Original | Odaily Planet Daily (@OdailyChina)

The blockchain has struck again, with Bitcoin plunging continuously, dropping over 15% at one point in the past 24 hours, quickly sliding to $60,000, down more than 40% from its peak in October 2025, setting a new low for this phase, and possibly recording the largest single-day drop since the 2022 FTX incident. Altcoins have been severely impacted, with bloodshed across the market. (Related reading: Single-day drop of nearly 20%, how long has it been since you saw a $60,000 Bitcoin?)

Regarding the reasons behind this drop, the market has largely linked it to macro-level factors, such as the "Walsh Effect" triggered by the new Federal Reserve Chairman Walsh, the AI capital race draining liquidity from other global assets, and escalating tensions between the U.S. and Iran.

In addition, there have been many unfounded speculations, as this drop has been too smooth, with almost no pauses, and lacks specific events driving it. Many voices speculate whether there are large institutions facing liquidation, and hidden black swans may surface soon. It's like watching a pile of explosives go off without knowing who lit the fuse. According to Alternative.me data, the crypto market's fear and greed index has dropped to 9 today, in the "extreme fear" range, down from 12 the previous day and 16 last week, while last month the index was still at 42.

“The peak generates hypocritical supporters, the dusk witnesses true believers.”

The more it is a moment of "analysis failure," the more we can see investors' true thoughts from their positions. As we face the fear of a deep bear market, which whales in the market are selling, and who is genuinely buying the dip?

Who is selling valuable coins?

