Author: Yokiiiya

I. Introduction: The "Invisible Revolution" in the Global Payment Landscape

Over the past fifteen years, the global cross-border payment industry has undergone a profound transformation from "black box operations" to "transparent infrastructure." As the initiator and core driver of this change, Wise plc (formerly TransferWise) has not only redefined the experience of personal remittances but also attempted to reconstruct the underlying logic of global capital flows.

The story of Wise is not just about reducing exchange rate spreads; it is a grand narrative about "disintermediation." From the early P2P fund matching model to now directly accessing real-time gross settlement systems (RTGS) of various central banks, Wise is building a "Layer 0" fund network independent of the traditional SWIFT correspondent banking network. Meanwhile, with the dramatic fluctuations in the global interest rate environment, the acceleration of compliance processes for crypto assets (especially stablecoins), and the reshaping of capital market valuation logic for FinTech, Wise stands at a new strategic crossroads.

We intended to analyze in depth the complete journey of Wise from an Estonian startup to a global financial infrastructure giant, focusing on its complex "frenemy" relationship with payment giant Stripe, comparing the business model differences with core competitors like Revolut and Remitly, and conducting a quantitative risk assessment of Wise's aggressive U.S. listing plan (US Listing Pivot) in 2025, stablecoin strategic layout, and sensitivity of net interest income (NII) during a rate-cutting cycle.

II. Founding Genes and the "Skype Mafia": From Personal Pain Points to Systemic Disruption

2.1 The Dual Dilemma of Tallinn and the Birth of the P2P Model

The birth of Wise did not stem from a grand business plan but from the personal pain points of its two Estonian co-founders, Taavet Hinrikus and Kristo Käärmann. This "pain" directly shaped Wise's early radical culture of transparency and anti-bank marketing tone.

The story begins before 2011 in London and Tallinn. At that time, Taavet Hinrikus, the first employee of Skype, lived in London, but it was a company that paid salaries in euros; meanwhile, Kristo Käärmann, who had worked at Deloitte, also lived in London, receiving a salary in pounds but needing to pay a euro mortgage in Estonia.

Both faced the same structural exploitation: when they tried to make cross-border transfers through traditional banks (like Lloyd’s or Swedbank), they not only had to pay high wire transfer fees but also suffered from hidden exchange rate markups. Banks claimed "no fees," yet marked up the exchange rate by 3% to 5%, creating an information asymmetry that angered the two founders.

To avoid the banks' exploitation, they established a rudimentary "hedging system" based on Skype chat records: Taavet directly transferred euros to Kristo's account in Estonia to pay for Kristo's mortgage; in exchange, Kristo transferred an equivalent amount in pounds to Taavet's account in the UK. The funds never actually crossed borders but were exchanged through two local transfers. The agreed exchange rate was the mid-market rate displayed on Reuters, with no markup.

This simple bilateral agreement became the prototype of TransferWise's (Wise's predecessor) core business model: peer-to-peer (P2P) fund matching. The revolutionary aspect of this model is that it fundamentally eliminates the physical costs of cross-border capital flows, reducing the financial act of "remittance" to an "information matching" act.

