Original Author: Santiago Roel Santos

Original Translation: Luffy, Foresight News

At the time of writing this article, the cryptocurrency market is experiencing a sharp decline. Bitcoin has touched the $60,000 mark, SOL has dropped back to the price level during the liquidation of FTX's bankruptcy assets, and Ethereum has also fallen to $1,800. I won't elaborate on the long-term bearish arguments.

This article aims to explore a more fundamental question: why can't tokens achieve compound growth.

For the past few months, I have maintained the view that, from a fundamental perspective, crypto assets are severely overvalued. Metcalfe's Law cannot support the current valuations, and the divergence between industry applications and asset prices may continue for years.

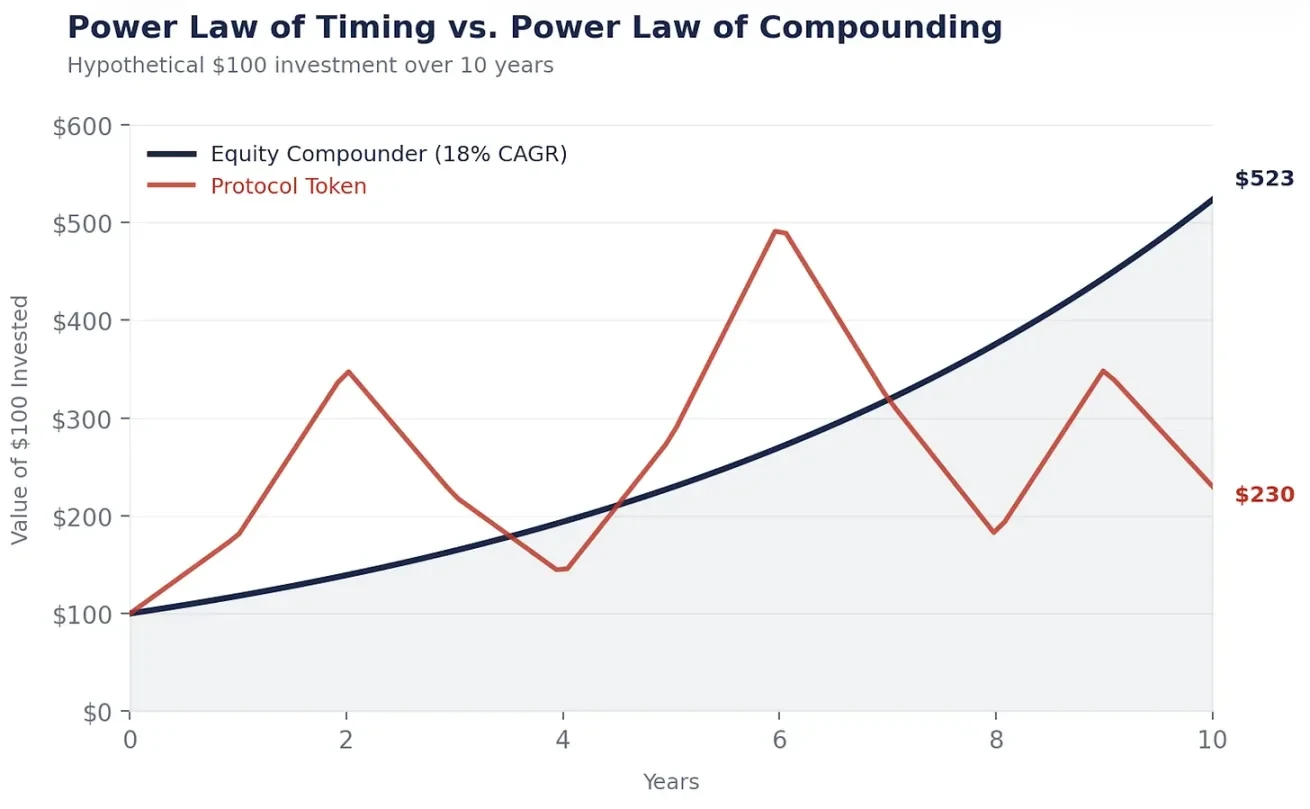

Imagine a scenario: "Dear liquidity providers, the trading volume of stablecoins has increased 100-fold, but the returns we bring to you are only 1.3 times. Thank you for your trust and patience."

