Written by: nicoypei

Translated by: Block unicorn

Summary: Current money market protocols (such as Aave, Morpho, Kamino, and Euler) serve lenders well, but they fail to cater to a broader borrower demographic, especially institutions, due to the lack of fixed borrowing costs. Growth has stagnated as only lenders benefit.

From the perspective of money market protocols, P2P fixed rates are a natural solution, while interest rate markets offer a capital efficiency alternative that is 240 to 500 times greater.

P2P fixed rates and interest rate markets complement each other and are crucial for each other's success.

Insights from Leading Protocols: All Protocols Aim to Provide Fixed Rates for Borrowers

The team's roadmap at the beginning of the year typically sets the tone for the next steps in development.

Morpho, Kamino, and Euler Labs are currently the leading on-chain money markets, with a total locked value (TVL) of $10 billion. Browsing their 2026 roadmaps, one obvious theme stands out: fixed rates.

From Morpho

Morpho V2 Briefing

From Kamino

Kamino 2026 Plan

From Euler

Euler 2026 Roadmap

In the 2026 announcements from Morpho, Kamino, and Euler, the terms "fixed rate" or "predictable rate" appeared 37 times. This is the most frequently mentioned term in their announcements (excluding filler words) and is listed as a top priority in all three roadmaps.

Other recurring keywords include: institutions, RWA, credit.

So, what happened?

Early DeFi: Fixed Rates for Borrowers Were Irrelevant

Early DeFi was full of fun and experimentation for developers. But for users, early DeFi can be summarized in two sentences: surreal speculation and terrifying hacks.

Surreal Speculation

From 2018 to 2024, DeFi resembled a "casino on Mars," detached from the real world. Liquidity was primarily driven by early retail and speculation. Everyone was chasing four-digit annual percentage yields (APY). No one cared about fixed-rate borrowing.

The market was also extremely volatile and fast-changing. Liquidity lacked stickiness. Total locked value (TVL) fluctuated wildly with market sentiment. While demand for fixed-rate borrowing was low, demand for fixed-rate loans was even lower.

Lenders preferred the flexibility to withdraw funds at any time. No one wanted to be locked in for a month—because in a rapidly changing and nascent market, a month felt like a century.

Terrifying Hacks

From 2020 to 2022, hacking incidents were frequent. Even blue-chip protocols were not spared: Compound suffered a major governance exploit in 2021, resulting in losses of tens of millions of dollars. During this period, losses from DeFi vulnerabilities totaled billions of dollars, exacerbating institutional investors' concerns about smart contract risks.

Institutions and high-net-worth individuals lacked trust in the security of smart contracts. As a result, participation from more conservative pools of capital remained low.

Instead, institutions and high-net-worth individuals chose to borrow from off-chain channels, such as Celsius, BlockFi, Genesis, and Maple Finance, to avoid smart contract risks.

At that time, Aave was not the safest DeFi protocol, so there was no notion of "directly using Aave."

Catalysts for Change

I am not sure if this was intentional or merely coincidental, but we often refer to platforms like Aave and Morpho as "lending protocols," which is quite fitting—despite both lenders and borrowers using them.

The term "lending protocol" is indeed very appropriate: these platforms excel at serving lenders but are clearly lacking in serving borrowers.

Borrowers want fixed borrowing costs, while lenders want the ability to withdraw funds at any time and receive floating rates. Current protocols favor lenders but are unfavorable to borrowers. Without fixed-rate borrowing options, institutions will not engage in on-chain borrowing, and the bilateral market cannot develop—this is why these platforms are now actively working to build fixed-rate features.

Even in this clearly lender-biased structure, change requires user pain points or product advancements. Over the past year and a half, DeFi has accumulated both.

In terms of pain points, fixed income looping strategies are constantly affected by fluctuations in borrowing costs, and the premium between off-chain fixed rates and on-chain floating rates is continually widening.

User Pain Point 1: Fixed Income Looping

Traditional finance (TradFi) offers a wealth of fixed income products. Before 2024, DeFi had almost no yield-sharing mechanisms until Pendle and liquid staking protocols began splitting the yields from ETH liquid staking.

