The market has not been good during this period, and it has almost become a consensus.

With no increase in coin prices, low sentiment, and a quiet discussion area, even the usually lively Alpha community has quieted down significantly.

The changes in Alpha are evident to everyone:

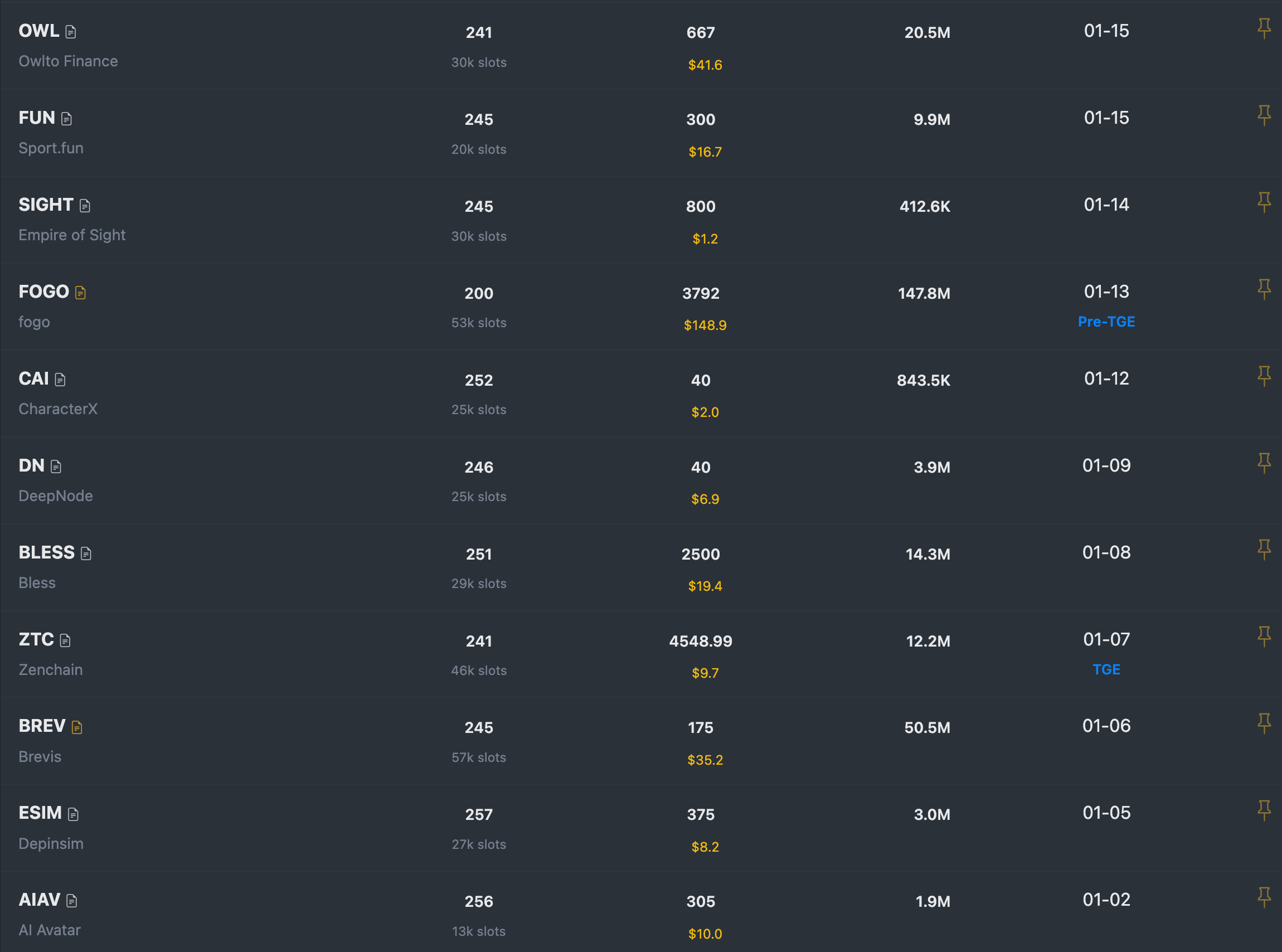

The speed of listing coins has noticeably slowed down, and the thresholds have been raised repeatedly.