2.2 Capital and Cultural Injection from the "Skype Mafia"

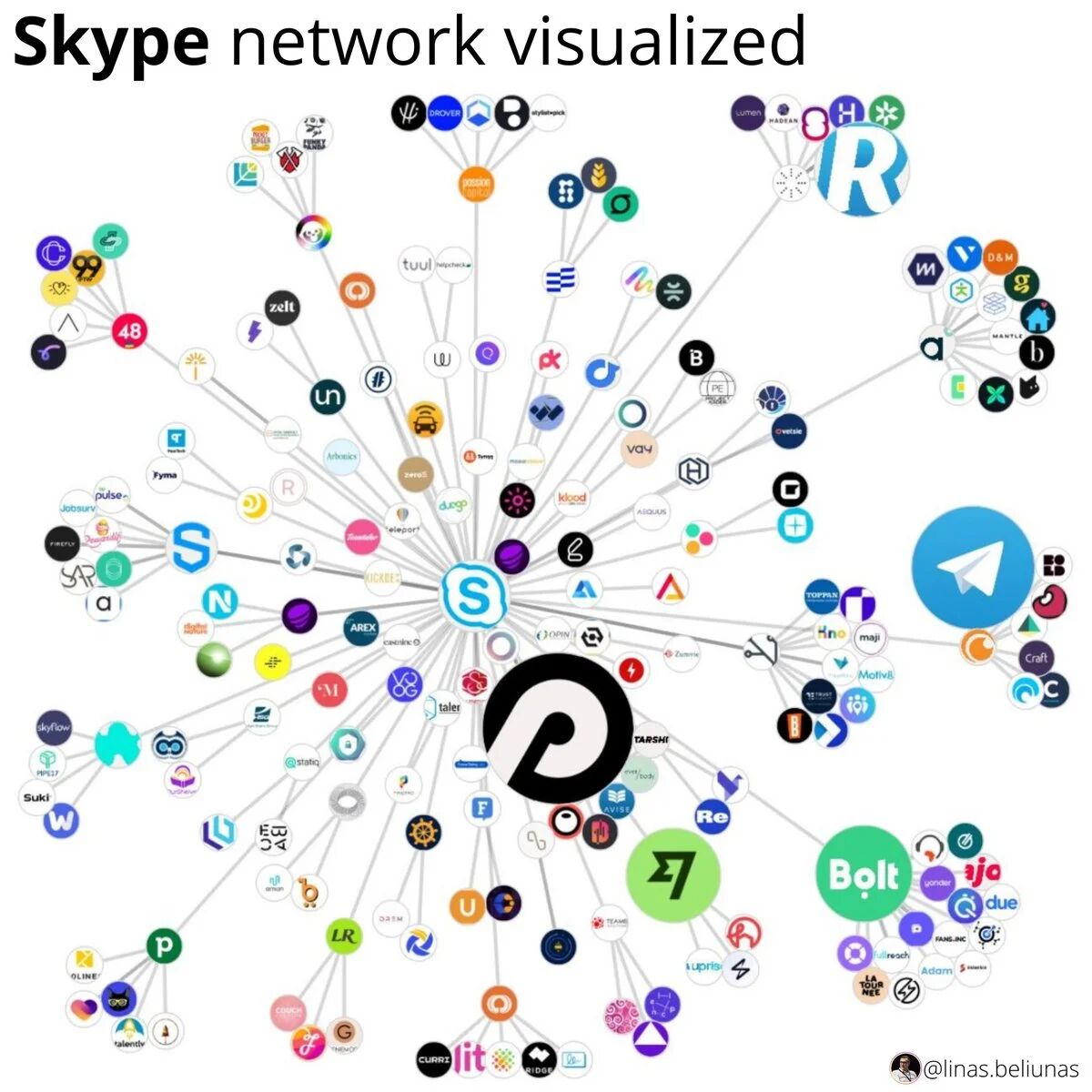

Wise's success is inseparable from the strong support of the "Skype Mafia." As a totem of the Estonian tech ecosystem, Skype not only proved that even a small city like Tallinn could produce global tech giants but also provided funding, talent, and methodologies for later entrepreneurs.

Capital Support:

The co-founders and early investors of Skype became Wise's first angel investors. This includes Valar Ventures, founded by Peter Thiel (who is also a co-founder of PayPal), whose involvement injected Silicon Valley-level ambition and a deep understanding of "network effects" into Wise. Taavet Hinrikus often mentions that Skype destroyed the "international roaming fee" business model of telecom operators, while Wise's mission is to destroy the "remittance fee" business model of banks.

Cultural Heritage:

Skype's engineering culture—reducing marginal costs to zero through technological means—was fully transplanted to Wise. This engineering mindset dominated Wise's development path: unwilling to hire a large number of customer service representatives or traders, Wise relied heavily on automated systems to handle KYC (Know Your Customer), AML (Anti-Money Laundering), and fund matching. This extreme pursuit of efficiency allowed Wise to support hundreds of billions of pounds in transaction volume at a very low labor cost later on.

Note: The "Skype Mafia" is not just an investment network; it is also an ideological alliance of "anti-monopoly." Skype fought against telecom giants, while Wise fights against the global banking industry. This gene ensures that Wise maintains a challenger posture even after going public, even resorting to aggressive marketing activities (such as the famous "bank robbery" parade) to expose the industry's hidden rules.

