In early 2026, the global gold market kicked off with a jaw-dropping "roller coaster" trend. After hitting a historic high, gold prices plummeted dramatically, leading the market to exclaim "bubble burst." However, amidst the clamor, mainstream institutions on Wall Street unanimously stated: the foundation of the bull market remains unshaken, and the current fluctuations are merely a "healthy adjustment." More critically, a sustained purchasing power from the East—Chinese investors—has emerged with unprecedented strength, becoming an indispensable "stabilizing force" in the global gold market.

1. Extreme Volatility: A Technical "Healthy Liquidation"

● Historic Surge and Lightning Reversal

○ At the beginning of 2026, spot gold prices experienced a frenzy, skyrocketing from around $4,300/ounce to a historic peak of $5,600/ounce within just a few weeks.

○ However, the upward trend did not last, as gold prices soon faced a cliff-like drop, quickly retreating below $4,500/ounce, with daily declines exceeding 10% multiple times, spreading panic in the market.

● Wall Street Consensus: Not a Fundamental Reversal, but Position Liquidation

○ In the face of extreme volatility, Wall Street giants like Barclays, UBS, and Deutsche Bank did not turn bearish. They generally believe that this sharp decline is not due to a change in the fundamental drivers of the gold bull market, but rather a result of the internal technical structure of the market.

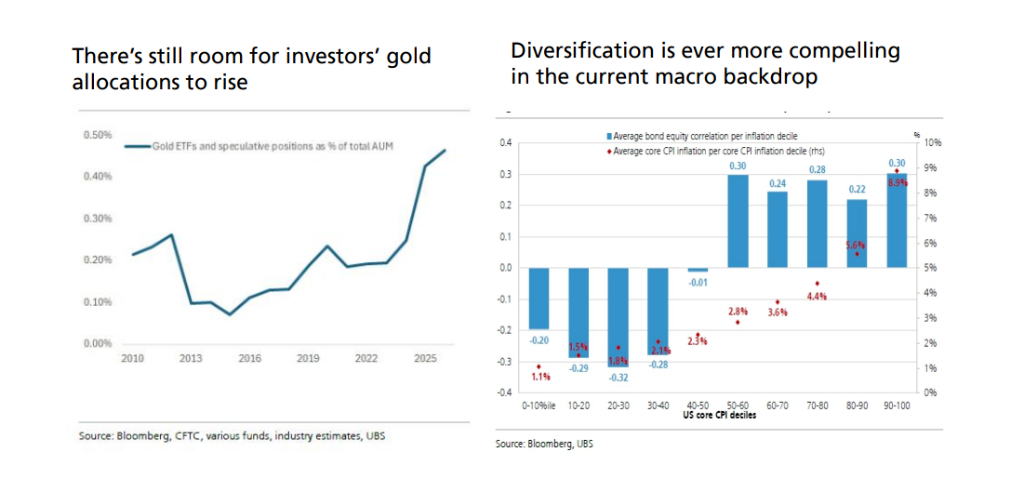

○ Overcrowded Speculative Positions: The previous one-sided surge in gold prices had accumulated a massive short-term speculative long position, putting the market in an "extremely crowded" state. Once some profit-taking began, it easily triggered a chain reaction of selling and panic, amplifying price volatility.

○ Premium Returning to Reasonable Range: Barclays analysis pointed out that although gold prices have retreated from their peak, their trading price remains above the fair value model estimate of around $4,000/ounce. However, after falling to around $4,900, the previously high premium has returned to a relatively reasonable statistical standard deviation. This pullback is seen as a "healthy liquidation" of overly optimistic sentiment, laying the foundation for the market's subsequent healthy development.

2. Bull Market Foundation: The Macro Narrative is Far from Over

Despite the significant price pullback, the macro backdrop supporting a long-term bull run in gold has not fundamentally reversed, and in some aspects, it has even strengthened.

● "Fiscal Dominance" and Concerns Over Fiat Currency Credit

○ The persistently high U.S. government debt and expansionary fiscal policy tendencies have raised deep concerns in the market about "fiscal dominance." In this context, the independence of monetary policy may be compromised, long-term inflation risks are rising, directly undermining the credit quality of the dollar and U.S. Treasuries.

○ Investor fears of long-term depreciation of fiat currency purchasing power are one of the core drivers pushing funds toward gold, a non-credit asset. This structural concern is particularly strong during periods of high policy uncertainty.

● Geopolitical and "De-risking" Reserve Demand

○ The global geopolitical landscape remains tense, with a trend of fragmentation in trade and financial systems. Central banks' demands for asset safety and "strategic autonomy" have surged unprecedentedly.

○ Following the freezing risks faced by some countries' foreign exchange reserves, gold, as the ultimate reserve asset not bound by any country's credit, has increasingly highlighted its strategic importance. Central bank gold purchases have shifted from mere asset diversification to a more "survival-driven" demand based on security and sovereignty considerations.