In the first half of January, only 11 airdrops were issued in 15 days, with each airdrop scoring above 240 points;

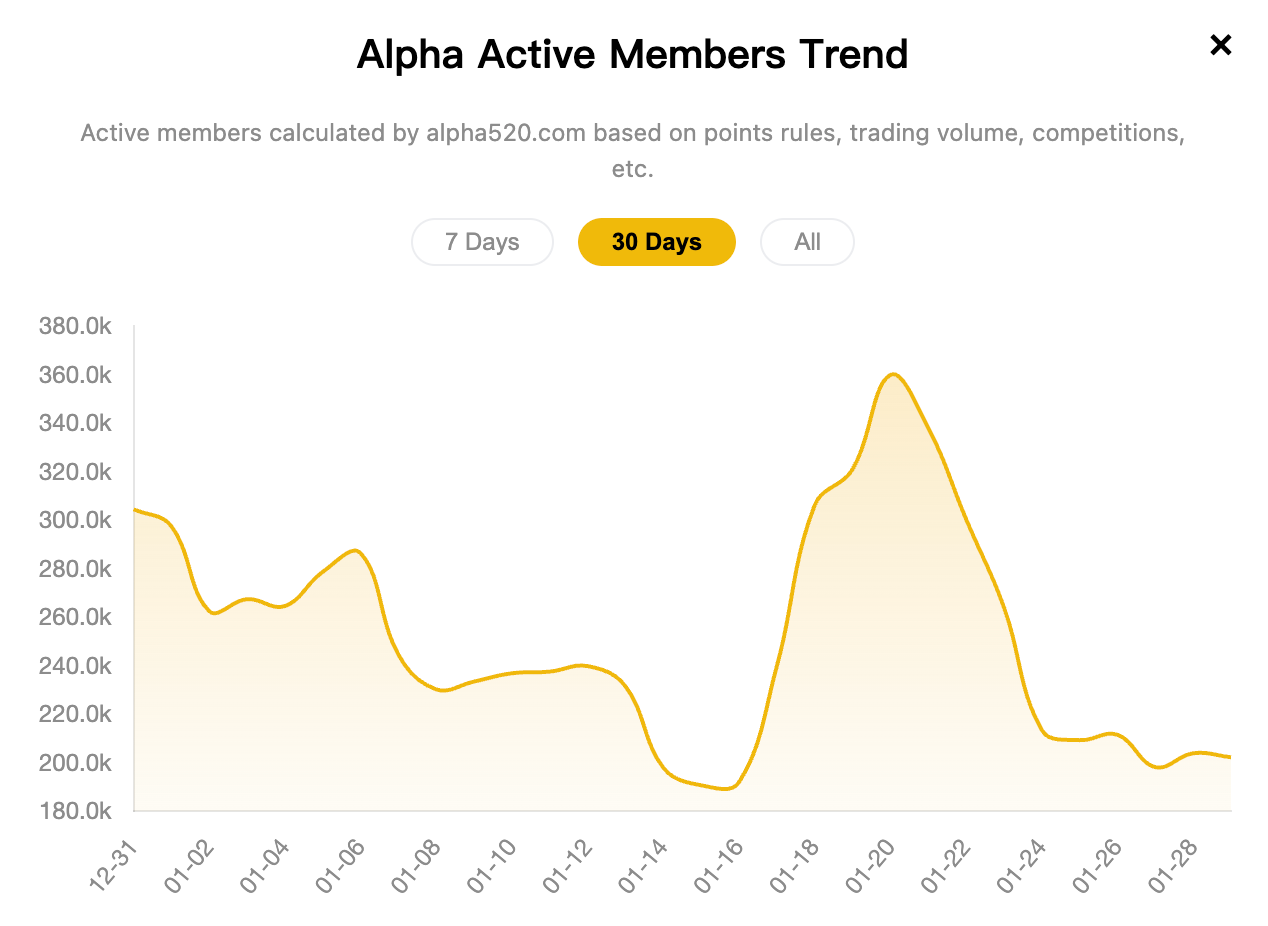

The number of active participants has dropped from a peak of 300,000 to a low of 180,000;

In major communities, almost no one is seriously discussing Alpha anymore.

