Original Title: State of Prediction Markets

Original Author: Paul Veradittakit, Partner at Pantera Capital

Original Translation: Saoirse, Foresight News

Abstract

· Prediction markets are not a new phenomenon—they have finally achieved decentralization. Humans have historically wagered on the outcomes of predictions, but cryptographic technology has transformed this ancient practice into a permissionless, transparent global market. In such markets, prices reflect real-time collective wisdom rather than poll results.

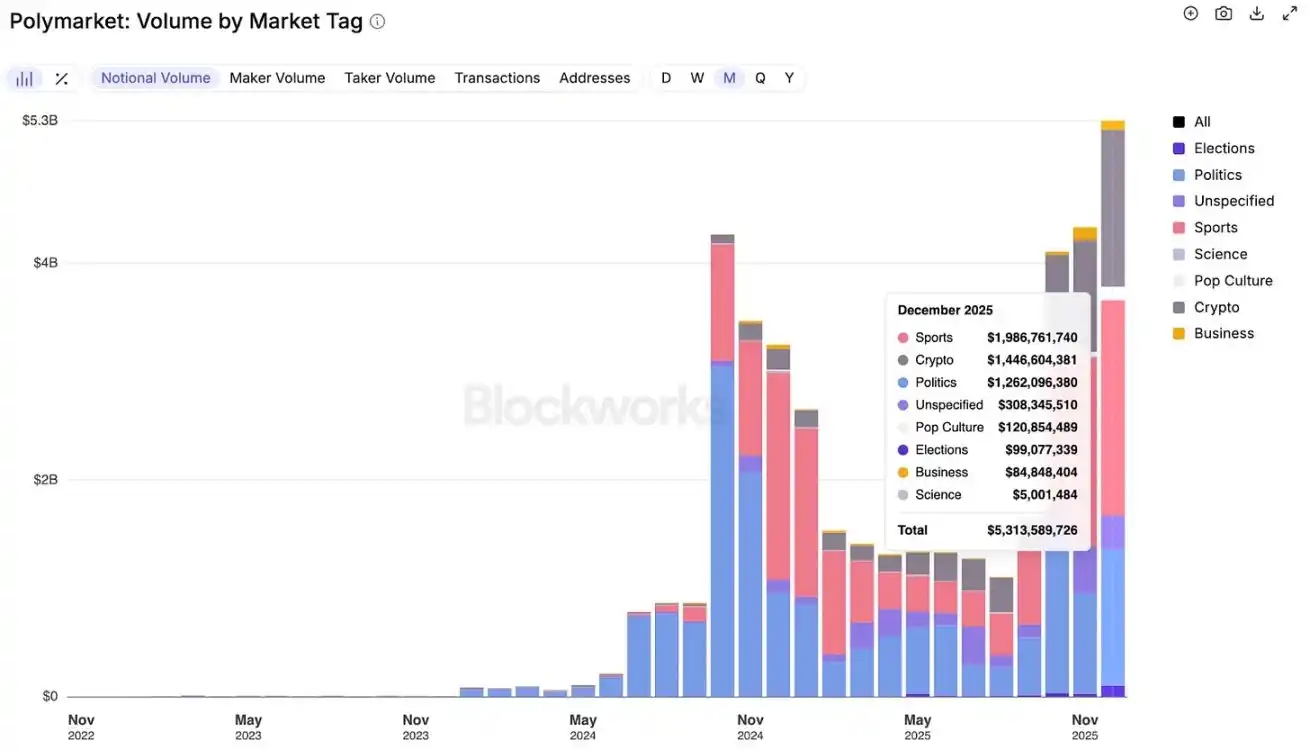

· Infrastructure and regulation are the dual engines driving market expansion. The clear regulatory stance of the U.S. Commodity Futures Trading Commission (CFTC), collaboration within traditional finance (TradFi), and multi-chain scalability have propelled prediction markets from niche experiments to a sector with weekly trading volumes reaching $3.9 billion, with relevant platforms directly embedded in brokerage firms, media, and consumer applications.

· "Uncertainty" has become a new category of financial assets. As prediction markets gradually evolve into core hedging, data, and forecasting infrastructures, platforms that combine liquidity, credibility, and coverage to "price" real-world outcomes globally will continue to accumulate value.

For thousands of years, humanity has explored ways to leverage collective wisdom to predict the future. Ancient Greeks would receive exclusive tokens and cast votes through a piping system; jurors at the time would choose solid stones or perforated stones to express their verdicts. Betting in the ancient taverns known as "kapeleia" was likely also quite common.

