What to know : Strategy (MSTR) stock has fallen for seven consecutive months. The company’s multiple to net asset value now stands at 1.09, allowing continued stock sales to fund bitcoin purchases. During the previous bear market, in 2022, Strategy was able to raise only $275 million, which it used to purchase roughly 10,000 bitcoin.

As February begins, Strategy (MSTR), the world’s largest publicly traded holder of bitcoin , is already down 7% and on track for an eighth consecutive monthly decline.

The stock, currently trading near $141, is down roughly 75% from its November 2024 record high of around $540.

The bulk of the decline has occurred since July, with seven straight negative months. By end-2025, the stock had fallen 48% for the year, its second-worst annual performance on record. The worst year remains 2022, when shares declined 75%.

The bitcoin price, by comparison, has dropped around 40% from its October all time high. This puts the performance gap between MSTR and bitcoin at roughly 35%. In January, that spread briefly widened to 45%, matching a record last seen in 2021, according to checkonchain.

The company’s multiple to net asset value (mNAV), calculated by dividing enterprise value by its bitcoin reserves, remains above 1 at 1.09. This means Strategy is able to continue selling common stock through at-the-market offerings to buy bitcoin.

However, if the stock drops further, future bitcoin purchases are likely to be smaller. Should mNAV fall below 1, the company may be forced to pause purchases and wait for a rebound.

During the previous bear market, in 2022, Strategy was able to raise only $275 million, and used the proceeds to buy roughly 10,000 BTC.

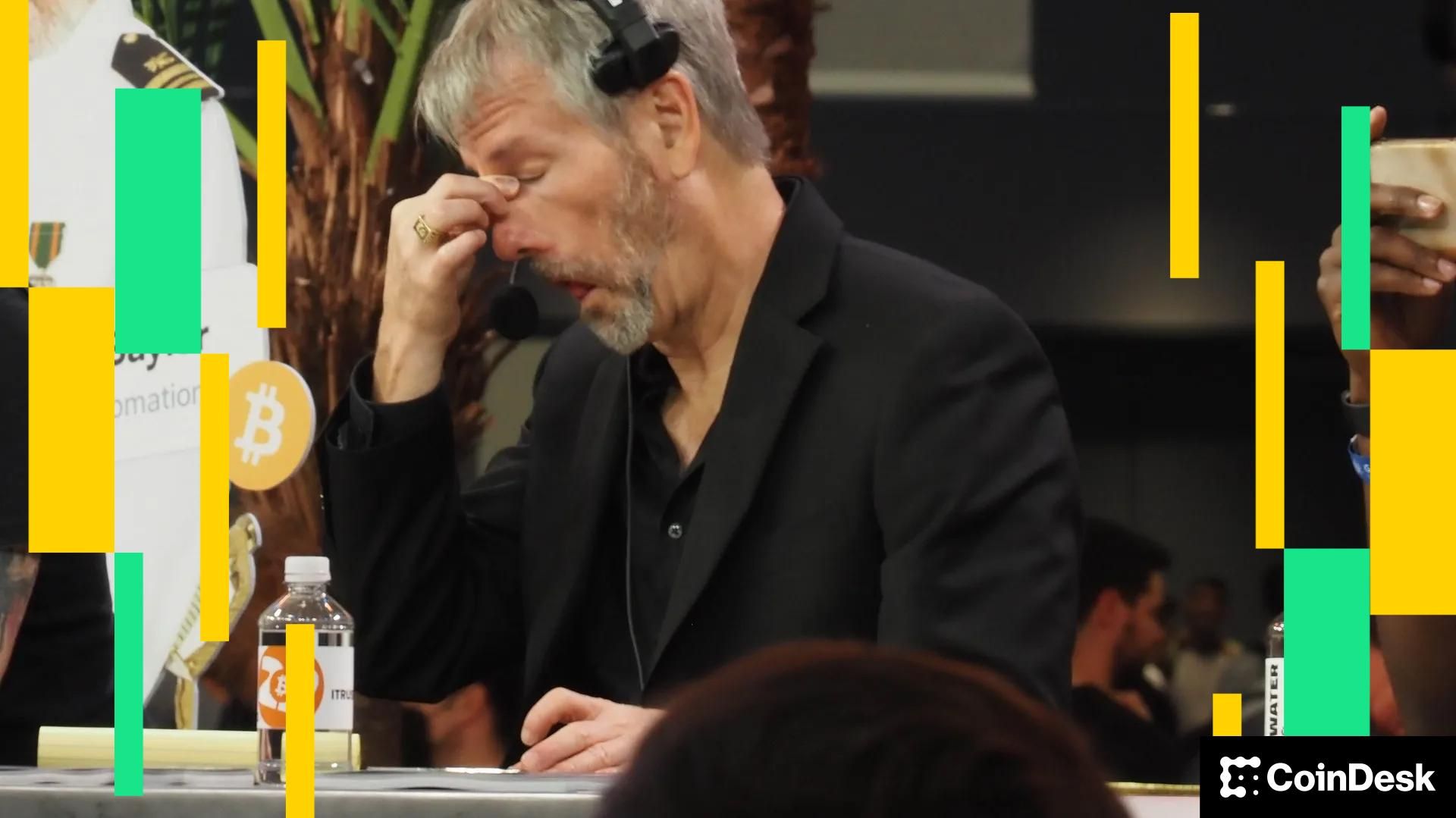

Read More: Michael Saylor’s bitcoin stack is officially underwater, but here’s why he likely won't reach for the panic button

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。