1. Market Overview This Week

This week, the cryptocurrency market experienced a significant downturn, with the Fear and Greed Index falling into the extreme fear zone. Bitcoin and Ethereum saw notable declines over the past 7 days, and the total market capitalization dropped below the $2.5 trillion mark. Large withdrawals from BTC and ETH spot ETFs became the core selling pressure, while the derivatives market faced intense deleveraging due to high leverage, leading to frequent liquidations across the network. Mainstream coins showed signs of being oversold in the short term, indicating potential for a rebound, but current selling pressure remains high, and buying interest is lacking, resulting in a continued decline in market participation amid panic.

Core driving factors are intertwined across multiple dimensions: on the macro front, the Federal Reserve maintained interest rates, and Trump's nomination of a Federal Reserve chair disturbed rate cut expectations; on the regulatory front, the U.S. CFTC sued leading exchanges for violations, and multiple countries advanced crypto compliance and risk management; on the institutional front, stablecoin regulatory legislation is progressing, and the global stablecoin market is expanding; on the technical front, Ethereum's zkEVM has clear security goals, and Bitcoin's BitVM2 testnet has gone live, with steady technological iteration in the industry.

2. Core Market Trends and Capital Dynamics

This week, the cryptocurrency market as a whole faced a significant downturn, with no signs of recovery. Market sentiment is deeply entrenched in extreme fear, and after the total market capitalization fell below key support, it is under pressure and fluctuating. Mainstream coins collectively declined sharply, institutional funds withdrew simultaneously, and the derivatives market underwent intense deleveraging, placing the overall market in a state of panic selling, with the bottoming process far from complete and weak expectations for a short-term rebound.

From the perspective of market sentiment, the Crypto Fear & Greed Index plummeted from last week's 37 to 11, officially entering the extreme fear zone, reflecting a sharp deterioration in market sentiment and an upgrade from caution to panic selling. Currently, mainstream coins continue to decline, with frequent liquidations across the network, leading funds to shift towards stablecoins for safety. Market confidence has dropped to a freezing point; although extreme fear often accompanies a phase of emotional bottoming, there are currently no signs of stabilization, and further spread of panic sentiment must be monitored.

In terms of core market capitalization, the total cryptocurrency market capitalization is reported at $2.99 trillion, down 0.76% in the last 24 hours, showing a continuous acceleration of the downward trend, having already fallen below the critical $2.5 trillion mark, with a faster pace of market cap shrinkage in the short term. After the previous market cap decline, there has been a persistent lack of sufficient buying support, with a clear outflow of funds, placing continuous pressure on the market, and the bottoming process has yet to start, indicating further potential for decline in the short term.

Specifically regarding the two major cryptocurrencies, BTC and ETH both exhibited significant declines, short-term overselling, and a bearish outlook in the medium to long term. BTC is currently priced at $88,673.59, down 5.88% in 24 hours and 19.15% over 7 days, with a market cap of $1.409 trillion and a slight increase in market share to 58.66%. Short-term indicators show overselling signals, indicating potential for a technical rebound, but medium to long-term indicators remain bearish, and downward pressure has not been fully released. ETH is currently priced at $2,992.38, down 5.71% in 24 hours and 28.74% over 7 days, with a market cap of $251.935 billion and a slight decrease in market share by 1.60% to 10.56%. Short-term indicators show slight warming, but the rebound strength is limited, and despite extreme overselling in the medium to long term, the downward trend is hard to change. Caution is required in operations for both.

In terms of capital flow, the ETF market has broken the previous divergent pattern, showing synchronized withdrawals of funds from BTC and ETH, with institutional attitudes collectively turning pessimistic. Bitcoin ETF outflows have significantly intensified compared to last week, with a surge in institutional selling willingness; Ethereum ETF has ended last week's inflow trend, turning into net outflows, with significant signs of institutional risk aversion withdrawal in the short term, reflecting a substantial decline in institutional risk appetite under the current market environment, with demand for capital safety dominating.

