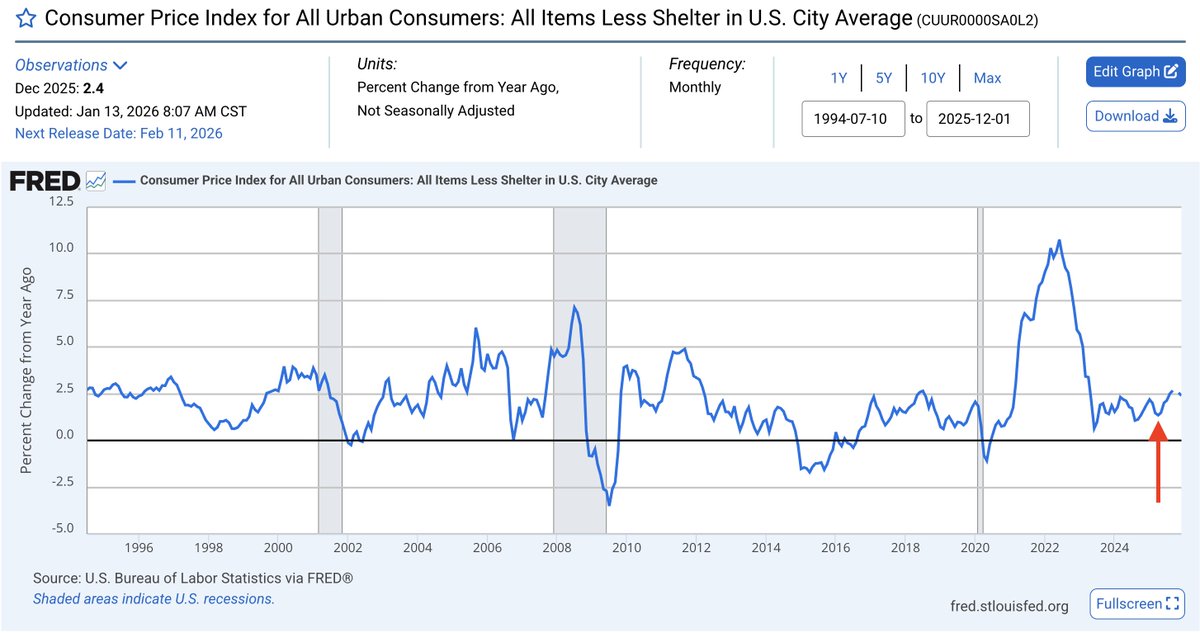

This is headline CPI excluding Shelter inflation YoY.

Why am I excluding Shelter?

Because it's the:

• Largest component in the CPI (33%)

• Laggiest component in the CPI (8-12 months behind)

By excluding it, we can evaluate how the other 67% of components are experiencing price changes & get a grasp on Non-Shelter dynamics.

Additionally, the Fed can't control Shelter prices.

We know that for a fact.

So why is this so important?

The All Items ex-Shelter inflation rate is +2.4% YoY.

It's only slightly higher than the Fed's target of +2% YoY.

But here's the tricky part.

This inflation rate was +1.35% in April 2025.

So, the inflation rate has nearly doubled within a year.

The other critical thing to realize is this...

Headline & Core CPI have been decelerating YoY for awhile now... but this datapoint isn't...

So that means one thing and one thing only.

All of the disinflation that we're seeing at the headline & core CPI level is being entirely driven by the disinflation in Shelter, which is the laggiest and most detached datapoint within the CPI calculation.

Also, see that arrow?

That was Liberation Day.

Are tariffs the culprit for this entire reacceleration?

Of course not!

Inflation is multi-variate.

It's caused by deficit spending, monetary policy, lending activity, credit expansion, demand pulls, cost pushes, wage growth, and many many many other things.

This post isn't a statement on tariffs at all.

I'm just pointing out the fact that dynamics in Shelter are having an outsized impact on Headline & Core inflation metrics, which provides an unfair representation of actual inflation dynamics that Americans are feeling on a day-to-day basis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。