Original Title: A Fresh Start for Tokenomics in 2026

Original Author: David Hoffman, Co-founder of Bankless

Original Translation: Deep Tide TechFlow

Introduction: Are most tokens garbage? David Hoffman, co-founder of Bankless, points out that historically, teams have not treated tokens with the same seriousness as equity, and the market has responded to this with token prices.

But a turning point emerged in 2026:

MegaETH locked 53% of its tokens in a KPI program, unlocking them only upon achieving growth targets;

The Cap protocol replaced governance tokens with stablecoin airdrops, allowing true investors to acquire CAP through token sales.

These innovative strategies are ending the era of "spray-and-pray" token distribution, shifting towards precise and conditional allocation mechanisms.

The full text is as follows:

The crypto industry has a "good coins problem."

Most tokens are garbage.

Most tokens have not been treated by teams on a legal and strategic level with the same seriousness as equity. Because teams historically have not given tokens the same respect as equity in companies, the market has reflected this in token prices.

Today, I want to share two sets of data that make me optimistic about the state of tokens in 2026 and beyond:

MegaETH's KPI program

Cap's stablecoin airdrop (stabledrop)

Conditioning Token Supply

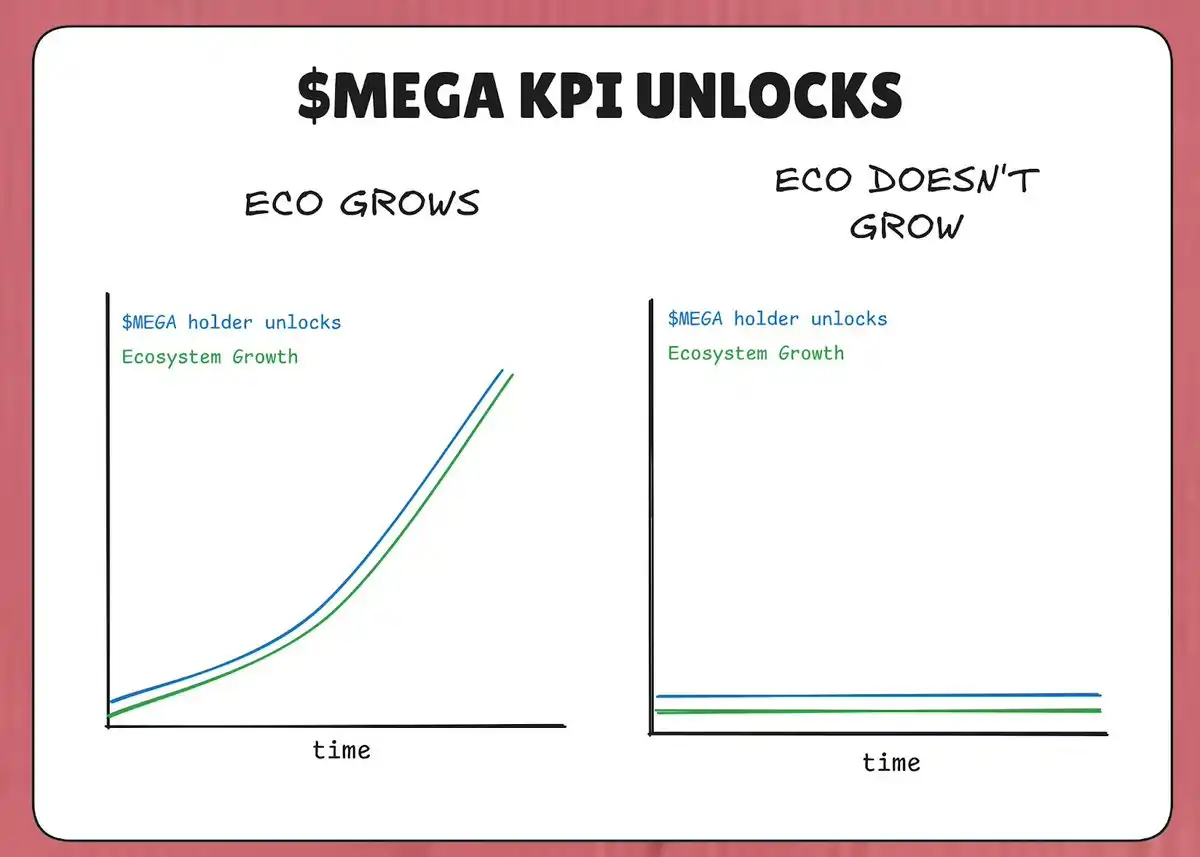

MegaETH has locked 53% of its total supply of MEGA tokens in a "KPI program." The logic is: if MegaETH does not meet its KPIs (Key Performance Indicators), these tokens will not be unlocked.

