Original Title: The Depths of Crypto Winter

Original Author: Matt Hougan, Chief Investment Officer of Bitwise

Original Translation: Chopper, Foresight News

The bad news is: We have been in a crypto winter since January 2025. The good news is: we are likely closer to the end of the winter than to its beginning.

I want to state something obvious because I believe it can help you make favorable decisions in the coming months: we are in a full-blown crypto winter.

I find that few people online and in mainstream media talk about this, but it is an undeniable fact. Bitcoin has dropped 39% from its historical peak in October 2025, Ethereum is down 53%, and many other crypto assets have fallen even more.

It is important to recognize its nature. This is not a bull market correction or a dip. This is a full-blown winter, comparable to 2022, as harsh as the one Leonardo DiCaprio experienced in "The Revenant," caused by everything from excessive leverage to early players cashing out en masse.

For me, acknowledging and accepting this makes everything incredibly clear.

Why, despite continuous good news in areas like application landing and regulation, are crypto prices falling? Because we are in the depths of a crypto winter. Why is the new Federal Reserve Chair a Bitcoin supporter while the crypto fear and greed index is in the historical high fear zone? Because we are in a crypto winter.

Those who experienced the past winters of 2018 or 2022 will remember that in the depths of winter, good news is meaningless. We will not see a rebound just because Wall Street is hiring en masse or Morgan Stanley is doubling down on crypto. These things are important in the long run, but not now. The crypto winter will not end in frenzy; it will only conclude when exhaustion sets in.

So, when will the winter end? The good news is: I believe we are nearing the end.

The Historical Patterns of Crypto Winter

Crypto winters typically last about 13 months. For example, Bitcoin peaked in December 2017 and bottomed in December 2018; it peaked in October 2021 and bottomed in November 2022.

Based on this cycle, we still have a tough period ahead. After all, Bitcoin peaked in October 2025; are we to wait until November 2026? I don’t think so.

After analyzing the current winter more, I increasingly realize that it actually began in January 2025. We cannot see it because the inflows from ETFs and crypto treasury companies (DAT) have obscured the truth.