III. Generational Evolution of Infrastructure: From P2P Matching to Direct Central Bank Connection

Although P2P matching is the cornerstone of Wise's beginnings, as transaction volumes grew exponentially, relying solely on a "buyer-seller matching" model faced significant liquidity bottlenecks. If at any moment, the funds flowing from the UK to India far exceed those flowing from India to the UK, P2P matching would fail, leading to transaction delays. To address this issue, Wise initiated a more profound second strategic transformation around 2016: moving from the application layer down to the infrastructure layer.

3.1 Breaking the P2P Bottleneck: Establishing Proprietary Liquidity Pools

To ensure the immediacy of all transactions, Wise gradually abandoned the pure P2P waiting model and instead utilized its balance sheet to establish a global liquidity fund pool. This means Wise needs to pre-deposit a large amount of operating capital in banks around the world. When a user initiates a transfer from pounds to dollars, Wise's UK account receives pounds, while Wise's US account almost simultaneously sends dollars to the recipient. This model completely separates "fund flows" from "information flows," greatly enhancing speed.

According to data from the fiscal year 2025, Wise processed cross-border transaction volumes reaching £145 billion, with 65% of transactions completed within 20 seconds (instant arrival). This speed is entirely dependent on the pre-paid liquidity network built globally.

3.2 The Ultimate Moat: Direct Access to Central Bank Clearing Systems

Wise's most strategically significant move is its commitment to becoming one of the few non-bank financial institutions (NBFI) that can directly access central bank payment systems. Traditionally, only commercial banks can open settlement accounts at central banks, and payment companies like Wise must rely on commercial banks as intermediaries (i.e., "correspondent banks"), which not only increases costs but also subjects them to the processing speed and compliance preferences of banks.

Wise invested significant lobbying resources and technical capabilities to successfully break this barrier:

UK: In 2018, Wise became the first non-bank institution to directly access the Bank of England's real-time gross settlement system (RTGS) and fast payment system (FPS).

Hungary: In 2020, Wise obtained a direct settlement account from the Hungarian National Bank (MNB), becoming the first FinTech company in the EU to directly connect to a central bank payment system.

EU (SEPA): Wise also obtained relevant licenses from the National Bank of Belgium, achieving direct connection to the eurozone through the Single Euro Payments Area (SEPA) instant credit transfer (SCT Inst) scheme.

Global Network: As of 2025, Wise claims to have direct participation qualifications in eight domestic payment networks.

Here, we attempt to analyze the strategic significance of direct connection:

Cost Reduction to Zero: Bypassing commercial banks means Wise does not need to pay correspondent bank fees, bringing its marginal transaction costs close to zero. This explains why Wise's average fee rate (Take Rate) can continue to decline to 0.53% while maintaining a gross margin above 70%.

Speed Control: Direct access to central banks gives Wise complete control over the payment chain, eliminating concerns about fund freezes or delays due to intermediary compliance checks.

Regulatory Lobbying: Wise actively advocates for "direct access rights for non-bank institutions" to G20 and various national regulatory bodies, attempting to institutionalize this advantage. For example, in the 2025 G20 report, Wise explicitly recommends that central banks prioritize granting payment companies full operational autonomy.

3.3 Wise Platform: B2B Infrastructure Output

Based on the global fund network constructed above, Wise launched the Wise Platform, API-ifying its infrastructure and selling it to banks and large enterprises.

Customer Base: Currently includes emerging banks such as Monzo, N26, and Nubank, as well as tech giants like Google Pay and Bolt, and even traditional banks like Standard Chartered and Morgan Stanley.

Business Logic: For traditional banks, maintaining relationships with correspondent banks and local clearing interfaces in dozens of countries is costly and inefficient. By directly integrating Wise's API, banks can immediately offer customers low-cost, high-transparency cross-border remittance services. Although this sacrifices some exchange rate profit, it retains customers and reduces operational expenses.

