Will MicroStrategy have issues? It's not an arithmetic problem, but a game theory problem.

As Bitcoin declines, MicroStrategy's creditors may directly demand their money back.

MicroStrategy has prepared a reserve of $2.19 billion to cope with this.

At the same time, similar to a bank run: the worse the situation, the harder it is to finance, the lower the confidence, and the more the stock price falls.

When the new weekly report is released, losses will further increase, and some conservative institutions will not be allowed to allocate their stocks anymore, which may lead to them being kicked out of the index, further triggering sell-offs and causing the aforementioned negative spiral.

MicroStrategy's business model is perfect; it has designed to consider various worst-case scenarios as much as possible. However, whether it can withstand the test if extremely bad situations occur in the future depends on the market's faith in it.

If the bull market returns, it will be safe.

If the bull market does not return, it will remain at risk.

If the bear market is deep, it will be in a chain of risks.

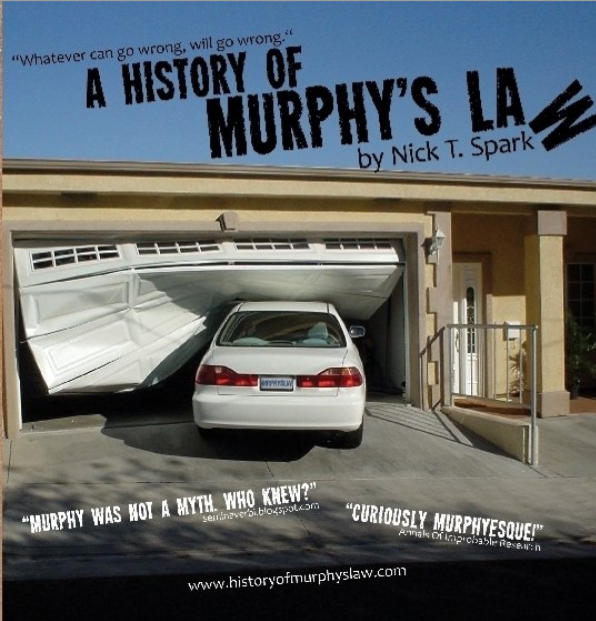

One can't help but recall the famous Murphy's Law: the more you worry about something happening, the more likely it is to happen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。