The derivatives market has shown a divergent trend, perfectly aligning with the current atmosphere of extreme panic. The scale of open futures contracts is $354 million, up 3.11% in 24 hours, reflecting an increased demand for hedging against downside risks through futures contracts amid the backdrop of a significant drop; the scale of open perpetual contracts is $45.689 billion, down 16.71% in 24 hours, affected by widespread liquidations triggered by the extreme market downturn, coupled with investors actively cutting positions for safety, leading to intense deleveraging of high-leverage funds and a rapid contraction of overall market leverage levels.

Overall, the current cryptocurrency market is in a phase of extreme panic selling, with sentiment, capital flow, and technical indicators all showing weakness. The short-term overselling of mainstream coins does not change the medium to long-term downward trend, institutional funds continue to withdraw, and market leverage is rapidly contracting, with the bottoming process yet to start. In the short term, it is crucial to focus on the stabilization of key support levels for mainstream coins, waiting for effective signals of emotional easing and capital inflow. Until then, strict position control and cautious operations are necessary to avoid further downside risks.

3. Selected Trading Strategy Rankings

1. High-Yield Strategy Selection

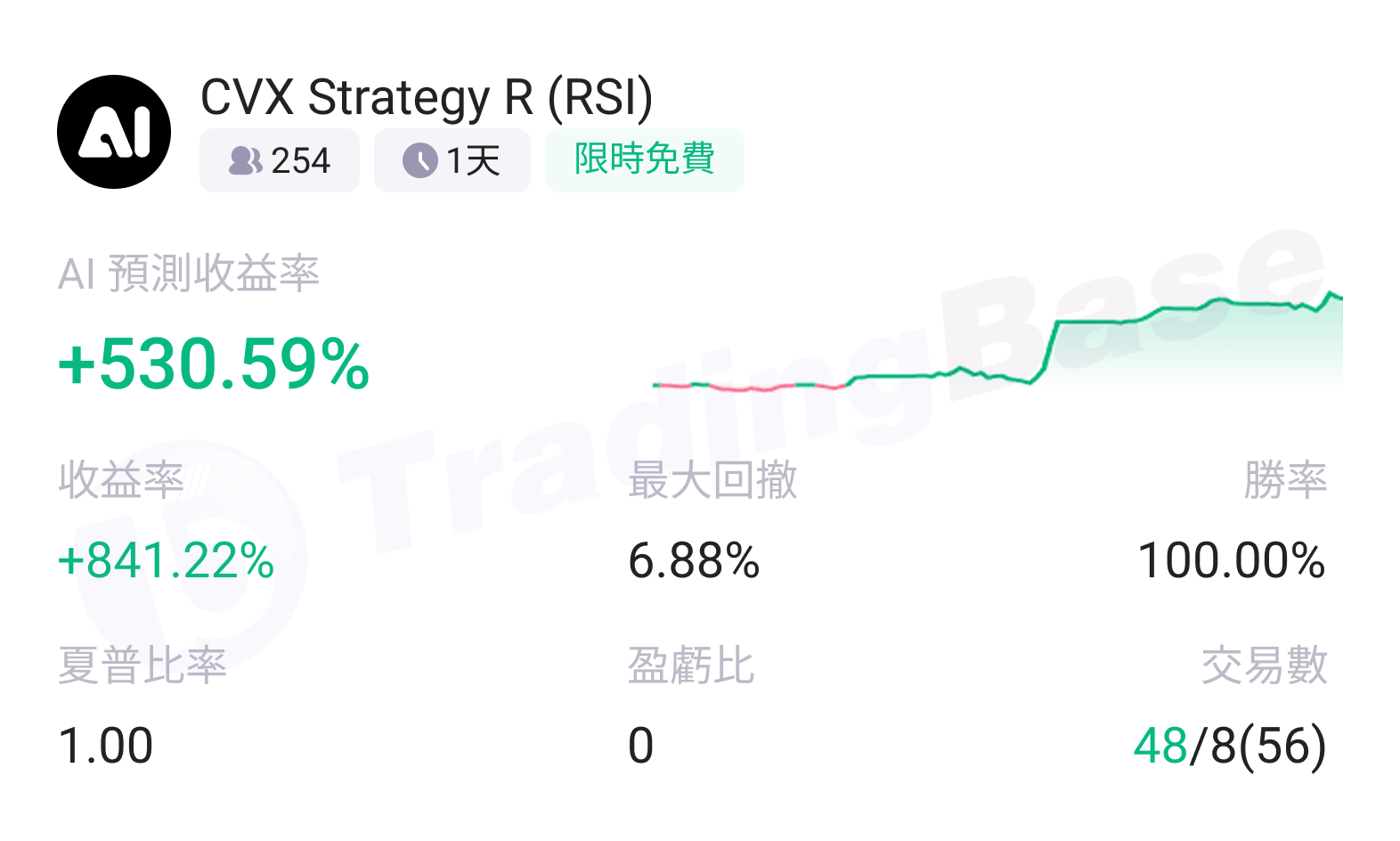

Core Highlights:

- Extreme Win Rate: 100% historical win rate, no losses in all trades, with very high signal accuracy.

- Strong Profit Potential: Over 800% actual return, perfectly suited for high-volatility small coins.

- Excellent Drawdown Control: Maximum drawdown of less than 7%, outstanding stability among small coin strategies.

- Risk-Reward Ratio Meets Standards: Sharpe ratio of 00, achieving a basic balance between returns and risks.

Applicable Scenarios:

Suitable for traders with medium to high risk tolerance seeking high win rates and high returns in small coin trading, particularly fitting for hot coins in the DeFi sector like CVX, especially in pulse-like market conditions driven by DeFi concept speculation and capital rotation. This strategy is not suitable for long-term conservative funds or extreme one-sided market conditions.