What is the strongest objection among all these? "You are too pessimistic and do not understand the intrinsic value of tokens; this is a whole new paradigm."

I am precisely aware of the intrinsic value of tokens, and that is the crux of the problem.

Compound Growth Engine

Berkshire Hathaway's market capitalization is now about $1.1 trillion, not because Buffett's timing is precise, but because the company has the ability to achieve compound growth.

Every year, Berkshire reinvests its profits into new businesses, expands profit margins, and acquires competitors, thereby increasing the intrinsic value per share, and the stock price rises accordingly. This is an inevitable result because the economic engine behind it is continuously growing.

This is the core value of stocks. It represents ownership of a profit-reinvesting engine. After management earns profits, they allocate capital, plan for growth, cut costs, and buy back shares. Every correct decision becomes the cornerstone for the next growth, forming compounding.

$1 growing at a 15% compound rate for 20 years will become $16.37; $1 stored at a 0% interest rate for 20 years will still be $1.

Stocks can turn $1 of profit into $16 of value; whereas tokens can only turn $1 of transaction fees into $1 of transaction fees, with no appreciation.

Show Me Your Growth Engine

Let's take a look at what happens when a private equity fund acquires a company with $5 million in annual free cash flow:

Year 1: Achieves $5 million in free cash flow, and management reinvests it into R&D, building a stablecoin fund custody channel, and repaying debt—these are three key capital allocation decisions.

Year 2: Each decision generates returns, and free cash flow increases to $5.75 million.

Year 3: The early returns continue to compound, supporting a new round of decision-making, and free cash flow reaches $6.6 million.

This is a business with a 15% compound growth. The $5 million grows to $6.6 million, not because of market sentiment, but because every capital allocation decision made by people empowers each other and builds upon one another. If this continues for 20 years, $5 million will eventually become $82 million.

Now, let's see how a crypto protocol with $5 million in annual transaction fee income would develop:

Year 1: Earns $5 million in transaction fees, all distributed to token stakers, with funds completely flowing out of the system.

Year 2: Perhaps it can still earn $5 million in transaction fees, provided users are willing to return, and again, all distributed, with funds flowing out once more.

Year 3: The amount of income depends entirely on how many users are still participating in this "casino."

There is no compounding to speak of because there was no reinvestment in the first year, and naturally, there will be no growth in the third year. Relying solely on subsidy programs is far from enough.

Token Design Is Like This

This is not a coincidence, but a legally driven strategic design.

Looking back at 2017-2019, the U.S. Securities and Exchange Commission conducted a thorough investigation of all assets that appeared to be securities. At that time, all lawyers advising crypto protocol teams gave the same advice: never let tokens look like stocks. Do not grant token holders cash flow rights, do not allow tokens to have governance rights over core R&D entities, do not retain earnings, and define them as utility assets rather than investment products.

As a result, the entire crypto industry deliberately drew a line between tokens and stocks in their design. No cash flow rights to avoid appearing like dividends; no governance rights over core R&D entities to avoid appearing like shareholder rights; no retained earnings to avoid appearing like corporate treasury; staking rewards are defined as network participation returns rather than investment income.

This strategy worked. The vast majority of tokens successfully avoided being classified as securities, but at the same time, they lost all possibilities of achieving compound growth.

This asset class has been deliberately designed from its inception to be incapable of creating the core action of long-term wealth—compounding.

Developers Hold Equity, You Only Hold "Coupons"

Every leading crypto protocol corresponds to a profit-driven core development entity. These entities are responsible for developing software, controlling the front-end interface, owning brand rights, and connecting corporate partnership resources. And what about token holders? They can only obtain governance voting rights and a fluctuating claim to transaction fee income.

This model is ubiquitous in the industry. Core development entities hold talent, intellectual property, brand, corporate partnership contracts, and strategic choices; token holders can only receive floating "coupons" linked to network usage and have the "privilege" to vote on proposals that the development entity increasingly ignores.

This makes it easy to understand why, when Circle acquires a protocol like Axelar, the acquirer buys equity in the core development entity rather than the tokens. Because equity can compound, while tokens cannot.

