China, the United States, Europe, Japan — love and kill each other? Money explains everything.

Recently, tensions arose between the United States and Europe over Greenland, and the cooperation between Canada and China has also caused friction between the U.S. and Canada. The biggest variable in the U.S.-China market throughout 2025 will be trade disputes and the redistribution of supply chains.

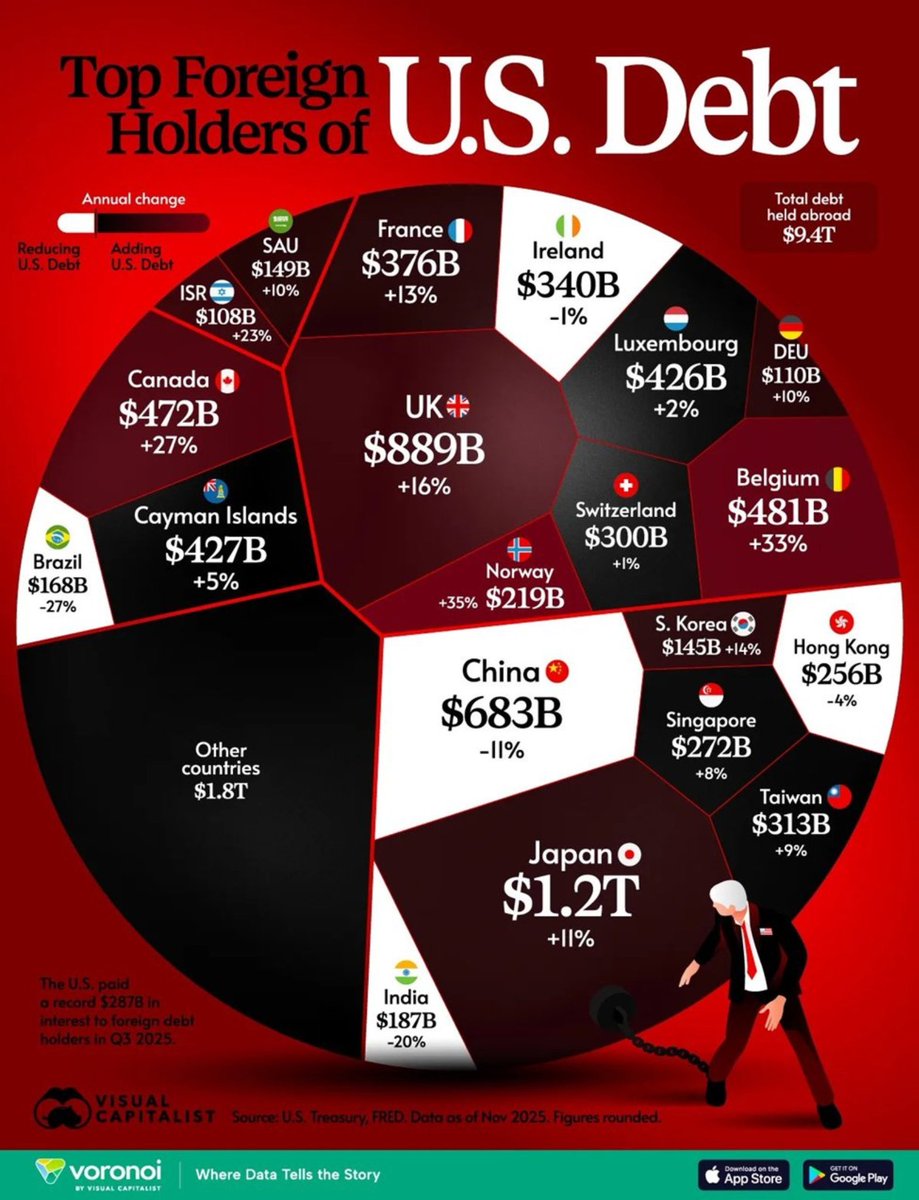

However, looking at the purchase of U.S. Treasury bonds, overseas holders own a total of $9.4 trillion in U.S. debt, with Europe (not the EU) accounting for 33.4% of that share. Japan is one of the largest holders among single countries and continues to increase its holdings, indicating that geopolitical conflicts can tear narratives apart, but it is difficult to immediately disrupt the settlement and collateral systems.

First, the more conflicts there are, the more U.S. dollar assets resemble cash during wartime.