Even if you are still holding on, you might encounter a "soul-cutting knife" like LISA,

where a single misstep can wipe out your mindset.

But even so, I still haven't quit.

Not for any other reason, but because I can't think of a second one—

A project that requires only five minutes a day, offers relatively stable monthly returns, and allows ordinary people to participate with almost no barriers.

1. When the market is bad, what is truly scarce is not the "get-rich opportunities," but "certainty."

In a bull market, opportunities are everywhere.

You don't need Alpha, you don't need airdrops, and you don't even need too many skills; just stepping on a narrative or a hot topic can double your investment.

But once the market turns bad, the problems become apparent.

You dare not touch contracts, altcoins are in a continuous decline, and trading in waves leads to constant losses; leaving your money idle makes you fear missing opportunities, while acting makes you worry about further losses.

During this phase, what the market lacks is never "high-yield stories," but rather the certainty of knowing what you are doing, why you can earn, and where the boundaries of loss lie.

And Alpha precisely provides this extremely scarce certainty in a bear market.

2. Many people have quit; can Alpha really not make money?

The biggest misunderstanding many have about Alpha is comparing it to speculative returns.

But Alpha has never been a game of vision or direction from the start.

It earns money from rules, participation, and execution.

You don't need to predict whether BTC will rise or fall, nor do you need to judge sector rotations; as long as you complete the interactions, you can get results.

What does this mean?

It means that in a highly uncertain market, you have found a source of income that is relatively independent of luck.

In a good market, this advantage may be obscured;

but the worse the market gets, the clearer the value of this "low correlation" becomes.

Let's calculate the returns from Binance Alpha this month, and everyone will have a clearer answer:

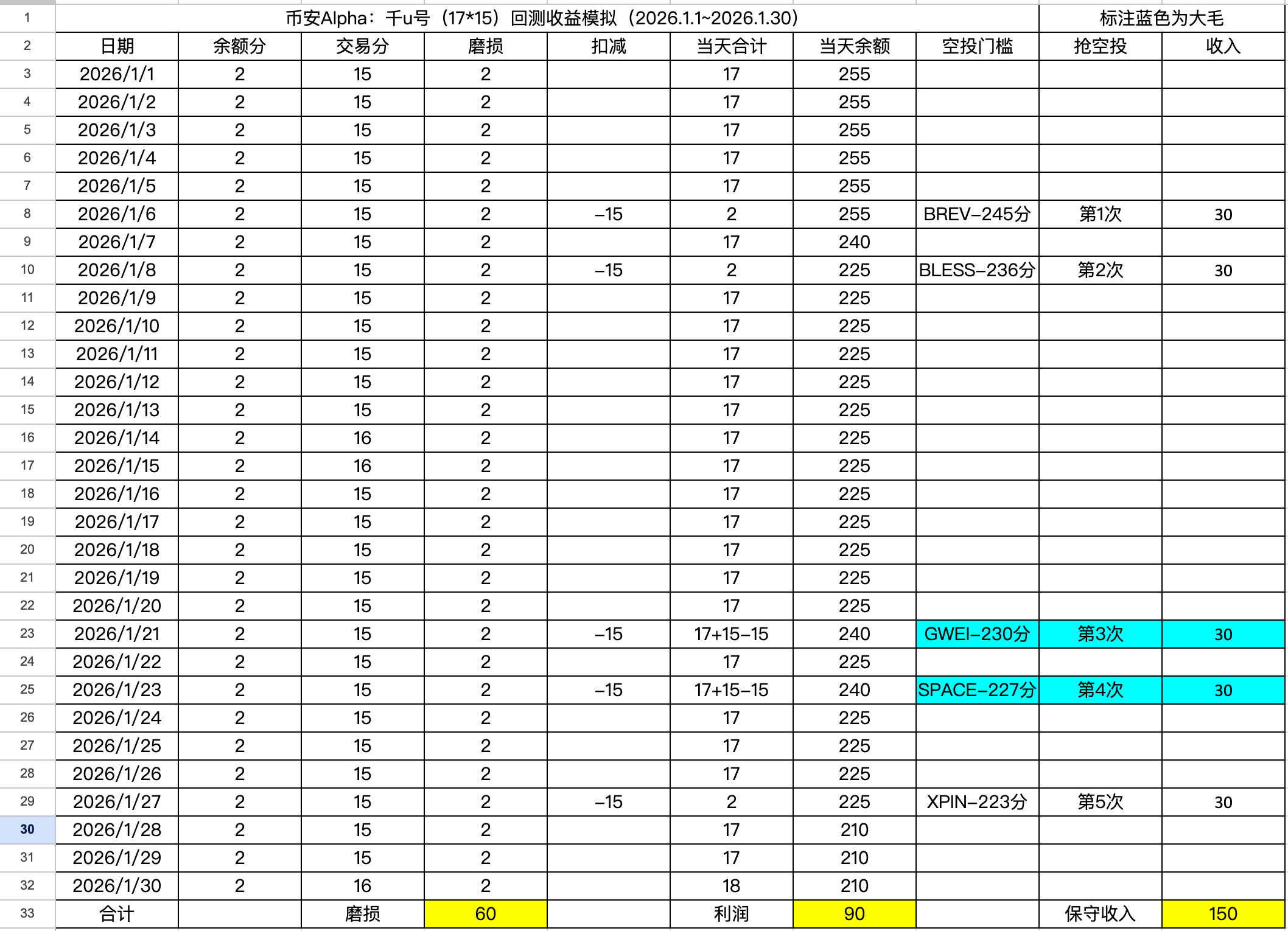

Based on my experience over the past few months, generally using a 1,000 USDT account, trading volume brushing 15 points, a daily +17 points is the most cost-effective and relatively low difficulty, so let's take this as an example.

This simulation period is from January 1 to January 30, covering two complete Alpha cycles. The starting score is calculated at 255 points, and the initial costs incurred from brushing from 0 to 255 points are not included in this statistic. The data is taken from the threshold scores required for regular airdrops (excluding TGE).

On the cost side, we uniformly choose coins with a 4x trading volume bonus for brushing points, and considering that in actual operations, there may occasionally be instances of being caught, we conservatively estimate an average wear of 2 USDT for every 15 points, resulting in a total trading cost of about 60 USDT for the month. On the revenue side, we are even more cautious, uniformly calculating each airdrop at the most conservative 30 USDT, with the projects marked in blue in the table being "big gains," where the actual returns are significantly higher than 30 USDT but have not been amplified in the basic calculations.

From the results, even without calculating the income from the two super big gains, Alpha's monthly guaranteed income is still around 90 USDT. For a 1,000 USDT account, the annualized return has reached 100%. If we include the two super big gains, GWEI and SPACE, the overall return elasticity will be significantly amplified—GWEI airdrop is currently priced at about 100 USDT, while SPACE peaked at 180 USDT during the early airdrop phase.

This also illustrates from another angle that even after experiencing a relatively sluggish and pessimistic early January, users who truly persisted still had the opportunity to encounter unexpected surprises in the latter half of the month. The pace of Alpha has indeed slowed down, but opportunities have not disappeared; they are just more inclined to reward patience and discipline.

3. Since it's profitable, why are there more voices quitting Alpha?

From the data, the number of people brushing Alpha has indeed decreased compared to previous months. At its peak, there were almost 300,000 participants daily, while now it stabilizes at around 200,000. This itself indicates that the heat has receded, but Alpha has not been completely abandoned.