In the 17th century, merchants in Amsterdam's stock exchange would bet on the arrival times of cargo ships; in 19th century America, political betting venues dominated during elections until they were banned in the 1940s. Additionally, commodity futures trading on the Chicago Mercantile Exchange falls into this category. It is evident that humanity has long understood that wagering on prediction outcomes can generate highly valuable information signals.

Today, crypto-driven prediction markets represent a digital rebirth of this ancient practice—but with a key difference: the former is permissionless, transparently open, and globally accessible.

The Information Market Revolution: What Makes Crypto Prediction Markets Different?

Traditional prediction markets require trusted intermediaries to hold funds, verify results, and distribute prizes, while cryptographic technology eliminates these intermediaries through blockchain. When you place a bet on the Polymarket platform regarding geopolitical, macroeconomic, or cultural questions—whether "Will the Federal Reserve cut interest rates in January?" or "Who will win the Best Picture at the 2026 Oscars?"—your funds are held in a smart contract, results are verified transparently, and prizes are automatically distributed via USDC. The entire process requires no bank account, has no geographical restrictions, and incurs no intermediary fees or participant eligibility limitations.

Another industry giant, Kalshi, focuses 90% of its business on sports, covering topics such as "Who will win the PGA Farmers Insurance Open?" and "Kent State University vs. Akron University basketball game results." The emerging prediction market platform Novig is also focused on sports.

The Moment of Convergence: Why Now?

Current prediction market trading volume has reached $3.9 billion over seven days, showing explosive growth, driven by three main factors: regulatory maturation, integration with traditional finance, and infrastructure breakthroughs.

On the regulatory front, the CFTC's approval has cleared obstacles for platforms to operate in the U.S. For example, in July 2025, Polymarket acquired the CFTC-licensed derivatives trading platform QCX LLC and clearinghouse QC Clearing LLC. This allows traders to confidently participate in prediction market contract trading on the Polymarket platform, with clear and defined rules. Kalshi completed a $1 billion funding round at a $11 billion valuation in December 2025, reflecting institutional investors' confidence in the sector. Overall, regulatory clarity is unlocking institutional capital and retail participation through mature brokerage channels.

The Intercontinental Exchange (ICE) not only invested $2 billion in Polymarket but will also become the global distributor of Polymarket's event-driven data—this move highlights the growing trend of integration between traditional finance and prediction markets.

Partnerships further deepen this integration. Polymarket has established a multi-year collaboration with TKO Group Holdings to become the official exclusive partner of the Ultimate Fighting Championship (UFC) and Zuffa Boxing, directly combining prediction market technology with live fan experiences.

In 2026, Kalshi will partner with CNN and CNBC, allowing viewers to see real-time prediction probabilities in news tickers. Both Polymarket and Kalshi have partnered with Google; companies like Robinhood, Fanatics, and Coinbase have also entered the space through partnerships or native applications. In November 2025, Robinhood's prediction market contract trading volume reached 300 million contracts, a 20% increase month-over-month, confirming significant retail participation.

Technological advancements have driven infrastructure breakthroughs, including: multi-chain scalability through Polygon, Solana, Base, Gnosis Chain, etc.; integration of AI oracles for permissionless instant settlement; and the adoption of hybrid automated market maker (AMM) and order book models to reduce trading friction and enhance liquidity. In contrast, when early platform Augur launched, both the technology and regulatory environment were immature, making development challenging.

Market Dynamics: Leading Players and Challengers

Although Polymarket is currently the dominant platform in the industry, its position may face challenges from competitors offering users more choices. In fact, in 2025, 12 institutions either submitted applications for "Designated Contract Markets (DCM)" or successfully obtained that qualification, a 500% increase from the previous year. Additionally, some companies are looking to collaborate with DCMs to provide prediction market services as "futures commission merchants."

Here is a brief comparison between Polymarket and the Opinion platform (data period: 30 days ending December 3, 2025):

· Polymarket Key Data: Open contracts worth $247.1 million; nominal trading volume of $4.39 billion; market share accounting for 82% of the industry's total locked value (TVL); employing a historical zero-fee model to drive user growth.

· Opinion Key Data: TVL surged 110% in 30 days (from $30 million to $63 million); estimated monthly trading volume of $4 billion, posing a potential threat to existing market share; achieving product-market fit on emerging Layer 2 infrastructure.

Network effects and a "winner-takes-all" market structure are attracting significant growth capital—these platforms provide scalable diversified options for traditional derivatives and betting products. Revenue models have also expanded beyond a single fee structure, including: licensing real-time probability data to news media and financial terminals; API integration with social platforms and applications; and some companies (like Robinhood) leveraging this for cross-selling core financial services.