Growth Engine: In the fiscal year 2025, while the transaction volume of Wise Platform still accounted for a smaller share compared to the consumer business, its strategic position is extremely high. Through B2B partnerships, Wise can reach tens of millions of potential end users at a very low customer acquisition cost (CAC).

IV. Wise and Stripe: From "Ecosystem Complementarity" to "Stock Game" Rivalry

The relationship between Wise and Stripe is one of the most typical "co-opetition" (Co-opetition/Frenemies) dynamics in the global fintech sector. In the early days, both occupied their own territories: Stripe monopolized acquiring, helping merchants collect payments, while Wise monopolized remittances, helping people send money. However, as both expanded their territories, the boundaries have become blurred, especially when serving global small and medium-sized businesses (SMBs) and platform clients.

4.1 Collaborative Aspect: Natural Complementarity Based on User Behavior

At this stage, Stripe remains an important "invisible role" in the Wise ecosystem. This collaboration is more based on spontaneous user behavior rather than a deep strategic alliance between the two.

Avoiding Stripe's Mandatory Currency Exchange: Freelancers, e-commerce sellers, and digital nomads around the world are a common core user group for both Wise and Stripe. One of Stripe's core business models is to charge high foreign exchange conversion fees (usually a markup of 1% - 2%) during cross-border payment settlements.

Scenario: A developer living in France uses Stripe to collect payments from a U.S. client. If he directly uses his French euro account as the Stripe receiving account, Stripe will automatically convert the dollar income into euros and deduct about 1% in exchange fees, with often unfavorable exchange rates.

Wise's Solution: Wise provides users with a local U.S. bank account (ACH routing number and account number). After entering this account in the Stripe backend, Stripe recognizes it as a local U.S. user, allowing payments to be made in dollars without currency exchange. Subsequently, users can convert dollars to euros within Wise at the mid-market exchange rate, with fees only around 0.4% - 0.5%.

Data Support: This operational model is widely recommended in Reddit and developer communities, regarded as a "must-know for digital nomads." Wise even provides detailed guidance on its official blog on how to connect Stripe to receive international payments.

4.2 Competitive Aspect: Wise Platform vs. Stripe Connect & Treasury

As Stripe launched Stripe Treasury (banking services) and cross-border payment products, and Wise introduced Wise Platform for large enterprises, the competition between the two has intensified. Both are vying for control over "fund distribution" (Payouts) and "fund management" (Treasury).

Direct Conflict in Pricing and Business Models

One of Stripe's core profit sources is the foreign exchange conversion fee (FX Conversion Fee), which is a high-margin zone in its business model. Wise's existence (providing mid-market rates) directly attacks this profit center of Stripe.

Wise is effectively educating users through transparency, stripping away Stripe's hidden exchange rate profits. This is the root of the rivalry: the "transparent infrastructure" represented by Wise versus the "packaged premium services" represented by Stripe, which leads to essential conflicts in business ethics and profit distribution.

Although Wise is currently also a partner of Stripe (for example, Wise-issued debit cards may use Stripe's processing services in certain aspects, and vice versa), the two are in direct confrontation when competing for B2B platform clients (such as Deel, Remote, and other payroll payment platforms).

V. Competitive Landscape Analysis: Revolut, Remitly, and Traditional Banks

Wise's competitors have long surpassed early players like Western Union and now face multidimensional pressure from super apps and vertical giants.

5.1 Revolut: The All-Out War of Super Apps

Revolut is Wise's most direct and aggressive competitor, both originating from Europe with similar user bases but choosing entirely different expansion paths.

Differences in Business Models:

Wise (Specialist): Focuses on vertical fields. The core remains "cross-border mobile funds." Although it has launched asset features, it still revolves around payments, emphasizing stability and profitability.

Revolut (Generalist/Superapp): A financial super app. It not only does remittances but also cryptocurrency trading, stock investments, insurance, and even travel bookings. Revolut tends to acquire customers through high-frequency lifestyle features and then monetize through subscription models (Premium/Metal).

Comparison of Pricing Strategies:

Revolut: Adopts a "conditional free" strategy. It offers no markup exchange rates on weekdays but charges a 1% markup on weekends (when the foreign exchange market is closed) to mitigate risk. Additionally, standard accounts have a monthly exchange limit (e.g., $1000/month), with a 0.5% fee for amounts exceeding this limit.

