Written by: Thejaswini M A

Translated by: Block unicorn

I have always wanted to slowly read "The Bitcoin Standard" from start to finish to see how it would influence my thinking. It often comes up in many Bitcoin discussions, hailed as a foundational work. People say, "As Saifedean explains…" and then you realize that everything they are quoting is based on a meme or a cover screenshot.

So, I will read this book in three parts. This is the first part.

We are still in the early chapters and have not yet entered the comprehensive critique phase of "fiat currency has ruined everything, from architecture to waistlines." Currently, Saifedean Ammous is laying the groundwork, trying to convince you that money is a technology, that certain forms of money are "harder" than others, and that history is essentially a process of continuously filtering and ultimately favoring the harder options. If he can get you to understand this, Bitcoin will emerge as "the hardest money yet" and you will feel that this is inevitable.

I am not fully convinced yet, but I must admit, it is a tricky framework.

The book begins by stripping money of its romantic veneer, revealing its core essence. It is not a "social contract," nor a "state product," but merely a tool for transmitting value across time and space, something people do not need to think about too much every day.

Ammous repeatedly emphasizes the concept of "salability." A good monetary asset should be easily sellable anytime and anywhere without incurring huge losses. To have salability, it must meet three conditions: across space—so you can carry it with you and use it to exchange for what you need; across time—so it does not rot or collapse in value; across scale—so it can be used for any purpose, from a cup of tea to a house, without needing a calculator or a large bag of change.

Next, the truly decisive term appears in the book: hardness. Hard money refers to currency whose supply is difficult to increase. Soft money is easy to print. That is the essence. The core logic is simple: why would you store your life’s work in something that others can easily create?

You can feel the influence of the Austrian School in every sentence, but once you strip away the ideology, the book leaves you with a very useful question: if I invest my savings in X, how easy is it for others to earn more X?

Once you examine your life through this lens—whether it’s rupees, dollars, stablecoins, Bitcoin, or any other currency combination—it becomes hard to ignore.

After setting this framework, the book takes you on a tour of a small "broken currency museum."

The first exhibit is the Yap Islands and their Rai Stones. These massive circular limestone discs, some weighing up to four tons, were quarried from other islands and transported to Yap with great effort. Ammous writes that this method has been surprisingly effective for centuries. These stones are large, difficult to move or steal. Everyone in the village knows which stone belongs to whom. Payment is made by announcing the change of ownership to the community. These stones "are easily sold anywhere on the island" because they are known throughout the island; they also withstand the test of time because the cost of acquiring new stones is so high that the existing stock "is always far greater than the new supply that can be produced in a specific period… the stock-to-flow ratio of Rai stones is very high."

Then, technology arrived.

In 1871, an Irish-American captain named David O'Keefe shipwrecked on Yap Island. After recovering, he left and returned with a large ship and explosives, realizing he could mine Rai stones in large quantities with modern tools. The villagers had mixed opinions about this. The chief believed the stones he mined were "too easy" and banned the mining, insisting that only traditional stones counted. Others disagreed and began mining the newly discovered stones. Conflict ensued. The use of these stones as currency gradually disappeared. Today, they are mostly used in ceremonial rituals.

This is a neat, perhaps overly simplistic fable. But it illustrates a key point: once a currency commodity loses its hardness (once someone can cheaply produce it in large quantities), those who once held that commodity will ultimately subsidize the newcomers.

Beads and shells follow the same pattern. The Aggry beads of West Africa are valuable because they are rare and time-consuming to make. Later, European merchants began importing these beads in large quantities from glass factories. Ammous describes how this importation "slowly but surely" transformed them from "hard money" to "cheap money," "destroying their salability and causing the purchasing power of these beads in the hands of African owners to decline over time, ultimately impoverishing them as their wealth shifted to Europeans who could now easily obtain these beads."

Wampum and shell money also experienced a similar trajectory. They were initially scarce hard currencies, difficult to obtain, with a high stock-to-flow ratio. Later, with the arrival of industrial ships, "their supply expanded dramatically, leading to a decline in their value and a loss of salability over time," and by 1661, they had lost their status as legal tender.

