This week, a closed-door meeting hosted by White House crypto advisor Patrick Witt focused on the issue of stablecoin yields, bringing the debate over U.S. crypto regulation to the forefront. On one side are exchanges like Coinbase and representatives from the crypto industry, trying to maintain high yields and product innovation; on the other side are banking representatives, hoping to bring this emerging market under familiar deposit and money market fund regulatory frameworks. At the same time, Rosa María González, a suspect in the Generación Zoe scam, was captured in Venezuela, with reports from a single source claiming the amount involved exceeds $120 million and that she fled with 611 BTC, highlighting the cost of regulatory vacuums in Latin America. Meanwhile, an address that had been dormant for 8 years, “3BTqd,” suddenly transferred 243 BTC to Gemini, worth approximately $19.15 million, and Tether open-sourced its Bitcoin mining operating system MOS and rallied a developer community, creating a series of “background noises” outside the grand regulatory game. Amidst the opposing interests, shadows of scams, and the probing of whales, how the U.S. will set future regulatory paths for crypto assets, especially stablecoins, has become a core issue that cannot be ignored.

White House Debate: How to Define and Divide Stablecoin Interest

● Meeting Framework: According to a single source, this closed-door meeting held at the White House this week, hosted by White House crypto advisor Patrick Witt, had its core topic clearly focused on “how stablecoin yields should be regulated and distributed.” Participants included crypto industry representatives like Coinbase and several banking representatives, indicating that the discussion was not about abstract principles but directly addressed the substantive issue of “who has the right to earn interest from the dollar assets backing stablecoins.”

● Points of Disagreement: From the disclosed information, there are fundamental disagreements between the crypto representatives and the banking camp regarding yield ownership and product attribute identification. Crypto platforms hope that stablecoin-related products will be viewed as tools for technological and payment innovation, allowing them to continue offering attractive yields to users under compliance; the banking side, however, prefers to view them as financial products akin to deposits or money market funds, advocating for stricter capital constraints, liquidity requirements, and yield distribution rules to prevent “shadow banking” from squeezing the traditional system.

● Atmosphere and Stance: According to market voices cited in research briefs, “crypto industry representatives expressed optimism about the meeting's progress,” signaling that they believe there is still room to negotiate for more lenient arrangements before rules take shape. In stark contrast, “banking representatives maintained a hardline stance with a lack of willingness to compromise,” showing that traditional finance is concerned about stablecoin yield products eroding the foundation of their deposit and wealth management businesses, remaining highly vigilant against any model that “circumvents bank licenses to capture interest spreads.”

● Information Limitations: It is important to emphasize that the specific terms of the meeting, verbatim statements, and internal negotiation details have not been made public; currently, the external references are mostly from single-source disclosures, which carry risks of information asymmetry and biased viewpoints. Therefore, the progress and conclusions of this discussion can only be seen as a snapshot of the U.S. regulatory path, rather than a complete picture, and future understanding will still need to be calibrated with legislative texts and official statements from regulatory bodies.

Clash Between Banks and Exchanges: Who Truly Controls the “Right to Yield”

● Traditional Framework Motivation: The banking industry strongly advocates for using the existing regulatory framework for deposits and money market funds to constrain stablecoin yields, essentially to avoid the emergence of a gray market that functions “like deposits, like money market funds, but is not subject to the same level of regulation.” According to this logic, as long as stablecoin issuers or platforms hold large-scale dollar assets that generate interest, bank regulators will believe that these funds and yields should fall under the purview of bank-style capital adequacy, deposit insurance, and liquidity regulation.

● Crypto Platform Demands: In contrast, platforms like Coinbase hope to retain as much high yield and product design innovation space as possible on a compliant basis. The reason is twofold: on one hand, yields are a key driver for attracting users to hold stablecoins and participate in on-chain activities; on the other hand, one of the competitive advantages of crypto platforms over traditional banking is their ability to rapidly iterate various yield-generating products. If yields are overly “bankified,” profit margins will be compressed, significantly weakening the platforms' advantages in attracting existing dollars and expanding new users.

● Interest Spread and Fund Relationships: The current game can be dissected into two main lines: the first is “who takes the interest spread”—whether it is divided among issuers, custodians, and the banking system, or whether a larger proportion is returned to users after deducting compliance costs; the second is “who holds the legal relationship with users' funds”—whether the asset custody and yield distribution relationship is dominated by the platform and users, or whether banks view it as their own liabilities, incorporating users into the traditional deposit system. These two lines will determine whether users face products that are “more like bank deposits” or tools that are “closer to crypto-native assets.”

● Legislative Precursor Battle: The White House meeting is not an isolated event but is intertwined with the Senate's ongoing progress on crypto and stablecoin legislation. Before formal legislation is enacted, the coordination and communication at the White House level essentially serve as a “pre-deployment” around the interests at stake. Those who can influence policymakers' perceptions at this stage will have a better chance of securing favorable terms in future regulations, which also explains why both sides exhibit a high-intensity game posture regarding yield and attribute issues.