When using looping fixed income tokens (Pendle PT), the pain caused by fluctuations in borrowing rates becomes evident—the promised 30-50% annual percentage yield (APY) of looping strategies is often eroded by rate volatility.

I personally tried to automatically adjust these strategies based on interest rate changes, but each adjustment incurred multiple layers of fees: underlying yield sources, Pendle, money markets, and gas fees. It was clear that volatile borrowing rates were unsustainable—often leading to negative yields for me. On-chain liquidity dynamic pricing for borrowing costs introduces volatility far beyond acceptable limits.

This pain is merely a prelude to everything that is about to happen once private credit goes on-chain. Private credit generally tends to favor fixed-rate borrowing because real-world operations require certainty. If DeFi wants to shed its image as a "casino on Mars"—detached from actual economic activity—and truly support meaningful business activities, such as GPU-backed loans and credit borrowing from trading firms, then fixed rates are imperative.

User Pain Point 2: Expanding Fixed/Floating Rate Premiums

As lending protocols provide excellent service to lenders—flexible withdrawals, no KYC, and ease of programming—on-chain lending liquidity has been steadily increasing.

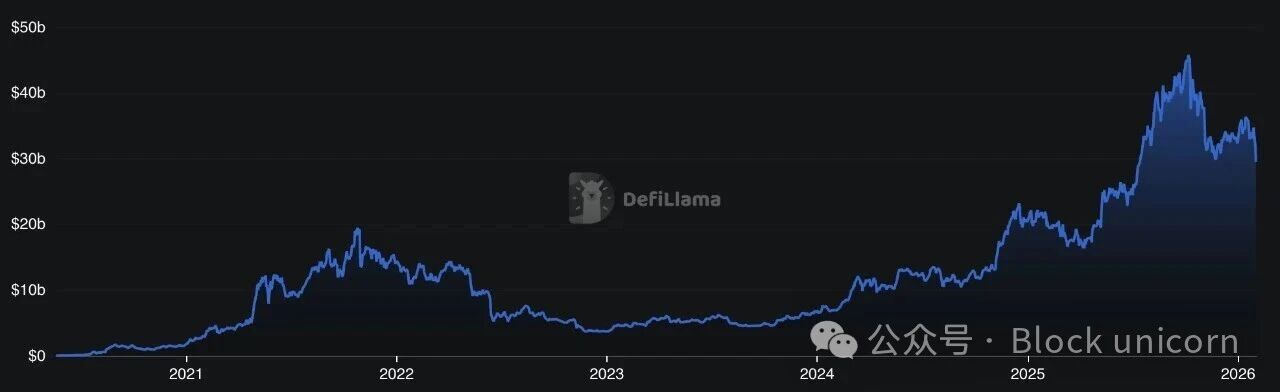

Aave's TVL over the years. This chart shows its growth rate is about twice that of Bitcoin's price growth.

With the growth of lending liquidity, the speed of floating rate lending in these protocols has decreased. While this seems beneficial for borrowers, it is irrelevant for institutional borrowers—they prefer fixed-rate loans and are obtaining these loans through off-chain channels.