The lack of clear regulatory intent has fostered this distorted industry outcome.

What Exactly Do You Hold?

Setting aside all market narratives and ignoring price fluctuations, let's see what token holders can truly obtain.

By staking Ethereum, you can earn about 3%-4% returns, which are determined by the network's inflation mechanism and dynamically adjusted based on the staking rate: the more stakers there are, the lower the returns; the fewer stakers there are, the higher the returns.

This is essentially a floating interest rate coupon linked to the protocol's established mechanism, not a stock, but a bond.

Indeed, the price of Ethereum may rise from $3,000 to $10,000, but the price of junk bonds may also double due to narrowing spreads, which does not make it a stock.

The key question is: what mechanism drives your cash flow growth?

The cash flow growth of stocks: management reinvests profits to achieve compound growth, with the growth rate = capital return rate × reinvestment rate. As a holder, you participate in an ever-expanding economic engine.

The cash flow of tokens: entirely depends on network usage × fee rate × staking participation, and what you receive is merely a coupon that fluctuates with block space demand; there is no reinvestment mechanism in the entire system, nor is there a compounding growth engine.

The significant price fluctuations lead people to mistakenly believe they hold stocks, but from an economic structure perspective, what people hold is actually a fixed income product, with an annual volatility of 60%-80%. This is simply unappealing on both ends.

The vast majority of tokens, after accounting for inflation dilution, have actual yields of only 1%-3%. No fixed income investor would accept such a risk-reward ratio, but the high volatility of these assets continues to attract waves of buyers, which is a true reflection of the "greater fool theory."

The Power Law of Timing, Not the Power Law of Compounding

This is why tokens cannot achieve value accumulation and compound growth. The market is gradually becoming aware of this; it is not foolish but is starting to shift towards stocks related to crypto. First, digital asset treasury bonds, and then more and more funds are beginning to flow into companies that use crypto technology to reduce costs, increase revenue, and achieve compound growth.

