The questions from my friends are great, and I also overlooked this. The calculation method for dual currency winning is as follows:

OKX: It is based on the average price in the 1 hour before settlement, which means the expiration price is the average index price between 15:00 and 16:00 (Beijing time) on the expiration date. In simple terms, if the average price during that hour is below $40,000, then your purchase at $40,000 will be executed.

This means that if the last moment of settlement is $40,001, but the average price for the hour is still below $40,000, you can still execute the trade.

If the average price is above $40,000, then the trade cannot be executed, even if the last moment's price drops to $30,000, but the average price remains above $40,000, you still cannot execute the trade.

Binance: It is based on the average price in the 30 minutes before settlement, and everything else is the same.

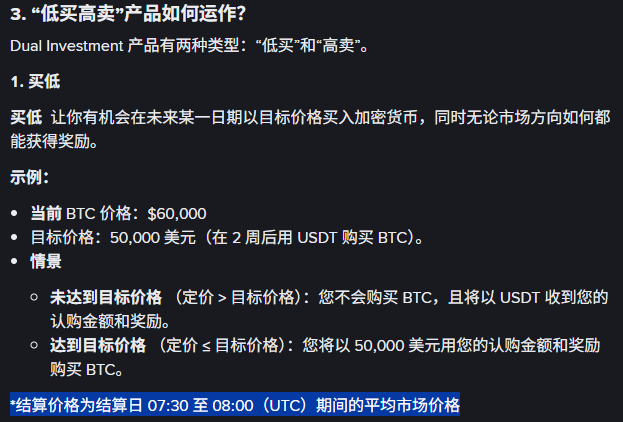

Therefore, one of the biggest drawbacks of dual currency winning is that using it to take advantage of spikes relies on luck; just because there is a spike does not mean you will benefit from it. It still depends on the price at the time of settlement. For example, if I bought $BTC at $63,000 using dual currency winning, but the settlement time is at 16:00 on February 9.

This means that even if the price drops to $30,000 in the meantime, it doesn't matter to me; only the average price in the last half hour (Binance) can determine whether I can buy. So my current order is also uncertain, but I am happy if I can buy; this is the price I prepared. If I can't buy, I still made a little pocket money.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。