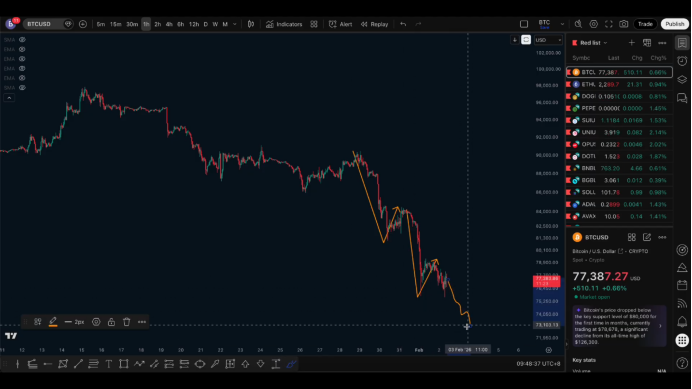

Yesterday, the market experienced a significant drop. In fact, I made it very clear on Saturday: there are no reversal signals at the current position, and it is highly likely that the decline will continue.

Currently, the price has dipped to around 75,000. At this position, I still maintain a bearish outlook and do not see any signs of reversal.

Why continue to be bearish?

The reason is simple; we only look at the current market reality.

So far:

There are no signs of a bottom, no reversal signals, and no bottoming structure has appeared. Most importantly—there is no limit down behavior.

Since there is no limit down, why go long? Why try to catch the bottom?

If you successfully catch the bottom at this position, it does not mean it was a correct trade; it is more like you happened to get it right among multiple attempts. Even if you make a profit, this method itself is not replicable.

On the contrary, participating in the bearish trend, even if close to a temporary bottom or even getting stopped out, this trading logic remains correct.

To judge whether a trading system is reasonable, it is not about looking at individual profits and losses, but whether it follows the trend and has long-term stability.

Previously, we clearly stated our judgment:

When Bitcoin rebounded to around 97,000 to 98,000, it confirmed a second-stage decline on the daily level.

The first stage of the decline started from 126,000;

The second stage of the decline began around 98,000, with the target being to break below 70,000.

This viewpoint has not changed to this day.

Currently, only the previous low of 80,000 has been broken.

Is there an expectation of a rebound? Of course, but we will not gamble on this rebound for a long position because the risk is high.

Unless there is:

A reclaim after breaking the low, and a clear bullish structure formed on the hourly level, only then might there be a short-term long opportunity.

But even so, it does not mean the market has reversed; it is more likely to continue downward, testing the 70,000 level.

Ethereum

On January 28, I clearly pointed out:

Ethereum's resistance zone is around 3,050.

At that time, the price was still between 3,200 and 3,300, and I set the target for Ethereum's next phase at 2,000.

Currently, the lowest point has reached around 2,200.

In my view, the 2,000 level may not hold, and there is a significant possibility of further decline to 1,700 to 1,800.

The reason is simple: this round of decline has clearly accelerated, and Bitcoin's downward trend has not ended.

Even if there is a short-term rebound, I believe the rebound space is likely around 2,500, or above 2,000 to 2,500.

After the adjustment ends, the possibility of another decline and breaking below 2,000 remains high.

Returning to Bitcoin's larger cycle

As early as October of last year, when the price was still around 124,000, I clearly pointed out:

The weekly level spot buying range is between 70,000 and 50,000.

Since 126,000, the overall market has entered a correction cycle, and this directional judgment has not changed to this day.

In the short cycle, breaking the previous low does not mean an immediate reversal; it is more likely to adjust first and then continue to decline.

A true large-scale reversal must go through a bottoming process, not a simple V-shaped rebound.

Currently, many people choose to gamble on a rebound after breaking the low; I personally think this is unreasonable.

Unless you see a clear small cycle reversal structure, otherwise going long in a downward trend carries far greater risk than following the trend to short.

From a larger cycle perspective, there is still a high probability that the previous low will continue to be broken.

If calculated with a 15% extension, in extreme cases, we might see around 63,000 below.

This is also what I have repeatedly emphasized:

The weekly level range around 65,000 is the real position worth considering for gradual spot allocation.

Of course, do not expect to buy at the lowest point; buying in a reasonable bottom range is already sufficient.

From the hourly level, after this round of volume increase and decline, there has not been a rapid V-shaped rebound, indicating that demand below remains weak.

Demand is weaker than supply, making it naturally easier for the market to continue downward.

Price behavior itself has already reflected the market's true trading psychology.

We only need to focus on the price and not be disturbed by so-called "institutional entry" or "capital inflow."

Finally,

Trading is not about "if it has dropped a lot, it should rebound," nor is it "if it has risen high, it should drop," but about seeing what is there and doing what is necessary.

Follow me, join the community, and let's improve together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。