Over the past decade, Bitcoin's remarkable rise during the Spring Festival has been one of the most discussed seasonal patterns in the cryptocurrency market. However, with the maturation of the market itself and profound changes in the global macro landscape, this once-celebrated "red envelope market" is facing unprecedented challenges.

As we enter 2026, the trading logic of Bitcoin has fundamentally changed: it is no longer a self-indulgent fringe asset; its price is increasingly shaped by macro forces such as global liquidity, central bank policies, and geopolitical risks. This means that the simple seasonal historical patterns are being overshadowed by grander and more complex narratives.

1. The "Spring Festival Effect" Defined by Data: How Historical Patterns Formed

Before discussing the changes, it is essential to understand where the so-called "Spring Festival Effect" originated. Historical data clearly depicts this phenomenon: over the past ten years (2015-2024), Bitcoin has recorded gains during the Lunar New Year holiday, with a significant average increase. Some analyses suggest that if one buys three days before the Spring Festival and sells ten days after, based on data from 2015 to 2023, an average investment return of about 11% can be achieved.

Bitcoin Price Performance During the Spring Festival Holidays from 2015 to 2024

● 2024: The Spring Festival holiday is from February 8 to February 14. During this period, Bitcoin's price rose from $44,349 to $52,043, an increase of +17.3%.

● 2023: The Spring Festival holiday is from January 20 to January 29. During this period, Bitcoin's price rose from $21,071 to $23,960, an increase of +13.7%.

● 2022: The Spring Festival holiday is from January 29 to February 6. During this period, Bitcoin's price rose from $37,716 to $42,656, an increase of +13.1%.

● 2021: The Spring Festival holiday is from February 10 to February 16. During this period, Bitcoin's price rose from $46,420 to $50,689, an increase of +9.2%.

● 2020: The Spring Festival holiday is from January 23 to January 29. During this period, Bitcoin's price rose from $8,682 to $9,449, an increase of +8.8%.

● 2019: The Spring Festival holiday is from February 2 to February 10. During this period, Bitcoin's price rose from $3,462 to $3,685, an increase of +6.4%.

● 2018: The Spring Festival holiday is from February 15 to February 20. During this period, Bitcoin's price rose from $9,449 to $11,786, an increase of +24.7%.

● 2017: The Spring Festival holiday is from January 27 to February 1. During this period, Bitcoin's price rose from $918 to $986, an increase of +7.4%.

● 2016: The Spring Festival holiday is from February 6 to February 14. During this period, Bitcoin's price rose from $374 to $404, an increase of +8.0%.

● 2015: The Spring Festival holiday is from February 18 to February 24. During this period, Bitcoin's price rose from $234 to $238, an increase of +1.7%.

The formation of this pattern is not derived from mysticism but is driven by a series of specific structural factors:

Liquidity Pulse: On the eve of the Spring Festival, the People's Bank of China typically injects short-term liquidity into the financial system to ensure smooth payments during the holiday. At the same time, businesses and residents withdraw large amounts of cash (for year-end bonuses and red envelopes), and some of this money may flow into risk assets like cryptocurrencies during reallocation.

Funds Redistribution: The "red envelope" (lucky money) culture leads to a large amount of cash circulating among the public in a short period, some of which may be invested in the cryptocurrency market by the younger generation of investors.

Market Activity Changes: The week-long Spring Festival holiday causes Asian traders to leave the market, resulting in a significant reduction in overall trading volume. In a low liquidity environment, any directional flow of funds is more likely to trigger price fluctuations.

Behavioral Finance Influence: The festive atmosphere may affect investors' risk preferences and decision-making psychology.

Thus, the historical Spring Festival market is essentially the result of the resonance between specific regional liquidity changes, investor behavior, and the prevailing global accommodative macro environment.

2. Cracks in the Pattern: When Old Frameworks Encounter New Realities

However, no market pattern is eternal. The Spring Festival market of 2025 has already shown signs of fatigue, and even well-researched trading strategies may fail when the macro landscape shifts. This marks a critical turning point.