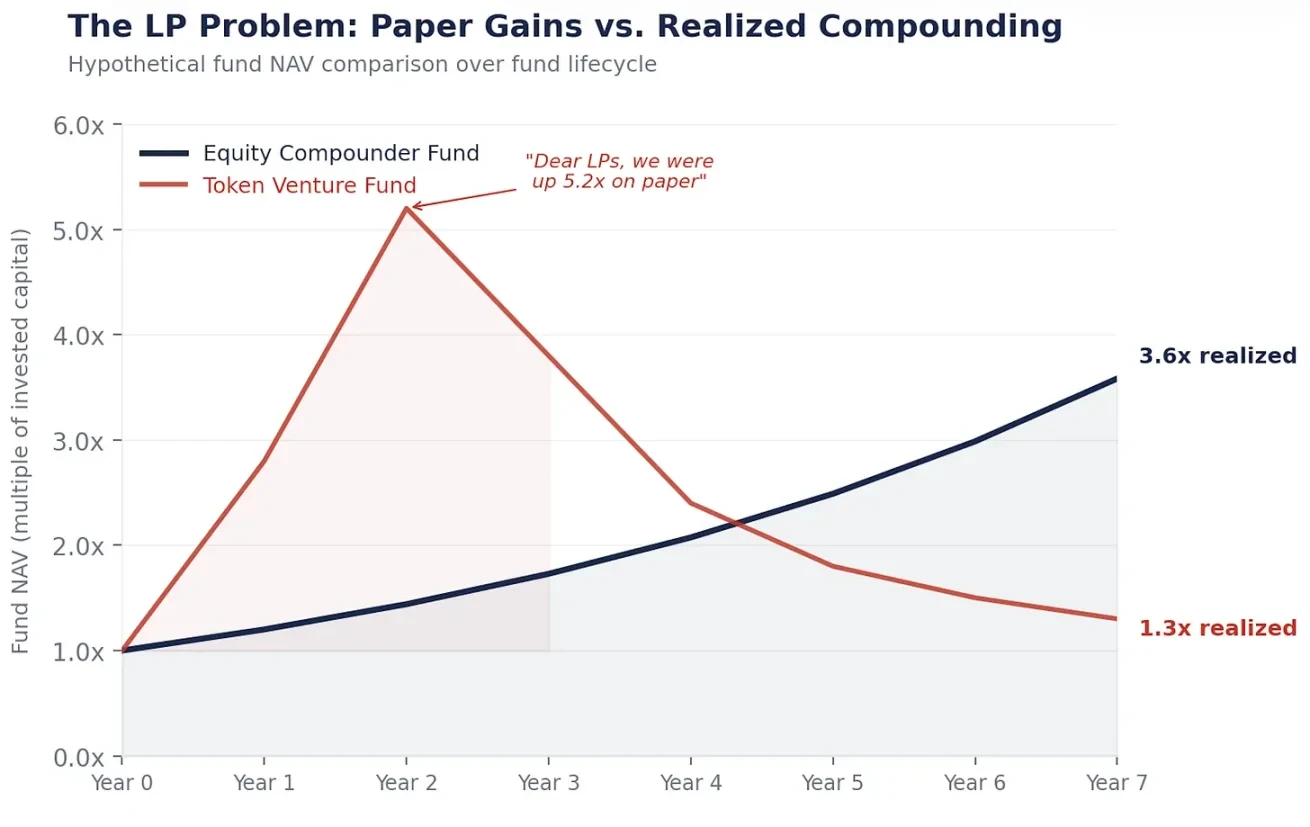

Wealth creation in the crypto space follows the power law of timing: those who make a fortune are the ones who bought early and sold at the right time. My own investment portfolio also follows this rule; crypto assets are referred to as "liquidity venture capital" for a reason.

Wealth creation in the stock market follows the power law of compounding: Buffett did not become wealthy by timing his purchase of Coca-Cola but by buying it and holding it for 35 years, allowing compounding to take effect.

In the crypto market, time is your enemy: hold too long, and your gains will evaporate. High inflation mechanisms, low circulation, and high fully diluted valuations, combined with insufficient demand and an oversupply of block space, are all important reasons behind this. Super-liquid assets are one of the few exceptions.

In the stock market, time is your ally: the longer you hold a compound growth asset, the more substantial the returns from mathematical laws.

The crypto market rewards traders, while the stock market rewards holders. In reality, far more people become wealthy by holding stocks than by making money through trading.

I must repeatedly calculate these numbers because every liquidity provider will ask, "Why not just buy Ethereum directly?"

Let's pull up the performance of a compound growth stock—Danaher, Constellation Software, Berkshire—and compare it to Ethereum's performance: the curve of compound growth stocks steadily rises to the right because the economic engine behind it grows every year; whereas Ethereum's price fluctuates wildly, cycling back and forth, with the final cumulative returns entirely dependent on your entry and exit timing.

Perhaps the ultimate returns of both will be comparable, but holding stocks allows you to sleep soundly at night, while holding tokens requires you to become a market-predicting prophet. "Long-term holding beats timing," everyone understands this principle, but the difficulty lies in truly sticking to holding. Stocks make long-term holding easier: cash flow supports stock prices, dividends give you the patience to wait, and buybacks continue to compound during your holding period. The crypto market makes long-term holding incredibly difficult: transaction fee income dries up, market narratives change, you have no support, no price floor, no stable coupons, only a belief.

I would rather be a holder than a prophet.

Investment Strategy

If tokens cannot compound, and compounding is the core way to create wealth, then the conclusion is self-evident.

The internet has created trillions of dollars in value; where did this value ultimately flow? Not to protocols like TCP/IP, HTTP, SMTP. They are public goods, immensely valuable, but cannot bring any returns to investors at the protocol level.

Value ultimately flowed to companies like Amazon, Google, Metaverse, and Apple. They built businesses on top of the protocols and achieved compound growth.

The crypto industry is repeating the same mistakes.

Stablecoins are gradually becoming the TCP/IP of the currency field, highly practical and with a high landing rate, but whether the protocol itself can capture matching value remains to be seen. USDT is backed by a company with equity, not just a simple protocol, which holds important implications.

Only those enterprises that integrate stablecoin infrastructure into their operations, reduce payment friction, optimize working capital, and cut foreign exchange costs are the true compound growth entities. A CFO who can save $3 million annually by switching cross-border payments to a stablecoin channel can reinvest that $3 million into sales, product development, or debt repayment, and this $3 million will continue to compound. As for the protocol facilitating this transaction, it only earns a fee, with no compounding involved.