Vitalik and Aave Founder Sell ETH for Cash

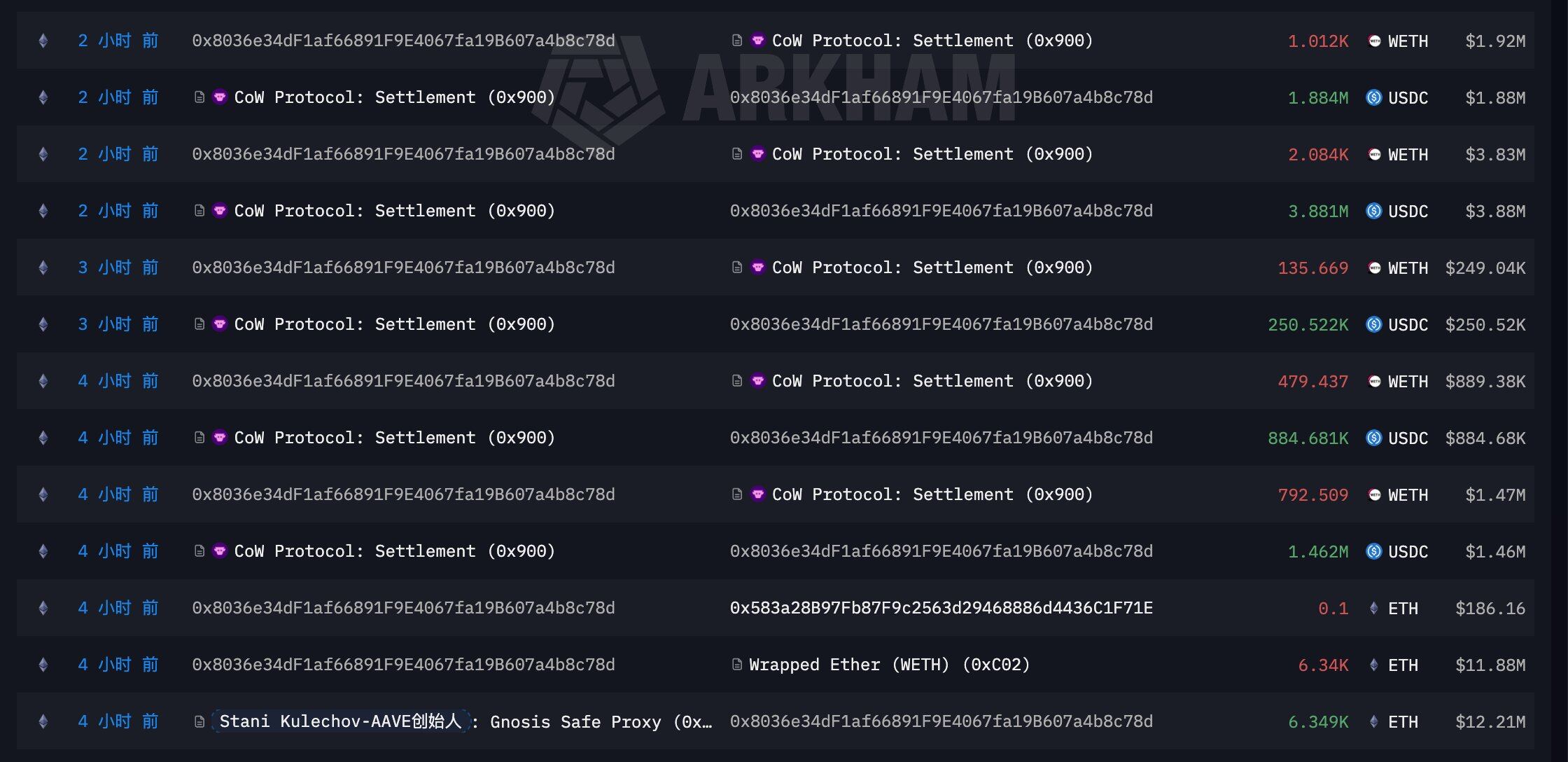

In the early hours of February 6, as the market fell, Aave founder Stani Kulechov (0x803…c78d) sold 4,504 ETH on-chain, converting it to 8.36 million USDC at a price of $1,855. ETH dropped to a low of $1,747 in the early hours of February 6.

