Original | Odaily Planet Daily (@OdailyChina)

Authors | Azuma (@azuma_eth), Mandy (@mandywangETH)

For a long time, Binance has been crowned the "largest exchange in the crypto universe," but recently, I have begun to have increasingly strong doubts about this label that has long been solidified in the minds of retail investors.

Of course, with its vast matrix composed of public chains, ecosystems, wallets, and VC landscapes, Binance remains the super platform with the widest influence in the current Crypto industry—this is indisputable.

What truly deserves re-examination is another more core question: In the most essential and important battlefield of exchanges—trading itself, especially in the contract market where the volume is large, fees are high, and price centers are determined, does Binance still hold the industry’s top position? Does it still possess an absolute advantage that is difficult for other competitors to shake? And in terms of innovation leadership in other areas, is there anyone surpassing Binance?

The reason for raising this question is not due to a short-term data change, but because of several recent small events—individually they may seem insignificant, but together, they are continuously shaking my existing perception of Binance's market position.

Contract Trading Volume Faces Challenges

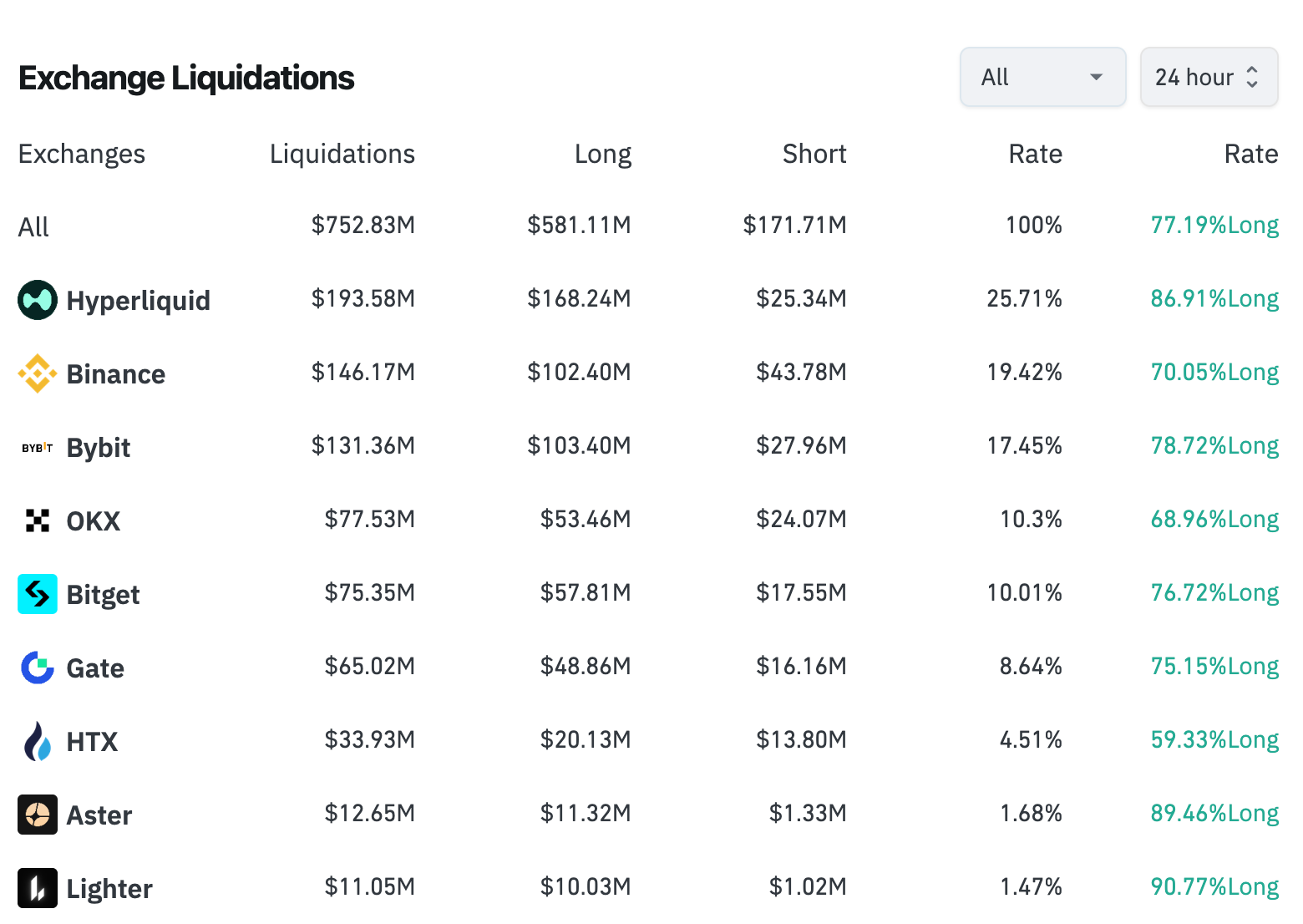

First, in the recent days of volatile market conditions, the liquidation data from Hyperliquid has surpassed that of Binance. As shown in the figure below, the liquidation amount on Hyperliquid in the last 24 hours was approximately $193 million, while Binance's was $146 million.

