Changes in Bitcoin On-Chain Data for Week 5 of 2026 — Do You Still Have Money to Buy the Dip?

This week has been very difficult for the overall risk market. Not only did U.S. stocks experience a pullback, but cryptocurrencies also saw a decline, and even gold and silver faced unprecedented pullbacks. It can be said that almost no asset is safe in this wave of decline. What’s even more painful is that investors who cut losses during the downturn find that their assets are starting to rebound.

While many are saying that the gold and silver bubbles have burst, gold has already returned above $5,000, and silver is back above $85. In the U.S. stock market, aside from Microsoft and Meta filling gaps, other assets are still holding up. In the cryptocurrency space, for example, $BTC rebounded after the halt ended. The rebound in gold and silver, as previously mentioned, is normal, especially since the Chinese government is now buying large amounts of gold to hedge against the dollar and geopolitical risks.

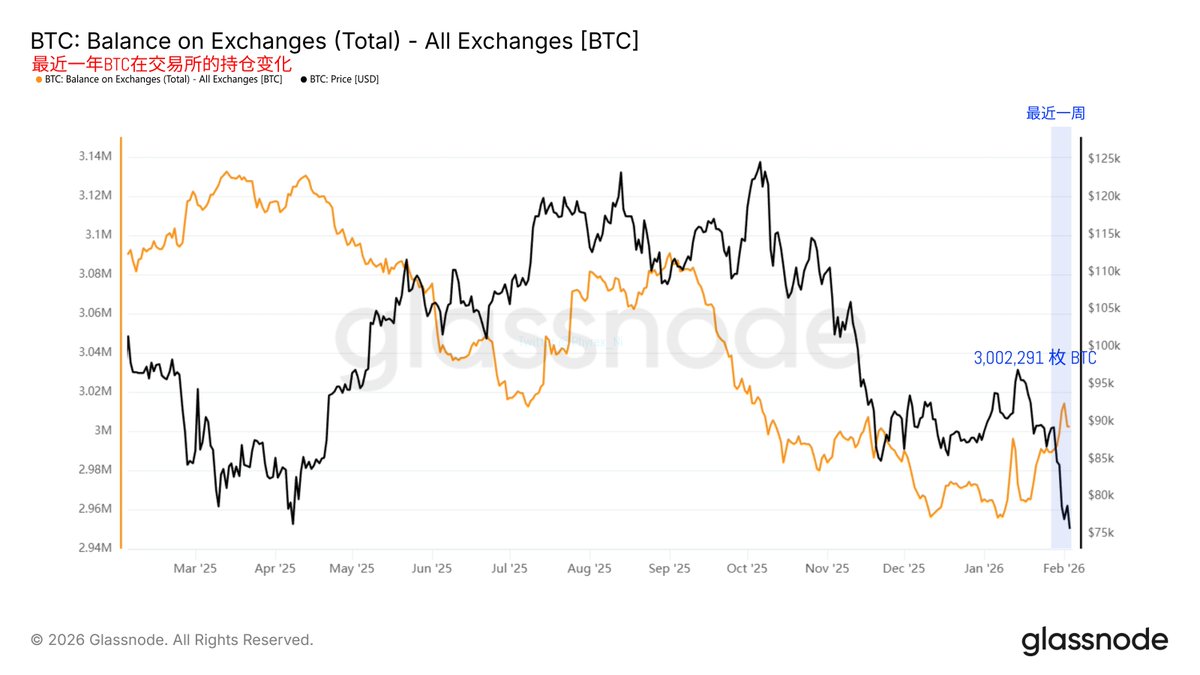

Recent Year Bitcoin Inventory on Exchanges

Cryptocurrencies have indeed faced some difficulties. From the recent week’s exchange inventory data, it shows that inventory has mostly increased this week, with a slight drop today due to the end of the halt. This indicates that there has been pressure and negative sentiment among investors recently, but it’s not excessively high. Approximately 12,000 Bitcoins are currently held on exchanges, which may represent newly added pressure.

The likely reason for this is that market liquidity has worsened, and negative sentiment has led investors to seek safety. The past few weeks have been quite challenging, and data shows that global fund managers' cash exposure has continuously broken historical lows. The ability of institutions to drive the market has been declining, first impacted by Trump’s tariff weapon, followed by disappointing earnings reports from the three major oil companies, which triggered market declines. Next, the U.S. government shutdown exceeded market expectations, not to mention the geopolitical conflict between the U.S. and Iran.