Wise: Always adheres to mid-market rates but charges transparent fees for each transaction. For large transfers or urgent needs on weekends, Wise's cost structure is more predictable, with no hidden traps.

B2B Battlefield:

Revolut Business is also actively expanding, offering multi-currency cards and expense management, directly competing with Wise Business. Wise's advantage lies in the localization depth of its global accounts (more local receiving accounts), while Revolut's advantage is in the software experience of card issuance and corporate expense management.

5.2 Remitly: The Sniper in the Immigrant Remittance Market

Positioning: Remitly focuses on personal remittances (C2C) from "developed countries to developing countries," particularly targeting blue-collar immigrant groups (e.g., from the U.S. to Mexico, the Philippines, and India).

Strategy: Remitly still adopts the traditional "exchange rate markup" model (though cheaper than Western Union) and does not promise mid-market rates. Its core competitiveness lies in deep localization for specific remittance corridors, such as supporting cash pickups and mobile money, which is crucial for recipient countries with low bank account penetration.

Comparison: Wise dominates the B2B and white-collar/digital nomad/student markets (Account-to-Account), but in the pure labor immigrant remittance market, Wise's penetration is lower than Remitly due to a lack of cash distribution networks.

5.3 Traditional Banks' Counterattack: SWIFT gpi and Swift Go

Traditional banks have not remained idle. SWIFT has launched SWIFT Go, aiming to provide speed and predictability similar to Wise for small and medium-sized payments. However, since it still relies on correspondent banking chains, banks find it difficult to compete with Wise, which has direct access to central bank channels, in terms of cost structure. Banks need to maintain large compliance teams and legacy systems, which makes their "bottom line" much higher than Wise's.