Odaily Note: Data sourced from Coinglass, as of February 2, 14:00.

One point of doubt here is that Binance's liquidation data push frequency has a limit of once per second, so data platforms like Coinglass may experience some delays in capturing the data.

However, from the information we have observed, there are indeed more and more large accounts choosing to open positions on Hyperliquid. Typical representatives include Ma Ji Da Ge, "1011 Insider Whale," James Wynn, AguilaTrades, "CZ's Opponent," "14 Consecutive Wins Whale," Gambler@qwatio, Low-Stack Degen, and other eight major figures… You can criticize them as gamblers, but where the gamblers are, the volume is, and volume is the lifeblood of exchanges.

The reason for this situation is that compared to the inevitable "black box" suspicions of CEX, all orders, trades, liquidations, and settlements on Hyperliquid are executed on-chain, naturally possessing advantages of transparency and fairness. In the first half of last year, a certain big shot who had founded several well-known projects over the years (not naming names) encountered a targeted liquidation on a certain CEX (not Binance) and lost over $100 million, yet the platform never disclosed the internal order matching and liquidation details.

Mainstream Coin Liquidity Being Surpassed

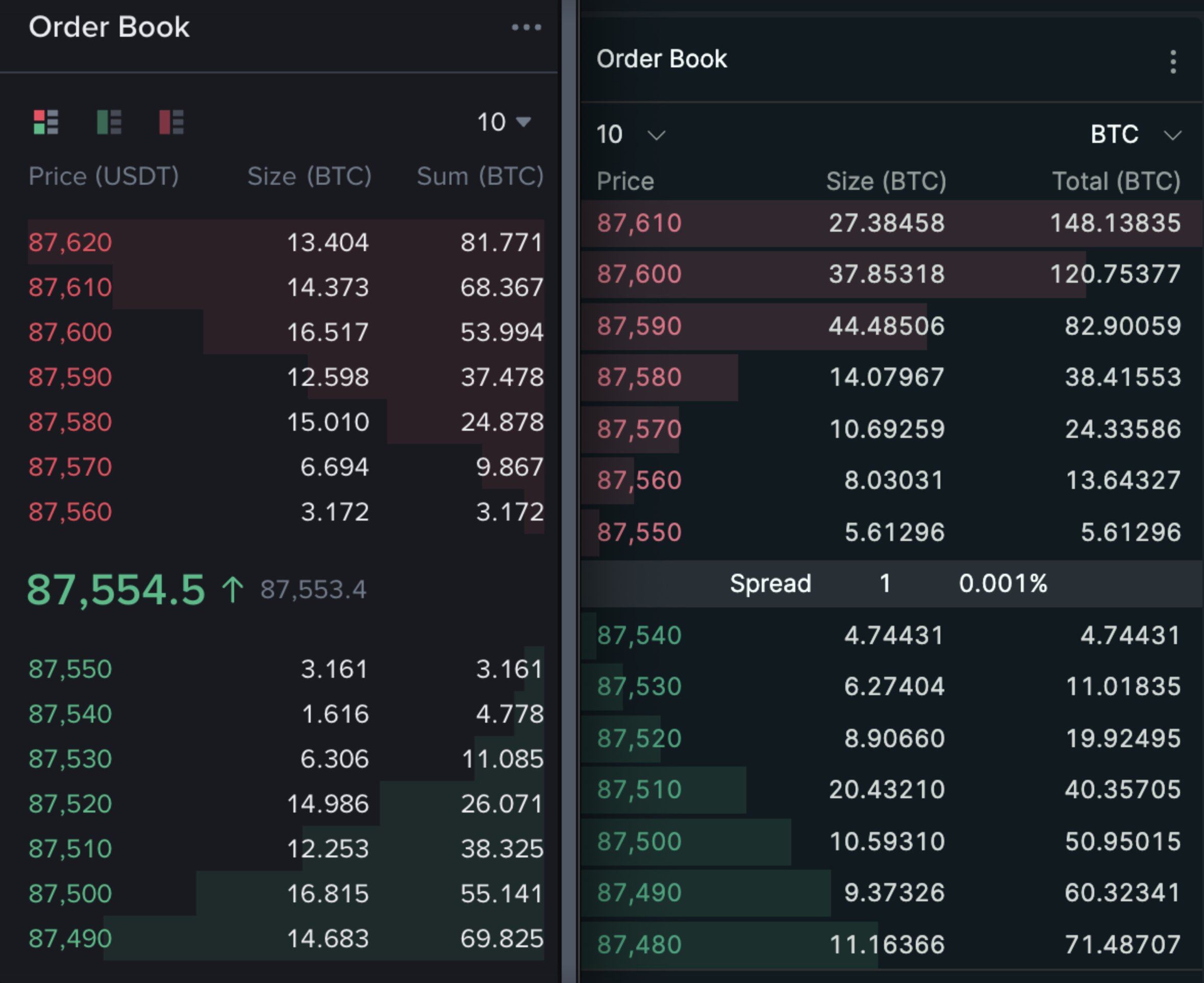

The second matter is that last week, Hyperliquid's founder Jeff posted a comparison of the BTC contract order books on the platform (right side of the image) and Binance (left side of the image) on X. The chart shows that the bid-ask spread for BTC on Hyperliquid is narrower, and the order depth is thicker.

Jeff boldly declared: "Hyperliquid has become the best cryptocurrency price discovery platform in the world."

This is not an isolated case; by checking the order book status of other mainstream tokens like ETH and SOL in real-time on Hyperliquid and Binance, it can be found that the liquidity performance of the former is no less than that of the latter.

Slow Progress in New Listing Expansion

Over the past year, compared to many second-tier exchanges, Binance has noticeably tightened its pace in "officially listing coins," giving more opportunities for high-frequency testing to Binance Alpha. However, the performance after listing has often been unsatisfactory, and due to the explosive popularity of Chinese memes, Alpha's focus has further tilted towards the BSC ecosystem. After the 10.11 incident, the ongoing controversies surrounding Binance have raised questions about its listing path.

A few days ago, Solana co-founder Natoly Yakovenko (toly) criticized Binance on X and was unfollowed by CZ. In fact, prior to this, there had already been a voice in the market suggesting that Solana ecosystem projects are shifting towards Bybit. Following this change, Binance may not dominate the first launch and pricing power of future projects as it once did.