Aave founder sells ETH

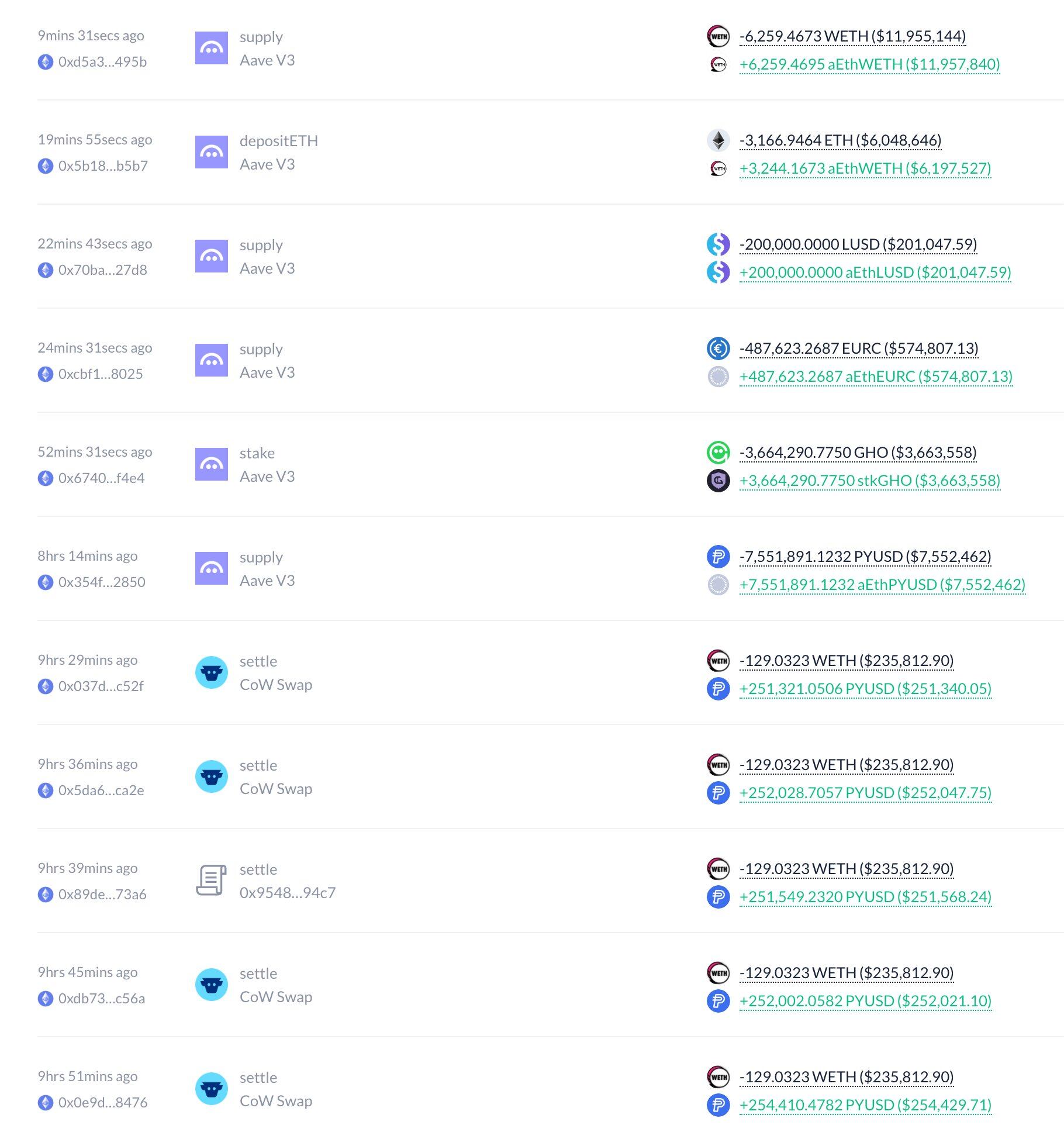

In addition to the Aave founder, Ethereum founder Vitalik has also been selling ETH recently. On January 30, Vitalik announced that he had withdrawn 16,384 ETH for a multi-year donation plan, focusing on supporting an open, verifiable, end-to-end software and hardware technology stack to protect personal lives and public environments.

On February 3, Vitalik began selling these ETH, selling 493 ETH that day, worth about $1.16 million. As of February 6, 42.1% of the 16,384 ETH planned for donation had been sold, totaling 6,899.5 ETH, with a total value of $14.15 million, at an average selling price of $2,052. However, Vitalik has deposited the remaining 9,484.5 ETH into Aave, which may indicate he does not plan to sell in the short term.

"ETH Bull" Yi Li Hua Falls, Sells About 250,000 ETH

Yi Li Hua's Trend Research has been the most notable ETH bull in this cycle, and he often publicly promotes the bull market on social media, with the community likening him to "Tom Lee in the West, Yi Li Hua in the East."

However, as ETH fell, Yi Li Hua could no longer hold on. On February 1, according to monitoring, Trend Research began to deposit over 10,000 ETH into Binance. On February 2, Yi Li Hua posted on X platform admitting that he had indeed been too early in his bullish outlook on ETH, stating that the profits from the last peak had been given back, and he decided to continue waiting for the market to rise while controlling risks.

On February 3, he posted again, expressing optimism for the new bull market, predicting ETH would exceed $10,000 and BTC would surpass $200,000, but recently made some position adjustments to control risks.

This statement may have laid the groundwork for subsequent ETH transfers. As of now, the six addresses publicly held by Trend Research hold only about 396,000 ETH, down from 650,000 ETH on February 1, having sold about 250,000 ETH, worth $554 million. Meanwhile, Yi Li Hua's latest liquidation range is between $1,509 and $1,800.

From being a firm bull to being forced to "cut losses," Yi Li Hua may also feel a sense of helplessness.

In the Past 8 Days, Whales Sold 81,068 BTC

In addition to these public figures selling, hidden whales on-chain are also "fleeing." According to Santiment statistics, whales holding 10 to 100,000 BTC currently hold 68.04% of the total BTC supply, a new low in nine months, having sold 81,068 BTC in just the past eight days.

After the market drop, whales also began to stop losses and unwind leverage. According to monitoring, during yesterday's market drop, a whale deposited 10,128 ETH, worth $20.44 million, into Galaxy and FalconX. A whale (0xfdd…6a92) holding an ETH lending position on Spark also began selling ETH to stop losses when the price dropped to $2,050, having sold a total of 27,800 ETH to repay $44.14 million in loans.

However, unlike the whales, retail investors are more inclined to buy the dip at this time. According to Santiment statistics, "shrimp addresses" holding less than 0.01 BTC account for 0.249% of the total BTC supply, reaching a 20-month high, reflecting retail investors buying on the dip. However, it is important to be cautious, as this combination of whale selling and retail buying has historically led to bear market cycles.

Who is quietly buying the dip?

In addition to retail investors buying the dip, some steadfast large holders/institutions are also accumulating. Statistics show that after the market drop, Bitfinex's margin long positions rose to about 77,100 BTC, a near two-year high, indicating that there is still significant leveraged buying in the market during the downturn. Additionally, over the past six months, Bitfinex's margin long positions have increased by about 64%, which is typically seen as a signal of large holders or high-risk preference funds continuing to accumulate during market pressure.

Well-known trader Eugene Ng Ah Sio also posted on his personal channel, stating, "Buy when the streets are running with blood, even if it's your own blood."