I have summarized three of the most likely reasons for quitting Alpha:

1) Reduced earnings, significant psychological gap

This is especially evident among veteran players. After experiencing the "big gains flying around" during the red-hot period from May to September last year, where one could easily earn a couple of hundred USDT, looking back at the current earnings naturally feels like "cutting in half again."

But if we step out of the emotions and look at the data? According to the previous calculations, a 1,000 USDT account can still achieve an annualized return of around 100%.

2) One misstep, all previous efforts wasted

The risk of being caught does exist, but it is not completely uncontrollable.

For example, checking stability in advance, observing minute-by-minute K-lines, choosing to operate during less volatile periods, avoiding peak times from 8-10 AM, controlling the scale of each brushing operation, and manually setting stop-loss limits if a reverse order is not executed immediately.

I have long adhered to this set of principles; although I occasionally get caught, my overall average cost remains stable at around 15 points, approximately 2 USDT, and it hasn't reached the level of "one mistake wipes out a month's work."

3) Too busy, no time to brush

This is the "opportunity cost" issue many people mention. But brushing Alpha does not mean you have to stare at the screen all the time. Most of the time, you only need to take a quick look during a few relatively stable periods throughout the day, and the actual operation time often takes less than 5 minutes.

Even if you encounter an unstable market, waiting a few more times, in extreme cases, half an hour is enough.

To be honest, those 5 minutes during non-working hours, if not brushing Alpha, are mostly spent on short videos, playing games, or watching ads anyway. At least for me, this time is not scarce.

Thus, it can be seen that most problems can actually be avoided; as long as you maintain the right mindset, Alpha is still a pretty good stable profit project.