You will find countless stories of cattle, salt, counting sticks, and cigarettes in prisoner-of-war camps. Each story does the same thing: trains your intuition to feel that if the supply of new units can suddenly increase significantly at a very low cost, then the stock held by savers is essentially a donation.

You might criticize these historical narratives for being too neat. There is little mention of violence, politics, or culture in these little stories. Everyone acts like a rational economic agent with an exceptional memory. But as a means to make you skeptical of easily printed money, it is indeed effective.

After you feel a complete dread of shells and beads, metals emerge as a mature solution.

Metals solve many salability problems. They do not rot as easily as grains. They are more portable than massive stones. They can be minted into uniform coins, making pricing and accounting easier. Over time, gold and silver ultimately prevailed because they are the least susceptible to inflation. The annual mining output only adds a small fraction to the existing stock, so no single miner can devalue everyone’s savings.

Thus began the long era of metallic currency and later gold-backed paper money. The book does not dwell too much on these details. Its purpose is to make you feel that once humanity discovered gold, it found a near-perfect currency: portable, durable, divisible, and most importantly, costly to produce.

You will later understand how this lays the groundwork for the birth of Bitcoin. If you fully accept the statement that "under the physical and metallurgical conditions of the time, gold was the best material we could produce," then "Bitcoin is digital gold with greater hardness" sounds logical.

What interests me is that in this section, gold is less of a mysterious item and more of a makeshift solution that bypasses physical limitations. If you imagine ancient societies as constantly trying to answer the question, "How do we preserve the fruits of harvest or navigation in a form that can be passed down through generations?" then gold is a relatively clever, albeit imperfect, yet reasonable answer.

This framework also benefits Bitcoin. It is no longer "a magical internet stone," but "another attempt to solve the same problem with new tools."

The book has not reached that point yet, but you can feel the runway being built.

Then, government currency comes into play, becoming the culprit.

So far, currency collapses have stemmed from external factors. New technologies emerge, breaking the rigidity of the currency system, leaving savers with nothing. Now, the culprit comes from within: governments and central banks have the legal right to print money without any backing of scarce goods.

Under this narrative, fiat currency is a product of governments realizing they can completely separate the currency symbol from actual assets. They retain the currency unit but remove the constraints. Governments tell people that their paper money is valuable because the law says so, because taxes must be paid in paper money, not because they have any physical assets backing them.

Under the gold standard or silver standard, currency can depreciate or be adjusted, but there will not be a Zimbabwe-style economic collapse where wages vanish in a matter of months. But under a fiat currency system, this can happen. And some governments indeed repeat this cycle time and again.

Ammous spends a lot of time explaining the social consequences of this phenomenon. To survive, people have to liquidate capital, and production activities are thus eroded. Long-term contracts collapse due to a lack of trust. Political extremism breeds in anger and chaos. Weimar Germany is a classic example. Currency collapse is merely a precursor to worse situations.

Most fiat currencies have indeed depreciated against physical goods over the long term. This is somewhat by design in the currency system.

The place where I began to question this book in my mind is not the facts themselves, but its narrative framework. Almost all the ills of modern society are attributed to the fiat currency system. Central banks are almost entirely depicted as tools that secretly tax savers and subsidize borrowers. Any benefits of having a flexible last resort lender are downplayed to "but they will abuse it," which is certainly true, but it is not the only question society must answer.

Even if you dislike central banks, you might find the statement "from the moment we abandoned the full metal standard, the entire twentieth century has been a mistake" a bit excessive.

Impressions

So, aside from adding more noteworthy classic quotes to the timeline, what practical significance does the first part have for me?

Strangely, it has not made me more convinced about Bitcoin. It has merely clarified a question I had not asked carefully enough before.

I rarely look at my money the way Ammous does. I consider risks and returns, I think about volatility, I consider how much time I am willing to invest in cryptocurrency rather than in those tedious things. I do not systematically sit down and carefully study who can print how much of each cryptocurrency I handle and what rules must be followed.