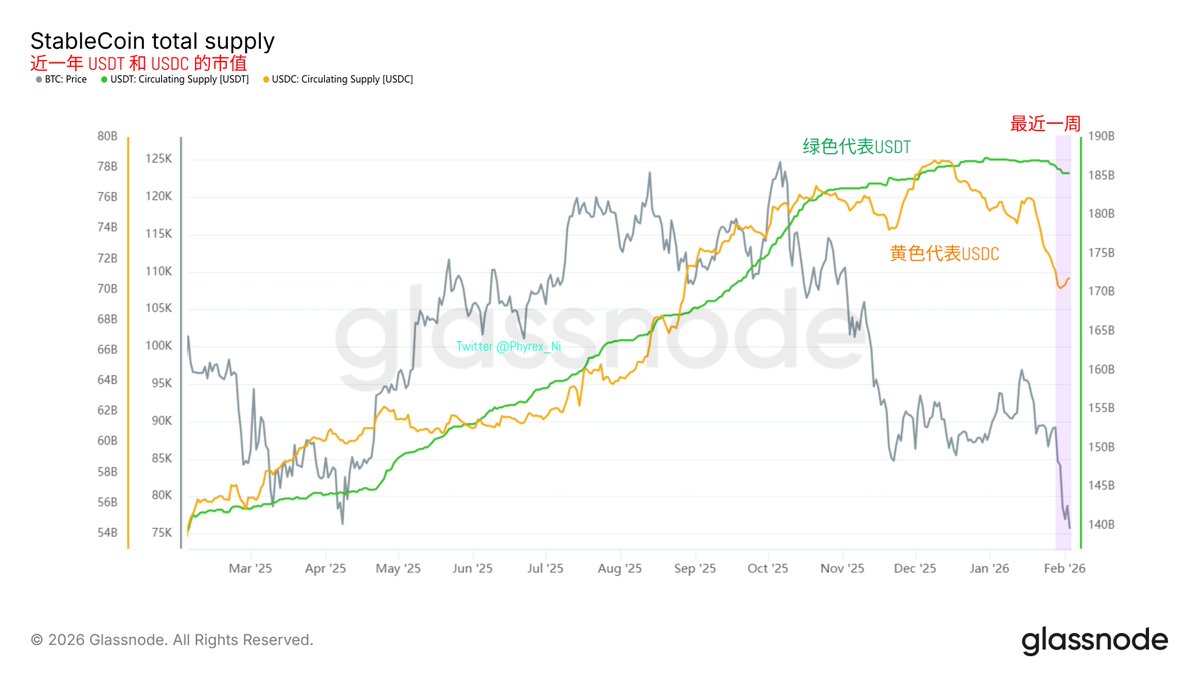

Recent Year Changes in Market Capitalization of USDT and USDC

The direct result of this is a weakening of market liquidity, which can be seen in the changes in the market capitalization of major stablecoins. Both USDT and USDC have seen declines in their market capitalizations, especially USDC, which is being used more frequently in transactions in Europe and the U.S. In fact, in terms of inflow amounts to exchanges, USDC has surpassed USDT to become the main trading currency.

Of course, some may argue that the decline in the market capitalizations of USDT and USDC could be due to conversions into USD1 for interest. However, the changes in market capitalization here are based on user purchases and redemptions. For instance, USDC's market capitalization has decreased by nearly $8 billion in the last two months, indicating that users have redeemed $8 billion worth of USDC for USD, which is not significantly related to converting to USD1.