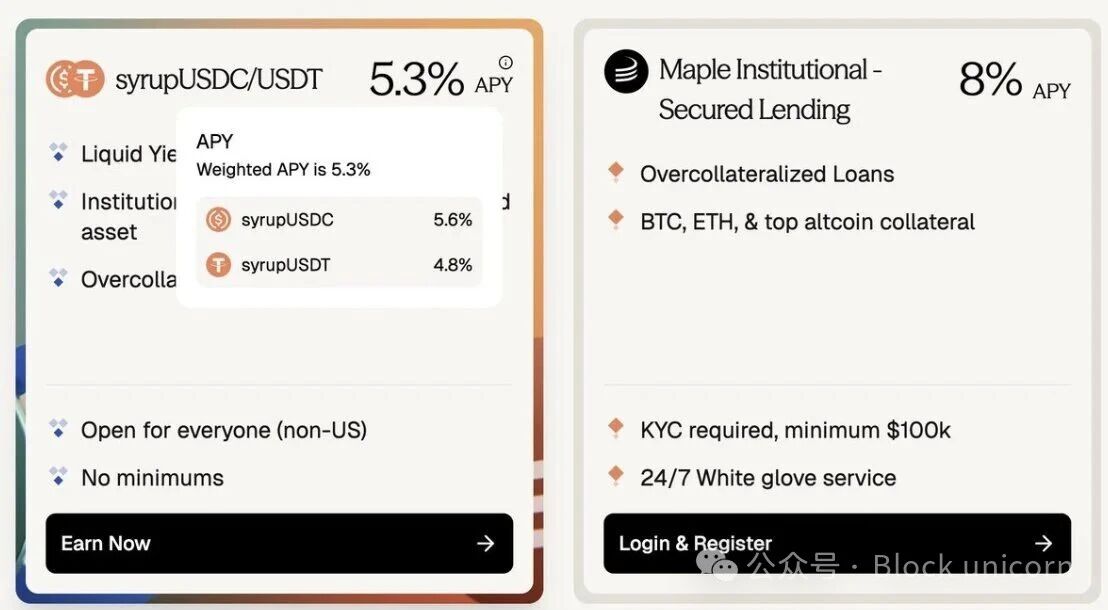

The real pain point in the market is the widening gap between off-chain fixed-rate borrowing costs and on-chain floating rates. This gap is quite significant. Institutional investors pay an average premium of 250 basis points for fixed-rate borrowing, and when using blue-chip altcoins as collateral, the premium can be as high as 400 basis points. Based on an average annual interest rate of 4% (Aave), this means a premium of 60% to 100%.

Aave approximately 3.5% vs Maple approximately 8%: The premium for fixed-rate cryptocurrency collateral loans is about 180 to 400 basis points.

On the other side of this gap, on-chain yields are also compressing. Due to the current lending market being structurally biased towards lenders, there are more lenders attracted than borrowers—this will ultimately harm lenders' yields and hinder the growth of protocols.

Product Progress: DeFi Becomes the Default Choice for Lending

In terms of progress, Morpho has been integrated into Coinbase, becoming its primary source of yield; while Aave has become the cornerstone of protocol fund management, retail stablecoin savings applications, and new stablecoin banks. DeFi lending protocols provide the most convenient way to obtain stablecoin yields, with liquidity continuously flowing on-chain.

As TVL increases and yields decrease, these lending protocols are actively iterating to strive to become excellent "lending protocols" to better serve borrowers and balance the bilateral market.

Meanwhile, DeFi protocols are becoming more modular—this is a natural evolution from Aave's "one-size-fits-all" funding pool model (note: although I believe there will still be sustained demand for funding pool models in the long term—this could be the subject of another article in the future). With Morpho, Kamino, and Euler leading the modular lending market, loans can now be set more precisely based on collateral, LTV, and other parameters. The concept of independent credit markets has thus emerged. Even Aave v4 is upgrading to a centralized radial modular market structure.

The modular market structure paves the way for new types of collateral (such as Pendle PT, fixed income products, private credit, and risk-weighted assets (RWA)) to go live, further amplifying the demand for fixed-rate lending.

Mature DeFi: Money Markets Thrive Through Interest Rate Markets

Market Gap:

Borrowers strongly prefer fixed rates (off-chain services are well-developed)

Lenders strongly prefer floating rates and the flexibility to withdraw funds at any time (on-chain services are well-developed)

If this market gap is not bridged, on-chain money markets will stagnate at their current scale and will not expand into broader money and credit markets. Bridging this gap has two clear paths, which are not mutually competitive but are highly complementary, even symbiotic.

Path One: P2P Fixed Rates Operated by Risk Management Institutions

The P2P fixed rate model is straightforward: every demand for fixed-rate borrowing locks in an equivalent amount of funds for fixed-rate loans. While this model is simple and efficient, it requires 1:1 liquidity matching.

According to the announcements from major lending protocols for 2026, they are all moving towards a P2P fixed rate model. However, retail users will not borrow directly from these P2P fixed rate markets for two main reasons:

They value the flexibility of withdrawals

They face too many markets to assess and choose from

Conversely, only the liquidity currently deployed in the risk management institution's treasury can be borrowed in these fixed-rate markets—and even then, only partially. Risk management institutions must maintain sufficient liquidity to meet the immediate withdrawal demands of their depositors.