ETF and DAT Fund Flows Obscured the Winter of 2025

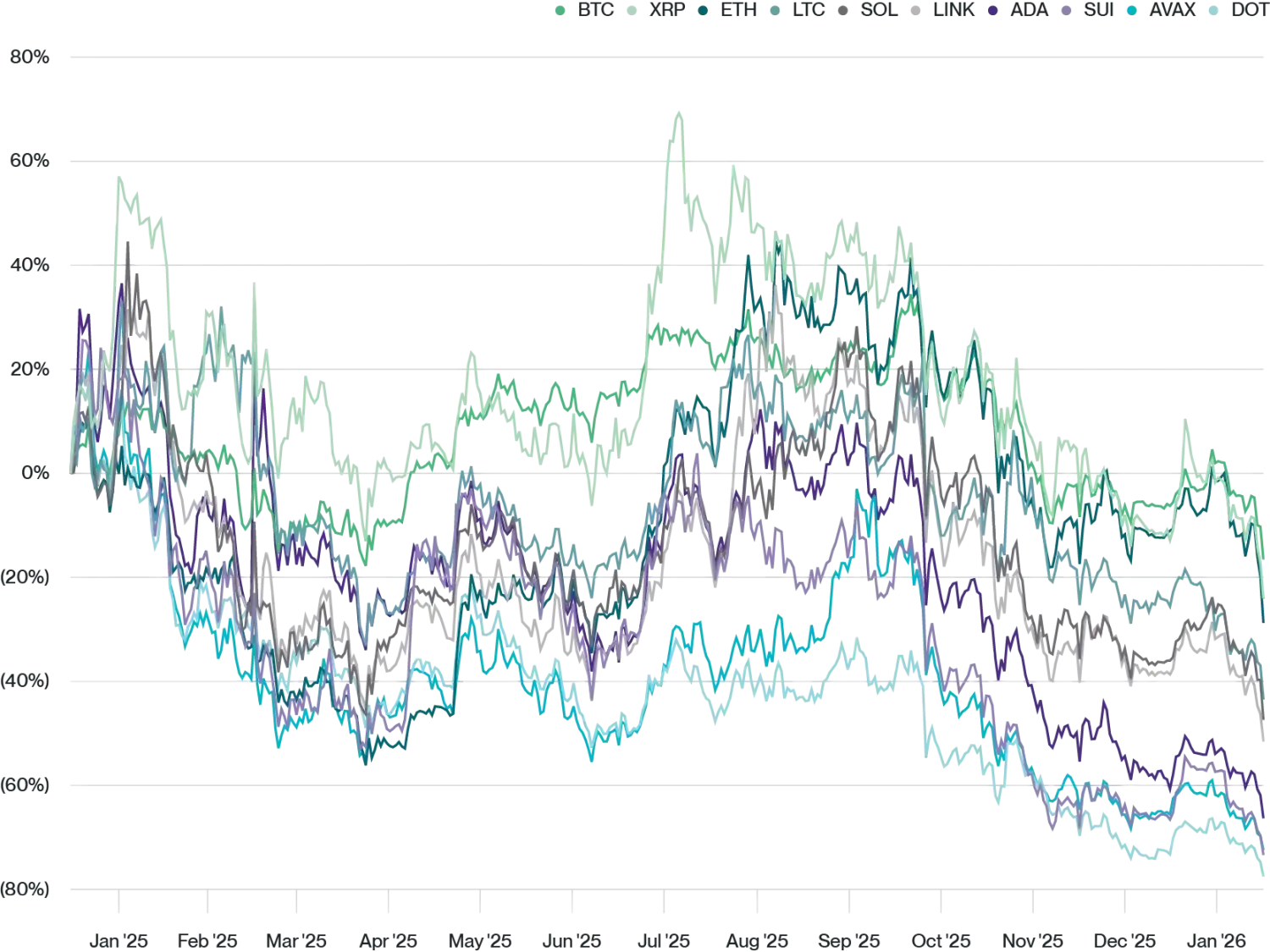

Take a close look at this chart showing the performance of the Bitwise 10 Large Cap Crypto Index constituents since January 1, 2025.

Performance of Bitwise 10 Large Cap Crypto Index constituents from 2025 to date. Data source: Bitwise Asset Management

They clearly fall into three categories:

· The first category of assets (BTC, ETH, XRP) performed reasonably well, down 10.3% to 19.9%

· The second category of assets (SOL, LTC, LINK) experienced a standard bear market, down 36.9% to 46.2%

· The third category of assets (ADA, AVAX, SUI, DOT) was severely hit, down 61.9% to 74.7%

The core difference among these three categories lies in whether institutions have channels to invest in them. The first category of assets received massive support from ETF/DAT throughout the year; the second category had ETFs approved in 2025; the third category has never had one. (Note: XRP is an exception; it performed well at the beginning of 2025 despite not having an ETF, possibly because it faced a life-and-death lawsuit from the SEC in early 2025, which was dismissed, leading to a significant rebound.)

The scale of institutional support is astonishing. For example, during the period shown in the chart, ETFs and DATs cumulatively bought 744,417 Bitcoins, worth about $75 billion. Just imagine, without this $75 billion support, where would Bitcoin be? I guess it would have dropped about 60%.

The retail market has been in a brutal winter since January 2025. It’s just that institutional funds once obscured this fact for some assets.

It’s Always Darkest Before the Dawn

What needs to be remembered at this moment is that there are actually a lot of real positives in the crypto space. Regulatory progress is real, institutional adoption is real, stablecoins and asset tokenization are real, and Wall Street's embrace is also real.

In a bear market, good news is ignored but does not disappear. They are stored as potential energy. Once the clouds clear and market sentiment returns to normal, this accumulated potential will be released in a vengeful manner. What can disperse the clouds? Strong economic growth triggering a broad rebound in risk assets, positive signals from the Clarity Act, signs of sovereign nations adopting Bitcoin, or simply the passage of time.

As a veteran who has experienced multiple crypto winters, I can tell you that the feeling before the end of winter is very similar to now: despair, helplessness, and gloom. But the current market pullback has not changed the fundamentals of the crypto market at all.

I believe we will rebound faster and more violently. After all, the winter began in January 2025. Spring is definitely not far away.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。