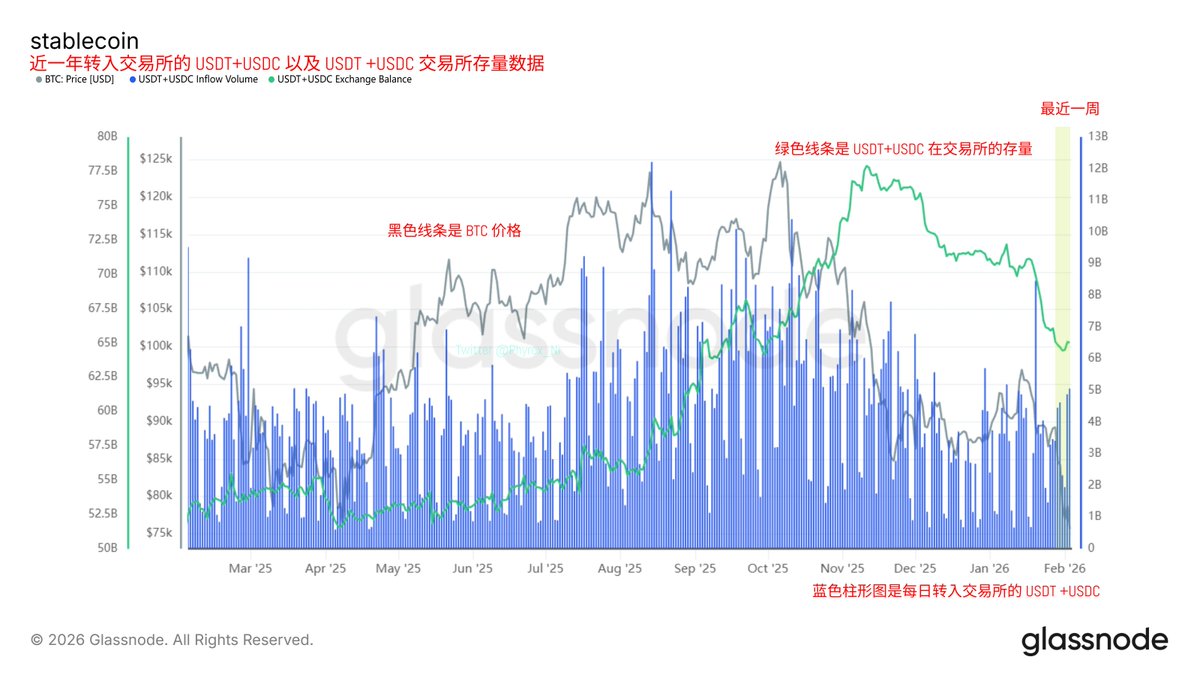

Recent Year Inflows of USDT + USDC and Exchange Inventory Data

From the data, USD1 has seen an increase of about $2.4 billion in market capitalization over the past two months. While this is indeed a good performance, it still leaves a significant gap compared to the $8 billion reduction in USDC. Not to mention, USDT has also seen a reduction of over $2 billion in market capitalization in the past month. Moreover, not only is there a decrease in market capitalization, but the inventory of USDT and USDC on exchanges is also declining.

Therefore, from the dual data verification, the purchasing power in the cryptocurrency space is gradually decreasing, and it is evident that more funds have left the cryptocurrency market. This leads to a situation where, once negative news arises, buying power falls below selling power. Previously, we used to say that there was money in the market, but now the capital in the cryptocurrency market is in decline.

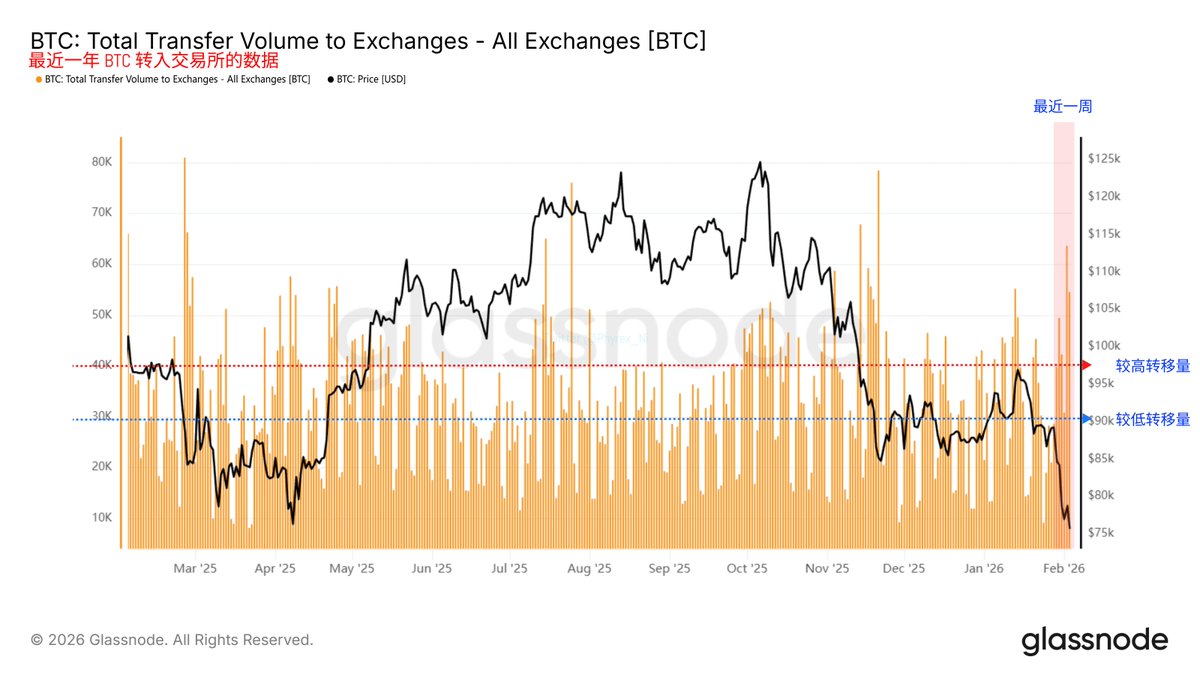

Recent Year Bitcoin Transfers to Exchanges Data

Moreover, from the recent week’s data on BTC transfers to exchanges, it can be seen that due to various negative factors converging, sell-offs are increasing. In the absence of sufficient buying power, the only option is to decline. However, as of now, there are no new issues with tariffs, the shutdown problem has ended, and although geopolitical conflicts still exist, the U.S. has started importing oil from Venezuela, so oil prices are not high. Currently, only the ongoing earnings reports may cause some market confusion.

In summary, there is still a lack of money and liquidity. Although there is still a correlation between cryptocurrencies and tech stocks, the depth of the cryptocurrency market is deteriorating. This results in U.S. stocks rising while cryptocurrencies rise less, and when U.S. stocks fall, cryptocurrencies fall even more. The only solution to this problem is to wait for monetary policy changes, specifically interest rate cuts.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。