Collapse of the Argentine Ponzi: A Painful Footnote to the Regulatory Vacuum in Latin America

● Latest Developments: Research briefs indicate that Rosa María González, a suspect involved in the Generación Zoe scam, was recently captured in Venezuela, marking the latest node in the cross-border pursuit of this case. According to a single source report, the case involves funds exceeding $120 million, and she allegedly fled with 611 BTC during her escape, a figure that stands out starkly in Latin America's already fragile financial system and complicates the victims' recovery efforts.

● Data and Information Caution: Currently, the external understanding of Generación Zoe is largely based on media reports and victim statements, with specific operational models and rebate structures not fully disclosed at the official level. Similarly, the aforementioned $120 million and 611 BTC figures also come from single sources, lacking multi-party cross-verification. In the absence of systematic judicial disclosures, these numbers are better suited as “risk magnitude references” rather than rigorous statistical conclusions.

● Regulatory Vacuum and Educational Deficiency: Generación Zoe is not the first large-scale crypto-related scam in Latin America. The lack of regulatory frameworks or weak enforcement often allows high-yield promises to operate long-term in gray areas; the general lack of financial education makes it difficult for many ordinary people to distinguish between legitimate compliant investments and Ponzi structures. When the crypto narrative combines with “get rich quick” rhetoric, this region becomes a breeding ground for various Ponzi and pseudo-investment projects.

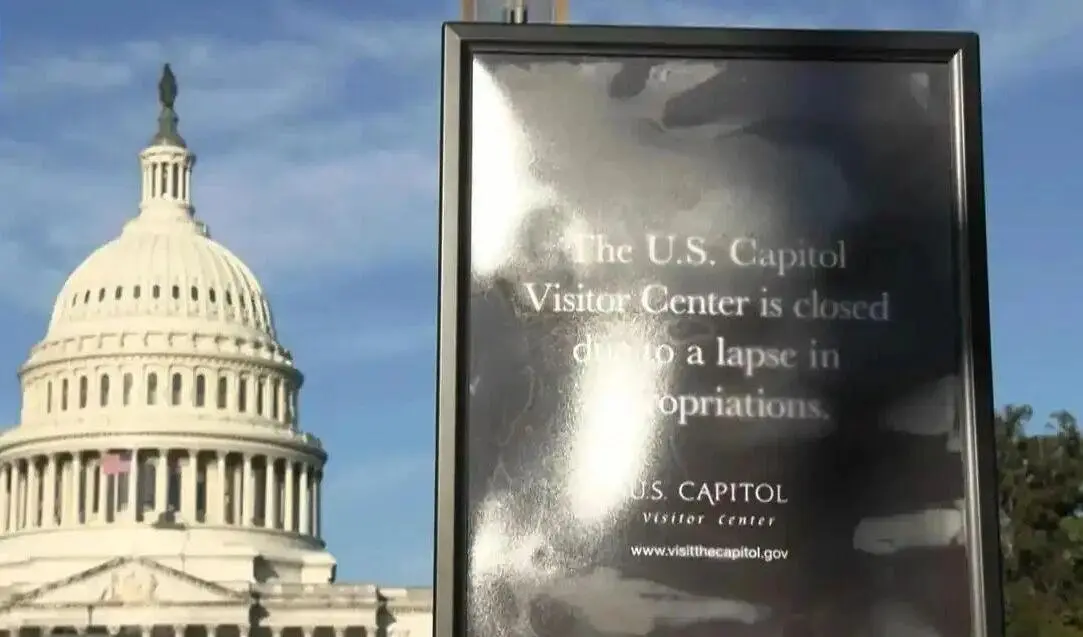

● Rules First or Incidents First: Unlike the forward-looking discussions currently surrounding stablecoin regulation in the U.S., many Latin American countries often only address issues after scams explode and funds evaporate, resorting to criminal accountability to clean up the aftermath. The capture of the Generación Zoe suspect in Venezuela signifies a strengthening of the “post-incident pursuit” mechanism, but compared to preventing risks through clear regulatory frameworks and investor protection systems beforehand, this path is costlier, harder to recover from, and will widen the gap in the quality of the crypto ecosystem compared to mature markets.

Awakening of Sleeping Whales and Tether's New Layout Behind the Probes

● Whale Activity Details: Research briefs point out that a Bitcoin address that had been dormant for 8 years, “3BTqd,” recently transferred 243 BTC to the Gemini exchange, valued at approximately $19.15 million. The sudden awakening of such a long-dormant address is often interpreted by the market as a signal that “early large holders are reassessing their positions,” regardless of whether actual selling occurs afterward, it will trigger a chain of associations on an emotional level.