● Enhanced "Immunity" of Real Interest Rates

○ Recently, the gold market has shown an important change: its sensitivity to expectations of U.S. Federal Reserve interest rate hikes and rising U.S. real interest rates seems to have decreased. This indicates that the main logic driving gold prices is shifting from the traditional "interest rate-opportunity cost" model to a broader "credit hedge" and "risk aversion" model.

3. Eastern Pillar: The Structural Rise of Chinese Buyers

In this round of the gold market, the most notable change is the role of Chinese investors shifting from "important participants" to "key pillars."

● Investment Demand Surges Against Weak Consumption

○ Traditionally, high gold prices suppress physical consumption, primarily jewelry. This was indeed the case at the beginning of 2026, as domestic gold and jewelry consumption in China showed seasonal slowdown.

○ However, investment demand has surged explosively. Sales of gold bars, coins, and the subscription of gold ETFs have been exceptionally robust, completely offsetting and surpassing the weakness in jewelry consumption. This indicates that Chinese investors' perception of gold is profoundly shifting from "consumer goods" to "financial safe-haven assets."

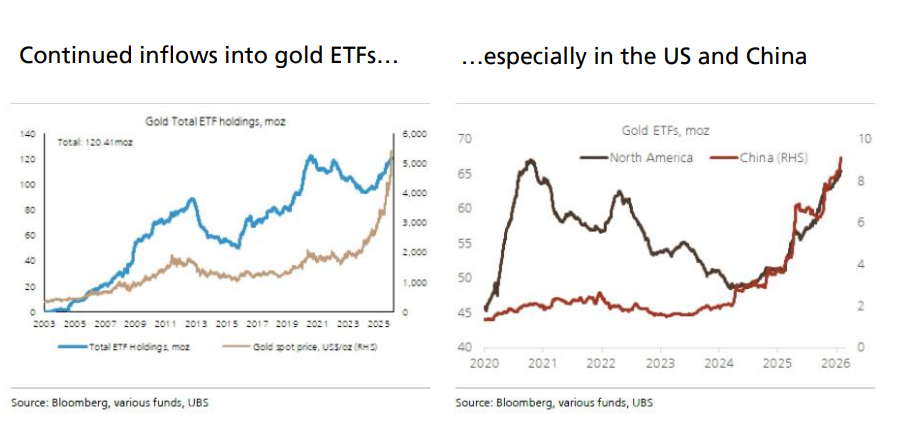

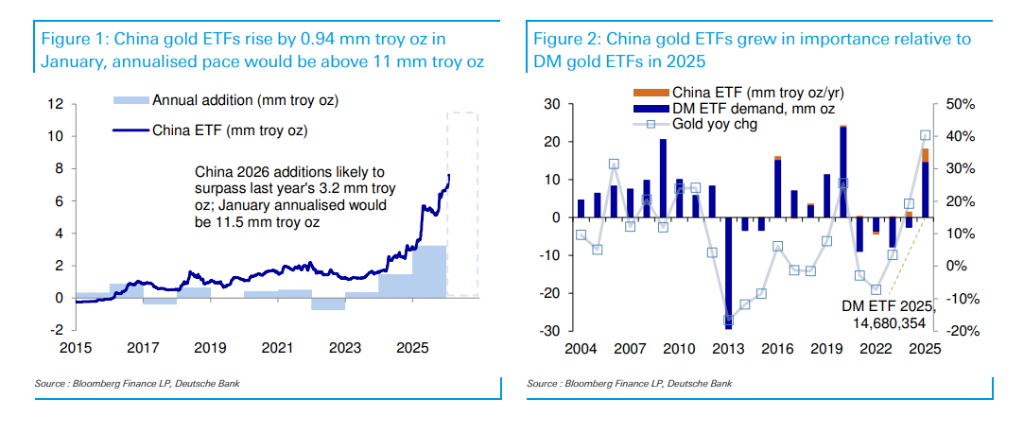

● Record-Breaking Gold ETF Purchases

○ A Deutsche Bank report revealed a key statistic: In January 2026 alone, the increase in Chinese gold ETFs reached approximately 940,000 ounces. If this pace continues, the annual increase could reach an astonishing 11.5 million ounces.

○ In comparison, the total increase in Chinese gold ETFs for the entire year of 2025 was only 3.24 million ounces, setting a historical record at that time. This means that the current buying intensity of Chinese investors may be more than three times that of last year. China has become the main contributor to global gold ETF inflows.

● "Buy More as Prices Rise" Asset Allocation Logic

○ UBS research found that bullish sentiment towards gold in the Chinese market is at a multi-year high. Unlike the previous "buy high, not buy low" consumer psychology, this time there is a clear investment characteristic of "buy more as prices rise."

○ This reflects a profound asset preservation demand among domestic investors: amid adjustments in the real estate market, significant stock market volatility, and a complex external environment for the internationalization of the renminbi, gold has become an important tool for hedging domestic economic uncertainty, asset rotation, and wealth preservation. Strong offshore asset allocation and risk aversion demands are flowing into the gold market through legal channels.

● Silver Market's Linked Signals

○ The enthusiasm of Chinese investors is not limited to gold. Due to relatively limited high-quality investment channels domestically, some funds have even flowed into silver.

