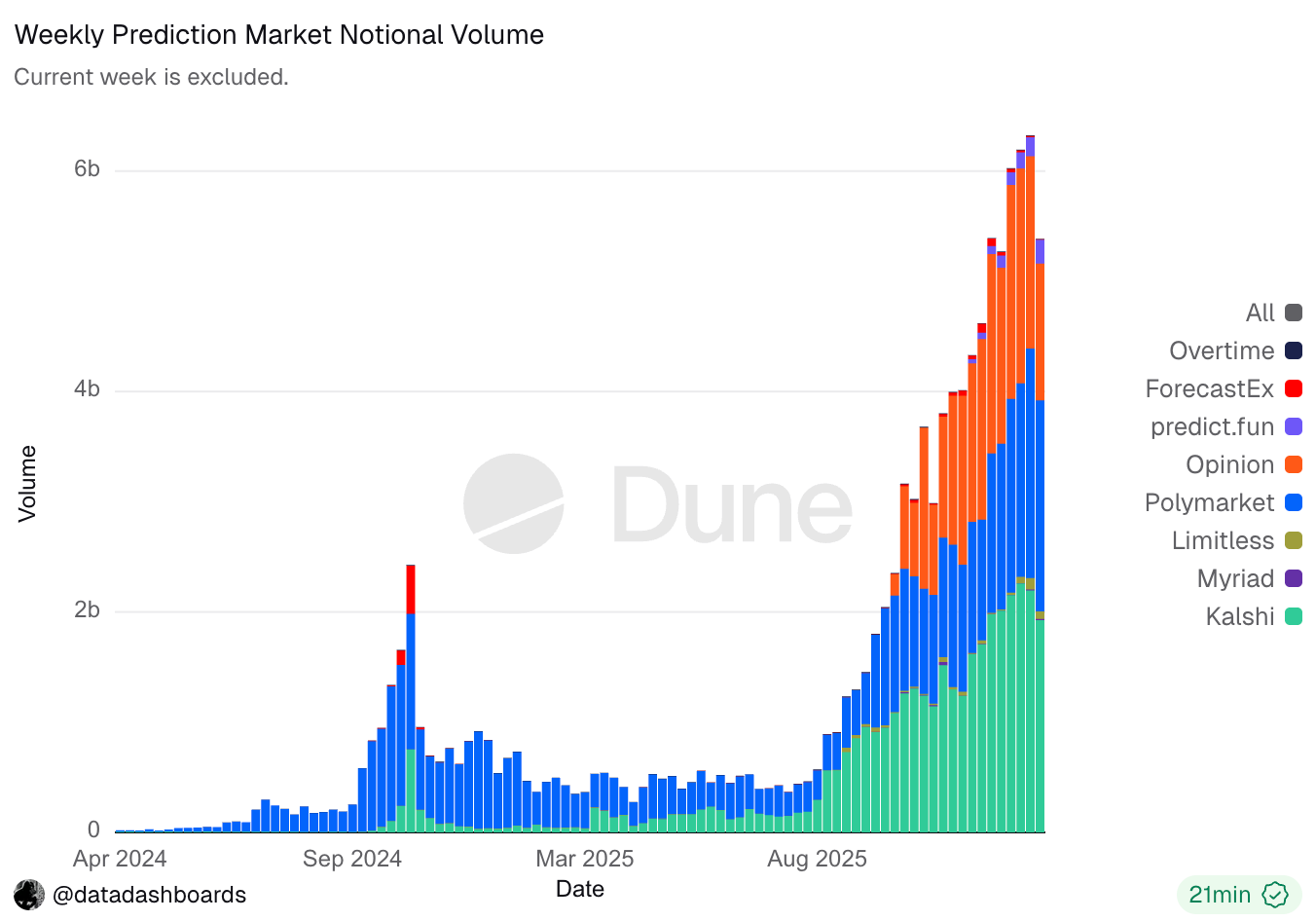

From on-chain data, the weekly nominal trading volume of prediction markets has significantly increased in recent weeks. Although there was a slight decline last week, it has remained at historically high levels for a long time, indicating that user demand for trading in prediction markets has not significantly decreased with the cooling of the market; instead, it has shown more stable activity.

The core reason behind this is that the trading drive of prediction markets does not rely on the price fluctuations of crypto assets but comes from various events continuously occurring in the real world—from major sports events like basketball, football, rugby, tennis, ice hockey, and League of Legends, to macro policy changes, Federal Reserve interest rate cuts, U.S. government shutdowns, and even entertainment topics, new trading targets are generated almost every day. Because of this, compared to traditional crypto trading that relies on market cycles, the activity in prediction markets is more driven by "event flow," showing significantly lower sensitivity to market ups and downs, thus maintaining high participation and trading frequency even during market downturns.