● Boundaries of Signals: Although such whale address movements have always attracted attention from on-chain analysts, equating them simply with “a significant price change is imminent” is not rigorous. On one hand, transferring to an exchange does not necessarily mean selling; it may involve asset restructuring, pledging, or compliance arrangements; on the other hand, in a phase of heightened regulatory uncertainty, large amounts of capital migrating between compliant platforms may itself be a preemptive layout for future regulatory environments, rather than merely a short-term trading signal.

● Tether's Technical Layout: In contrast to individual whale operations, Tether has recently made new investments at the infrastructure level: open-sourcing the Bitcoin mining operating system MOS and establishing a Discord developer community, attempting to attract developers and mining participants around this system. Although the research briefs did not disclose the specific technical architecture and performance indicators of MOS, it can be confirmed that this marks Tether's further expansion from being a “dollar token issuer” into the Bitcoin ecosystem's infrastructure.

● Probes and Expansion: On one side, early whales are adjusting their asset positions on the eve of regulatory crossroads; on the other side, Tether is continuously expanding its ecological influence through technological open-sourcing and community operations. Both reflect a broader behavioral pattern: institutions and large funds, in the face of an uncertain compliance future, choose to test the waters with small steps and diversify their layouts, preserving upward space for participation in the crypto ecosystem while leaving room for maneuvering against potential regulatory red lines.

From Latin American Lessons to Washington Tug-of-War: The Two Ends of Rule Absence and Interest Overload

● Two Extreme Landscapes: Placing the Generación Zoe scam alongside the White House stablecoin yield meeting, on one end is a Ponzi structure expanding almost without regulatory constraints, ultimately resulting in over a hundred million dollars in losses and cross-border flight; on the other end, regulators, banks, and the crypto industry are engaged in high-density games around “who takes how much yield” before rules are finalized. The former is a disaster caused by serious rule absence, while the latter implies the risk that overly prioritized interests may slow down the formation of rules.

● Balancing Triple Objectives: The current policy choices in the U.S. must seek a balance among three objectives: first, protecting investors and consumers, to avoid a repeat of the Latin American Ponzi tragedy; second, maintaining the dollar's dominant position in the global financial and payment systems, preventing foreign or regulatory arbitrage products from seizing the narrative power of stablecoins pegged to the dollar; third, not stifling crypto and fintech innovation, to prevent overly tightening rules from pushing innovative activities overseas or completely underground.

● Cost of Stalemate: If banks and the crypto industry continue to be at an impasse regarding yield attributes and regulatory frameworks, the most direct consequence will be regulatory delays—legislation and rules will be continuously postponed while the market accelerates its evolution in gray areas. Without filling the regulatory vacuum, more and more “high-yield products” will innovate in ambiguous areas, raising systemic risks; and when incidents occur, the costs will be borne by users and the broader financial system, repeating Latin America's cycle of “incidents first, accountability later.”

● Core of the Discussion: Among all discussions, there are two lines that will almost certainly be prioritized by any new regulations: first, “how yields are to be distributed in compliance”—including interest rate caps, information disclosure, risk matching, and suitability management; second, “who bears the risk”—once underlying assets or platforms encounter issues, whether there are arrangements similar to deposit insurance, capital advances, or regulatory intervention. Whether U.S. regulation can find a balance between these two lines that does not overly stifle innovation while sufficiently stabilizing systemic risk will directly determine the future shape of the stablecoin industry.

Where to Look Next: Regulatory Implementation Window and Behavioral Adjustments

In the coming months, the interaction rhythm between the White House and the Senate on stablecoin legislation will become a key observation point. Once a consensus at the White House level gradually becomes clear, related Senate bills may gain greater momentum, forming a relatively clear regulatory expectation window for the industry; conversely, if the interest landscape remains unresolved for too long, the legislative process will be repeatedly delayed, forcing the market to navigate in a state of “regulatory uncertainty” for an extended period.

For exchanges, issuers, and users, it is necessary to incorporate the expectation that “yield models will gradually be bankified” into medium- to long-term forecasts: yields may be more constrained by regulatory ceilings, product designs will emphasize transparency and risk matching, and “unlimited high-yield promises” will become increasingly difficult to sustain in a compliant market. At the same time, lessons from Ponzi cases in Latin America, as well as signals like the movements of whale addresses, repeatedly remind the market: in the face of any high-yield temptation, due diligence, risk identification, and self-protection are responsibilities that cannot be outsourced.

From a longer-term perspective, the final determination of U.S. regulation on stablecoins and crypto assets will not only reshape the product forms and capital flows in the domestic market but will also have spillover effects on the global compliance landscape: those who can provide safe, transparent, and predictable dollar-pegged assets within the rules will have a better chance of occupying a stronghold in the next phase of the global crypto financial order. Every tug-of-war in the White House meeting and every ruling in Latin American courts are pieces of the puzzle in this reconstruction process.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。