Headache, difficult to write homework. Today is another day of decline for US stocks and cryptocurrencies, and even the trends of gold and silver are not good. The main reason for the drop in the risk market should be the poor data from the ADP non-farm payrolls, and there is no non-farm payroll data this month, which makes the ADP non-farm payrolls the market reference. The employment figures from the ADP non-farm payrolls were significantly below expectations, which may lead to market pessimism about the US economy. Theoretically, this situation is favorable for the Federal Reserve to cut interest rates.

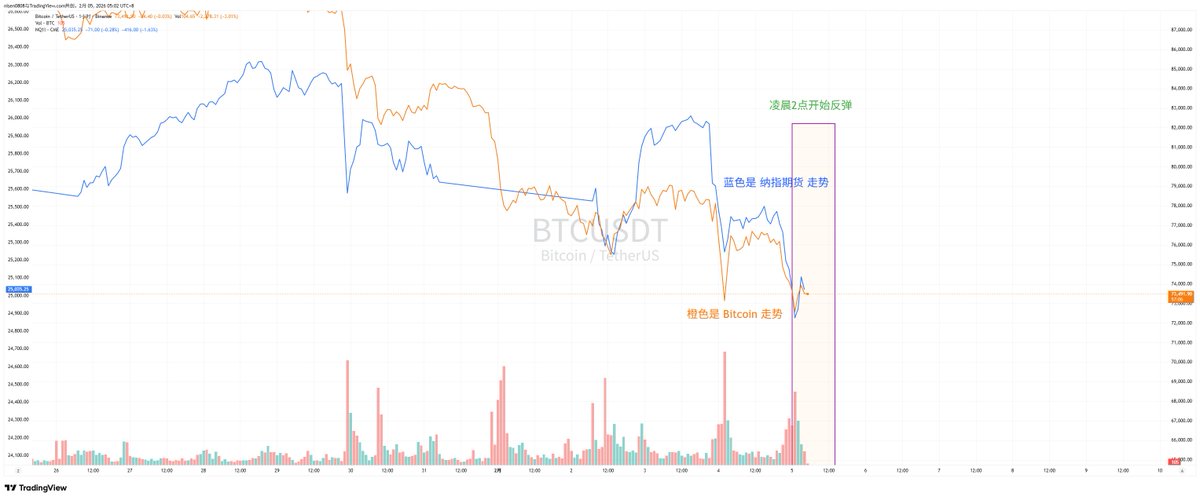

From the details of US stocks, during Asian and European trading times, the futures trends were actually decent, even showing slight increases. However, as US trading hours began, a decline occurred, and after the ADP non-farm payroll data was released, the drop intensified. After the US stock market opened, the decline continued to expand, and it wasn't until 2 AM that it began to gradually rebound, with $BTC also starting to rebound at that time.

The Nasdaq saw its largest drop today, exceeding 2.2%. Such a magnitude of decline usually corresponds to significant negative information, but this time there wasn't any; the most was that the US and Iran did not reach an agreement, which led to such a large drop, indicating that the entire risk market is already in a fragile state.

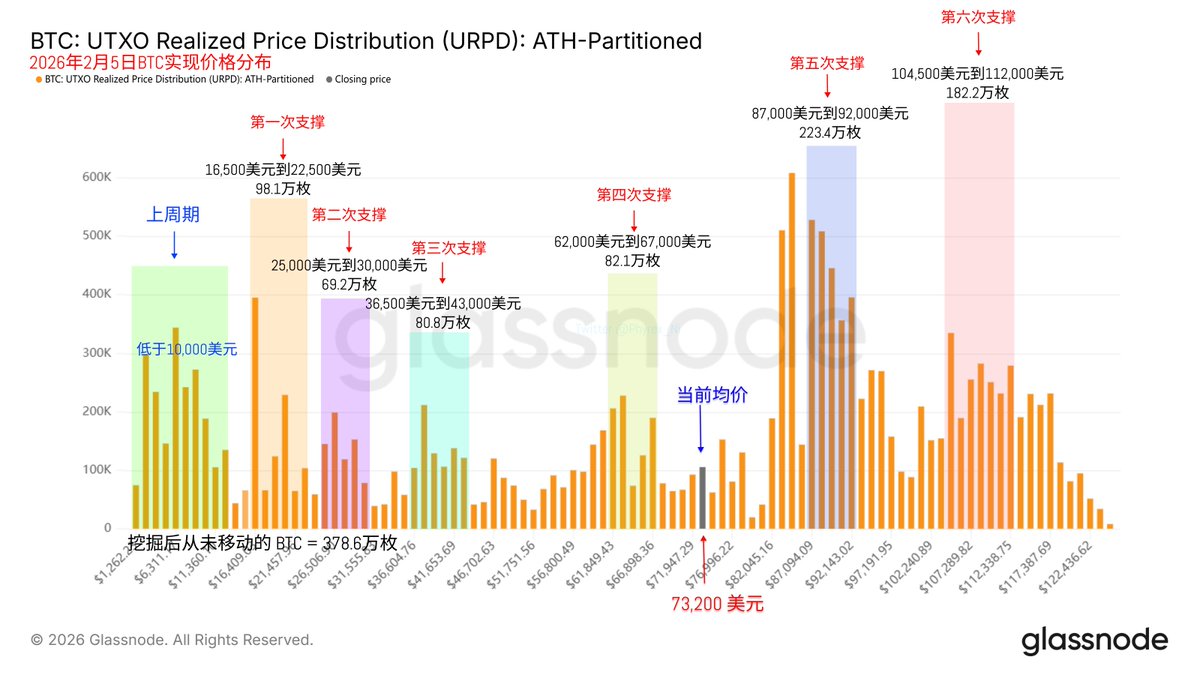

Looking back at Bitcoin's data, today, as the price of $BTC fell below $73,000, signs of panic indeed appeared, with a significant increase in turnover rate. The data suggests that the portion above $73,000 seems to be reducing positions, and today's decline, like that of US stocks, does not have a clear reason, yet it is falling so sharply. Investor sentiment and liquidity are truly in disarray, and Trump must take some responsibility.

From the perspective of chip structure, although it is still relatively stable, investor sentiment is indeed poor. More importantly, due to poor liquidity, even a small portion of selling by short-term investors has already triggered a significant decline. Traditional investors, although not selling much, have almost no purchasing power left, and what remains is the investment from the cryptocurrency circle itself. For the time being, the outlook is still not very optimistic.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。