In the early hours of today, Beijing time, the blockchain data tracking organization Onchain Lens captured an on-chain movement that has drawn significant market attention.

A related address under BlackRock, the world's largest asset management giant, deposited 1,134.13 Bitcoin (BTC) and 35,358 Ethereum (ETH) into Coinbase, the largest cryptocurrency exchange in the United States. At the time of the deposit, the total value of this batch of cryptocurrencies was approximately $1.69 billion.

1. Event Focus: An Unusual Massive Transfer

This is not an ordinary transfer between wallets. BlackRock, a traditional financial "giant" managing over $10 trillion in assets, is seen as a bellwether for institutional trends.

● Notably, the scale of this deposit is enormous and flows directly into a centralized exchange's "hot wallet." In the trading logic of the crypto market, transferring assets from a custody wallet or cold storage to an exchange is typically interpreted as a potential prelude to selling or preparation for large trades, sending a strong signal to the market.

● BlackRock's connection to cryptocurrencies has become increasingly close since 2023. It is not only an active applicant and issuer of the first U.S. spot Bitcoin ETFs (under its iShares Bitcoin Trust, IBIT) but is also actively exploring cutting-edge areas such as tokenized funds and Ethereum ETFs.

● This large-scale transfer occurred at a sensitive moment when the crypto market had experienced several days of decline, and market sentiment had turned cautious. Its intent and impact go far beyond a single transaction, revealing deeper institutional power dynamics behind the current market adjustment.

2. Market Overview: Multiple Pressures Resonating Amid Decline

Before and after the news of BlackRock's asset transfer was disclosed, the cryptocurrency market was undergoing a significant correction. Bitcoin's price has been continuously declining from a high of $70,000, briefly falling below the critical support level of $65,000; Ethereum and other mainstream altcoins have also been under pressure, with the total market capitalization shrinking significantly. This round of decline is not driven by a single factor but is the result of multiple pressures resonating:

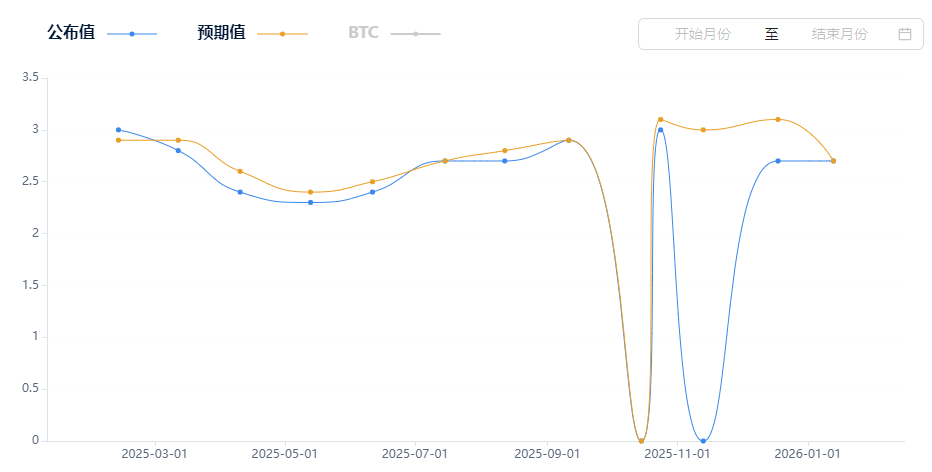

- Tightening macro liquidity expectations: Recent U.S. inflation data (CPI, PCE) has consistently exceeded expectations, indicating that the "last mile" of anti-inflation efforts is exceptionally challenging.

● Federal Reserve officials have made a series of hawkish statements, significantly cooling market expectations for interest rate cuts this year, and even starting to discuss the possibility of further rate hikes.

● High interest rate environment persists, directly diminishing the appeal of high-risk assets like cryptocurrencies, leading to a more cautious global capital flow.

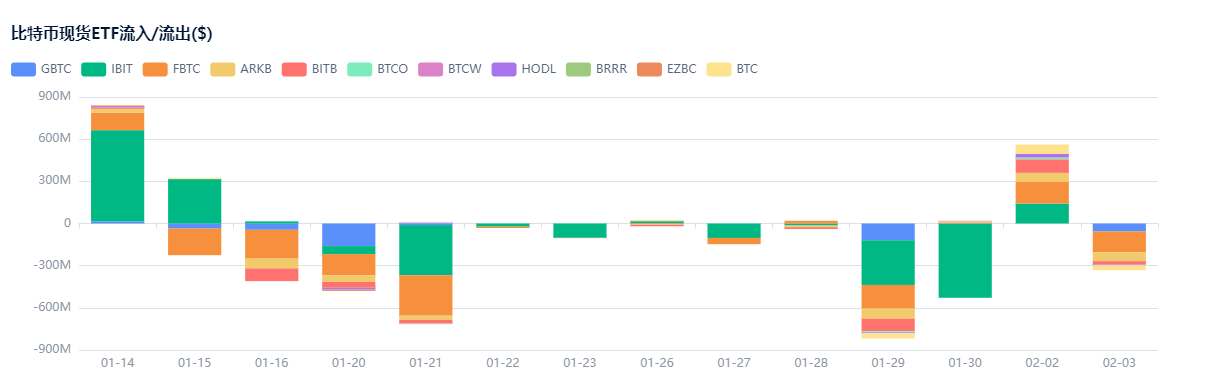

- Volatility in spot Bitcoin ETF fund inflows: As a core narrative leading the bull market in 2024, the fund flows of U.S. spot Bitcoin ETFs have become a barometer of market sentiment.

● After experiencing several months of record net inflows, recent data has begun to show significant daily net outflows or a sharp slowdown in inflows. While BlackRock's IBIT remains strong, the overall weakening of ETF buying power has diminished direct market support.