Geopolitical conflicts lead to uncertainties in energy and shipping costs, increased risks of supply chain disruptions, and extreme policy measures (including sanctions, export controls, industrial subsidies, and defense budget expansions). This directly raises risk premiums, causing global funds to naturally gravitate back to U.S. dollar liquidity and U.S. Treasury collateral.

Thus, the overseas holdings of U.S. Treasury bonds are the most reflective of the distinction between "friends and foes," showing more pronounced characteristics of custodial and allocation features within the "financial center and ally system."

Second, the high holdings in Europe are precisely the result of the financialization of conflicts.

In Europe, especially in countries like the UK, Luxembourg, Ireland, and Belgium, it is often not that Europeans love the U.S. more, but rather that global funds rely more on mature custodial, clearing, repurchase, and derivatives systems in a conflict environment. These systems are most likely to register positions in European financial hubs.

In simpler terms, when the world is more chaotic, funds need channels more than ever, and Europe serves as that channel while the U.S. provides the underlying assets. This explains why Europe holds such a high proportion of U.S. Treasury bonds, reflecting financial infrastructure and funding pathways rather than emotional statements.

Third, Japan is a passive major player in geopolitical conflicts.

For Japan, geopolitical conflicts amplify two types of pressure:

A. Exchange rate pressure and energy price pressure. The more volatile the exchange rate, the more foreign exchange assets are needed as a buffer.

B. As risks rise, life insurance or pension funds increasingly need long-duration assets to match liabilities. Coupled with the need for foreign exchange intervention when necessary, Japan's holdings of U.S. Treasury bonds resemble structural allocations; it's not about whether they want to buy, but rather that the system necessitates holding them.

This also explains why, during rising tensions and conflicts, Japan often does not take sides as vocally as slogans suggest, but continues to maintain a stable weight of U.S. dollar assets on the asset side.

Fourth, China's logic of reducing holdings is essentially a logic of geopolitical conflict.

An increase in conflict means a rise in tail risks. The Russia-Ukraine conflict has already taught us a valuable lesson: risks of freezing, sanctions, payment channel disruptions, and even the politicization of assets will accompany conflicts.

Thus, China's reduction in holdings resembles risk management of foreign reserves, lowering exposure to single counterparties, increasing asset mobility, and enhancing diversification. Of course, reducing holdings does not equate to decoupling, nor does it mean exiting the U.S. dollar system, as in reality, there are not many deep and liquid assets that can be substituted in the short term. This is the love-hate relationship: political confrontations escalate, yet financially, they are still constrained by the same system.

Geopolitical conflicts will accelerate the contradictions of fiscal policy, interest rates, and debt.

Conflicts mean increased defense spending, industrial subsidies, and localization costs in supply chains, all of which ultimately contribute to fiscal deficits. The larger the deficit and the higher the interest rates, the more the interest payments on U.S. debt resemble an ever-expanding black hole.

The more conflicts there are, the more U.S. Treasury bonds are needed, and the higher the interest costs the U.S. pays, the more likely policies will be countered by the market. This is the real financial battlefield in the coming years; by 2025, the interest the U.S. pays to other countries will reach $287 billion.

Therefore, from the perspective of fund distribution, the so-called "friends and foes" are actually quite clear on the financial level. The U.S., European financial hubs, and Japan will naturally "band together" within the same settlement and collateral system, not because they are more united, but because they share the same pool of U.S. dollar assets, custodial clearing networks, repurchase markets, and risk hedging tools. The more chaotic the world becomes, the more this system needs stable underlying collateral, making U.S. Treasury bonds resemble standard ammunition in wartime cash.

Although China is reducing its holdings, it remains one of the major holders of U.S. Treasury bonds. This fact itself indicates that the confrontation between China and the U.S. can escalate in narrative, but a complete financial fallout has not occurred, at least not to the point of liquidation. More realistically, it is not that they want to break ties, but that there are too few deep and liquid assets that can be substituted in the short term, and foreign reserve management cannot make decisions based on emotions.

You can dislike your opponent, but it is very difficult to avoid using your opponent's system in the short term.

PS: This situation also appears in the cryptocurrency field; you can criticize #Binance every day, but when it comes to trading choices, you may still have to choose Binance, not because you like it, but because depth and liquidity often leave you with no other options.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。