4. Alpha Heart Sutra

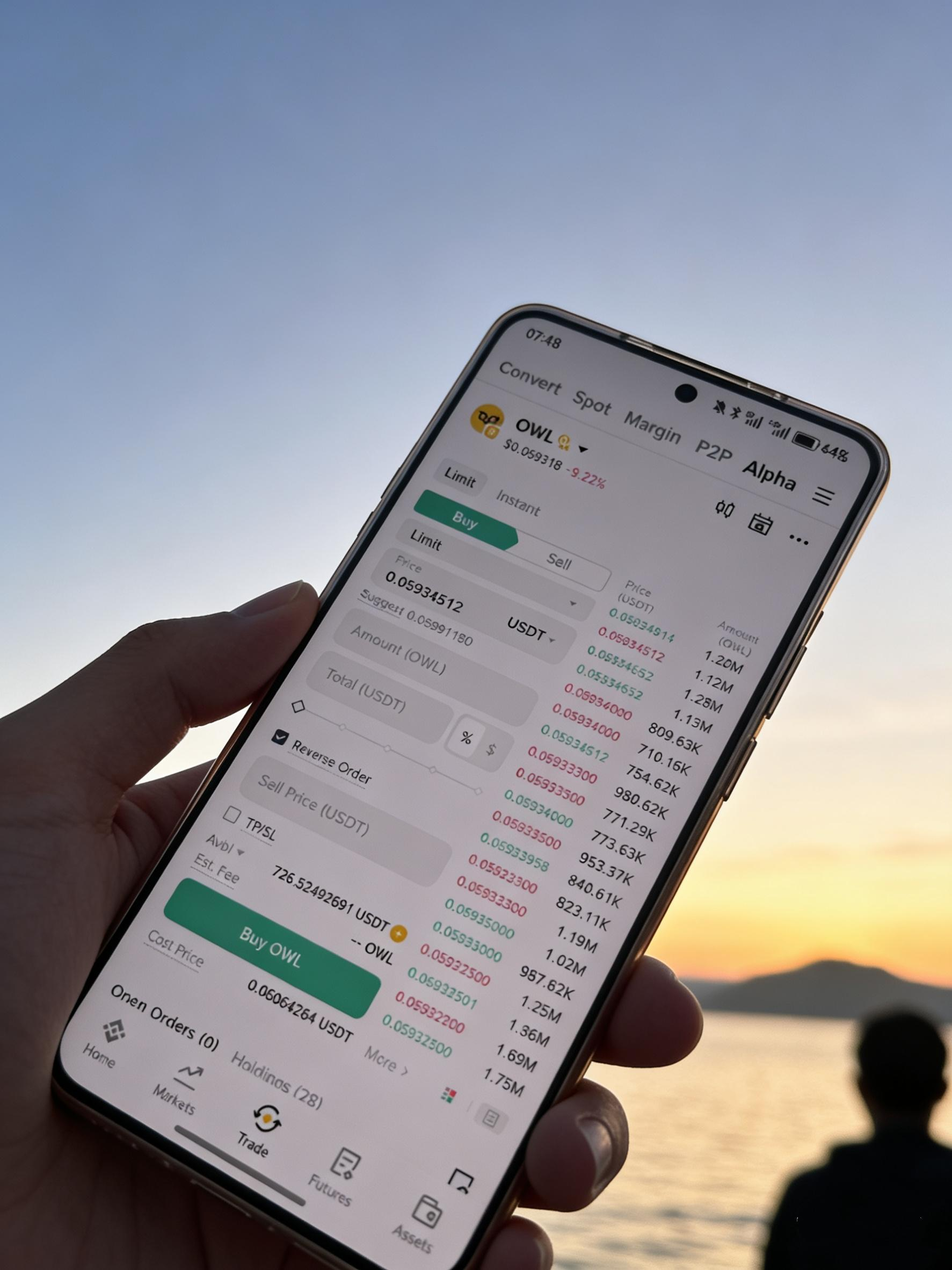

Always remember one thing: We brush Alpha to increase trading volume, not to trade Alpha tokens themselves. Never hold the mindset of "brushing volume while making a profit"; this is the easiest way to crash. Once you encounter a downturn during the volume brushing process, not only may your earnings be swallowed, but it can also cause a devastating blow to your mindset, ultimately leading to a loss.

However, the significance of Alpha is not just a volume brushing task. It is more like a key to the on-chain world.

Many people have never truly engaged with the on-chain ecosystem before and have no way to participate in new projects or airdrops, while Alpha's existence has greatly lowered the participation threshold—allowing ordinary users to complete on-chain interactions in a familiar exchange environment and gradually understand how Web3 operates. You will slowly realize that the opportunities in Web3 do not only exist in trading itself.

More importantly, brushing Alpha has never been a lonely road.

You can join the community, study Alpha projects with others, and share experiences and judgments on Twitter and Binance Square. Everyone continuously learns Web3 knowledge in this process, from initially "not understanding anything" to gradually understanding the rules, familiarizing themselves with the rhythm, and ultimately forming their own methodology.

When you start sharing what you've learned and gain recognition and discussion from others, that sense of achievement often lasts longer than a single airdrop itself. This is the true value that Alpha leaves for long-term participants.

Conclusion: No matter what, I will not give up brushing Alpha.

So, no matter how bad the market is or how cold the sentiment, I will not give up brushing Alpha.

Not because it can produce the next big gain, but because in this highly uncertain market, it still provides me with a certain, executable, and compound interest path—more importantly, it has opened the door to the on-chain world for me, allowing me to meet a group of community partners who are eager to share on-chain knowledge.

When most people choose to exit, give up, or pin their hopes on the next market reversal, I prefer to use those few minutes each day to secure a stable lower limit.

Alpha may no longer be noisy or dazzling, but it still rewards those who follow the rules and are willing to persist in the long term.

The market will fluctuate, and cycles will repeat, but what truly makes a difference is not a single instance of getting rich, but whether you can continue to do the right things during the downturn and do them correctly.

For me, brushing Alpha is that thing "that is still worth doing continuously even when the market is at its worst."

