$500 million financing, $40 billion valuation

This is the data when Ripple Labs announced a new round of financing in 2025.

Even looking at the entire crypto world, these numbers are astonishing.

For comparison, similar levels of financing include:

http://Pump.fun public offering round

Galaxy Digital debt financing

BNC Post-IPO, etc.

The question arises: why do many institutions, including Pantera Capital and Galaxy Digital, dare to heavily bet on Ripple?

The answer is not complicated: Ripple has long completed its strategic transformation.

It is no longer just about cross-border payments, but a financial infrastructure that integrates "stablecoin issuance + institutional custody + cross-border settlement."

▌From the product dimension

Ripple launched the compliant stablecoin RLUSD, which is the first stablecoin to enter the card network system.

Mainstream exchanges such as Binance, Bybit, and Bitget have successively listed RLUSD.

▌From the merger and integration dimension

Acquired Hidden Road ($1.25 billion) to gain institutional-level clearing capabilities.

Acquired GTreasury ($1 billion) to enter the fund management market.

Acquired Rail ($200 million) to improve the stablecoin issuance system.

However, as the fifth-largest crypto asset, XRP has always faced a fatal problem compared to Bitcoin, ETH, and BNB:

ETH has long had a mature native DeFi ecosystem.

BTC achieves staking yields through protocols like Babylon and Lombard.

XRP has long lacked a secure, native, scalable yield layer.

For Ripple, XRPfi is not just an enhancement, but a strategic necessity.

This is also why I say @doppler_fi is of extremely strategic importance.

Doppler is a crucial part of Ripple's strategy and is currently the leading project in XRPfi.

Its core significance is to make XRP a productive asset that generates yields.

We prove its leading position from three levels:

Core ecological circle

Establish deep cooperation with core Ripple ecosystem partners such as SBI Ripple Asia, Evernorth, and VivoPower.

Note: SBI Ripple Asia is a joint venture established by Ripple and SBI Holdings; Evernorth is a $1 billion XRP DAT supported by Ripple, SBI Holdings, and Arrington Capital.

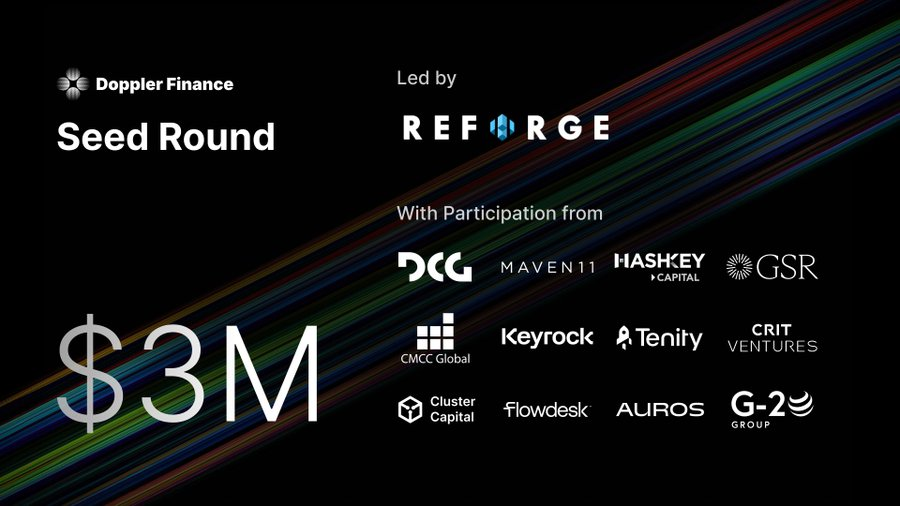

Financing background

Completed a $3 million seed round financing, with investors including Reforge (leading), DCG, HashKey Capital, GSR, and other top institutions.

Data performance

TVL: Approaching the $100 million mark

Number of users: Over 10,000 active users

Average deposit: About $11,000 per transaction

Finally, to summarize.

The $500 million bet from industry giants is essentially a bet on the future of financial infrastructure.

Through mergers and acquisitions, Ripple has built a complete financial stack from payments, custody to fund management.

XRPfi, as the yield layer of this ecosystem, will be key to unlocking the true value of XRP.

It is recommended to closely monitor Doppler's subsequent actions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。