○ For example, a domestic silver futures fund saw an astonishing premium of over 60% from the end of 2025 to early 2026, and even after regulatory risk warnings, the premium rate remained high. This indirectly confirms the overall popularity of precious metals in the Chinese investment field.

4. Market Outlook: After the Adjustment, the Path Ahead Still Shines Bright

Based on the above analysis, Wall Street institutions maintain a cautiously optimistic attitude towards the future of gold.

● Short-Term Support and Target Price Levels

○ Technical Support: Institutions like UBS point out that the $4,500/ounce area is an important technical support level. The recent rapid rebound of gold prices from low levels to above $4,900 also confirms the strong buying power in this area.

○ Long-Term Target: Deutsche Bank firmly maintains its long-term target price of $6,000/ounce. They believe that the thematic factors driving gold's rise remain intact, and the current pullback provides a more attractive opportunity for long-term investors to build or increase positions.

● Diverse Demand Drivers Continue

○ Institutionalization of Central Bank Demand: The gold purchasing behavior of global official sectors is expected to normalize. For example, the Polish central bank plans to significantly increase the proportion of gold reserves; the South Korean central bank is also considering restarting gold purchases. This provides continuous and stable "bottom buying" for the gold market.

○ Western Investment Positions Still Light: UBS points out that despite the significant rise in gold prices, many large institutional investors in the West still have gold allocation ratios at historically low levels. Once gold prices end their sharp adjustments and the trend becomes clear again, this potential allocation demand may become an important force driving the next wave of increases.

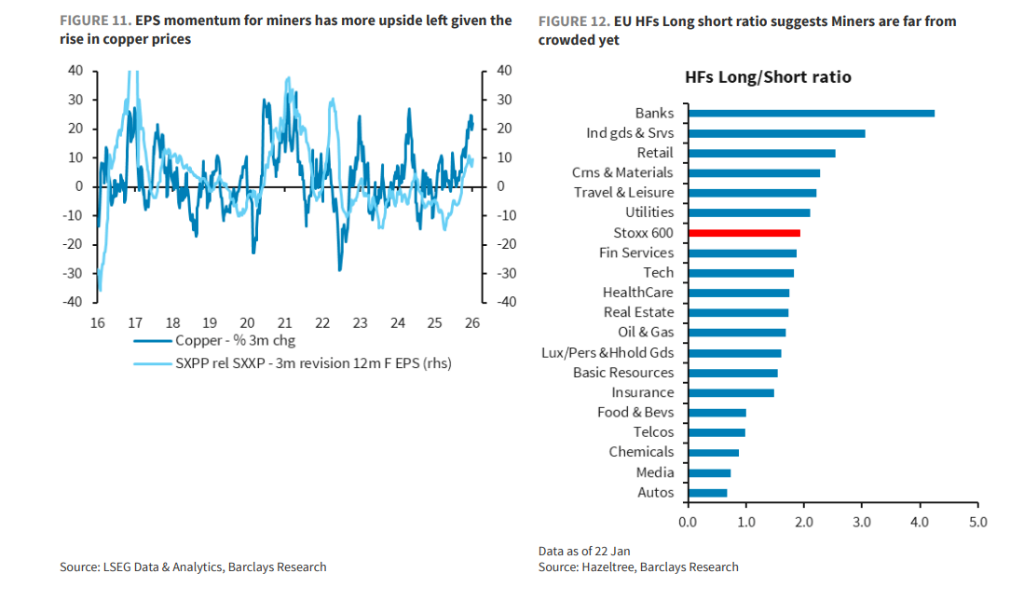

● Opportunities for Mining Stocks to Catch Up

○ Banks like Barclays indicate that during gold bull market cycles, gold mining stocks often exhibit greater price elasticity. Currently, mining companies' stock price increases may not fully reflect the expected future earnings per share (EPS) growth brought about by high gold prices. Once gold prices end their adjustments and resume their upward trend, mining stocks are expected to experience significant retaliatory catch-up rallies, providing investors with another high-beta investment option besides physical gold and ETFs.

The massive tremor in the gold market at the beginning of 2026 can be seen not so much as the beginning of a crisis, but rather as a pressure test under extreme emotions and crowded trading. The test results indicate that the macro foundations behind the gold bull market—doubts about fiat currency credit, geopolitical risks, and the rebalancing of global asset allocation—remain solid.

More importantly, there has been a profound change in market structure: Chinese investors have entered the gold market with unprecedented intensity and sustainability, building a solid "Eastern defense line" for global gold prices from the demand side. Their behavioral patterns have shifted from traditional consumption-driven to asset preservation and risk-averse financial investment, which will become a key variable influencing gold pricing in the coming years.

Overall, the long-term upward narrative for gold has not been broken. The current fluctuations and adjustments are accumulating strength for the next phase of the journey. In a globally uncertain macro landscape, the unique value of gold as a "non-credit" anchor continues to shine. For investors, the market's "pause for thought" may be an excellent opportunity to reassess their asset allocation and position themselves for this "certainty."

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。