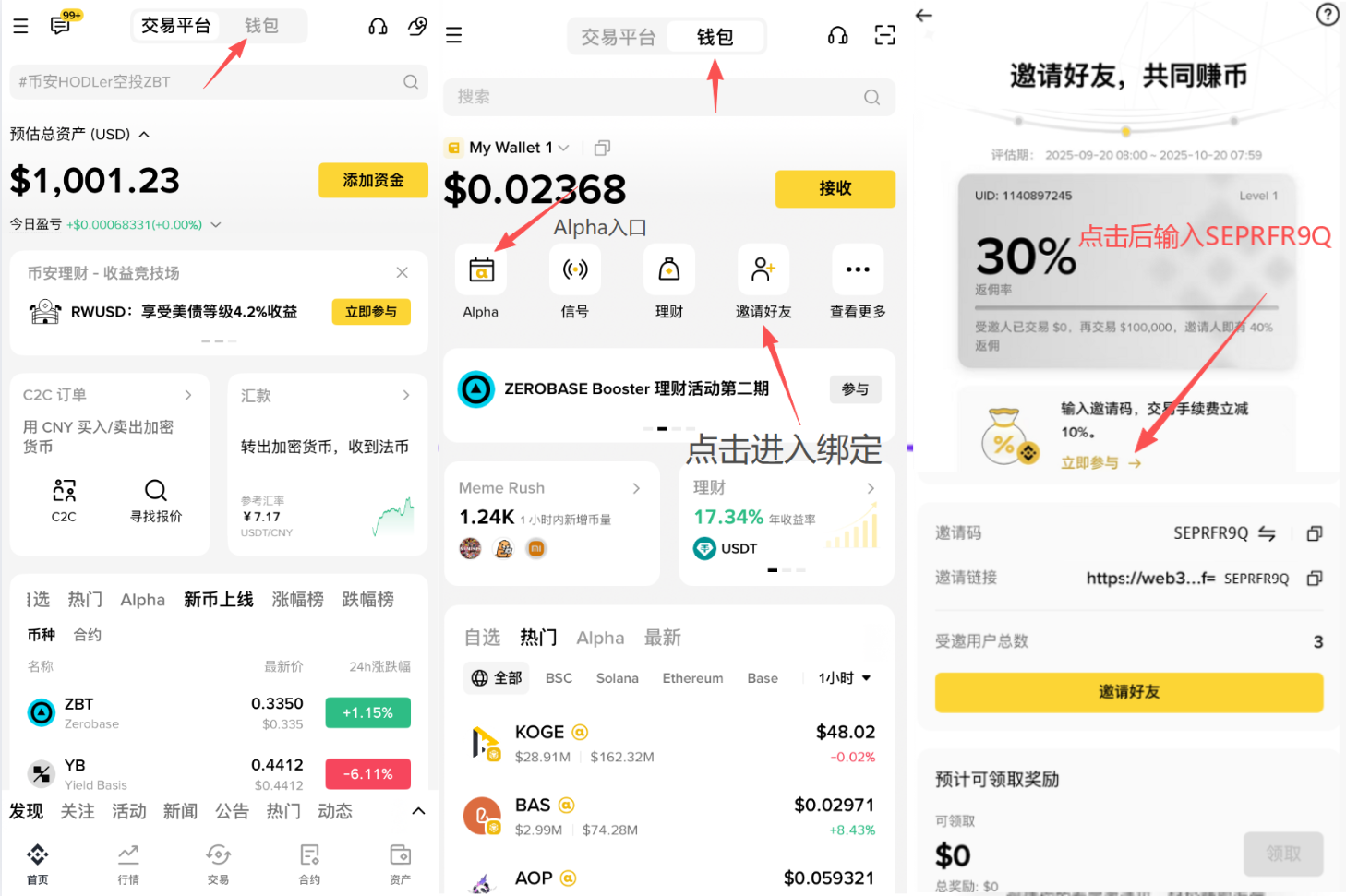

Bind your Binance wallet with AiCoin's exclusive invitation code SEPRFR9Q, and enjoy a permanent 10% reduction in fees.

Here’s the direct link to complete the binding:

https://web3.binance.com/referral?ref=SEPRFR9Q

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。