More importantly, in the current context of continued sluggishness in crypto-native assets, the industry has viewed asset classes derived from traditional finance, such as stock tokens and precious metals, as new breakthroughs. However, in this path, Binance's progress, whether compared to Hyperliquid or other very proactive CEXs (like Bitget, Gate, Bybit, etc.), appears somewhat slow.

Last Monday, Binance officially launched its first stock token contract TSLA (Tesla), and today it followed up with INTC (Intel) and HOOD (Robinhood). However, at the same time, Binance's pursuers like Gate and Bitget are aggressively expanding traditional asset classes, from stock tokens to precious metals, from indices to commodities, and competitors have already initiated a battle for potential users.

On the decentralized side, Hyperliquid has already launched dozens of traditional asset targets, including Pre-IPO stocks like OpenAI and Anthropic, with its HIP-3 open architecture, accumulating considerable trading volume around these assets—recently, traditional assets once occupied half of Hyperliquid's trading volume rankings.

What Has Changed?

Looking at the current arguments together, it is actually difficult to conclude that "Binance has lost its throne." Binance remains the most important liquidity hub. However, what I believe is truly worth being vigilant about is not that Binance's share has been temporarily surpassed by a specific second-tier exchange, but rather that Binance is continuously facing structural challenges in the most core trading battlefield.

What Binance is losing is not market share, but the discourse power of "defining what an exchange is."

For a long time, the reason Binance has been considered the "largest exchange in the universe" is not only because it has the largest liquidity but also because—where price discovery occurs, where mainstream funds transact, and which exchange new assets should first test the waters, the industry’s default answer has always been Binance.

But as more and more high-net-worth accounts prioritize "verifiable, fair, and traceable" over fees and brand, as price discovery begins to be reorganized on-chain, and as the experimental field for new assets gradually shifts from the back end of exchanges to the front-end verifiable market mechanisms, Binance is encountering not the same type of competitor challenges it faced in the past, but opponents that may bring about a paradigm shift in the industry.

While the article discusses some specific categories, the underlying issue is the core value of exchanges themselves: where prices are generated, and who backs the trust.

Perhaps Binance should consider how deep their moat really is.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。