2. High-Frequency Trading Strategy Selection

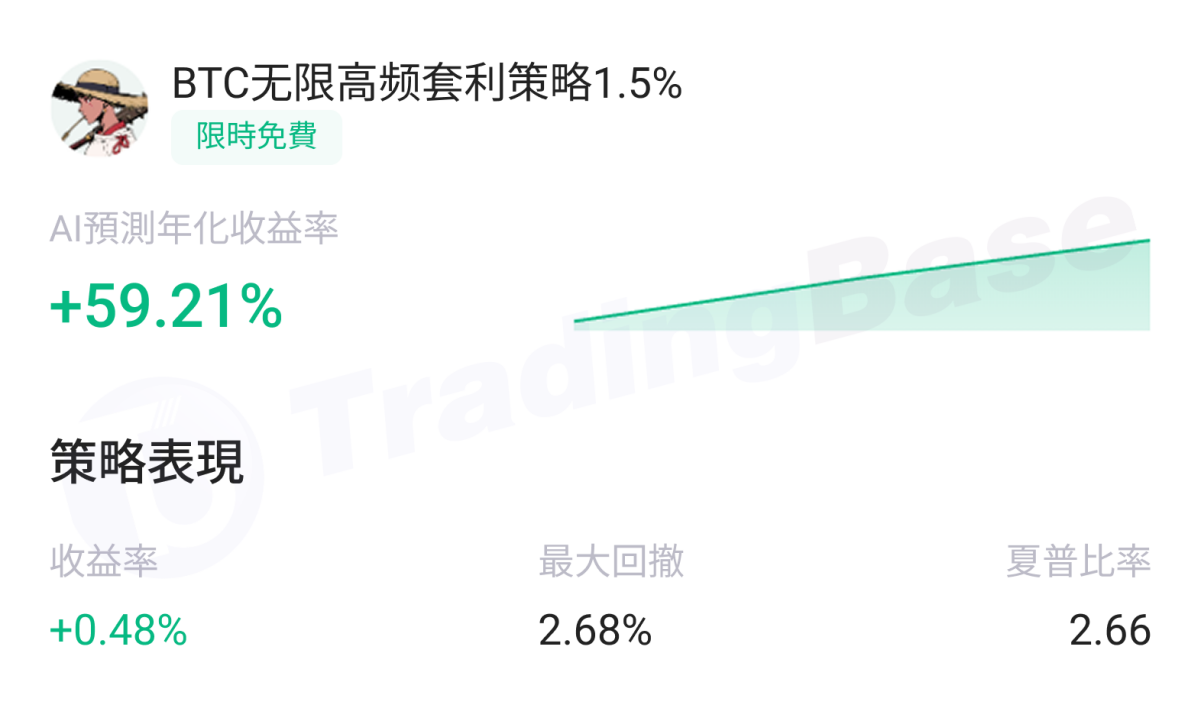

Core Highlights:

- Extremely High Risk-Reward Ratio: Sharpe ratio of 66, with attractive returns corresponding to unit risk, aligning with the core logic of high-frequency arbitrage "low volatility, stable returns."

- Excellent Drawdown Control: Maximum drawdown of only 68%, with very low volatility in high-frequency strategies, highlighting fund safety.

- Stable and Predictable Returns: Nearly 60% annualized return paired with a smooth return curve, with arbitrage strategies relying on price differences, providing strong return certainty.

- Suitable for High Liquidity Targets: Designed for BTC's high liquidity, with ample arbitrage opportunities and good strategy sustainability.

Applicable Scenarios:

Suitable for investors with medium risk tolerance seeking low volatility and stable returns, specifically designed for high liquidity mainstream coins like BTC, adaptable for price difference arbitrage in fluctuating markets. This can serve as a stable foundational strategy for funds, especially for those looking to avoid one-sided volatility and pursue stable compounding. It is not suitable for small coins or extreme one-sided market conditions.

3. High Stability Strategy Selection

Core Highlights:

- Extreme Win Rate: 100% historical win rate, no losses in all trades, with very high signal accuracy.

- Strong Profit Potential: Over 280% actual return, with outstanding return elasticity among mainstream coin strategies.

- Excellent Risk-Reward Ratio: Sharpe ratio of 22, with high unit risk returns and good balance between returns and risks.

- Controllable Drawdown: A maximum drawdown of 33% is reasonable for high-volatility coins like SOL, indicating good stability.

Applicable Scenarios:

Suitable for traders with medium to high risk tolerance seeking high win rates and high returns in mainstream coin trading, specifically designed for high-growth, high-volatility mainstream blockchain coins like SOL, adaptable for phase-based trend markets. This can serve as an elastic enhancement strategy for mainstream coin allocation and is not suitable for extremely conservative long-term funds or extreme one-sided downward market conditions.

Download TradingBase.AI to follow quality strategies with one click:

https://app.tradingbase.ai/downLoad

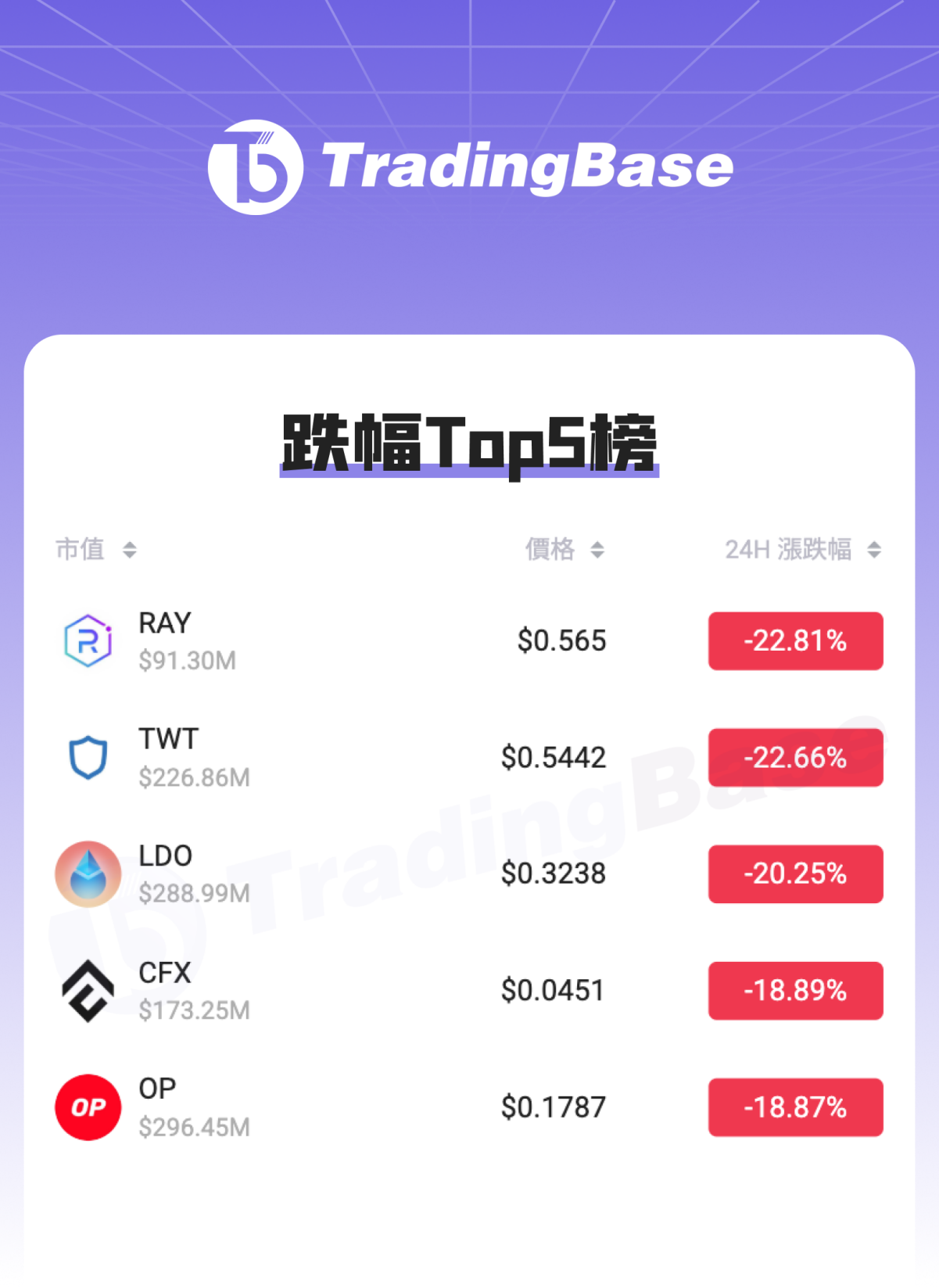

4. Top 24h Cryptocurrency Price Changes

Top 5 Declines:

Note: Institutional withdrawals, unmet expectations for Federal Reserve rate cuts, and declining dollar credit have resulted in no cryptocurrencies showing gains (as of February 5).

5. Conclusion

This week, the cryptocurrency market faced a significant decline due to simultaneous withdrawals of institutional funds, the spread of panic sentiment, and disturbances from macro uncertainties. After a sharp drop, the market is showing signs of being oversold and awaiting stabilization. Although short-term selling pressure has not been fully released, excessive deleveraging has absorbed some risks. The advancement of industry compliance and technological iteration continues to progress steadily, laying a solid foundation for healthy medium to long-term development. Moving forward, it is crucial to focus on the defense of key support levels for BTC, signs of ETF fund inflows, and macro liquidity trends. In the medium to long term, attention can be directed towards compliant cryptocurrency products, technological upgrades of mainstream coins, and structural opportunities in the stablecoin sector, while rationally responding to short-term volatility and strictly controlling position layouts. We welcome you to continue following this column for the latest market interpretations and strategy analyses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。