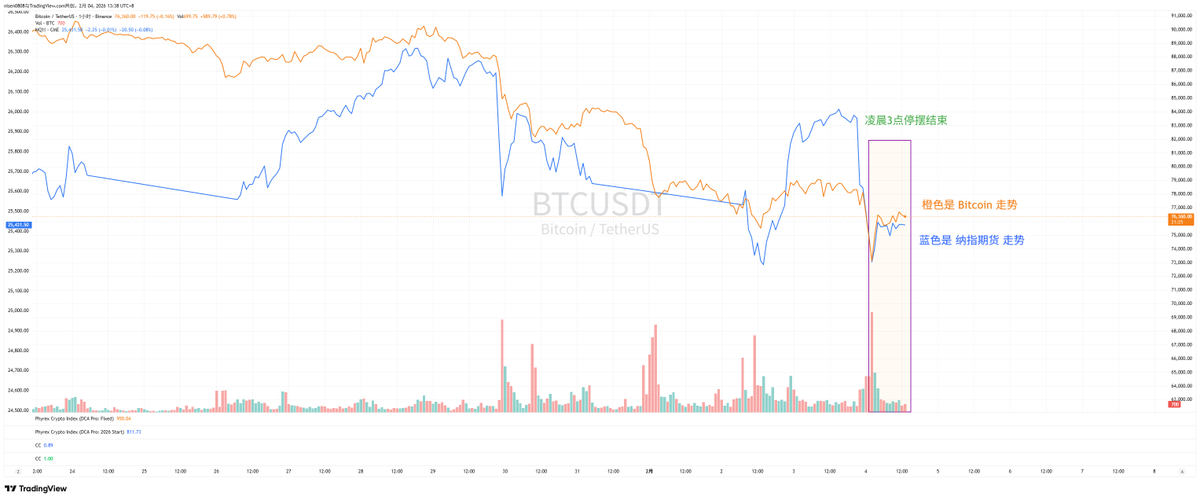

The past two days have been as busy as a dog, life is not easy. From the current situation, the end of the U.S. government shutdown has indeed warmed up the market. Around 3 a.m., after the shutdown completely ended, the U.S. stock market began to rebound, and Bitcoin also showed a rebound. From the hourly K-line trend, it can be seen that the Nasdaq index and $BTC have a high degree of synchronization, which indicates that the judgment made during the early hours was correct.

Currently, there are not many bearish factors left to face. There may still be geopolitical conflicts between Iran and the U.S., but these should be quickly digested by the market. Iran mainly affects oil prices, but now that the U.S. has obtained oil from Venezuela, there hasn't been much change in oil prices. Therefore, I personally believe that in the short term, there are no obvious bearish factors.

Next is the market game. Of course, the absence of obvious bearish factors does not mean that prices will definitely rise; it mainly means that the information that previously led to the decline is now almost nonexistent. The emotional and financial aspects still need to be assessed with more data.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。