Geopolitical tensions and rising risk aversion: Escalating geopolitical conflicts in the Middle East and elsewhere have strengthened traditional safe-haven assets like gold and the U.S. dollar, putting pressure on risk assets. The correlation between the cryptocurrency market and traditional financial markets has increased, making it difficult for the crypto market to remain insulated.

Technical selling pressure and leveraged liquidations: After a rapid rise, the market accumulated a large number of profit-taking positions. When prices fell below critical technical levels, it triggered programmatic trading and stop-loss sell orders, while the cascading liquidation of high-leverage long positions further amplified the decline, creating a "downward-liquidation-further decline" negative feedback loop.

3. In-Depth Analysis: Multidimensional Interpretation of BlackRock's "Deposit" Behavior

In this complex context, BlackRock's massive transfer action provides an excellent lens to observe the evolution of institutional strategies. Market analysis of its motives mainly focuses on the following aspects:

1. Liquidity management and operational maneuvers:

● Preparing for ETF redemptions? As the manager of a spot Bitcoin ETF, BlackRock needs to ensure sufficient liquidity to respond to potential investor redemption requests. Transferring some BTC from custody addresses to addresses closely connected to exchanges is one of the standard processes to enhance operational flexibility and efficiency, especially during periods of increased market volatility and potential redemption demand.

● Rebalancing or collateral operations? BlackRock may be rebalancing its internal investment portfolio or preparing assets for other financial operations (such as collateralized lending). For institutions holding massive assets, such on-chain movements of this scale may be part of their routine asset management.

2. Potential supply shock in the spot market:

● Direct selling signal? Depositing assets into an exchange is the easiest step for selling in the spot market. If BlackRock or its institutional clients decide to take profits or reduce exposure to crypto assets, this action will directly increase market selling pressure. Even if not all assets are ultimately sold, the act itself influences market psychology.

● Preliminary step for over-the-counter (OTC) trading? Large institutional block trades are often completed through OTC desks, but preemptively transferring assets to exchange-associated addresses is a common preparation for final settlement. This may lay the groundwork for one or more large OTC trades.

3. Strategic layout and product evolution:

● Paving the way for Ethereum ETFs? The deposited assets include approximately $800 million worth of ETH, which is particularly striking. Currently, BlackRock and several other institutions are actively applying for U.S. spot Ethereum ETFs. Although regulatory approval has not yet been granted, preemptively reserving and mobilizing ETH may be a practical exercise and resource allocation for future product creation, market making, or operations.

● Exploring tokenized real-world assets (RWA)? BlackRock has been an advocate for RWA tokenization. Large-scale operations involving ETH may relate to its efforts to build or test related financial products on the Ethereum network, such as tokenizing fund shares.

4. Signal significance and market psychological warfare:

● Testing market depth and reactions: Transactions by giants like BlackRock inherently affect the market. It may use this opportunity to observe the market's capacity and reaction within specific price ranges, collecting data for subsequent larger-scale strategic deployments.

● Influencing pricing and volatility: Public on-chain data is transparent. BlackRock may be well aware that its actions will be tracked and interpreted, making this a way to interact and compete with other market participants (such as hedge funds and market makers), indirectly influencing short-term price trends and volatility expectations.

4. Trend Outlook: Challenges and Opportunities in the Institutional Deep Water Zone

BlackRock's operation is a vivid footnote to the cryptocurrency market's entry into a "deep institutionalization" phase. Future market fluctuations will increasingly reflect the internal decisions, risk management, and responses to the macro environment of traditional financial giants.

Changes in volatility structure: Institutional participation has not eliminated volatility but may have altered the structure and causes of volatility. The market will more closely track ETF fund flows, macroeconomic data, regulatory dynamics, and on-chain footprints of key institutions like BlackRock.

The double-edged sword of compliance and operational transparency: Under a compliance framework, institutional operations (especially those involving exchanges) will leave more public or traceable footprints. This increases market transparency but also makes large transactions' impact on market sentiment more direct and rapid.

Shift in narrative dominance: The market narrative is shifting from simple "halving" and "meme coin frenzy" to more complex financial engineering narratives such as "institutional allocation ratios," "ETF approvals and inflows," and "government bond yields and crypto asset correlations." Understanding the rules of the traditional financial game has become crucial.

Divergence between long-term confidence and short-term volatility: The long-term strategies of giants like BlackRock indicate that their confidence in crypto assets as an asset class remains unchanged. However, in the short term, they will also make tactical position adjustments, risk management, and even swing trading as rational economic agents, which will inevitably exacerbate short-term market volatility and uncertainty.

BlackRock's deposit of a massive amount of cryptocurrency into Coinbase is like a stone thrown into a calm lake, with its ripples revealing the turbulent undercurrents beneath the surface—reallocating and competing institutional funds amid macroeconomic changes, regulatory evolution, and strategic needs.

The current market decline is the result of a combination of changing liquidity expectations, technical adjustments, geopolitical risks, and shifts in institutional behavior. BlackRock's actions are not the sole cause of the decline, but they are undoubtedly a key piece of the puzzle, reminding the market that as the crypto world embraces traditional financial giants, it must also accept the more complex and intense patterns of capital flow and price discovery they bring.

For ordinary investors, in an increasingly institutionally dominated market, relying solely on historical cycle models or community narratives may no longer be sufficient. It is essential to pay attention to the global macro interest rate path, the policy direction of regulatory agencies, and the subtle changes in major institutions' holdings and on-chain behaviors. The winds of change often begin with seemingly ordinary position adjustments. The market is holding its breath, waiting to see whether this $1.69 billion transfer is a prelude to a storm or a routine course adjustment during deep-water navigation.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。