Weekly Trading Volume of Prediction Markets

The shift in user attention is also clearly visible. Nick Tomaino, founder of 1confirmation, recently stated that the monthly visits to the Polymarket website continue to rise, while visits to Robinhood and Coinbase are showing a downward trend, indicating that some trading and speculative demand is shifting from traditional trading platforms to event-driven markets.

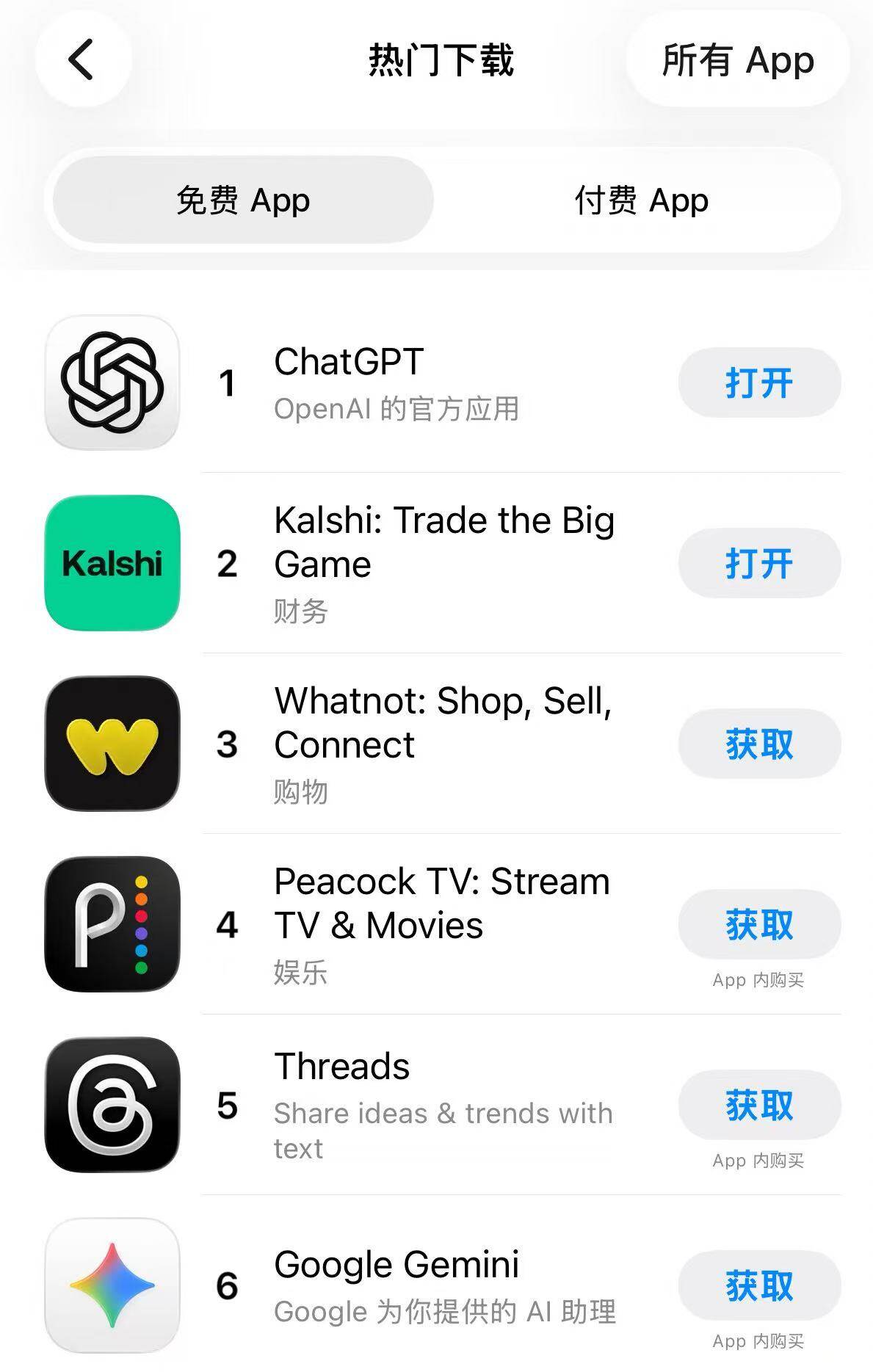

At the same time, the growth rate of Kalshi is even more tangible: its iOS app has recently jumped to the second position in the U.S. App Store's free app download chart, second only to Coinbase, which is particularly rare during a period of overall low trading sentiment in the cryptocurrency market.