This creates a tricky dynamic for risk management institutions that need to satisfy immediate withdrawal demands:

When deposit withdrawals surge and treasury liquidity decreases due to funds being locked in fixed-rate lending, the treasury lacks mechanisms to prevent withdrawals or encourage deposits. Unlike money markets with utilization curves, the structural design of the treasury is not intended to maintain withdrawal liquidity. An increase in withdrawals does not lead to higher earnings for the treasury.

If the treasury is forced to sell its fixed-rate loans in the secondary market, these loans are likely to trade at a discount—potentially leading to the bankruptcy of the treasury (similar to the situation with Silicon Valley Bank in March 2023).

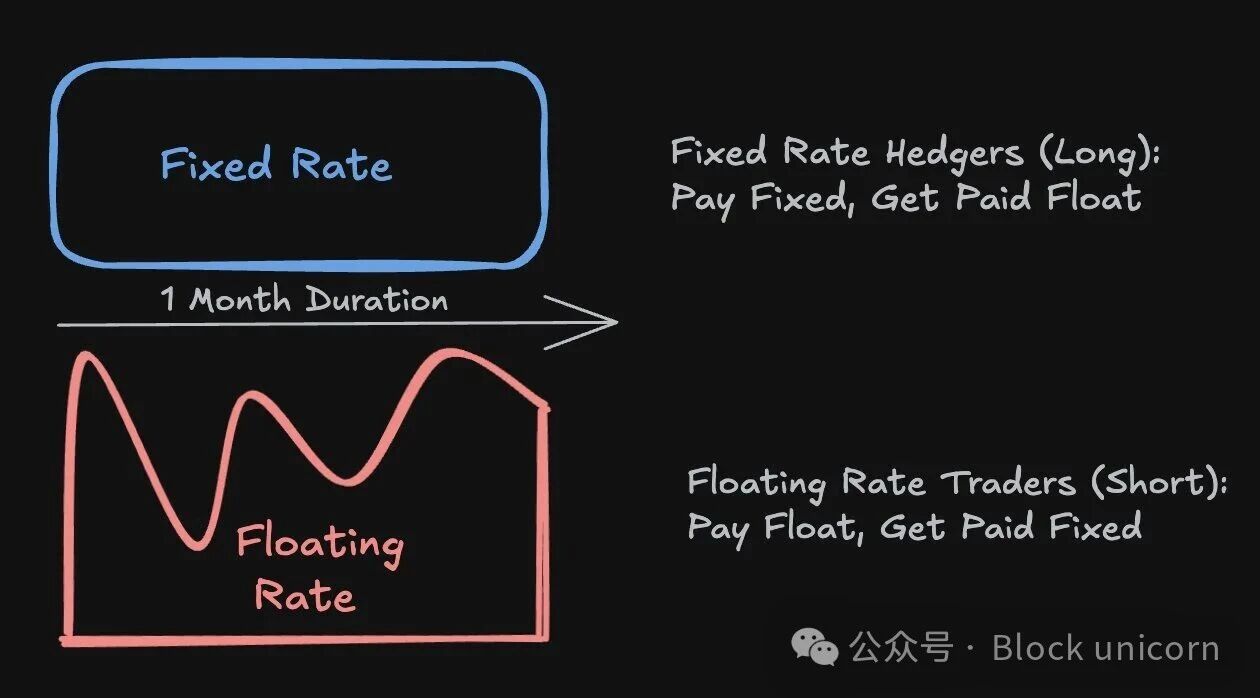

To mitigate this tricky dynamic, risk management institutions are more inclined to adopt the traditional practices of conventional lending institutions: converting fixed-rate loans into floating-rate loans through interest rate swaps.

They pay a fixed rate to the swap market and receive the corresponding floating rate, thereby avoiding the risk of being locked into a low fixed rate when floating rates rise and withdrawals increase.

In this scenario, institutional lenders and risk management institutions leverage the interest rate market to better provide fixed-rate liquidity.

Path Two: Interest Rate Markets Based on Money Markets

Interest rate markets do not directly match fixed-rate lenders with borrowers. Instead, they match borrowers with capital willing to cover the difference between the agreed fixed rate and the floating rate on the money market utilization curve. This approach offers capital efficiency that is 240-400 times greater than the 1:1 liquidity matching required by P2P markets.

