The weekend has ended, and Monday marks the beginning of another week of speculation. It's hard to say whether the declines in U.S. stocks, cryptocurrencies, and even gold and silver have truly come to an end this week; there are various opinions in the market. I even saw a Goldman Sachs trader state that the stock market sell-off is not over yet.

Goldman Sachs believes that CTAs may sell as much as $33 billion this week, and if the S&P 500 continues to decline, they could sell up to $80 billion in the next month. Moreover, even in a sideways or rising market, these funds are still expected to continue selling.

Currently, market pressure remains high, and liquidity has not returned. This decline has been significant, yet there has not been a clear negative catalyst, which is the most concerning situation. Without a definitive reason, the volatility in risk markets remains elevated, and other systematic strategies may also reduce their exposure.

Looking back at Bitcoin's data, the turnover rate over the weekend was still somewhat high, and investor sentiment has not fully stabilized. Therefore, there is still uncertainty regarding next week's trends. We will first observe the statements from Asian investors after the CME opens on Monday morning, followed by the trends after the U.S. stock market opens in the evening. Hopefully, this wave will pass just like that.

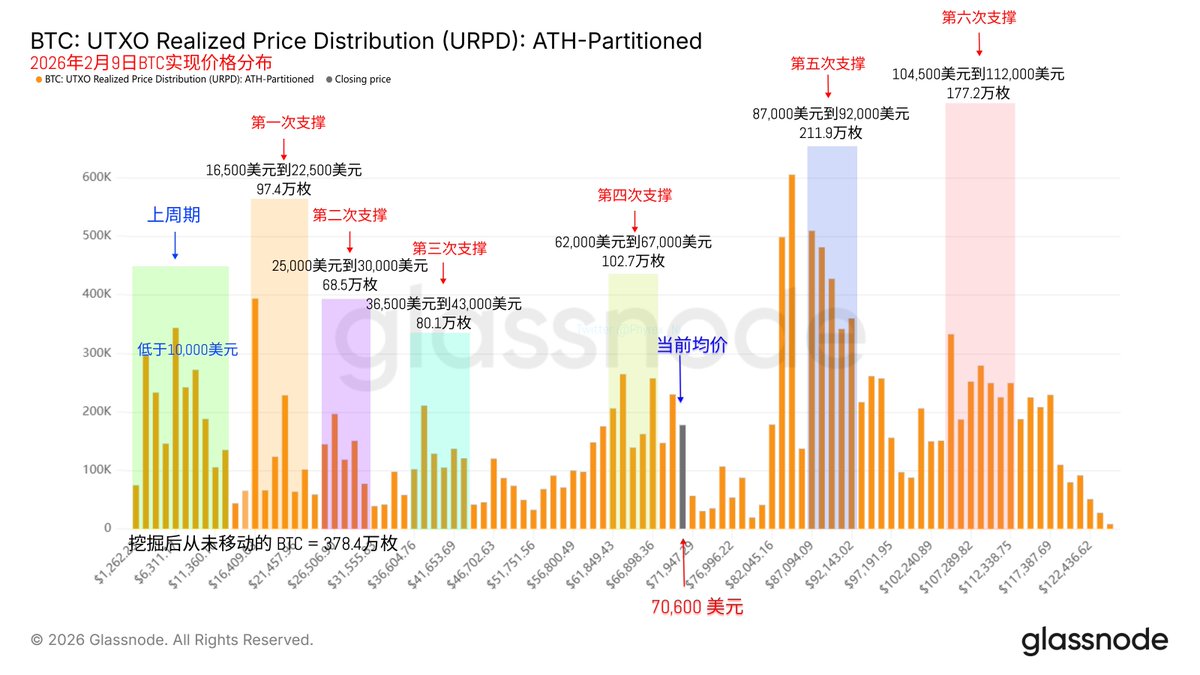

The chip structure has not changed significantly, and investors who are trapped at high levels have not panicked and exited. It is evident that the proportion of losing investors is higher now, but the sentiment remains very stable.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。