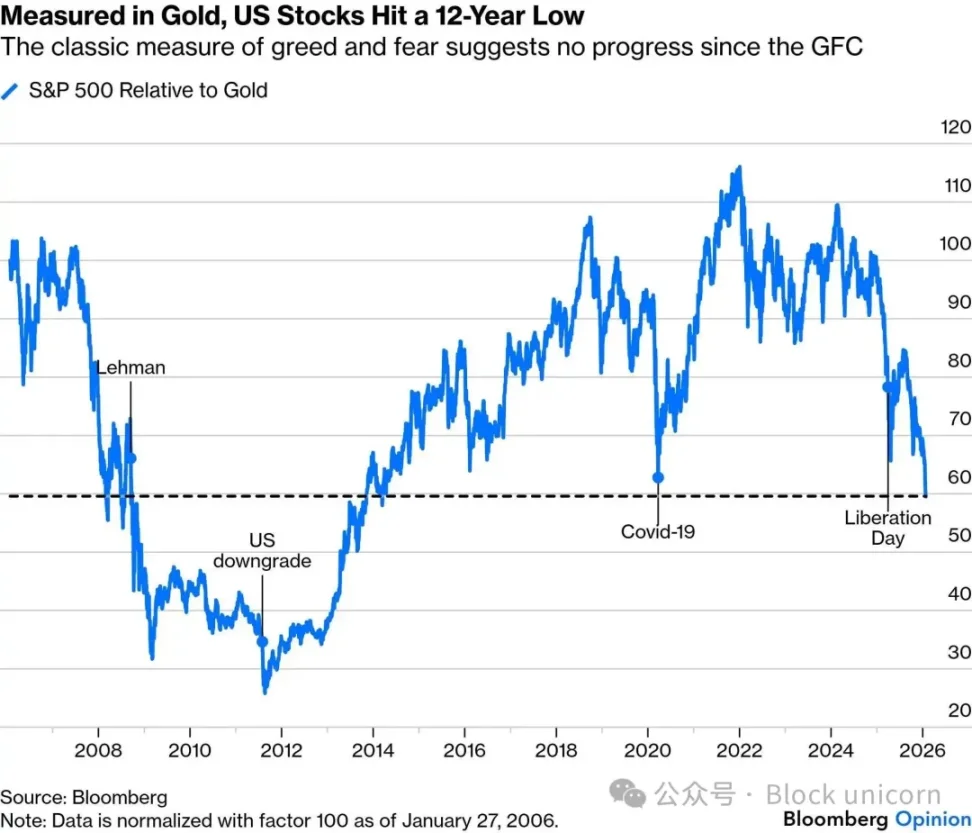

Then I saw a chart from Bloomberg showing that the S&P 500 index is not priced in dollars, but in gold. This is so unfair. When priced in gold, the U.S. stock market has returned to levels not seen in over a decade, back to the period after the global financial crisis. All those historical highs in dollars, all the post-pandemic frenzy, have turned into a noisy fluctuation on a flat line.

Once you understand this, it becomes hard to ignore the simple truth that Ammous has been emphasizing: performance is always "performance under what conditions." If your base unit is slowly depreciating, even if your index hits an all-time high, your performance in harder units may still be stagnant.

I realize that the book misses a lot. It hardly explores the significance of credit as a social tool, nor does it mention that states do not only destroy currencies; they also create legal and military environments that allow markets to grow. The book does not delve into the idea that certain groups may sacrifice some economic power to gain greater resilience against shocks. All questions revolve around one core issue: are the interests of savers being diluted?

Perhaps that is the point. This is a polemical article, not a textbook. But I do not want to pretend that this is the whole truth.

For now, I am happy to take it as a perspective rather than a belief. Whenever I see central bank balance sheets, new secondary bond issuance plans, or certain "stable income" products promising dollar yields of up to 18%, I always hear a Saifedean-like voice in my ear: how hard is this currency really? And how many people like O'Keefe have already gone underwater with explosives?

Now, I just want to remember one thing: money stores our future choices. Choose your currency units carefully and be wary of anyone who can print money beyond your income.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。