The "Fat Protocol" theory posits that crypto protocols capture more value than application layers. However, seven years later, public chains account for about 90% of the total market capitalization of cryptocurrencies, yet their fee share has plummeted from 60% to 12%; the application layer contributes about 73% of the fees, but its valuation share is less than 10%. The market is always efficient, and this data speaks for itself.

Today, the market still clings to the narrative of "Fat Protocols," but the next chapter of the crypto industry will undoubtedly be written by crypto-enabled stocks: those that have users, generate cash flow, and whose management can leverage crypto technology to optimize business and achieve higher compound growth rates will far outperform tokens.

Companies like Robinhood, Klarna, NuBank, Stripe, Revolut, Western Union, Visa, and Blackrock will certainly outperform a basket of tokens.

These companies have real price support: cash flow, assets, and customers, while tokens do not. When the valuation of tokens is inflated to absurd multiples based on future income, the extent of their decline can be imagined.

In the long term, be bullish on crypto technology, choose tokens cautiously, and heavily invest in the stocks of companies that can leverage crypto infrastructure to amplify their advantages and achieve compound growth.

The Unfortunate Reality

All attempts to solve the token compounding issue inadvertently validate my point.

Decentralized autonomous organizations attempting actual capital allocation, such as MakerDAO buying government bonds, establishing sub-DAOs, and appointing specialized teams, are slowly reshaping corporate governance models. The more a protocol seeks to achieve compound growth, the more it must align itself with the form of a business.

Digital asset treasury bonds and tokenized stock packaging tools cannot solve this problem either. They merely create a second claim on the same cash flow, competing with the underlying tokens. Such tools do not enable protocols to become better at compounding; they simply redistribute earnings from token holders who do not hold these tools back to the holders.

Token burning is not the same as stock buybacks. Ethereum's burning mechanism is like a thermostat with a fixed temperature, unchanging; whereas Apple's stock buybacks are flexible decisions made by management based on market conditions. Intelligent capital allocation and the ability to adjust strategies according to market conditions are the core of compounding. Rigid rules cannot generate compounding; flexible decision-making can.

And what about regulation? This is actually the most worthy part to discuss. The reason tokens cannot compound today lies in the fact that protocols cannot operate in the form of a business: they cannot register as companies, cannot retain earnings, and cannot make legally binding commitments to token holders. The "GENIUS Act" proves that the U.S. Congress can incorporate tokens into the financial system without stifling their development. When we have a framework that allows protocols to operate using corporate capital allocation tools, it will become the biggest catalyst in the history of the crypto industry, with an impact far exceeding that of Bitcoin spot ETFs.

Until then, smart capital will continue to flow into stocks, and the compounding gap between tokens and stocks will widen every year.

This Is Not a Bearish View on Blockchain

I want to make one thing clear: blockchain is an economic system with limitless potential and will undoubtedly become the underlying infrastructure for digital payments and intelligent commerce. My company, Inversion, is developing a blockchain precisely because we believe in this.

The issue is not with the technology itself, but with the economic model of tokens. Today's blockchain networks merely transfer value rather than accumulate and reinvest it for compounding. But this situation will eventually change: regulation will continue to improve, governance will mature, and some protocol will find a way to retain and reinvest value like a successful business. When that day comes, tokens will essentially become stocks, aside from their name, and the compounding engine will officially start.

I am not bearish on that future; I just have my own judgment about when it will arrive.

One day, blockchain networks will achieve compounding growth of value, and until then, I will choose to invest in those companies that leverage crypto technology to achieve faster compounding growth.

I may make mistakes in timing; the crypto industry is an adaptive system, and that is one of its most valuable traits. But I do not need to be absolutely precise; I just need to be correct in the general direction: the long-term performance of compound growth assets will ultimately surpass that of other assets.

And that is the allure of compounding. As Munger said, "What is amazing is that people like us, just by trying not to be stupid all the time instead of chasing after being extremely smart, have gained such a huge long-term advantage."

Crypto technology significantly reduces the cost of infrastructure, and wealth will ultimately flow to those who utilize these low-cost infrastructures to achieve compound growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。