The old driving factors are weakening or changing. For example, the promotion of the digital yuan (e-CNY) and the widespread adoption of digital payments are altering traditional cash flow patterns. More importantly, the structure of participants in the Bitcoin market has undergone a dramatic transformation.

● Shift in Dominant Forces: Institutional funds, represented by the U.S. spot Bitcoin ETF, have become one of the dominant forces in the market. The decision-making logic of these funds is entirely based on global macroeconomic indicators (such as Federal Reserve policies, inflation data), regulatory developments, and asset allocation needs, rather than Eastern festivals.

● Narrowing Trading Windows: Due to improved information efficiency and the prevalence of algorithmic trading, any arbitrage opportunities based on seasonal expectations are priced in by the market at a faster rate. This means that relying on historical patterns for trading has become highly time-sensitive, and mere "faith" is no longer sufficient to guarantee profits.

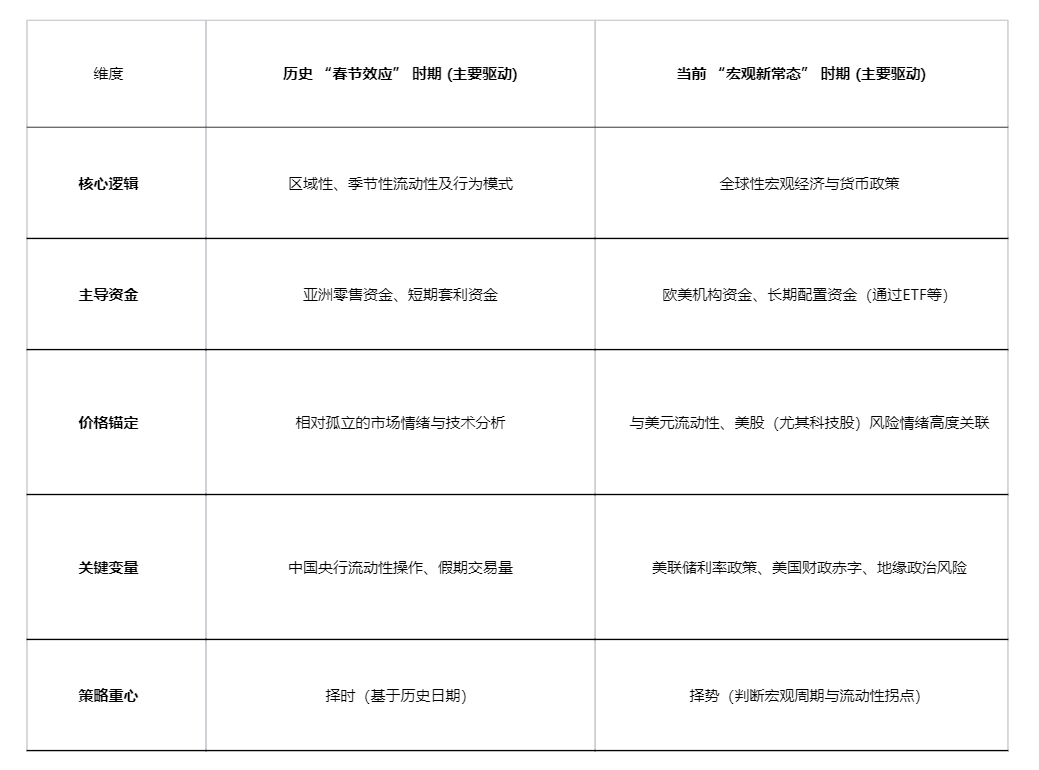

The table below summarizes the evolution of the core factors driving the Bitcoin market from the "Spring Festival Effect" period to the current "New Macro Normal":

3. The Start of 2026: Navigating Between Multiple Macro Variables

As we enter 2026, the Bitcoin market has not exhibited the strong unilateral trend that was anticipated but has instead entered a phase of fluctuation at high levels. This perfectly reflects the current market's search for balance under multiple macro variables.