"Maji" with Infinite Ammo for Longs

Iron-headed "Maji" is a representative of large holders who buy the dip. According to monitoring data, in the early hours of February 6, during the market drop, Maji continued to go long, depositing 250,000 USDC into Hyperliquid, opening 25x leveraged ETH long positions, 40x leveraged BTC long positions, 10x leveraged HYPE long positions, and 10x leveraged PUMP long positions. However, the BTC and PUMP long positions were quickly liquidated in the subsequent market drop, while HYPE and ETH long positions were increased after facing partial liquidation.

As of now, "Maji" still holds a 25x leveraged Ethereum long position of 320 ETH, with a liquidation price of $1,841; he also holds a 10x leveraged HYPE long position of 14,720 HYPE, with a liquidation price of about $31.

This week, Maji has closed positions 11 times, with 3 profitable trades and 8 losses, resulting in a win rate of 27.27%, with a net loss of about $286,000 for the week. The messages in hyperbot's pop-up are all encouraging Maji.

BTC's Eternal "Backer" Strategy: Cost Price of $76,052

Fortunately, during the market crash, BTC's largest treasury, Strategy, did not choose to sell. Strategy's CEO Phong Le stated during the Strategy Q4 financial performance webinar that Bitcoin needs to drop to $8,000 and stay at that level for five to six years to pose a real threat to repaying its convertible debt. This means that only then might Strategy consider selling BTC, providing some reassurance to the market.

At the beginning of this month, as the market fell, Strategy also purchased 855 BTC for approximately $75.3 million, at a unit price of about $87,974. As of now, Strategy holds a total of 713,502 BTC, with a total acquisition cost of about $54.26 billion, and an average acquisition price of about $76,052. Therefore, based on the current Bitcoin price of $66,000, Strategy has an unrealized loss of over $7.168 billion.

In addition to Strategy's firm holding and buying, Japan's largest BTC treasury company, Metaplanet, also expressed its faith in BTC on February 6. Its CEO, Simon Gerovich, stated on the X platform that, "In light of the recent stock price movements and the severe situation faced by shareholders, Metaplanet's strategy has not changed, and the company will continue to increase its BTC holdings." However, data shows that Metaplanet has not purchased BTC for three consecutive weeks.

ETH Supporter Tom Lee: $6.6 Billion Unrealized Loss is Just a "Minor Issue"

From the perspective of holding ETH, Tom Lee clearly has a stronger stance than Yi Li Hua. His ETH treasury company, Bitmine, not only did not sell ETH but also continued to buy during the market downturn.

In the last week of January, when ETH dropped to a low of $2,200, Bitmine purchased 41,788 ETH that week, worth $96.55 million. Subsequently, on February 2, Tom Lee stated, "The company currently has no liabilities, and given the strengthening fundamentals of Ethereum, the recent market correction is very attractive," which essentially indicates Tom Lee's strategy of buying on dips. On February 3, Bitmine bought 20,000 ETH through FalconX, worth $46.04 million.

On February 4, in response to external claims that Bitmine's ETH holdings had an unrealized loss of up to $6.6 billion, Tom Lee responded that this is a normal phenomenon. However, as of now, Bitmine holds a total of 4,285,125 ETH, with an average cost price above $3,500. As ETH has fallen below $2,000, Bitmine's unrealized loss has exceeded $8 billion.

On-chain Whales Remain Optimistic About ETH

For on-chain whales, the downturn is also a rare opportunity to buy the dip. According to monitoring, a whale (3M4p1i) that had been silent for seven months began to accumulate after the BTC crash on February 6, purchasing 482 BTC worth $32.5 million. This whale currently holds a total of 1,960 BTC, valued at $12.8 million.

Compared to BTC, on-chain whales seem to prefer ETH. A certain new wallet withdrew 55,483 ETH from WhiteBIT in the past two days, worth $115.16 million.

From the evening of February 5 to February 6, several on-chain whales/institutions continued to buy ETH. According to Lookonchain monitoring, a wallet associated with Longling Capital withdrew 8,500 ETH from Binance on the evening of February 5, worth $17.51 million. The whale/institution "7 Siblings" increased their position by 6,923.85 ETH, worth about $13.91 million, when ETH fell below $2,000, with an average cost of $2,009.8, bringing their total ETH holdings to 318,508.07 ETH. Meanwhile, another whale account spent 28 million USDT to buy 13,837 ETH, with an average purchase price of $2,024, but this whale wallet is also believed to possibly belong to "7 Siblings."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。