The mathematical calculation of capital efficiency is as follows:

Borrow $100 million at a floating rate from Aave's existing liquidity

The borrower wishes to convert this floating rate loan into a one-month fixed rate loan. Assume the fixed rate is 5% annual interest

$100 million * 5% / 12 = $416,667

Interest rate swaps can achieve an inherent leverage of 20 * 12 = 240 times

Interest rate swaps help hedgers and traders price and swap fixed and floating rates

The interest rate swap mechanism based on money markets cannot provide completely unleveraged fixed-rate loans like the P2P model—if rates soar 10 times and remain high for an extended period, hedgers could theoretically face automatic deleveraging (ADL).

However, the likelihood of this occurring is extremely low, as it has not happened in the three-year history of Aave or Morpho. Interest rate exchanges can never completely eliminate ADL risk, but they can implement multilayered protective measures—conservative margin requirements, insurance funds, and other safeguards—to reduce it to negligible levels.

This trade-off is highly attractive: borrowers can obtain fixed-rate loans from well-established money markets with high TVL (total value locked) such as Aave, Morpho, Euler, and Kamino, while benefiting from capital efficiency that is 240-500 times greater than that of P2P markets.

Path Two resembles the operations of traditional finance—interest rate swaps have a daily trading volume of up to $18 trillion, facilitating credit, fixed income products, and real economic activities.

This strategy, which combines the security of mature money markets, $30 billion in liquidity from existing lending protocols, appropriate risk mitigation measures, and excellent capital efficiency, makes interest rate exchanges a pragmatic choice for expanding fixed-rate lending on-chain.

Exciting Future: Connecting Markets, Expanding Credit

If you patiently read through the previous section's tedious mechanisms and market microstructures, I hope this section inspires you with boundless imagination about the exciting developments ahead!

Some predictions:

1. Interest Rate Markets Will Become Equally Important as Existing Lending Protocols

Since lending primarily occurs off-chain while loans mainly happen on-chain, the market remains incomplete. Interest rate markets connect lending demand by meeting the different preferences of both lenders and borrowers, greatly expanding the potential of existing money market protocols and becoming an indispensable part of on-chain money markets.

In traditional trading finance, interest rate markets and money markets complement each other. We will see the same dynamic on-chain.

2. Institutional Credit: Interest Rate Markets Will Become Pillars of Credit Expansion

Disclaimer: The credit referred to here pertains to unsecured or under-collateralized money markets, not over-collateralized modular markets like the Morpho Blue market.

The credit market's reliance on interest rate markets exceeds that of over-collateralized loans. When institutions finance real-world activities (such as GPU clusters, acquisitions, or trading operations) through credit, predictable capital costs are crucial. Therefore, interest rate markets will evolve alongside the expansion of on-chain private credit and risk-weighted assets (RWA).

To connect off-chain real-world yield opportunities with on-chain stablecoin capital, interest rate markets are a critical pillar for the expansion of on-chain credit.

3. Consumer Credit: "Borrowing to Spend" Benefits Everyone

Selling assets triggers capital gains taxes and tax issues, which is why ultra-high-net-worth individuals rarely sell assets; they choose to borrow to spend. I envision a future where everyone will be able to "borrow to spend" rather than "sell to spend"—a privilege currently limited to the super-rich.

Asset issuers, custodians, and exchanges will have strong incentives to issue credit cards that allow people to borrow against their assets and spend directly. To ensure this system works in tandem with a complete self-custody framework, decentralized interest rate markets are essential.

EtherFi's credit card has led the trend of collateral-based consumer credit, with its credit card business growing 525% last year, achieving a single-day transaction volume of up to $1.2 million. If you haven't applied for an EtherFi card yet, I highly recommend you try it out and experience the joy of "borrowing to spend"!

Finally, I want to point out that fixed rates are far from the only driving force behind the growth of money markets. Money markets can address many pressing issues, such as enabling off-chain collateral and oracle-based RWA redemptions to support looping strategies, among others. The future is full of challenges, and I am very much looking forward to seeing the development of this market and hope to contribute to it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。