VI. Financial Structure and Macroeconomic Risks: Interest Rate Sensitivity and Valuation Dilemmas

6.1 Overview of Financial Performance for Fiscal Years 2025-2026

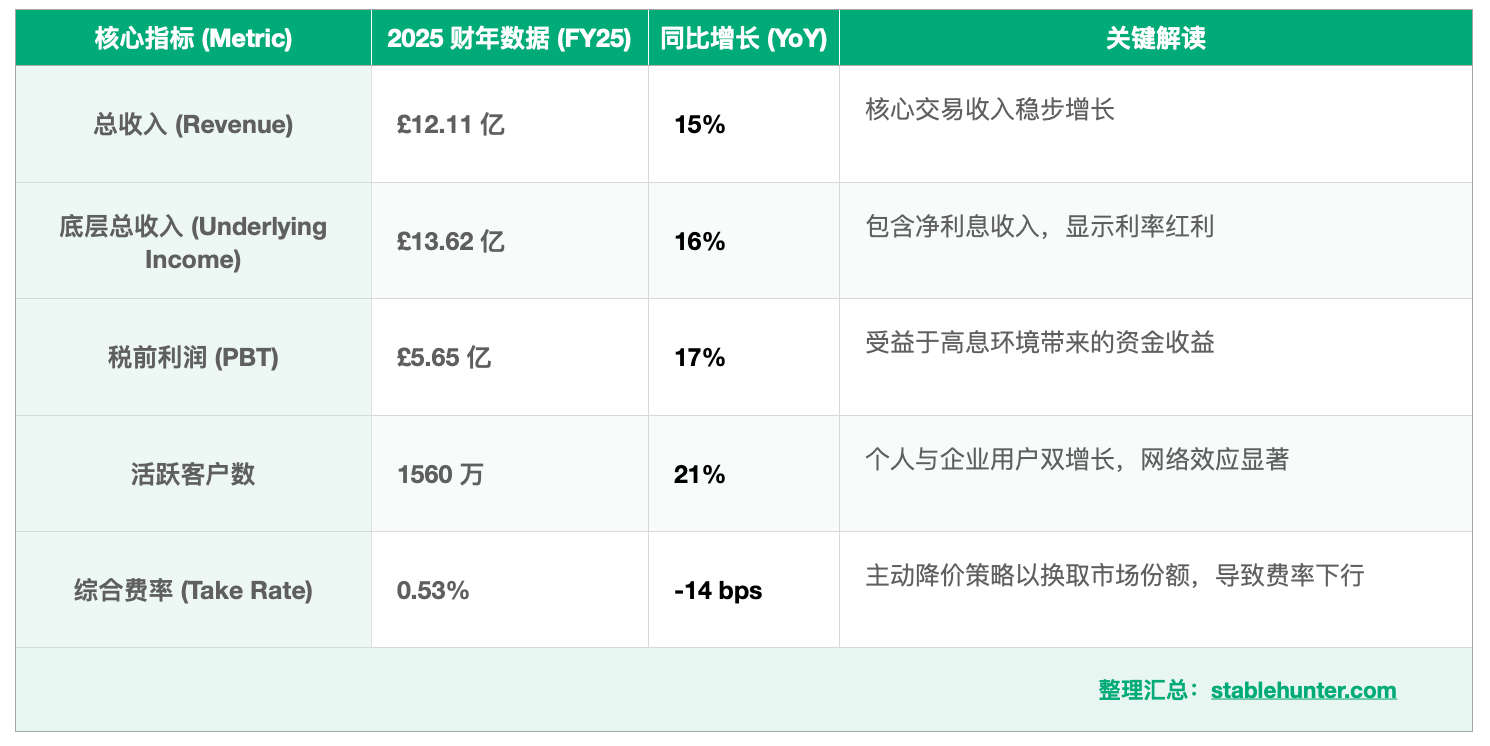

According to data from the fiscal year 2025 and the first quarter of 2026, Wise has demonstrated strong growth resilience but also faces structural adjustments in profit margins.

6.2 Net Interest Income (NII) Traps and Risks of Rate-Cutting Cycles

The global high-interest rate environment from 2023 to 2025 has brought Wise a significant "windfall." Since Wise holds tens of billions of pounds in customer floats, these funds are primarily deposited in high-credit-rated government bonds or central bank accounts.

Revenue Dependency: In the fiscal year 2025, interest income above the first 1% yield reached £444 million. This portion of income contributed to the vast majority of profit growth, masking potential pressures on the profit margins of core transaction businesses.

Sensitivity Analysis: As the Federal Reserve (Fed) and the European Central Bank (ECB) enter a rate-cutting cycle in 2025-2026, Wise faces significant downward pressure on profitability. According to Wise's annual report, for every 100 basis points (1%) decrease in interest rates, its annual net interest income will decrease by approximately £141 million. This represents a substantial exposure.

Strategic Hedging: To address this risk, Wise actively promotes Wise Interest (Assets) products, encouraging users to invest idle funds in money market funds (MMF) or stock indices. Through this approach, Wise aims to convert uncertain interest income into certain asset management fee income (Platform fees), attempting to smooth the impact of interest rate fluctuations on the company's P&L.

The market's valuation of Wise over the past two years has included expectations of high NII. The fact that operating profit in H1 of the fiscal year 2026 has decreased by 15% has sounded the alarm: Wise must prove that the growth rate of its core transaction business (non-interest income) can outpace the rate of interest decline, or it will face a valuation re-evaluation (De-rating).

VII. The Capital Market Chess Game: The US Listing and Governance Storm (The US Listing Pivot)

In 2025, Wise initiated plans to move its primary listing from the London Stock Exchange (LSE) to a US exchange (expected to be Nasdaq or NYSE), while retaining a secondary listing on the LSE. This move shocked the City of London and was seen as a significant setback for the UK tech sector.

7.1 Motivation: Valuation Gap

The core motivation for Wise's departure from London is valuation arbitrage.

Market Preference Differences: The US market has a more mature understanding and higher valuation multiple tolerance for high-growth FinTech companies (such as Affirm, Block, PayPal). In contrast, LSE investors prefer traditional, dividend-stable blue-chip stocks (such as banks and energy).

Liquidity and Capital Depth: The US market has the deepest capital pools and the most active trading liquidity for tech stocks in the world. Wise's management believes that being listed on the LSE limits the company's valuation potential, leading to its price-to-earnings (P/E) ratio being consistently lower than that of similar companies in the US.