Therefore, in a pessimistic scenario, even if the ecosystem does not grow, at least no more tokens will flood the market to dilute holders. MEGA tokens will only enter the market when the MegaETH ecosystem truly achieves growth (as defined by the KPIs).

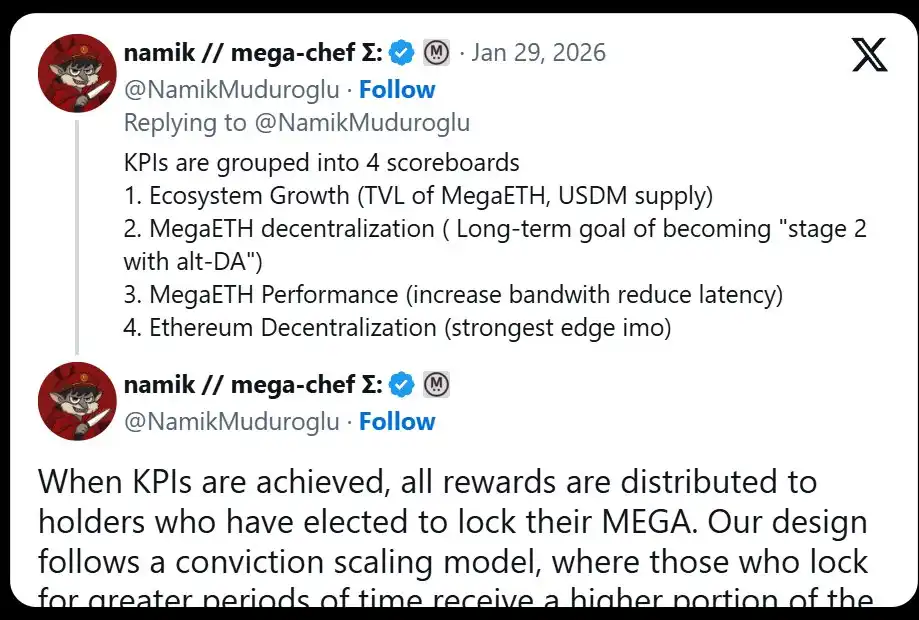

The KPIs of the program are divided into four scoreboards:

Ecosystem growth (TVL, USDM supply)

MegaETH decentralization (L2Beat stage progress)

MegaETH performance (IBRL)

Ethereum decentralization

Thus, theoretically, as MegaETH meets its KPI targets, the value of MegaETH should correspondingly increase, thereby mitigating the negative impact of MEGA dilution on market prices.

This strategy is very similar to Tesla's "only deliver to be rewarded" compensation philosophy for Elon Musk. In 2018, Tesla granted Musk an equity compensation plan that vested in tranches, only redeemable when Tesla simultaneously achieved increasing market cap and revenue targets. Elon Musk could only be rewarded when Tesla's revenue and market cap grew.

MegaETH is attempting to transplant the same logic into its tokenomics. "More supply" is not a given—it's something the protocol must earn by achieving real points on meaningful scoreboards.

Unlike Musk's Tesla benchmarks, I do not see any mention of using MEGA's market cap as a KPI target in Namik's KPI goals—perhaps for legal reasons. But as a public sale investor in MEGA, this KPI is indeed interesting to me.