Apple App Store Free App Download Ranking

More importantly, prediction market projects are still on the eve of token issuance

Many tracks in the crypto space often share a common problem: when most people start paying attention, the tokens have already been issued, and the profit phase for early participants is basically over. However, the current position of prediction markets is exactly the opposite—user growth has already begun, while the token cycle has just started.

The most notable signal comes from Polymarket. Its parent company Blockratize recently submitted a trademark application for "POLY," covering tokens and related financial service scenarios. It is reported that the management of Polymarket has confirmed that they will launch a native POLY token and conduct an airdrop in the future, although the specific timing has not yet been announced. This means that the large amount of trading and interaction behavior generated around the platform at this stage is likely still in the early window of a potential airdrop cycle.

At the same time, the prediction market Opinion, which has recently been the most discussed on the BNB Chain, has launched OPN token airdrop tasks on the Binance Wallet Booster, which is widely seen as a signal that the TGE is approaching. Additionally, Opinion recently announced the completion of a $20 million Series A financing, with participation from institutions such as Hack VC, Jump Crypto, Primitive Ventures, and Decasonic, reflecting that investment institutions are proactively laying out in this track.

From market expectations, the community is also maintaining high attention on Opinion's TGE performance. Data from the Polymarket website shows that the probability of the betting event "Opinion's opening day FDV exceeding $500 million" is currently as high as 76%, with a trading volume of nearly $4 million. In the current environment where the overall performance of the altcoin market is sluggish, the related predictions still maintain a high probability, reflecting the market's general expectation that the project may still receive strong price support in its early launch phase.

"Opinion's opening day FDV exceeding $500 million" betting event

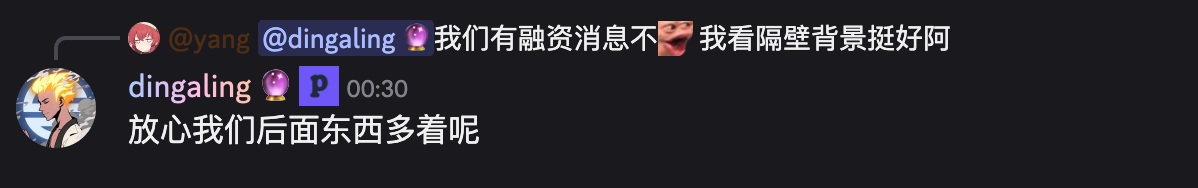

Perhaps driven by the upcoming TGE of Opinion, another prediction market, predict.fun, which ranks among the top in weekly trading volume on the BNB Chain, has also seen a noticeable increase in community activity recently. Notably, the project's founder dingaling recently stated in the official Discord community that "there are still many things being prepared," hinting that new developments will be announced this month, further increasing market attention on its subsequent actions.

Screenshot of founder dingaling's reply in the official Discord

The period before the World Cup may be the true explosion period for prediction markets

The Super Bowl in the U.S. that started this morning has already provided a very intuitive reference. Just on Polymarket, the trading volume for the "Super Bowl Champion" prediction event has exceeded $700 million, and the trading scale brought by a single event is already quite considerable.

But the Super Bowl is essentially just (the most watched) event domestically in the U.S., while the World Cup is a completely different level of catalyst.

Compared to a single match, the World Cup lasts longer, has more matches, and involves countries from around the world. From the group stage to the knockout stage, new prediction market trading targets are generated almost every day: advancement probabilities, score ranges, knockout matchups, golden boot ownership, championship odds, etc., will continuously form new markets. This sustained high-frequency event flow over several weeks often brings more stable and longer-term trading activity, rather than just short-term traffic peaks.

Therefore, if the Super Bowl has already proven that large sports events can bring massive trading to prediction markets in a short time, then the World Cup is more likely to become a key node in determining whether the overall user scale and trading volume of the track enter the next stage.

I believe that many prediction market platforms will emerge for TGE around the World Cup, and perhaps now is the best time to ambush. For me personally, with the market being bleak, it’s better to place bets in prediction markets than to buy altcoins.

Related Content

Hot track, new interaction opportunities: Three prediction markets favored by YZi Labs

A step-by-step guide to participating in predict.fun, supported by CZ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。