7.2 Controversial Focus: Extension of Dual-Class Share Structure

To go public in the US, Wise's board proposed a highly controversial measure: to extend the dual-class share structure, which was supposed to expire five years after the 2026 listing, to 2036.

Control Solidification: Under this structure, Class B shares have super voting rights (9 votes per share). This means that co-founder Kristo Käärmann, despite holding only about 18% of the economic interest, can control about 50% of the voting rights through Class B shares, effectively having absolute control over the company.

Co-Founder Split: This proposal sparked public opposition from Wise's other co-founder, Taavet Hinrikus. Taavet issued a statement through his investment company, Skaala Investments, accusing the proposal of being "management entrenchment," which severely violates shareholder democracy and the transparency values that Wise promotes. He believes that the US listing and the extension of voting rights should not be bundled for voting.

7.3 Kristo Käärmann's Compliance Shadow

Adding to governance concerns is CEO Kristo Käärmann's personal tax compliance issues. In 2021, he was placed on the "deliberate defaulters" list by HMRC for failing to declare capital gains tax on a share sale in 2017 and was fined £365,651. In 2024-2025, the FCA concluded its long-term investigation into him and imposed a £350,000 fine on him personally.

Although the FCA ultimately did not find him to be lacking in integrity, allowing him to retain his CEO position, this is a significant blemish in the highly regulated financial industry. Taavet's deep-seated reason for opposing the extension of Kristo's super voting rights may stem from concerns about compliance risks under such a "one-person dominance" governance structure.

Despite the significant controversy, the proposal was ultimately approved at the shareholders' meeting in July 2025, indicating that institutional investors' desire to enhance valuation (through a US listing) outweighed concerns about governance structure flaws.

VIII. Embracing Digital Assets and Stablecoin Strategy

For a long time, Wise held a conservative or even exclusionary attitude towards cryptocurrencies, explicitly prohibiting users from using Wise accounts for cryptocurrency-related transfers. However, in the face of the dramatic changes in the global payment landscape in 2025, Wise's attitude underwent a 180-degree strategic turnaround.

8.1 The Rise and Threat of Stablecoins

With the passage of the US GENIUS Act and the implementation of the EU MiCA regulations, stablecoins (especially USDC) are rapidly becoming compliant and starting to take on the role of "instant settlement layer" for cross-border payments. Visa, Mastercard, and Stripe have all deeply integrated USDC settlements.

The real risk of a dimensional reduction is: if stablecoins become a globally accepted "intermediate currency," Wise's hard-built fiat central bank direct connection network may be bypassed. This is because sending USDC via blockchain is extremely low-cost and operates around the clock, directly threatening Wise's core value proposition.

8.2 Recruitment and Strategic Shift

At the end of 2025, Wise announced a job opening for a "Product Lead - Digital Assets" in London, which is a very clear signal.

The job description leaked the secret: the position explicitly requires candidates to have experience in "building wallets and payment solutions based on stablecoins" and to be responsible for "allowing users to hold and use digital assets in their Wise accounts."

Potential Product Form: This means that Wise is likely to allow users to hold USDC just like they hold pounds or dollars in the near future. Wise may utilize its existing fiat network as an "on/off ramp" for USDC, thereby integrating the advantages of fiat networks with blockchain networks.

Wise's future depends on its ability to successfully complete this "self-disruption." If in the past 15 years Wise was building roads (establishing fiat direct connection channels), then in the next 10 years, Wise must learn how to transmit value in the cloud (blockchain). A US listing will provide ample ammunition, but Kristo Käärmann must prove that he is still the captain capable of leading Wise to challenge the trillion-dollar market under the triple pressure of compliance governance, interest rate headwinds, and technological change.

References and Data Source Index

1: Wise's historical background, the origins of the Skype mafia, and the early P2P model.

2: Infrastructure transformation, central bank direct connection details, and B2B platform data.

3: The co-opetition relationship between Stripe and Wise, pricing comparisons, and user behavior analysis.

4: Competitive analysis of Revolut and Remitly.

5: Fiscal year 2025/26 financial data, interest rate sensitivity analysis, and asset products.

6: US listing plans, dual-class share structure controversy, and Taavet Hinrikus's statement.

7: Kristo Käärmann's tax fines and FCA investigation details.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。