User Behavior Shift

Traders are gradually shifting towards prediction markets—these markets have a more sophisticated speculative structure, serving as both hedging tools and providing alpha returns for decentralized finance (DeFi) portfolios. As real-time prediction probabilities in political and economic domains surpass traditional polling accuracy, this migration trend may extend to more related event contract areas.

Although Polymarket initially gained media attention for political predictions, it is not limited to that domain. Its largest open contract markets include:

· Non-election political domain: $55 million

· Cryptocurrency domain: $52 million

· Business domain: $36 million

· Election domain: $22 million

· Pop culture domain: $20 million

· Sports domain: $20 million

· Total: $242 million

New entrants are continuously emerging: Crypto.com has partnered with Hollywood.com to launch entertainment-focused prediction markets covering topics such as movies, television, theater, actors, musicians, and award outcomes; Limitless focuses on short-term prediction markets for cryptocurrency and stock prices, originating from the X (formerly Twitter) project, with investment support from Coinbase and 1confirmation.

Controversies, Challenges, and Emerging Solutions

Prediction markets still face several pain points, including centralization risks, manipulation issues under traditional oracle models, and settlement delays caused by manual reporting systems.

Regulatory gray areas still exist, including classification disputes regarding sports betting. For example, in November 2025, a judge in Nevada ruled that Kalshi is classified as a betting platform and is not exempt from the state's gambling regulations. However, Kalshi argues that its platform is a federally regulated financial trading platform offering legitimate derivatives contracts (event-based contract swaps), not betting wagers. Following the ruling, Kalshi has initiated an appeal process, and similar disputes have arisen in Massachusetts.

Regardless of the case outcome, several issues remain to be addressed, including age restrictions, concerns related to responsible gambling, and more. Cross-border regulatory arbitrage may also become a barrier to industry development.

Market manipulation risks also need to be managed, such as the influence of large players on low liquidity markets, wash trading and price manipulation in decentralized environments, and the balancing act between "permissionless trading" and "market credibility."

The current market landscape is continuously evolving, including: launching perpetual prediction markets for "ongoing results," handling complex multi-variable event composite markets, and enhancing dynamic liquidity binding curve mechanisms. Additionally, there are multiple opportunities: using prediction market probabilities as oracle inputs for DeFi protocols; enabling secondary trading and leverage through tokenized positions; and combining prediction markets with yield strategies and portfolio hedging.

Emerging solutions focus on three main directions: providing AI-driven instant settlement for permissionless markets; integrating trading platform oracles to reduce front-running; and developing application chains embedded with consensus mechanisms to ensure oracle credibility.

Future Outlook

From the current perspective, three main factors will drive the broader adoption of prediction markets in the short term: CFTC-approved U.S. platforms launching through mature brokers; integration with social platforms (such as embedding prediction APIs in tweets); and emerging banks embedding prediction markets to achieve a fusion of financial and speculative functions.

Moreover, as prediction markets gradually evolve into an independent category of financial markets, vertical prediction markets targeting specific sectors (such as sports, business, etc.) may emerge. For example, the sports-focused prediction market Novig is concentrating on creating highly customized markets and user experiences for sports betting users. As prediction markets become a more common consumer behavior, these vertical platforms may provide a better user experience than "one-size-fits-all" comprehensive platforms.

In the next 1-3 years, prediction markets focusing on privacy protection may adopt zero-knowledge proof technology; governance applications such as prediction-based governance (Futarchy) and outcome-based decision-making may also gradually develop.

(Note: "Futarchy" is a new governance concept proposed by economist Robin Hanson around the year 2000, centered on using "predictions of future outcomes" to guide decision-making, rather than relying on traditional voting, expert judgment, or power hierarchies. Its name is a combination of future and archy (rule, governance), which can be literally translated as "predictive governance" or "future-oriented governance.")

However, the industry may still face obstacles, including: regulatory agencies tightening controls, limiting global access or product scope; if the market fails to improve prediction accuracy, it may lead to user fatigue; and traditional platforms adopting blockchain technology will trigger more intense competition.

As integration deepens, prediction markets will bring various positive social impacts: providing collective wisdom support for resource allocation and policy decision-making; establishing decentralized predictions as public infrastructure; and promoting a shift in the media and governance fields from "polling models" to "participatory probability market models."

The current question is no longer "Can prediction markets scale?" but rather "How many prediction markets will emerge in the future?" and "Which models can capture this trillion-dollar opportunity—pricing real-world uncertainties on-chain?" These predictions will become an important complement to human wisdom and predictive capabilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。