1. Liquidity: From Tightening to Marginal Improvement Expectations

● Global dollar liquidity is widely regarded as the lifeline for Bitcoin prices. Some believe that the ongoing liquidity tightening in 2025 has bottomed out by the end of the year.

● The market is closely watching the Federal Reserve's actions, such as its reserve management purchases (RMP) aimed at alleviating pressure on the financial system. Although this is not quantitative easing, it helps restore the liquidity environment from "tight" to "neutral." Any marginal improvement in liquidity is seen as a potential boon for risk assets.

2. Monetary Policy: Tug-of-War Between Rate Cut Expectations and Economic Data

Slowing inflation has created a so-called "Goldilocks" environment, where the economy is neither too hot nor too cold, providing room for the Federal Reserve to continue cutting rates. However, stronger-than-expected economic data may weaken aggressive rate cut expectations, thereby suppressing Bitcoin prices in the short term. The market is seeking direction in this tug-of-war, making the Federal Reserve's January meeting minutes and subsequent statements crucial.

3. Institutional Behavior: ETFs as New "Ballast" and Barometers

● The fund flows of the U.S. spot Bitcoin ETF have become a real-time barometer for observing institutional sentiment. After experiencing outflows at the end of 2025, the beginning of 2026 saw a significant net inflow into ETFs, indicating that institutional funds are repositioning.

● This "behavioral reset" provides critical stability support for the market. Meanwhile, the selling behavior of "whales" (addresses holding large amounts of Bitcoin) has eased, while retail investors continue to accumulate.

4. Politics and Regulation: The Greatest Uncertainty

● The political situation in the U.S. in 2026 constitutes a significant variable. Analysts believe that if Trump is in power, his appointment of the Federal Reserve Chair could greatly impact the independence of monetary policy.

● More importantly, the legislative process of the "Digital Asset Market Clarity Act" is highly anticipated by the market, as this bill is expected to provide the first comprehensive federal regulatory framework for cryptocurrencies in the U.S., eliminating the long-standing regulatory cloud hanging over the industry. Any positive progress could become a powerful price catalyst.

4. Strategy Evolution: Seeking Asymmetric Opportunities in a Complex Market

In the face of such a complex market environment, traders need to evolve rather than cling to old rules.

● First, one must accept the new reality of "macro dominance." Trading Bitcoin, to a considerable extent, involves trading expectations around global dollar liquidity, Federal Reserve policies, and geopolitical factors. This means that monitoring changes in the U.S. Treasury General Account (TGA), the reverse repo market, and the Federal Reserve's balance sheet may have become more important than analyzing holiday dates.

● Second, view factors like the "Spring Festival" as liquidity disturbance items rather than directional indicators. The Spring Festival holiday will still lead to reduced liquidity during Asian trading hours, potentially amplifying volatility. However, this is more likely to create a high-volatility trading environment rather than a deterministic unilateral market. Successful trading lies in capitalizing on this volatility rather than simply betting on price movements.

● Finally, focus on the long-term opportunities brought about by structural changes. Traditional financial institutions on Wall Street, such as JPMorgan, are building cryptocurrency trading services for institutional clients, while Russia has seen its first compliant cryptocurrency-backed loans, and stablecoin payments are being integrated into global consumer scenarios like Trip.com. These seemingly isolated events point to a trend: cryptocurrencies are accelerating their integration into the infrastructure of global traditional finance and the real economy. This deep, structural integration is the fundamental support for their long-term value.

The "Spring Festival market" of Bitcoin, as a vivid historical memory, fading is precisely a sign of market maturity. It tells us that a market involving trillions of dollars in institutional capital must synchronize its pulse with the heartbeat of the global economy.

For investors, the real "red envelope" is no longer hidden in the Lunar New Year calendar but is concealed in a profound understanding of global liquidity cycles, a keen judgment of regulatory political winds, and a steadfast belief in technological integration trends.

The market in 2026 rewards not the devotion to old models but the adaptability to new frameworks. As Bitcoin trading increasingly resembles a macroeconomic game, only those who can read the broader chessboard will seize the opportunities of the next era.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。