Who Gets Unlocked Matters

Another interesting aspect of this KPI program is: who will receive MEGA when the KPIs are met. According to Namik's tweet, those who will receive MEGA unlocks are those who stake MEGA into the locked contract.

Those who lock more MEGA for a longer time can access 53% of the MEGA tokens entering the market.

The logic behind this is simple: dilute MEGA allocation to those who have already proven themselves as MEGA holders and are interested in holding more MEGA—those least likely to become MEGA sellers.

Alignment and Trade-offs

It is worth emphasizing that this also brings risks. We have seen historical cases where similar structures encountered serious problems. Look at this excerpt from Cobie's article: "(content)"

If you are a token pessimist, crypto nihilist, or just bearish, this alignment issue is what you worry about.

Or, from the same article: "Staking mechanisms should be designed to support the ecosystem's goals."

Locking token dilution behind KPIs that should actually reflect the growth in MegaETH's ecosystem value is a mechanism far superior to any ordinary staking mechanism we saw during the liquidity mining era of 2020-2022. During that time, tokens were issued regardless of the team's fundamental progress or ecosystem growth.

Thus, the net effect is MEGA dilution:

· Subject to the corresponding constraints of MegaETH ecosystem growth

· Diluted into the hands of those least likely to sell MEGA

This does not guarantee that MEGA's value will rise as a result—the market will do what it wants. But it is an effective and honest attempt to address a core underlying issue that seems to affect the entire crypto token industry complex.

Viewing Tokens as Equity

Historically, teams have "spray-and-pray" distributed their tokens in the ecosystem. Airdrops, mining rewards, grants, etc.—if what they were distributing was truly valuable, the teams would not engage in these activities.

Because teams distribute tokens as if they were worthless governance tokens, the market prices them as worthless governance tokens.

After Binance opened MEGA token futures on its platform (historically attempting to extort teams with this), you can see the same philosophy in MegaETH's approach to listing on CEX:

I hope teams start to be more selective about their token distributions. If teams begin to view their tokens as precious, perhaps the market will respond in kind.

Cap's Stable Airdrop

The stablecoin protocol Cap introduced a "stablecoin airdrop" (stabledrop) instead of a traditional airdrop. They are not airdropping the native governance token CAP, but distributing the native stablecoin cUSD to users who earn Cap points.

This approach rewards yield farmers with real value, thereby fulfilling the social contract. Users who deposit USDC into Cap's supply side accept the risks and opportunity costs of smart contracts, and the stablecoin airdrop compensates them accordingly.

For those who want CAP itself, Cap is conducting a token sale through Uniswap CCA. Anyone seeking CAP tokens must become a true investor and invest real capital.

Filtering Loyal Holders

The combination of stablecoin airdrops and token sales filters out steadfast holders. Traditional CAP airdrops would flow to speculative farmers who might sell immediately. By requiring capital investment for the token sale, Cap ensures that CAP flows to participants willing to accept all downside risks for upside potential—those more likely to hold long-term.

The theory is that this structure provides CAP with a higher probability of success by creating a concentrated holder base aligned with the protocol's long-term vision, rather than a less precise airdrop mechanism that puts tokens in the hands of those focused solely on short-term profits.

Check out this video: https://x.com/DeFiDave22/status/2013641379038081113

Token Design is Evolving

Protocols are becoming smarter and more precise in their token distribution mechanisms. No longer is it a shotgun approach to spray-and-pray token issuance—MegaETH and Cap are highly selective about who can receive their tokens.

"Optimizing distribution" is no longer just a phrase—perhaps a toxic hangover from the Gensler era. Instead, both teams are optimizing concentration to provide a stronger foundational holder base.

I hope that as more applications launch in 2026, they can observe and learn from these strategies, even improving upon them, so that the "good coins problem" is no longer an issue, and we are left with only "good tokens."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。