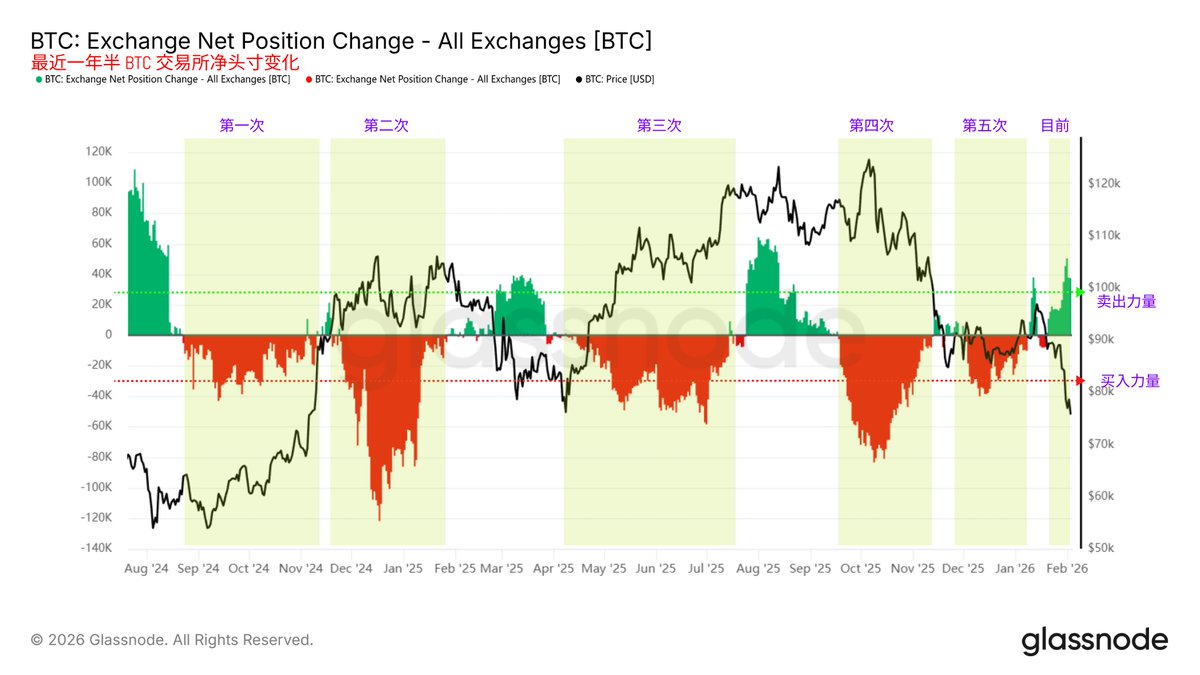

The data on purchasing power can be seen more clearly from the 30-day stock data of the exchange. Although the price was not very stable before, at least the focus was on buying, with a large amount of capital, whether active or passive, entering the market to buy Bitcoin at the bottom. However, in the past week, the trend has slightly changed from a buying focus to a selling focus, and with insufficient liquidity and capital, this naturally creates greater pressure.

Although there were similar signs in August and September of 2025, the capital was still sufficient at that time, and liquidity was somewhat better, with fewer negative factors. Trump was also able to exercise some restraint, but now, with the normalization of using tariffs as a weapon, the market is increasingly worried about what Trump will do next.

Moreover, the insufficient capital from institutions is also a significant reason. Without money, there is not enough ability to buy at the bottom, and the capital has mainly gone to precious metals and U.S. stocks, especially precious metals. Now, not only gold and silver, but many other precious metals have seen a large number of investors starting to position themselves, preparing for sector rotation, which is just adding insult to injury.

Therefore, the Federal Reserve's interest rate cuts provide a small opportunity for assets outside of cryptocurrency and U.S. tech stocks to catch their breath. Initially, it was thought that Trump would be the biggest supporter of cryptocurrency, but it has turned into the biggest uncertainty factor. 🥲

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。